Stay Strong and Keep a Good Thought

The past couple weeks have been tough in the Florida legislature and for that matter, around the country. The media has daily fodder to report the latest scandal in corporate, entertainment, and government circles.

Florida has served up some headlines of its own with, in the past 12 months, two state senators resigning, another one under investigation for workplace and sexual harassment and another couple senators for misusing the power of their elected office to get ahead of “regular” Floridians for utility and insurance claims adjusting services, respectively. And the House of Representatives has its own sort of spotlight with various members leaving because they didn’t anticipate the time commitment involved in serving in public office; had deteriorating health conditions or were appointed by the White House to federal offices.

As one seasoned reporter put it, most in the Capitol are just “going through the motions” of advocating for their causes. For those like me who have been around a long time, we try to encourage our elected officials that seem to be above the fray to stay strong and keep a good thought. And to stay focused on making Florida better. One elected official said that he would be careful from now on from giving hugs when greeting visitors as many do in the South. Another said he would not meet with female lobbyists unless someone else was in the room. Attorney General Pam Bondi said, ““As a career prosecutor, I would say you have to come forward, because someone has the right to face their accuser.”

Whatever the day or scandal, we at LMA are staying focused on what you, our heroes do, every day, serving policyholders and keeping promises. And whatever we can do to help with that, we are a phone call away! For now, take a minute to scan our great assortment of articles for this edition and if we don’t talk, Happy Thanksgiving!

Bill Watch

The third week of legislative committee meetings

This edition’s Bill Watch is a bit lengthier since the legislature’s committees met in full force this past week. Issues our legislators debated included Charter Schools and how they can peacefully co-exist with traditional schools; mandated financial literacy courses for graduating from K-12 schools; the proverbial assignment of benefits (AOB) debate in property insurance transactions; the use of insurer managed repair programs (MRPs) to rein in AOB abuses; housing shortages in Monroe County and the general state of affairs in Florida housing; and petroleum tank cleanup. The list goes on and for those of you who want to hear a bit more about issues other than this newsletter’s primary focus, we keep up with all of the things that make Florida’s public policy debates the most interesting in the world. And with that – here’s a snapshot of what happened in this week’s 2018 Bill Watch, with this past week’s updates in bold print in individual bills:

This edition’s Bill Watch is a bit lengthier since the legislature’s committees met in full force this past week. Issues our legislators debated included Charter Schools and how they can peacefully co-exist with traditional schools; mandated financial literacy courses for graduating from K-12 schools; the proverbial assignment of benefits (AOB) debate in property insurance transactions; the use of insurer managed repair programs (MRPs) to rein in AOB abuses; housing shortages in Monroe County and the general state of affairs in Florida housing; and petroleum tank cleanup. The list goes on and for those of you who want to hear a bit more about issues other than this newsletter’s primary focus, we keep up with all of the things that make Florida’s public policy debates the most interesting in the world. And with that – here’s a snapshot of what happened in this week’s 2018 Bill Watch, with this past week’s updates in bold print in individual bills:

Hurricane Irma Damage – The House Select Committee on Hurricane Response and Preparedness held another 4 hour meeting last week and heard testimony on nursing home generators, shelters and homeowners who only want to be in a shelter if they can have their pets with them (we get it!) and on other Irma-related issues. The senior living facility generator issue is very emotionally charged and has been since Governor Scott issued a November 15 deadline that all senior facilities shall have a generator for air conditioning and enough fuel for 96 hours. This edict was appealed to the judiciary who ruled against the Governor’s emergency generator rule but the Governor and the state agencies charged with implementing the rule are forging ahead. Concerns have been expressed by all stakeholders including emergency management officials who worry that facility owners are buying gasoline to fuel gas powered generators and storing the fuel near windows of a facility. As one expert said, “Facility owners don’t need to go to Home Depot to buy their generator. Buying a generator intended for a single family residence is a huge mistake if the owner thinks it will work for a commercial residential building.” Florida Health Care Association lobbyist Bob Asztalos told the panel that during Irma his association staff spent 12-hour shifts at the state emergency operations center in Tallahassee. “What happened at the Hollywood Hills Rehabilitation Center was unconscionable and must never happen again,” Asztalos said. He encouraged the state to work with the nursing home industry and vice versa on developing a plan to ensure that nursing homes and assisted living facilities can have generators in place to keep residents cool and safe during disasters. “Where we differ is on the process of getting there,” he said noting that the Nov. 15 deadline to have generators and fuel is not achievable. We will keep you apprised.

Personal Injury Protection (PIP), also called No Fault Insurance – The House Commerce Committee passed HB 19 which eliminates the state requirement that motorists carry $10,000 in PIP insurance and puts responsibility for vehicle accidents on the party at fault. It would require motorists instead to carry Bodily Injury liability insurance at a minimum $25K/$50K level. Rep. Erin Grall (R-Vero Beach) who is sponsoring this bill for second year in a row, reminded the committee that despite a series of reforms every few years, including the latest in 2012, costs keep going up, driven partly by fraud. On her side is OIR and committee staff analysis which show auto rates would go down (5.6% overall) if the bill passes and should encourage some driving illegally without proper insurance (22% of Florida drivers she said) to get coverage. The bill also revises the uninsured and underinsured coverage legal damage thresholds.

Despite questions raised about potential negative impacts to health insurance rates (injury costs will shift which could equate to a 1% increase in health insurance costs Grall said) and uninsured motorist insurance (a slight increased cost shift, she said) the bill passed 18-7. Some speakers wanted third-party Bad Faith reform included in the bill, but Grall countered that while that may need to be addressed at some point in the future, keeping this a simple repeal does provide incentives to settle claims and may positively impact Bad Faith. Unlike a Senate version (see below) HB 19 does not mandate medical payments (Med Pay). The bill was fast-tracked and now goes to the full House floor for a vote.

Senator Tom Lee’s (R-Brandon) version of PIP repeal, SB 150, replaces PIP with mandatory $5,000 of Med Pay coverage and varying amounts of Bodily Injury liability limits which appears to give consumers choices:

- 20/40/10 minimum coverage from 1/1/19-12/31/20 or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $50,000 for one crash;

- 25/50/10 minimum coverage from 1/1/21-12/31/22 or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $60,000 for one crash; and

- 30/60/10 minimum coverage from 1/1/23 and thereafter or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $70,000 for one crash.

SB 150 has yet to be scheduled before any of its three referenced committees.

HB 6011 by Rep. Julio Gonzalez (R-Venice) deletes the requirement for policyholders & health care providers to execute disclosure & acknowledgment forms to claim personal injury protection benefits. These requirements were originally established to help prevent fraud and include verification that actual services were rendered and weren’t solicited by the provider. While we have not had a personal conversation with Rep. Gonzalez to understand the catalyst behind this bill, we surmise that as an orthopedic surgeon, lessening the insurance paperwork burden for medical providers has long been a goal of those in the profession. This bill appears to be a step in that direction. The bill has been referred to the House Insurance and Banking Subcommittee.

Assignment of Benefits (AOB) – The House Judiciary Committee released the exact version of Rep. Jamie Grant’s 2017 Assignment of Benefits bill (HB 1421), (which had passed the House but was never heard in the Senate) with Rep. Jay Trumbull (R-Panama City) leading the House’s 2018 effort for reform. The bill has 3 main components: data collection aimed at having concrete evidence of attorney fee amounts and claim costs; parameters around attorney fees vs the current “wild, wild west”; and consumer disclosure language so the consumer is fully aware of the consequences when executing an assignment of benefits document. This year’s bill is scheduled for a hearing tomorrow in the Judiciary Committee.

The Senate Banking and Insurance Committee last week continued taking testimony about Florida’s AOB problem with this hearing’s focus on companies that use Managed Repair Programs (MRPs) to control runaway costs. OIR testified that nine property insurers in Florida have been approved for MRPs, with two more in the review process and that those with MRPs result in savings on losses and lower rates as a result. (Not all programs are up and running.) OIR verified it does not review the contractors list used in MRPs nor does the policyholder receive the list at time of application unless they ask for it. The response raised some eyebrows among committee members, with Chair Flores expressing “shock” that no one reviews lists to ensure credible contractors. What was missing from this exchange between Chair Flores and the OIR representative is that the insurance companies vet the contractors for appropriate licensure and compliance with worker’s compensation insurance coverage. The contract between the contractor and the insurance company is not subject to regulatory scrutiny as our readers know.

Citizens Property Insurance President & CEO Barry Gilway told the committee that Citizens is “late to the party” in just this year resorting to MRPs but that its program encompasses the best experiences of other insurers – and focuses on non-weather water losses. (Citizens MRP is voluntary and offers incentives such as no-cost, no-deductible water removal, together with permanent repairs guaranteed for three years; however, those that don’t accept the voluntary option at time of loss are limited to a $10,000 claim limit and new stringent documentation and resolution requirements.)

Gilway referenced Senator Dorothy Hukill’s (R-Port Orange) version of AOB reform (SB 62) that prohibits certain attorney fees and requires those vendors that execute the AOB to comply with certain requirements prior to filing suit. “In litigation, if we pay just one dollar more in a settlement or verdict than our original offer, we have to pay both defense and attorney fees,” said Gilway which he explained together amounted to $130 million out of $1 billion in review the company collected. “That’s what’s driving the immense increase in rates,” he said.

AOB abuse is now increasing in the auto insurance lines, as insurance companies note an increase in customers being solicited out of the blue for a “free windshield” with accompanying exorbitant claims costs. Senator Hukill has a bill for that, too, in SB 396, which would allow auto insurers to require an inspection of the damaged windshield of a covered motor vehicle before the windshield repair or replacement is authorized. The bill has not been assigned to committees yet. In a recent conversation with a circuit judge, we asked what kinds of cases made up his judicial docket. He couldn’t be specific but said he “keeps seeing more and more windshield cases.” We have begun the research to ascertain in certain judicial circuits if we can show the exponential increase in windshield cases over the past few years. SB 396 has been referred to the Banking and Insurance, Commerce and Tourism, and Rules committees.

SB 256 by Senator Gary Farmer (D-Ft. Lauderdale) would prohibit insurer managed repair programs and prevent most property insurance policies from prohibiting or limiting AOB. But it would also require the AOB be in writing, be limited to an accurate scope of work to be performed, and allow the policyholder to cancel the AOB within seven days without penalty and otherwise, be shared with the insurer within seven days of execution. A final repair bill would be required to both policyholder and insurer within 7 days of work completed. Referral fees would be limited to $750 and require water damage remediation assignees to be ANSI certified. Insurance companies would be required to offer any settlement within 10 days of assignee filing suit over an AOB dispute. It also prohibits insurers from including the costs of attorney fees paid in losing cases into their rate base or future rate requests. Under the bill, OIR would be required to conduct an annual AOB data call beginning in 2020. SB 256 has been referred to the Committees on Banking and Insurance, Appropriations, and Rules but has not been scheduled to be heard.

Rep. David Santiago (R-Deltona), who has been a champion in the fight against the abuse of assignment of benefits for the past several years, has filed a catch-all insurance bill (HB 465), known as an “omnibus” bill to change several provisions of the insurance code. The bill covers several insurance topics such as property, auto, surplus lines and some general regulatory provisions. One of the most interesting is that it excludes from the Department of Financial Services complaint registry complaints filed by third parties who are not satisfied with an insurance company’s claims handling when an assignment of benefits is involved. The thinking is that there is an incentive by third party vendors to dispute the claim to delay it, which drives up the cost of the claim. The bill also makes a priority the use of the Department of Financial Services mediation program for property insurance claims disputes involving an assignment of benefits.

Trade Secrets in Public Records – HB 459/HB 461 by Rep. Ralph Massullo (R-Beverly Hills). Recently, House Speaker Richard Corcoran held a press conference aimed to raise the awareness of his objection to state agencies who claim trade secret to shield contract and vendor information. He said that agencies should not be entitled to trade secret privileges if they “spend one penny of taxpayers’ dollars.” Shortly after his press conference, two bills that are a “priority” of Speaker Corcoran’s were released, filed by Rep. Massullo near the Speaker’s Pasco County district – HB 459 which repeals over 75 public records exemption references in current law, including the trade secret process used in the insurance code, Section 624.4213, Florida Statute. Interestingly, a “sister” bill to HB 459, HB 461 has been filed and appears to re-enact a new trade secret process that is not unlike current law regulating insurance entities use of trade secrets now. So in essence, HB 459 repeals the current insurance entity trade secret practice and HB 461 restores it. Much of this is procedural and we will follow this closely.

Workers’ Compensation – By far one of the most contentious – and by court rulings, most immediate – issues facing the legislature after the state Supreme Court last year ruled our workers’ comp system unconstitutional. Yet the two chambers couldn’t reach agreement on a fix in the 2017 session. Now House leadership is fast-tracking this Commerce Committee bill that is significantly the same as HB 7085 which passed the House last session but died in the Senate, in part, over a dispute on maximum hourly attorney fees (the House wanted $150/hr and the Senate more). The bill goes before the House Commerce Committee tomorrow. Also, last week, OIR approved a final rate decrease of 9.5% in Workers’ Comp rates for the upcoming year.

Workers’ Compensation for First Responders – SB 126 by Senator Victor Torres (D-Kissimmee) and HB 227 by Rep. Matt Willhite (D-Royal Palm Beach) removes the requirement that there be a physical injury in order to receive medical benefits for a “mental or nervous injury”, so long as the responder witnessed a specified traumatic event and begins treatment within 15 days. Neither bill has been scheduled to be heard.

Insurance Rates – SB 258 by Senator Farmer would prohibit insurance companies from including the costs of attorney fees paid in losing cases into their rate base or future rate requests in Workers’ Compensation and Life policies. Farmer’s similar bill in the 2017 session failed. SB 256 has been referred to the Committees on Banking and Insurance, Appropriations, and Rules but has not been scheduled to be heard.

Direct Primary Care – SB 80 by Senator Lee, allows doctors to enter into monthly fee for service arrangements directly with individuals or employers, essentially bypassing health insurance organizations. Informally dubbed “concierge medicine for the masses”, the bill passed by unanimous vote out of the Health Policy Committee in October and now awaits action in the Appropriations Committee. SB 80 has a companion bill in the House (HB 37) by Rep. Burgess which has only one committee stop. When just one committee is assigned, it’s usually a signal that leadership wants a bill to pass, especially given the House passed a similar measure last session, but it stalled in the Senate.

Health Insurer Authorization – SB 98 by Senator Steube and HB 199 by Rep. Shawn Harrison (R-Tampa) would prohibit prior authorization forms from requiring information not necessary to determine the medical necessity or coverage for a treatment or prescription. The bills would also require health insurers and their pharmacy benefits managers to provide requirements and restrictions on prior authorizations in understandable language and to make them available on the internet, along with a 60-day notice of any changes. SB 98 passed unanimously out of the Senate Banking and Insurance Committee last week but not without a senator asking in essence, “why are we bothering if the House won’t take up this bill?” and the sponsor said, “talk to Chair Cummings” who is the Chairman of the powerful Health & Human Services Committee in the House. Senator Steube’s SB 162 would prohibit health insurers and HMOs from retroactively denying insurance claims under certain circumstances. The bill has been referred to the Banking and Insurance, Rules, and Health Policy Committees and has not had its first hearing.

Flood Insurance and Mitigation – SB 158 by Senator Jeff Brandes (R-St. Petersburg) provides greater funding for flood mitigation so that more individuals and communities can meet NFIP flood insurance standards. The bill would allow flood mitigation projects to be funded by the Florida Communities Trust to reduce flood hazards. Senator Brandes has for the past 5 years taken the lead in Florida in the flood insurance arena. The bill has been referred to the Committees on Environmental Preservation and Conservation, Appropriations, and the Appropriations Subcommittee on the Environment and Natural Resources but has not been scheduled to be heard. We are closely following this bill including asking the committee chair to put this on her next committee’s meeting agenda.

Insurance Credit Scoring and Redlining – SB 414 by Senator Farmer would ban the use of credit scores as a determining factor in calculating auto insurance premiums. Currently, insurers are permitted to use a customer’s credit history as a justification for higher insurance rates. Statistically, drivers with poor credit scores pay more and according to Farmer “the use of credit scores as a determining factor for auto insurance rates has been found to disproportionately affect minority populations, with African American and non-white Hispanic policyholders often paying higher premiums, and is not a reliable indicator for increased risk.” Similarly, SB 410 would prohibit the use of zip codes as a determining factor in calculating auto insurance premiums, which Farmer called “de facto discrimination.” HB 659, which passed and became law in 2016, allows single zip code rating territories if they are actuarially sound and the rate is not excessive, inadequate, or unfairly discriminatory. Neither bill has been assigned committees.

Florida Hurricane Cat Fund – HB 97 by Rep. David Santiago (R-Deltona) adds an additional 10% charge to an insurer’s reimbursement premium with the money going to the Division of Emergency Management to fund a wind and flood mitigation program for residential structures. The charge would increase to 15% and remain there until the fund reaches $10 billion. It also contemplates OIR levying an emergency assessment to cure certain deficits in the fund. The bill also revises reimbursements the SBA must make to insurers to add a 25% and 60% level of insurer’s losses from each covered event in excess of the insurer’s retention and the overall contract year obligation. The bill has been referred to the House Insurance and Banking Subcommittee meeting.

Patient’s Choice of Providers – Dubbed the “Patient’s Freedom of Choice of Providers Act”, HB 143 by Rep. Ralph Massullo (R-Beverly Hills) prohibits a general health insurance plan from excluding willing and qualified health care provider from participating in a health insurer’s provider network so long as the provider is located within the plan’s geographic coverage area. The bill has been referred to the Health Innovation Subcommittee.

Telehealth – SB 280 by Senator Aaron Bean (R-Fernandina Beach) is part of a continued effort to put remote health practitioner visits via the internet on an equal footing as in-office visits, in order to reduce health costs and provide parity of care to rural patients. A state panel has spent the past year executing a list of legislative directives to help smooth the kinks and establish recommended procedures to help make this bill a reality. SB 280 would establish the standard of care for telehealth providers; encourage the state group health insurance program to include telehealth coverage for state employees; and encourage insurers offering certain workers’ compensation and employer’s liability insurance plans to include telehealth services. The bill has been referred to the Banking and Insurance; Health Policy; and Appropriations Committee, as well as the Appropriations Subcommittee on Health and Human Services, but no hearing has yet been scheduled.

Texting While Driving – SB 90 by Senator Keith Perry (R-Gainesville) would move Florida’s current ban on texting while driving from a secondary offense (where you can be ticketed during a traffic stop made for another reason) to a primary offense. The Senate Communications, Energy, and Public Utilities committee approved the measure in October, along with an amendment requiring the officer notify the driver of the constitutional right not to have their cellphone examined by authorities. The bill moves on to the Transportation Committee. A similar bill in the House (HB 121) goes a step further by doubling fines for violations in school zones.

Controlled Substances – Proclaiming that opioids are “ravaging families and communities” in Florida, Senator Lizbeth Benacquisto (R-Ft. Myers) filed SB 8 which would restrict opioid supply to three days for standard prescriptions but would allow doctors up to a seven-day supply in certain medical cases. Additionally, it provides for more continuing education for responsibly prescribing opioids and requires participation in the Prescription Drug Monitoring Program by all healthcare professionals that prescribe opiates. It comes on the heels of President Trump’s declaration of a national health emergency over opioid abuse. One of our readers sent us this research published in the Journal of the American Medical Association showing that states with any kind of medical marijuana law had a 25 percent lower rate of death from opioid overdoses than other states.

Autonomous Vehicles – HB 353 by Rep. Jason Fischer (R-Jacksonville) authorizes the use of vehicles in autonomous mode. The autonomous technology would be considered the human operator of the motor vehicle and provides that various provisions of law regarding motor vehicles such as rendering aid in the event of a crash do not apply to vehicles in autonomous mode where a human operator is not physically present as long as the vehicle owner promptly contacts law enforcement. The bill also addresses the applicability of laws regarding unattended motor vehicles and passenger restraint requirements as they relate to vehicles operating in autonomous mode where a human operator is not physically present in the vehicle. The bill unanimously passed the House Transportation and Infrastructure Subcommittee last week and now moves to the Appropriations Committee.

Helpful Links:

2018 Legislative Session Interim Committee Meeting Schedule

House Calendar for the week of November 13

Senate Calendar for the week of November 13

Keep updated on changes in the legislature’s schedules here House Calendar and here Senate Calendar

Hurricane Irma Two Months Later

Closed claims rate increasing but repairs slow due to high demand

This past weekend marks two months since Hurricane Irma hit Florida on September 10-11. The pace of new claims has slowed tremendously in the past two weeks and the focus is on closing claims and making needed repairs and replacements. Here’s the latest on post-Irma developments:

Damage & Claims

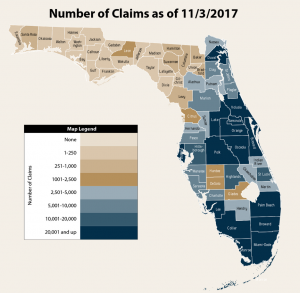

Source: Florida Office of Insurance Regulation

- Total Estimated Insured Losses in Florida as of a week ago Friday (Nov 3) were $5.5 billion. Almost 809,000 claims have been filed, with 55% closed, and a paid to unpaid ratio of almost 3:2. Industry estimates of total damage have ranged from $8 billion to $16 billion. OIR will post updated figures here later today.

- 1,548 of the above claims were flood claims filed with private carriers. In addition, FEMA’s two-month post-event update report says more than 26,600 Florida flood claims have been filed with the National Flood Insurance Program (NFIP) as of last week, with policyholders receiving $239.5 million in payouts for repair and rebuilding flood damaged property.

- More than 2.6 million Florida households have contacted FEMA for Individual Assistance help. This is aid for homeowners and renters whose insurance, or other forms of disaster assistance received, could not meet their disaster-caused needs. More than $899 million in individual assistance has been awarded so far.

- Homeowners, renters, and businesses have received $388 million in 10,579 low-interest disaster loans from the U.S. Small Business Administration (SBA) to repair, rebuild and replace damaged property and contents. SBA offers low-interest disaster loans to businesses of all sizes, private nonprofit organizations, homeowners and renters. More than 76,700 survivors have visited Disaster Recovery Centers, which opened six days after the presidential disaster declaration.

- More than 797,000 FEMA housing inspections have been completed. FEMA also says its disaster survivor assistance specialists canvassed affected communities, visiting more than 208,000 homes to encourage survivors to register for help, while providing them with recovery information and listening to their concerns.

- Upcoming Deadlines to apply for FEMA Individual Assistance and SBA loans is a week from this Friday on November 24. Please share this with your policyholders or friends who may need assistance making deductibles and related costs.

- Citrus damage from Hurricane Irma is still unfolding “and will continue to do so for some time,” said Agriculture Commissioner Putnam last week. The USDA revised downward the orange crop estimates from the current crop by 7.4% last week. Putnam said citrus crop losses from 30% to 70% have been reported by growers.

Regulation

- As we reported in this week’s Bill Watch, the Florida House Select Committee on Hurricane Response and Preparedness is contemplating changes in laws and regulations that may be needed on critical issues related to state disaster policy.

- Insurance Commissioner Altmaier is again warning homeowners not to sign Assignment of Benefits (AOB) agreements with contractors when ordering Irma repair work. In an initial press release he offers consumer tips and encourages homeowners to file a claim directly with their insurance company to maintain control of their policy.

Recovery

- Florida officials say they have distributed more than $1 billion worth of food assistance in the two months following Hurricane Irma. More than 20,000+ people waited in lines each day last week in South Florida – the last week for such emergency food relief. The Department of Children and Families says Irma has had an unprecedented impact on families.

- Through the State of Florida, Floridians in the past two months have received an estimated $1 million in disaster unemployment assistance if they lost work or are out of work due to Hurricane Irma. This dollar amount continues to increase to assist eligible applicants.

- 13,370 temporary roofs have been installed in Florida by the U.S. Army Corps of Engineers through Operation Blue Roof. The temporary covering of blue plastic sheeting is installed using strips of wood that are secured to the roof with nails or screws. Yet two-months post-storm, many homes tarps are deteriorating as homeowners wait their turn with roofers overwhelmed by the demand for replacement roofs.

- Two months later, local governments are employing increasingly creative ways to get rid of the piles of uprooted trees and other vegetation created by Irma’s high winds. Orange County alone has handled 210,000 cubic yards of such debris – and still has more to deal with.

- Thanks to a unified effort to mitigate pollution threats from vessels displaced by Hurricane Irma, nearly 1,500 sunken vessels have been recovered/removed from Florida waterways by the U.S. Coast Guard, the Environmental Protection Agency, the Florida Fish and Wildlife Conservation Commission as well as private owners. While boats submerged, new ones emerge, as Florida’s luxury yacht industry reports it’s having the best sales year in a long time.

- The Federal Housing Administration (FHA) extended its initial 90-day foreclosure moratorium for FHA-insured homeowners impacted by Hurricanes Irma, Maria, and Harvey for an additional 90 days due to the extensive damage and continuing needs in hard-hit areas. The Hurricane Irma moratorium is extended through March 9. Other helpful programs here.

- The Florida Housing Finance Corporation (FHFC) last week provided an update on its work with FEMA to match displaced renters from IRMA with landlords willing to rent short term and accept FEMA rental assistance vouchers. FHFC also focuses on long term housing recovery to provide additional housing to Florida communities by targeting funding based on where damage/destruction has occurred. The Shimberg Center for Housing Studies at UF testified at the same hearing that Florida’s affordable rental housing needs are increasing and that most low-income renters are cost burdened. For those of you who track housing statistics, these organizations are an excellent resource.

Florida’s Lennar Merger Creates Nation’s Largest Homebuilder

Just in time to rebuild from the hurricanes

Damage from Hurricanes Irma, Harvey, and Maria has created a greater need for new homes and now one of Florida’s oldest and largest homebuilders is expanding, right along with the state’s housing market, too. Miami-based Lennar recently announced a $9.3 billion merger with smaller rival CalAtlantic Group. Together they will be the largest homebuilder in the country by market capitalization at $18 billion. The combined company will control approximately 240,000 home sites and will have approximately 1,300 active communities in 49 markets across 21 states, where approximately 50% of the U.S. population currently lives.

Damage from Hurricanes Irma, Harvey, and Maria has created a greater need for new homes and now one of Florida’s oldest and largest homebuilders is expanding, right along with the state’s housing market, too. Miami-based Lennar recently announced a $9.3 billion merger with smaller rival CalAtlantic Group. Together they will be the largest homebuilder in the country by market capitalization at $18 billion. The combined company will control approximately 240,000 home sites and will have approximately 1,300 active communities in 49 markets across 21 states, where approximately 50% of the U.S. population currently lives.

The merger is expected to help Lennar here in Florida especially with the feast or famine supply of labor and rising land costs – two of the biggest challenges facing homebuilders in the country today. A recent U.S. Chamber of Commerce survey noted 60% of contractors had problems finding enough skilled workers.

“Accordingly, our overall company size and local critical mass will yield significant benefits through efficiencies in purchasing, access to land, labor and overhead allocation to a greater number of deliveries,” said Lennar CEO Stuart Miller in a company statement. “The combined land portfolio will position the company for strong profitability for years to come, as we continue to benefit from a solid homebuilding market, supported by job and wage growth, consumer confidence, low levels of inventory, and a production deficit.”

The timing of the merger is right. The U.S. Commerce Department reported last month September homebuilding in the South is up 26%.

Second District Court of Appeal AOB Ruling

Long term impact uncertain

A few weeks ago, the Second District Court of Appeal (DCA) issued a PCA – per curiam affirmed – it means the DCA has affirmed the trial court’s decision without explanation. The case is Bio Logic, Inc. vs. ASI Preferred Insurance Corp. and by its simple ruling, the court is allowing ASI to keep its policy language requiring that an insured party, such as the bank as mortgager, has to sign off on an Assignment of Benefit (AOB). If the bank doesn’t, then the AOB isn’t valid.

The DCA ruling contains one word – “Affirmed” – and is listed on the 2nd DCA website as being the opinion of the entire panel per curiam, or by the Court. In this case, the fact that the DCA didn’t elaborate, means there is no way to argue that this DCA decision “expressly and directly” sets precedent or has any implication on other cases. We are watching other AOB consumer abuse cases in the appellate courts. We are providing most of the filings involved with this case here, so please let us know if we can answer questions. We encourage our readers to consult with their lawyers as well.

Filings in Biologic vs. ASI Preferred Insurance Corp.:

Morgan’s Consolidated Reply Brief and Response to Amicus Brief

Florida Blue Bans OxyContin

Move follows state and national emergency opioid declarations

In health care, the goal is first to do no harm and then to do good. With that in mind, Florida’s dominant health insurer Florida Blue has announced it will no longer cover the opiate pain-killing drug OxyContin, due to its well-publicized potential for misuse and abuse. The decision is effective this January 1 for its commercial insurance lines but does not apply to its Medicare Advantage plans. Instead the insurer will offer Xtampza ER as a replacement for those patients needing a “long-acting oxycodone product,” according to a company release.

In health care, the goal is first to do no harm and then to do good. With that in mind, Florida’s dominant health insurer Florida Blue has announced it will no longer cover the opiate pain-killing drug OxyContin, due to its well-publicized potential for misuse and abuse. The decision is effective this January 1 for its commercial insurance lines but does not apply to its Medicare Advantage plans. Instead the insurer will offer Xtampza ER as a replacement for those patients needing a “long-acting oxycodone product,” according to a company release.

The move follows President Trump’s national public health emergency declaration last month and Governor Scott’s recent executive order proclaiming opioid abuse in Florida a statewide emergency. Florida Blue explained that Oxycontin is an easier drug to abuse than others, by crushing the pill for unprescribed uses such as injecting and snorting, which can lead to easy addiction and accidental overdose, too.

Statistics show opioids were in the systems of 4,515 Floridians at their time of death in 2016 and in 2015 the CDC reported its abuse was the direct cause of death for 3,900 more. Florida Blue, which covers nearly one-million Floridians – a third of the major medical market share in Florida – says it’s also cooperating with state and federal authorities in identifying doctors whose opioid prescription rates seem unusual. Purdue Pharma, the makers of OxyContin, was critical of the insurer’s move, saying Xtampza ER has potential for abuse, too.

If you ever wondered how the opiate crisis permeates all conversations in the Capitol, Senator Lauren Book recently quipped when asked about the recent resignation of a Democratic Senator for having an affair, “84 people died today from opioid abuse and we are still talking about someone who had an affair?” The legislature is considering several measures this upcoming session to address the crisis. As noted in our Bill Watch, these include SB 8 which would restrict opioid supply to three days for standard prescriptions but would allow doctors up to a seven-day supply in certain medical cases.

Autonomous Vehicle Technology Zooming Along

Feds urging developers share their data – and solutions to challenges

As we mentioned in this week’s Bill Watch, the Florida legislature is considering HB 353, which authorizes the use of vehicles in autonomous mode on our state’s roadways. On the federal level, the National Highway Traffic Safety Administration (NHTSA) recently released updated guidelines on autonomous vehicle (AV) technology that some feel is more relaxed than previous versions. NHTSA has concerns about cybersecurity – someone hacking into an AV’s computer guidance system and purposely crashing the car – and urges developers to share cybersecurity plans among themselves, as well as post-crash data and procedures being developed for returning crashed vehicles to roadway service.

In its Automated Driving Systems 2.0 – A Vision for Safety, cybersecurity is one of 12 safety elements that the NHTSA outlines. It urges developers to publish “voluntary self-assessments” on how each element has been methodically addressed – and resolved – while considering other issues as well. The NHTSA guidance says AV systems should retain and store data and make it readily retrievable and sharable with government entities.

One company that seems to be taking that advice to heart is Google, through its AV subsidiary Waymo. It has produced a report On the Road to Fully Self-Driving that although it doesn’t address data sharing, does describe how its system records and uses data after an accident. Also included is its virtual testing in training simulations.

Intel, the folks that provide the smart chips that drive most of home and work computers, are of course very involved in AV technology. They’re NHTSA’s master database of very detailed accident data to develop mathematical models to create a so-called “safe state” for autonomous vehicles. Intel claims its AV “won’t make a decision that causes an accident.” You can read more in A Plan to Develop Safe Autonomous Vehicles. And Prove It.

Meanwhile, a congressional committee is planning a field trip outside their toasty committee rooms this January to see and touch autonomous vehicles in a convention hall a few days before a big auto industry show. There’s no doubt that AV technology development is moving fast. XL Group CEO Mike McGavick was recently quoted in PropertyCasualty 360 as saying “Driverless vehicles will be here much sooner than we think…I believe completely that we’re living in the Renaissance of the insurance industry.”

Workers’ Comp Scams

The saga continues…

In case you missed it, the old “you have to cheat to compete” mantra is still around. Construction companies who legitimately purchase workers’ compensation insurance policies have complained for years that they feel like they have to cheat the system in order to keep their prices down to compete with their non-compliant competitors. And for years the Department of Financial Services has been doing all it can to stop the illegal construction activity that results. The latest installment in this saga comes from Jacksonville and a construction company owner who is accused of pulling a million dollar workers’ comp scam.

In case you missed it, the old “you have to cheat to compete” mantra is still around. Construction companies who legitimately purchase workers’ compensation insurance policies have complained for years that they feel like they have to cheat the system in order to keep their prices down to compete with their non-compliant competitors. And for years the Department of Financial Services has been doing all it can to stop the illegal construction activity that results. The latest installment in this saga comes from Jacksonville and a construction company owner who is accused of pulling a million dollar workers’ comp scam.

Carlos Contreras, who owns DJC Builders and Construction was arrested last month after providing false information on his workers’ comp insurance policy – specifically, by underreporting his number of employees, the scope of work they perform, and the company’s annual payroll. These are three key components that go into figuring an accurate workers’ compensation insurance policy by Florida law.

Contreras claimed his company’s annual payroll was $273,786, and thus was quoted an annual workers’ compensation policy premium of $25,311. However, between January and August 2017, DFS investigators determined that Contreras cashed at least 620 payroll checks for DJC Builders & Construction. In total, nearly $6,500,000 in payroll was cashed using various money service businesses located across the state. If Contreras had accurately reported the company’s total payroll, number of employees and correct work description, the company’s proper workers’ compensation premium would have been $1,217,161. As a result of the scam, Contreras’ insurance company was defrauded of more than $1,000,000.

Florida’s Contribution to the 25 Happiest Cities in America

Thoughts to contemplate during the upcoming Thanksgiving holiday

Many of our dedicated readers tell me they only read our newsletter’s opening and closing because they just need a little sunshine in their Monday. Our team saw this article and I just loved that a change of environment is underscored in changing our mental states.

Gallup teamed up with National Geographic to produce a different kind of report, The Happiest Cities in America. Based on new methodology by Gallup, they came up with an index to measure a population’s happiness and from that, a list of the 25 happiest cities in America. Author Dan Buettner writes “If you want to get happy, don’t try and change your belief system. Change your environment.” The index draws on a whopping 250,000 interviews conducted with adults from 2014 to 2015 in 190 metropolitan areas across the U.S as part of the Gallup-Sharecare Well Being Index. It uses 15 metrics for happiness including quality health care, healthy food, civic engagement, financial security, vacation time, and learning something new every day.

Florida has two regions on the top 25 happiest cities list: the Sarasota/Bradenton/North Port area and the Naples/Marco Island area. Colorado and California have 11 of the top 25 cities. The full list is clickable on the link above.

I want to know where your travels will take you as we approach next week’s Thanksgiving holiday. I come from a large Lebanese family (yes, think: “My Big Fat Greek Wedding”!) and imagine almost 50 middle easterners eating kibbe and fried chicken and dressing and cranberry sauce and tabouli!

Have a great week!

Lisa