Why a Bill is Made

![]() This week I had the privilege of being a part of the Governor’s State of the State address where he said goodbye (it’s his last year in office culminating his two term/8 year limit) and rolled out what he wants in his budget recommendations to the Legislature. I spent a great deal of time listening to many legislators and others talk about the future of Florida and heard so many great ideas that are included in proposed legislation. It reminded me of why some legislation gets filed and, in some cases, passed and I wanted to share that with you, our readers.

This week I had the privilege of being a part of the Governor’s State of the State address where he said goodbye (it’s his last year in office culminating his two term/8 year limit) and rolled out what he wants in his budget recommendations to the Legislature. I spent a great deal of time listening to many legislators and others talk about the future of Florida and heard so many great ideas that are included in proposed legislation. It reminded me of why some legislation gets filed and, in some cases, passed and I wanted to share that with you, our readers.

Case in point is Senate Bill 1782, by Senator Greg Steube (Republican, Sarasota/Charlotte Counties) that would allow cities and counties to contract with private independent auto adjusting firms to handle minor traffic crashes and complete the paperwork at the scene. There are two types of paperwork that can be used at a crash site – the long form, used when there’s a fatality or other “serious” factors – or the short form for minor incidents. SB 1782 allows independent adjusters to do contract work and report to the scene to complete the short form in the case of fender benders. I asked Senator Steube where the idea came from and he said from his wife, who waited hours for law enforcement to come to the scene so she could get the documentation she needed in case she needed to file a claim, etc. Simple, easy and the bill makes sense although I have made a few suggestions to Senator Steube to make the bill better.

My point? Many bills get filed to solve every day issues. Do you often say, “There ought to be a law” every now and then? If so, call me! Enjoy this week’s newsletter and you will see one every week until the conclusion of the legislative session – it’s our way of staying close to you!

Bill Watch

Recap of Week One & Preview of Week Two

The Florida Legislature began its 2018 session last week listening to Governor Scott’s last State of the State address which outlined his spending and policy priorities totaling $87.4 billion, an increase of 2.9% from the current year’s $85 billion budget. It includes $180 million in state and local tax cuts mostly from one-time sales tax holidays ($88 million) and driver license fee reductions ($88 million). Among the spending increases is $58 million to fight the opioid crisis and $770 million more for K-12 education, up 3.7% over the current year. Most of that increase ($534 million) would be paid for by local taxpayers. Although the Governor is proposing to maintain the current state school property tax rate, increasing property values will mean higher tax bills under the Governor’s plan.

The Florida Legislature began its 2018 session last week listening to Governor Scott’s last State of the State address which outlined his spending and policy priorities totaling $87.4 billion, an increase of 2.9% from the current year’s $85 billion budget. It includes $180 million in state and local tax cuts mostly from one-time sales tax holidays ($88 million) and driver license fee reductions ($88 million). Among the spending increases is $58 million to fight the opioid crisis and $770 million more for K-12 education, up 3.7% over the current year. Most of that increase ($534 million) would be paid for by local taxpayers. Although the Governor is proposing to maintain the current state school property tax rate, increasing property values will mean higher tax bills under the Governor’s plan.

That’s where we are already seeing divergence between the Governor and the Florida House of Representatives. House Speaker Richard Corcoran made it clear last week his chamber will not be taking part in any tax increase whatsoever. Ironically, there is agreement however, to push a proposed state constitutional amendment onto the ballot this November that if approved by voters, would require future legislatures to pass any statewide tax or fee increase by a supermajority (two-thirds) vote.

Any big spending ideas are pipe dreams out of the chute – the state simply doesn’t have the money (and the state constitution prohibits deficit spending). Budget forecasts show a surplus of just $52 million for this next fiscal year starting July 1, after set-asides for schools and Medicaid funding. Hurricane Irma added an extra almost $1 billion in unbudgeted storm expenses upfront for which the state is awaiting federal reimbursement.

On the major insurance issues (Assignment of Benefits, Personal Injury Protection auto insurance, and Workers’ Compensation insurance) there was significant movement this past week, with more expected this week. With the deadline passed for filing bills, we’ve reorganized Bill Watch at this point in the session to allow readers to more easily identify and focus on those bills progressing through the legislative process. We list them as those “In Play” and those “Not in Play”. We will watch both lists carefully, for anything can happen with seemingly dead bills becoming amendments and tacked onto other bills and other maneuvers.

Here’s a look at where things are in this week’s 2018 Bill Watch:

![]()

Assignment of Benefits (AOB) – The Florida House worked past 3pm Friday to pass HB 7015 by Rep. Jay Trumbull (R-Panama City), its point man on AOB reform. The bill addresses AOB abuses and enhances consumer/policyholder protections. It’s a replica of last session’s HB 1421, which had passed the House but was never heard in the Senate. The bill allows AOBs to exist under certain conditions, and requires that they be in writing, contain an estimate of services, notice the insurer, and allow the policyholder 7 days to rescind the AOB. It prohibits specified fees as part of an AOB as well as any policy changes related to a managed repair program. It requires a 10-business day notice prior to filing suit against an insurer, an assignee’s pre-suit settlement demand and insurer’s pre-suit settlement offer, and puts parameters around attorney fees. There would be consumer disclosure language so the consumer is fully aware of the consequences when executing an AOB and would limit an assignee from recovering certain costs directly from the policyholder. Beginning in 2020, insurers would be required to report to OIR their data on claims paid via AOBs.

While one-way attorney fees would continue to exist for first-party claims filed by a policyholder against an insurer, this bill sets special two-way attorney fees for third-party claims. Insurance Commissioner David Altmaier said consumers would be held harmless regardless of who wins the lawsuit and described the bill as a balance between discouraging abusive vendor claims while still allowing contractors to go after insurers who low-ball claims and settlement offers. Here’s how (from the bill):

“If the parties fail to settle and litigation results in a judgment, the bill provides the exclusive means for either party to recover attorney fees. The bill defines the difference between the insurer’s pre-suit settlement offer and the assignor’s pre-suit settlement demand as “the disputed amount.” The award of fees are as follows:

- If the difference between the judgment and the settlement offer is less than 25 percent of the disputed amount, then the insurer is entitled to attorney fees.

- If the difference between the judgment and the settlement offer is at least 25 percent but less than 50 percent of the disputed amount, neither party is entitled to fees.

- If the difference between the judgment and the settlement offer is at least 50 percent of the disputed amount, the assignee is entitled to attorney fees.”

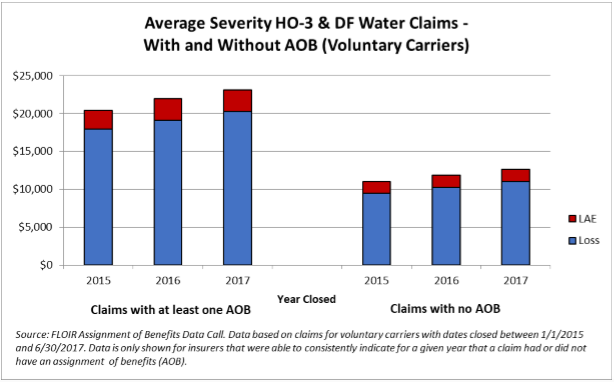

Rep. Trumbull has said the bill protects consumers, pointing out that the number of residential water loss claims jumped 46% from 2010 to 2016, “and it’s not because it was raining harder.” A short time later Friday afternoon, the Florida Office of Insurance Regulation proved Rep. Trumbull’s remarks with release of its 2017 Review of Assignment of Benefits (AOB) Data Call Report. The report says since 2015, the frequency of water claims has risen 44% and severity of those claims has risen 18%. “The total combined impact of these changes reflect an average 42.1% annual increase in water losses, which is nearly triple the 14.2% average annual increase shown in the previous report,” it said. That previous 2016 report covered the prior six years. This chart is probably the most telling of the report:

At this time, the differences between the House and Senate versions of AOB reform seem to boil down to how to handle attorney fees in third-party disputes (the same differences that sunk reform efforts last year).

In the Senate, Banking & Insurance Committee Chair Anitere Flores (R-Miami) took testimony last fall from various sides over several weeks to try to broker an AOB reform compromise bill – and Senator Greg Steube’s bill, filed right at the end of the last committee week in December may apparently be it. Steube (R-Sarasota) SB 1168, scheduled for its first hearing tomorrow before that Senate Committee, has good and bad elements in it. The conservative senator often puzzles many of us following his work. He is a brilliant attorney and great fun to work with on projects of public policy. What is puzzling is his version of AOB reform. SB 1168 indeed has some key reforms but has language that prohibits insurance companies from including the costs of attorney fees paid in losing cases into their rate base or future rate requests. That idea, originally floated by Democratic Senator Gary Farmer in SB 256 (see below in “Not in Play”) prompted Insurance Commissioner David Altmaier in a Senate Banking and Insurance committee meeting in October to call it “one of the worst ideas he’s heard.” The reason the commissioner has this opinion is that insurance companies, for the most part, are not the instigator of litigation; the vast majority of AOB suits are from AOB law firm “factories,” much like the home foreclosure saga where trial lawyer firms filed thousands of suits against banks.

Back in the House, Rep. David Santiago (R-Deltona), who has been a champion in the fight against the abuse of assignment of benefits for the past several years, has a catch-all insurance bill (HB 465), known as an “omnibus” bill to change several provisions of the insurance code. It will be the subject of a proposed committee substitute this Wednesday before the House Insurance and Banking Subcommittee. The bill covers several insurance topics such as property, auto, surplus lines and some general regulatory provisions. One of the most interesting is that it excludes from the Department of Financial Services complaint registry complaints filed by third parties who are not satisfied with an insurance company’s claims handling when an assignment of benefits is involved. The thinking is that there is an incentive by third party vendors to dispute the claim to delay it, which drives up the cost of the claim. The bill also makes a priority the use of the Department of Financial Services mediation program for property insurance claims disputes involving an assignment of benefits. The bill’s identical companion in the Senate (SB 784) by Senator Brandes has not been placed on an agenda thus far.

Windshield AOB – Assignment of Benefits abuse is now occurring in the auto insurance lines, as insurance companies note an increase in customers being solicited out of the blue for a “free windshield” with accompanying exorbitant claims costs. Senator Hukill’s SB 396, would allow auto insurers to require an inspection of the damaged windshield of a covered motor vehicle before the windshield repair or replacement is authorized. The bill was carried over and will get its first hearing tomorrow before the Senate Banking and Insurance Committee. Two amendments will also be heard: one that requires that any inspection be performed by an insurance company’s licensed adjuster within 24 hours of notice of claim unless doing so will be to the detriment of the insured (144400) and the other waives the right of inspection if the damage impacts safety or structural integrity (408714). Hukill’s bill has an identical companion bill in the House (HB 811) by Rep. Plasencia, which is still awaiting its first of three committee hearings.

Workers’ Compensation – Like AOB reform, Workers’ Comp reform is another issue being fast-tracked by the Florida House, with HB 7009 by Rep. Danny Burgess (R-Zephyrhills) passing the House this past Friday. It’s a near replica of HB 7085 from last session that died over disputes on maximum hourly attorney fees. This is by far one of the most contentious – and by court rulings, most immediate – issues facing the legislature after the state Supreme Court’s 2016 ruling that our workers’ comp system was unconstitutional. But because this bill has no Senate companion, it is not a good sign for its future success. Anything can happen though with bills becoming amendments and tacked onto other bills and other maneuvers, especially late in session. We’ll keep watching.

Last year’s bill came on the heels of a 14.5% average increase in workers’ comp rates – adding to the urgency. This fall, however, OIR approved decreased rates averaging 9.5%. Rep. Burgess has warned that those decreased rates don’t reflect the lagging cost increases still anticipated from state Supreme Court decisions throwing out limits on attorney fees and extending certain disability payments. Recent statistics do show increases in workers’ comp legal fees, as previously reported in the LMA Newsletter. Rep. Burgess said it was important to be proactive and pass reforms now, before the next rate increase. The bill eliminates fee schedules but puts a cap of $150/hour on plaintiff (workers) attorney fees.

Rep. Jamie Grant (R-Tampa) has noted this bill does not include a competitive rate making process that was in last year’s bill at one point. Florida is one of seven states solely using a “Full Rate” or administered system that takes into account an insurer’s extraneous expenses and profit. Thirty-eight states instead use a “Loss Cost” or competitive system which limits insurers to a rate necessary to cover losses and benefit costs and only expenses directly related to claims settlement. “Every dollar spent unnecessarily is another dollar not spent on workers care,” said Rep. Grant. “A competitive rate making process will go a long way to reducing rates.”

Workers’ Compensation for First Responders – Continued progress this past week on CS/SB 376 by Senator Lauren Book (D-Plantation) which removes the requirement on some first responders that there be a physical injury in some circumstances in order to receive medical benefits for a “mental or nervous injury”, so long as the responder witnessed a specified traumatic event. The bill passed the Senate Banking and Insurance Committee in December after an emotional 90-minutes of testimony from a parade of firefighters and other first responders, who shared personal stories of anguish on the job. The bill is scheduled for its second hearing tomorrow in the Commerce and Tourism Committee. These efforts are inspired, in part, by the city of Orlando’s refusal to pay such benefits to a police officer reportedly diagnosed with PTSD after responding to the Pulse nightclub shootings. House bill HB 227 by Rep. Matt Willhite (D-Royal Palm Beach) and SB 126 by Senator Victor Torres (D-Kissimmee), which would require treatment begin within 15 days, have not been heard.

Personal Injury Protection (PIP), also called No Fault Insurance –Various bills under consideration would eliminate the state requirement that motorists carry $10,000 in PIP insurance and put responsibility for vehicle accidents on the party at fault. The House chalked up another quick victory this past week with passage of HB 19 on 1/12/18. The bill eliminates PIP and would require motorists instead to carry Bodily Injury liability insurance at a minimum $25K/$50K level. Rep. Erin Grall (R-Vero Beach) who is sponsoring this bill for second year in a row, has noted that despite various PIP reforms in the past, costs keep going up, driven partly by fraud. OIR and committee staff analysis show auto rates would go down (5.6% overall) if the bill passes and should encourage those driving illegally without proper insurance (22% of Florida drivers she has said) to get coverage. The bill also revises the uninsured and underinsured coverage legal damage thresholds.

Last week, the Senate’s answer to PIP reform took its first formal step forward. The Banking and Insurance Committee passed by a 10-1 vote SB 150, by Senator Tom Lee (R-Brandon). It goes beyond the House bill and replaces PIP with mandatory $5,000 of Med Pay coverage (and loses the consumer savings as a result) plus varying amounts of Bodily Injury liability limits which appears to give consumers choices. Senator Lee revamped his original bill to now focus Med Pay coverage solely on emergency hospital treatment and within two weeks after the accident. The bill was further amended to allow less expensive treatment by other practitioners, including chiropractors. Some senators expressed concern that the bill will effectively raise auto insurance rates for those motorists who have just PIP policies. But Senator Lee refuted that, noting that mandatory BI will cost $49 per $1,000 of coverage versus the current $121 per $1,000 of PIP coverage. As an example, he said a scenario of PIP + minimum BI + Med Pay would cost just $4 more, proof of a more efficient system without PIP.

SB 150’s Bodily Injury liability coverage choices are:

- 20/40/10 minimum coverage from 1/1/19-12/31/20 or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $50,000 for one crash;

- 25/50/10 minimum coverage from 1/1/21-12/31/22 or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $60,000 for one crash; and

- 30/60/10 minimum coverage from 1/1/23 and thereafter or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $70,000 for one crash.

Senators are facing pressure by Incoming Senate President Bill Galvano to “get ‘er done” this session before he takes over in the fall.

HB 6011 by Rep. Julio Gonzalez (R-Venice) deletes the requirement for policyholders & health care providers to execute disclosure & acknowledgment forms to claim personal injury protection benefits. It had its first reading this past Tuesday 1/9/18. These requirements were originally established to help prevent fraud and include verification that actual services were rendered and weren’t solicited by the provider. The bill has been referred to the House Insurance and Banking Subcommittee but is still stalled. HB 6011 has no Senate companion – not a good sign for any bill’s future success – and time has just about run out for one, but again, anything can happen with bills becoming amendments and tacked onto other bills and other maneuvers.

Hurricane Irma Damage – The House Select Committee on Hurricane Response and Preparedness was expected to review various proposals last week but will instead do so tomorrow, toward presenting a formal report to House Speaker Corcoran. Corcoran has made clear the House spending priorities this session will be for hurricane relief. Last month the committee listened to a recap of the 141 member recommendations to date for responding to Hurricane Irma and preparing for future storms. They include extending the Suncoast Parkway from Citrus County to the Georgia line to aid in evacuations, using cruise ships to evacuate the Keys, burying more electric utility lines, and toughening penalties in state contracts for vendors that don’t deliver what they promise (such as debris cleanup). Most don’t have price tags attached. This capped two months of fall committee hearings on various ideas from government and private interests. Of note to insurance interests, Rep. Holly Raschein (R-Key Largo) suggests high-risk areas not be rebuilt after storms and instead, could be part of a state buyout program, with the land to revert to natural buffers. (This is an idea that will be familiar to newsletter readers from this past summer’s report Aligning Natural Resource Conservation, Flood Hazard Mitigation, and Social Vulnerability Remediation in Florida which found Florida has 15,000 “Repetitive Loss Properties”.) Speaker Corcoran noted specifically the Suncoast Parkway extension and underground utilities during a December appearance on C-SPAN.

Hurricane Flood Insurance – One of the bills out of the chute in Irma’s aftermath with action this past week is CS/HB 1011 by Rep. Janet Cruz (D-Tampa) which would require homeowners insurance policies that do not include flood insurance (most don’t) to so declare and would require policyholders to initial that declaration in acknowledgment. The bill and its Senate counterpart, SB 1282 by Senator Taddeo (D-Miami) were filed in December and prompted by two realities: upwards of 60% of Irma’s damage here was caused by water and up to 80% of Florida flood victims may not have either NFIP or private flood coverage. Insurance Commissioner Altmaier told legislators a month after Irma hit that he believed flood losses alone in Florida could exceed $4.5 billion and that certain areas of the state could see flood losses that exceed wind losses. A newer version of the bill unanimously passed the House Insurance and Banking Committee last week but its Senate companion hasn’t moved.

Florida Hurricane Cat Fund – HB 97 by Rep. David Santiago (R-Deltona) adds an additional 10% charge to an insurer’s reimbursement premium with the money going to the Division of Emergency Management to fund a wind and flood mitigation program for residential structures. Additionally, a 5% rapid cash build-up factor, progressing to 15%, would be in place until the fund balance reaches $10 billion. It also contemplates OIR levying an emergency assessment to cure certain deficits in the fund. The bill revises reimbursements the SBA must make to insurers to add a 25% and 60% level of insurer’s losses from each covered event in excess of the insurer’s retention and the overall contract year obligation. This bill was just moved to first reading. SB 1454 by Senator Brandes (R-St. Petersburg) has key similarities but would eliminate the rapid cash build-up factor. The factor was created by the legislature in 2002, raised to 25% in 2006, repealed in 2007, and re-introduced in 2009 at 5%, and increased in increments of 5% per year until it reached its current level of 25% in 2013. The elimination of this “hurricane tax” as it is described will reduce rates approximately 4% but may be offset by other rate increase drivers like the assignment of benefits.

Property Tax Exemption for Generators – Designed to help those who want to help themselves the next time a big hurricane or other calamity hits and the power goes out, SJR 974 by Senator Jeff Brandes (R-Pinellas) would place a constitutional amendment on the 2018 ballot for voters to consider a property tax exemption for the just value of a permanently installed stand-by generator system when assessing annual property taxes; a companion bill SB 976 (Brandes) would implement the measure.

Direct Primary Care – CS/SB 80 by Senator Lee, allows doctors to enter into monthly fee for service arrangements directly with individuals or employers, essentially bypassing health insurance organizations. Informally dubbed “concierge medicine for the masses”, the bill passed by unanimous votes in October out of the Banking and Insurance, as well as the Health Policy Committees and awaits action in the Appropriations Committee. SB 80 has a companion bill in the House (HB 37) by Rep. Burgess which passed the House Health and Human Services Committee unanimously in November – it’s only stop – and now awaits to be taken up by the full House.

Health Insurer Authorization – CS/SB 98 by Senator Steube passed unanimously out of the Senate Rules Committee last week and is ready for a vote before the full Senate. It and companion bill HB 199 by Rep. Shawn Harrison (R-Tampa) would prohibit prior authorization forms from requiring information not necessary to determine the medical necessity or coverage for a treatment or prescription. The bills would also require health insurers and their pharmacy benefits managers to provide requirements and restrictions on prior authorizations in understandable language and to make them available on the internet, along with a 60-day notice of any changes. HB 199 will get its first hearing before the House Health Innovations Subcommittee on Wednesday. Senator Steube is also sponsoring SB 162 that would prohibit health insurers and HMOs from retroactively denying insurance claims under certain circumstances. The bill passed unanimously out of the Senate Banking and Insurance Committee in December and now goes to the Health Policy Committee.

Flood Insurance and Mitigation – SB 158 by Senator Jeff Brandes (R-St. Petersburg) provides greater funding for flood mitigation so that more individuals and communities can meet NFIP flood insurance standards. The bill would allow flood mitigation projects to be funded by the Florida Communities Trust to reduce flood hazards. Senator Brandes has for the past 5 years taken the lead in Florida in the flood insurance arena. The bill has been referred to the Committees on Environmental Preservation and Conservation, Appropriations, and the Appropriations Subcommittee on the Environment and Natural Resources but has not been scheduled to be heard. An identical House companion, HB 1097 by Rep. Cyndi Stevenson (R-St. Augustine) was filed in later December.

Telehealth – SB 280 by Senator Aaron Bean (R-Fernandina Beach) gets its first committee hearing tomorrow. It’s part of a continued effort to put remote health practitioner visits via the internet on an equal footing as in-office visits, in order to reduce health costs and provide parity of care to rural patients. A state panel in 2016 executed a list of legislative directives to help smooth the kinks and establish recommended procedures to help make this bill a reality. SB 280 would establish the standard of care for telehealth providers; encourage the state group health insurance program to include telehealth coverage for state employees; and encourage insurers offering certain workers’ compensation and employer’s liability insurance plans to include telehealth services. A companion, HB 793 by Rep. Massullo, was filed in late November and has been referred to the House Health Quality Subcommittee and the Health and Human Services Committee.

Texting While Driving – Moving Florida’s current ban on texting while driving from a secondary offense (where you can be ticketed during a traffic stop made for another reason) to a primary offense passed the House Transportation & Infrastructure Subcommittee unanimously last week. Under HB 33 by Rep. Jackie Toledo (R-Tampa), first-time violators would face a $30 fine plus court costs for a non-moving violation. Second-time offenders would face a $60 fine plus court costs with a moving violation. Those involved in crashes or texting in school zones face additional penalties. Like SB 90 by Senator Keith Perry (R-Gainesville), this bill requires the officer notify the driver of the constitutional right not to have their cellphone examined by authorities. Neither applies to stationary vehicles. Florida one of four states where texting while driving isn’t a primary offense. House Speaker Corcoran has thrown his full support for the measure.

Controlled Substances – Two bills are progressing through their respective chambers to address the huge increase in Florida’s accidental drug overdose deaths. SB 8 by Senator Lizbeth Benacquisto (R-Ft. Myers) would restrict opioid supply to three days for standard prescriptions but would allow doctors up to a seven-day supply in certain medical cases. Additionally, it provides for more continuing education for responsibly prescribing opioids and requires participation in the Prescription Drug Monitoring Program by all healthcare professionals that prescribe opiates. The Senate Health Policy Committee held a workshop last week on the bill, prior to a scheduled vote tomorrow. There were about a dozen speakers that included doctors and patient groups and were very positive and supportive of the bill. Pain doctors expressed some concern about the three-day limit, but overall, the bill’s concepts were favorably viewed.

A similar bill in the House (HB 21) by Rep. Jim Boyd (R-Bradenton) last week passed the House Health Quality Subcommittee. It has the same prescription limits as the Senate version. It would also authorize the state Department of Health to share data with other states to avoid patient abuse in filling multiple prescriptions. The bill now goes to the Appropriations Committee and the Health and Human Services Committee.

A November report by the FDLE’s Medical Examiners Commission found the total number of drug-related deaths in Florida rose 22% from 2015 to 2016. The number of opioid deaths were up 35%, where opioids were either the cause of death or present in the decedents. And this whopper: deaths from the especially dangerous synthetic opioid fentanyl rose 97%. In fact, the report showed death from almost all kinds of drugs, prescription, street drugs, and alcohol – were all up. Deaths by cocaine jumped 83%. One of our readers sent us this research published in the Journal of the American Medical Association showing that states with any kind of medical marijuana law had a 25 percent lower rate of death from opioid overdoses than other states.

Last fall, Florida Attorney General Pam Bondi announced a multistate investigation into potentially unlawful practices by drug companies in the distribution, marketing, and sales of opioids, as the President declared a national health emergency over opioid abuse. Insurers in December announced that they are seeking reimbursement for the high cost of opioid addictions: Opioid Pain Treatment Addiction Costs Workers’ Comp Carriers, Health Insurers Billions.

![]()

Assignment of Benefits (AOB) – There are other AOB bills in the Senate, but they are all stalled. They include SB 62 by Senator Dorothy Hukill (R-Port Orange). The bill prohibits certain attorney fees and requires those vendors that execute the AOB to comply with certain requirements prior to filing suit. HB 7015, which passed the House on January 12 has some elements of this bill.

Likewise stalled is SB 256 by Senator Gary Farmer (D-Ft. Lauderdale), which would prohibit insurer managed repair programs and prevent most property insurance policies from prohibiting or limiting AOB. But it would also require the AOB be in writing, be limited to an accurate scope of work to be performed, and allow the policyholder to cancel the AOB within seven days without penalty and otherwise, be shared with the insurer within seven days of execution. A final repair bill would be required to both policyholder and insurer within 7 days of work completed. Referral fees would be limited to $750 and require water damage remediation assignees to be ANSI certified. Insurance companies would be required to offer any settlement within 10 days of assignee filing suit over an AOB dispute. It also prohibits insurers from including the costs of attorney fees paid in losing cases into their rate base or future rate requests. Under the bill, OIR would be required to conduct an annual AOB data call beginning in 2020. HB 7015 which passed the House on January 12 has some elements of this bill, but not the attorney fee rate recoupment.

Regulation of Workers’ Compensation Insurance – Filed by Senator Lee on the Friday before Session began, SB 1634 authorizes the Insurance Consumer Advocate to intervene as a party in certain proceedings relating to the regulation of workers’ comp insurance or to seek review of certain agency actions before the Division of Administrative Hearings (DOAH). The bill also specifies requirements and procedures for the consumer advocate in the examination of workers’ compensation rates or form filings. There is no House companion bill.

Property Insurance – Filed by Senator Lee on the Friday before Session began, SB 1652 would prohibit property insurers who fail to make inspections within 45 days of notice of claim from denying or limiting payments for certain hurricane-related claims under certain circumstances. It also restricts insurers from requiring proof of loss and requires all these changes be added to Florida’s Homeowner Claims Bill of Rights and provided to the policyholder. The bill also requires property owners to disclose the sinkhole report in lease or lease/purchase agreements when an insurance claim has been paid for sinkhole damage. It has no House companion bill.

Florida Building Commission – The Florida Building Commission, which oversees state building codes – some of the toughest in the nation due to Florida’s susceptibility to hurricane damage – would be downsized under HB 299 by Rep. Stan McClain (R-Ocala), who is a residential contractor. The bill would cut the board more than in half, from 27 to 11 members, removing representation from several sectors in the building industry. The bill removes members representing: air conditioning, mechanical or electrical engineering, county code enforcement, those with disabilities, manufactured buildings, municipalities, building products, building owners/managers, the green building industry, natural gas distribution, the Department of Financial Services, the Department of Agriculture and Consumer Affairs, the Governor appointee as chair, and reduces from three members to one municipal code enforcement official and would no longer require a fire official. The bill also changes the qualifications of the architect member, removing the requirement of actively practicing in Florida. Rep. McClain said the bill is meant to remove any Commission members that aren’t directly involved in the building process but that he’s open to suggested changes. An amendment that would have removed the insurance representative was withdrawn this fall. HB 299 would leave the Commission comprised mostly of contractors. The bill is on its way to its last stop at the Commerce Committee but has no Senate companion.

Contractors Without Insurance – HB 89 by Rep. Ross Spano (R-Riverview) requires that contractors lacking public liability insurance shall be personally liable to a consumer for damages that having the proper insurance would have covered. The bill passed the Civil Justice & Claims Subcommittee in early November but has two more stops. Its Senate companion SB 604 by Senator Greg Steube (R-Sarasota) hasn’t had a hearing in any of its three committees yet.

Trade Secrets in Public Records – HB 459/HB 461 by Rep. Ralph Massullo (R-Beverly Hills) were filed in October following House Speaker Richard Corcoran’s press conference about his objection to state agencies who claim trade secret to shield contract and vendor information. Corcoran said that agencies should not be entitled to trade secret privileges if they “spend one penny of taxpayers’ dollars.” HB 459 repeals over 75 public records exemption references in current law, including the trade secret process used in the insurance code, Section 624.4213, Florida Statute. Interestingly, a “sister” bill to HB 459, HB 461 appears to re-enact a new trade secret process that is not unlike current law regulating insurance entities use of trade secrets now. So in essence, HB 459 repeals the current insurance entity trade secret practice and HB 461 restores it. Much of this is procedural and we will follow this closely. HB 459 and HB 461 are stalled. HB 459 has companion SB 956 and similar bill SB 958 (both filed by Senator Mayfield in November) and HB 461 has a similar bill in SB 958.

Insurance Rates – Like he’s tried to do with AOB, SB 258 by Senator Farmer would prohibit insurance companies from including the costs of attorney fees paid in losing cases into their rate base or future rate requests in Workers’ Compensation and Life policies. Farmer’s similar bill in the 2017 session failed. SB 258 has been referred to the Committees on Banking and Insurance, Appropriations, and Rules but has not been scheduled to be heard. It is stalled and has no House companion.

Insurance Reporting – Filed by Senator Farmer on the Friday before Session began, SB 1668, follows the same bent as his previous bills on verifying insurance litigation costs. It would require insurers filing rates with the Office of Insurance Regulation provide specified information and projections relating to claim litigation in their rate filings. This includes litigation costs and total dollar value of denied or limited claims where either party prevailed (insurer or insured) and those claims that reached settlement, along with attorney fee breakdowns for all parties. This information would be culled from the year prior to the rate filing, as well as projected costs for the following year. It has no House companion bill.

Insurance Credit Scoring and Redlining – SB 414 by Senator Farmer would ban the use of credit scores as a determining factor in calculating auto insurance premiums. Currently, insurers are permitted to use a customer’s credit history as a justification for higher insurance rates. Statistically, drivers with poor credit scores pay more and according to Farmer “the use of credit scores as a determining factor for auto insurance rates has been found to disproportionately affect minority populations, with African American and non-white Hispanic policyholders often paying higher premiums, and is not a reliable indicator for increased risk.” Similarly, SB 410 would prohibit the use of zip codes as a determining factor in calculating auto insurance premiums, which Farmer called “de facto discrimination.” HB 659, which passed and became law in 2016, allows single zip code rating territories if they are actuarially sound and the rate is not excessive, inadequate, or unfairly discriminatory. Neither SB 414 nor SB 410 have had a hearing yet, and with no House Companion, their future is very uncertain.

Patient’s Choice of Providers – Dubbed the “Patient’s Freedom of Choice of Providers Act”, HB 143 by Rep. Ralph Massullo (R-Beverly Hills) prohibits a general health insurance plan from excluding willing and qualified health care provider from participating in a health insurer’s provider network so long as the provider is located within the plan’s geographic coverage area. The bill has been referred to the Health Innovation Subcommittee, but has stalled. There is a Senate companion, SB 714, which is also stalled.

Autonomous Vehicles – HB 353 by Rep. Jason Fischer (R-Jacksonville) authorizes the use of vehicles in autonomous mode. The autonomous technology would be considered the human operator of the motor vehicle and provides that various provisions of law regarding motor vehicles such as rendering aid in the event of a crash do not apply to vehicles in autonomous mode where a human operator is not physically present as long as the vehicle owner promptly contacts law enforcement. The bill also addresses the applicability of laws regarding unattended motor vehicles and passenger restraint requirements as they relate to vehicles operating in autonomous mode where a human operator is not physically present in the vehicle. The bill unanimously passed the House Transportation and Infrastructure Subcommittee in November and is awaiting a hearing before the Appropriations Committee. A Senate companion (SB 712) by Senator Brandes was filed in November and referred to the Transportation, Banking and Insurance, and Rules Committees. There’s been no movement since.

Helpful Links:

House Calendar for the Week of January 15-19, 2018

Senate Calendar for the Week of January 15-19, 2018

OIR Poised to Eliminate AOB Language Protections from Policies

Move would impact six homeowners insurance companies

Six Florida homeowners insurance companies caught-up in a regulatory contradiction stand to have consumer protection language stripped from their policies by the Florida Office of Insurance Regulation (OIR). The six companies successfully submitted policy forms to OIR in 2013 that require any AOB signed by a policyholder also include signatures of mortgagees and others with an insured interest. OIR, after recently turning down another insurance company that wanted to put the exact same language in its policies, now says those previous companies’ approvals shouldn’t have happened and technically, weren’t approvals at all.

As we reported here in the LMA Newsletter last month (see Another Day, Another DCA Decision), OIR’s decision to deny the same language to Security First Insurance was upheld by an administrative hearing judge and last month by a panel of the Fifth District Court of Appeal (DCA), which ruled such language was in violation of Florida statute. This despite the 2nd DCA having ruling last fall in favor of another insurer using the same language. Amy O’Connor in her excellent Insurance Journal story last week notes that Security First has now requested a hearing by the 5th DCA’s full bench and certification of questions to the state Supreme Court “of public interest and importance” from this case.

As I was quoted in Amy O’Connor’s story, those policyholders insured with the six companies that require mortgage company approval for a valid AOB are actually protected from unscrupulous vendors at a time we need further AOB protections desperately in this rampant environment of fraud. “It’s unfortunate that all policyholders cannot access this benefit because of regulatory, judicial and legislative limitations,” I told her.

The Insurance Journal also reports that OIR is awaiting a “mandate from the 5th DCA to take appropriate action” but if that means to eliminate a consumer protection, then we all need to rethink how to tackle this well-documented consumer abuse of a piece of paper called an assignment of benefits becoming a weapon for bad people to take advantage of good people. We’ll stay on this ongoing story!

Statewide Health Care Cost Database Expected to Premier this Year

Consumer-friendly cost comparison website awaiting final rule-making and additional funding

Florida is poised to have a state-run health care claims database fully online sometime later this year that will allow consumers to find the average prices for 300 medical procedures at hospitals and ambulatory surgical centers around the state. A beginning version of the website (www.FloridaHealthPriceFinder.com) is online now, with information on about 300 “bundled services” such as hip replacements and outpatient appendectomies. The database is meant to increase health care cost transparency in Florida. Prompted by the Governor and created by the legislature in 2016, it needs more funding this legislative session and some kinks worked out in a proposed rule, to make the project a reality.

Florida is poised to have a state-run health care claims database fully online sometime later this year that will allow consumers to find the average prices for 300 medical procedures at hospitals and ambulatory surgical centers around the state. A beginning version of the website (www.FloridaHealthPriceFinder.com) is online now, with information on about 300 “bundled services” such as hip replacements and outpatient appendectomies. The database is meant to increase health care cost transparency in Florida. Prompted by the Governor and created by the legislature in 2016, it needs more funding this legislative session and some kinks worked out in a proposed rule, to make the project a reality.

The state, through the Agency for Healthcare Administration (AHCA), has already spent $4 million to get the all-payers insurance claims database up and running and the Governor is pushing for another $925,000 appropriation to finish its implementation. But there are also industry concerns over disparities between the 2016 law that authorized and funded the database and the proposed AHCA rule developed since to implement the law.

The proposed rule currently requires insurance companies and HMOs submit claims data from 2014-2016, even though the law didn’t take effect until July 1, 2016, making the requirement retroactive. Also, the 93-page AHCA manual includes Medicare Advantage plans claims data, even though the 2016 law specifically excluded those claims. AHCA said it expects the proposed rule will be finalized this spring so insurance companies and HMO plans can begin submitting their data.

AHCA Secretary Justin Senior told a Senate committee last month that the website, when finished, will allow consumers to actually shop for health care procedures and find the least expensive alternatives. The website, which is powered by data collected by the Health Care Cost Institute, advertises that data on facilities will be out soon.

Florida is 5th Fastest Growing State in the Nation

But business rankings and economic forecasts question how we’re growing

There’s no doubt that people continue to migrate to Florida wanting to become new residents of our great state. In fact, a new study out by U-Haul says Florida ranked second in destinations for one-way arrival of its moving trucks, up 8% from 2016. “Eternal summer” weather and no state income tax are big draws according to the company. Our current population of 21 million is forecast to grow to 26 million by 2030. Those people will need insurance, housing, and a host of other products and services. But while Florida’s economy is forecast to reach the $1 trillion mark this year and unemployment is down and job growth up, challenges on filling the remaining demand with high-wage jobs remains a persistent challenge to our future prosperity.

At this past week’s Florida Chamber of Commerce Economic Summit, we learned that if Florida were a country, it would rank 16th in the world. More than 325,000 people migrated here between July 2016 to July 2017. Each day brings 900 new residents. While the state unemployment rate has fallen over the last seven years from 10% to 3.6% today, there is concern that too many of those newly-filled jobs were of the lower-wage variety.

The U.S. News & World Report “Best Jobs of 2018” report says no Florida metro areas made the top 50 list for high salaries, future opportunities, and work-life balance. This index report drew Labor Department data to identify jobs in highest demand, then scored them using seven components: 10-year growth volume, 10-year growth percentage, median salary, employment rate, future job prospects, stress level, and work-life balance. It should be noted though that most of those cities with highest salaried jobs were in high tax and cost of living states such as California, Connecticut, New Jersey and New York, where employers would naturally have to pay more for their workers. More here from Florida Trend, including what Florida metros were noted as hubs for certain occupations.

The Florida Chamber’s chief economist, Dr. Jerry Parrish, says Florida has reached a peak in job creation in this business cycle. That while job demand is there (256,000 open positions), the people here don’t have the right skills to fill them. That’s a tune we’ve heard repeated many times and why matching education output from our various in-state educational institutions and training programs to what the marketplace needs is crucial.

We’ve been doing better at doing just that, recently gaining high marks for trying and improving. Florida had five of the top 20 spots on the Milken Institute’s 2018 Index of Best-Performing Cities in the country. The North Port-Sarasota-Bradenton metro area was #6, followed by Orlando at #7, West Palm Beach-Boca Raton-Delray Beach at #12, Tampa-St. Petersburg-Clearwater at #15, and Naples-Immokalee-Marco Island at #18. Milken’s index “provides an objective benchmark for examining the underlying factors and identifying unique characteristics of economic growth in metropolitan areas,” it says. But the Milken study as well, points to low-wage jobs in Florida as a drag on rankings. The report noted that “top-performing metros have cohesive strategies that allow them to leverage their assets more effectively. They offer important lessons that may be helpful to peer regions.” Food for thought!

States Losing Population Have Some Things in Common

The un-Floridas

So many times we hear that Florida’s ace in the hole is our beautiful, warm weather (except in the past two weeks). But is it favorable weather climate or how much you’re being taxed that really influences what state you live and do business in? That’s the question tackled recently by the nonprofit watchdog Truth in Accounting, whose goal is to ensure that governments provide truthful, timely, and transparent financial information to their citizens. Its latest project is looking at similarities among the five states who’ve lost the most population in the past five years. And no, Florida is certainly not one of them.

So many times we hear that Florida’s ace in the hole is our beautiful, warm weather (except in the past two weeks). But is it favorable weather climate or how much you’re being taxed that really influences what state you live and do business in? That’s the question tackled recently by the nonprofit watchdog Truth in Accounting, whose goal is to ensure that governments provide truthful, timely, and transparent financial information to their citizens. Its latest project is looking at similarities among the five states who’ve lost the most population in the past five years. And no, Florida is certainly not one of them.

Connecticut, Illinois, New Jersey, New York, and Maryland have had the most net “outmigration” per taxpayer in the nation since 2012, according to IRS data. So what common traits or similarities do these states have? Bill Bergman, Director of Research at Truth in Accounting, says those leaving those states share a common perception of how much economic freedom they have, as well as trust in their state government. He told Watchdog News that “taxpayers, and imminently future taxpayers, are sensitive to that probability and are increasingly leaving the state. It appears that the citizens are neither that blind nor that stupid. They don’t trust their government,” he said.

States that lose population lose tax base and will have a harder time generating enough taxes to fund needed services as a result, he warns. Those five states also came in last in the Cato Institute’s Freedom Ranking, which ranks overall tax burden, trust in state government, and real value of $100 in buying power.

As for favorable weather climate? Bergman found average January temperatures aren’t as big a deal as some claim. It was a factor – but only to a degree!

The Next Seven Weeks

Thanks for being a part of this week’s newsletter reporting. We will be on the job this week and the following seven scheduled weeks of this legislative session, as we weigh in on issues affecting your professional and personal lives. One reader asked that we keep an eye on the opioid legislation as these drugs were connected to a tragedy in his family. If there’s a topic you want to know about or we can help track for you, just let us know. Our best for a great week.

See on the trail!

Lisa