In the three weeks since a Florida appellate court ruled that an insurance company is within its right to require an Assignment of Benefits (AOB) contract be approved by a mortgage company or anyone else with an insurable interest in a property, state regulators are reacting by arranging a round of public meetings through state-proxy Citizens Property Insurance Corporation.

In the three weeks since a Florida appellate court ruled that an insurance company is within its right to require an Assignment of Benefits (AOB) contract be approved by a mortgage company or anyone else with an insurable interest in a property, state regulators are reacting by arranging a round of public meetings through state-proxy Citizens Property Insurance Corporation.

As reported in the lastLMA newsletter, Florida’s 4thDistrict Court of Appeal on September 5 ruled in favor of Ark Royal Insurance Company in a dispute over an AOB with a contractor hired by a homeowner to do water damage cleanup work. Restoration 1 sued Ark Royal when it refused to pay the full amount of the claim, pointing to part of the AOB contract requiring approval from the homeowner’s mortgage company for benefits to be assigned to the contractor.

Afterward, Citizens Property Insurance, at the request of Florida’s CFO, announced it will conduct a series of roundtable discussions on how to resolve AOB fraud and prevent corresponding property insurance rate hikes. The state-backed insurer of last resort is receiving an average of 1,126 new lawsuits per month so far this year, a 60% increase as compared to 2017, directly related to water loss combined with Hurricane Irma litigation.

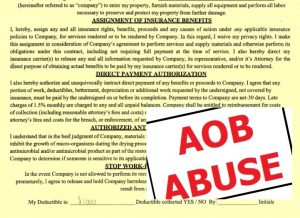

“The bottom line is AOB abuse and runaway litigation threaten to raise premiums for many Citizens policyholders who otherwise would see their rates remain steady or go down,” CEO Barry Gilway said in a statement. Citizens has delayed submitting its 2019 rate request until December – a proposed average 7.9% residential increase and average 8.9% commercial increase – so that it can assess the impact its managed repair program is having on curbing those water loss claims and lawsuits.

Depending on who you talk to, the 4thDCA decision may or may not be in conflict with a decision last Decemberby Florida’s 5thDCA, which ruled Security First Insurance could not impose what it deemed “a restriction” per Florida statute. Earlier last fall, the 2nd DCA ruled in favor of ASI Preferred Insurance sing the same language.

The Florida Office of Insurance Regulation (OIR) has said different companies using different policy form language was essentially accidental regulation created during a filing logjam several years ago that allowed the companies to submit the language in “informational filings” that OIR said it never reviewed nor formally approved or denied.

Yet, we now have two of three DCA’s (there are five total in Florida) that have affirmed such AOB policy language. Until or unless the state Supreme Court weighs in, some attorneys believe the 4th DCA decision is the law of the land. Regardless, it is certainly the right opinion for those who have an interest in an insurance policy that puts consumers and others with insurable interests first. The simple fact is that an AOB is the ticket in many instances to nefarious tactics by contractors who abuse consumers when they are at their most vulnerable.

Other stakeholders, such as the contractors who use AOBs are “peeved” at the 4thDCA decision, according to the headline of a recent Florida Politics article. “Mortgage companies are not equipped, qualified, or trained in homeowner insurance claims, nor should they be,” according to a statement from the Florida Restoration Association.

OIR says it is reviewing the recent 4thDCA ruling. Will this be a court ruling that OIR is eventually willing to utilize to change its regulatory direction to correct a marketplace condition that it publicly complainsabout? In the meantime, we will have yet another round of public meetings on a critical issue going into its seventh year and growing worse by the month. We are watching this closely and are hopeful that during the OIR Summiton October 24 & 25 we will hear more. Stay tuned!