June 23, 2020, Trading Risk – In that same webinar, industry consultant Lisa Miller warned that, despite reform efforts, insurance-related lawsuits in Florida have tripled since 2015, prompting some carriers to abandon the market, thereby cutting supply and driving up the price of primary and reinsurance cover… “Try as we might with AOB reform […] the real problem is that we have this idea that the minute you file a claim, you file a lawsuit,” Miller said. Looking ahead, Citizens could act as a bellwether for other Florida market participants, as claims related to hurricanes Michael and Irma continue, Miller said. (Original story location: https://trading-risk.com/articles/134073/irma-lawsuits-continue-in-run-up-to-hurricane-season )

Florida Florida insurers continue to grapple with new Hurricane Irma claims and lawsuits, with several months still to run before the statute of limitations expires on the 2017 storm.

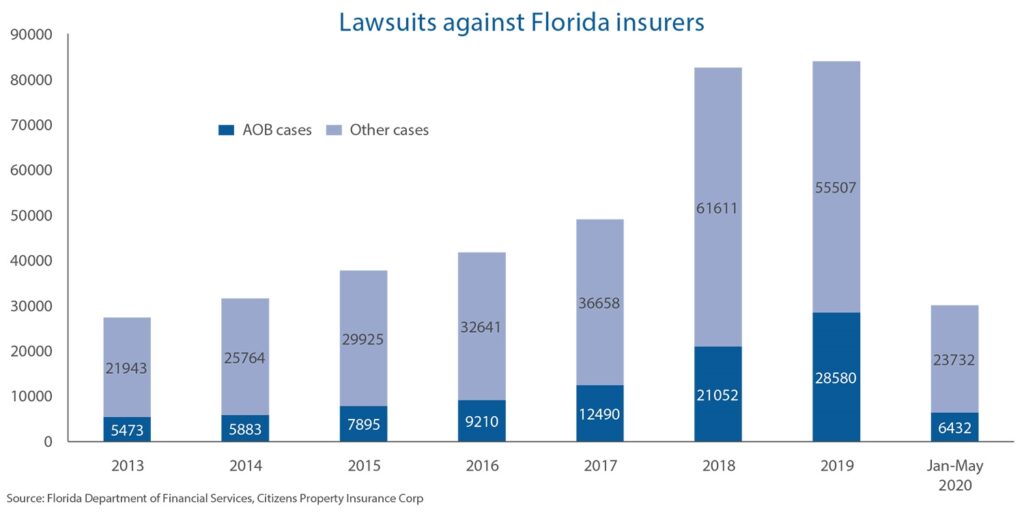

According to state-backed cedant Citizens Property Insurance Corporation, the number of lawsuits against Florida insurers reached a historic peak last year of over 84,000. Of this, nearly 29,000 related to assignment of benefit (AOB) cases pursued by third parties who had taken over policyholder rights.

Citizens received notice of 2,267 new lawsuits during the January to April period this year – equal to 567 new cases each month and adding to an already mounting backlog of over 12,000 pending lawsuits.

The volume of claims received in that four-month period was down more than 30 percent compared with the same period in 2019. Claims linked to cat losses made up 47 percent of new cases and 44 percent of pending ones, Citizens said in board meeting documents on its website.

Despite the new case load having slowed over the past year, Irma was one of the leading causes of loss in new and pending lawsuits, and Citizens said it anticipated an “increasing trend” in Irma litigation before the cut-off date for the three-year statute of limitations this September.

Earlier this year, the listed Floridian private insurers said that while there had been a significant drop-off in lawsuits in the latter half of 2019, Irma claims were expected to continue to flow in ahead of the statute of limitations expiry.

Prior-year loss deterioration was a major influence on this year’s Florida reinsurance renewal. Citizens estimated that most reinsurance treaties renewed at a price 25-30 percent higher than previous rates, which compounded increases of roughly 10‐20 percent charged last year.

Lawsuits slow but continue against Citizens

The lawsuits remain small in the context of total claims filed for recent major disasters that have struck the state, but have contributed to major loss deterioration for Irma in particular.

Wesley Todd, CEO of data management firm CaseGlide, estimated during a recent webinar hosted by rating agency Demotech that, as of May 2020, roughly 1 million property claims linked to Hurricane Irma and 100,000 tied to Hurricane Michael had come to market.

According to CaseGlide, as of last month, up to 10 percent of claims for both storms remained open and litigation was continuing at a steady pace, with “thousands” of new lawsuits related to Irma and Michael appearing each month, Todd said.

Together with a growing backlog of other lawsuits, Florida insurers are currently grappling with “tens of thousands” of legal challenges in the lead-up to the storm season, which leaves the sector vulnerable, Todd said.

“As far as looking forward to an active storm season, it’s very important to look at what we currently still have in the pipeline and focus on that first because time is running out as far as our ability to actively engage and get those cases closed,” he said.

In that same webinar, industry consultant Lisa Miller warned that, despite reform efforts, insurance-related lawsuits in Florida have tripled since 2015, prompting some carriers to abandon the market, thereby cutting supply and driving up the price of primary and reinsurance cover.

Those factors have made rising rates “the norm” in Florida, while also changing the risk appetite across the industry and pushing droves of customers to the state-owned carrier of last resort Citizens, she said.

“Try as we might with AOB reform […] the real problem is that we have this idea that the minute you file a claim, you file a lawsuit,” Miller said.

Looking ahead, Citizens could act as a bellwether for other Florida market participants, as claims related to hurricanes Michael and Irma continue, Miller said.

Official loss figures for the two storms are still being tallied, but the Florida Office of Insurance Regulation website shows incurred but not reported losses in Florida from Irma and Michael totalling $24.8bn at the end of 2019. Irma accounted for $17.4bn while Michael claims have reached $7.4bn, although total industry loss estimates are higher for both storms.

Looking ahead, legal action against insurers could lessen thanks to 2019 legislation on AOB.

Separately, industry participants hope that a bill which would limit fees that no-win, no-fee lawyers on property insurance cases will be resurrected in 2021, despite a previous version of the proposal having died in the Florida Senate in March.

Meanwhile, earlier this month a Florida supreme court granted an emergency suspension order prohibiting the owner of Florida-based Strems Law Firm from representing clients ahead of hearing the Florida Bar’s case against Scot Strems.

According to reports, Strems may have filed as many as 10,000 suits against property insurers in recent years. Citizens has also filed a civil complaint against the law firm.

© 2020 Euromoney Institutional Investor PLC.