New bill targets Repetitive Loss Properties

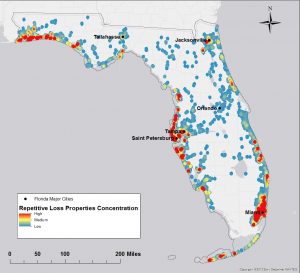

Repetitive Loss Properties Concentration in Florida. Courtesy, Esri DeLorme NAVTEQ in the Journal of Ocean and Coastal Economics

Acknowledging the growing disaster recovery costs of properties that repeatedly flood, Congress has introduced new bipartisan legislation to stem their number, which represent only 1% of federal flood policies but consume 10% of claim payouts. Florida is among the five states with the most Repetitive Loss Properties (RLP), defined as insured structures that have been paid two or more federal claims of more than $1,000 within any 10-year period.

The U.S. House of Representatives this month introduced H.R. 5776, The Repeatedly Flooded Communities Preparation Act, which would require certain flood-prone communities to develop and implement mitigation strategies to address their repeatedly flooded areas, such as drainage improvements or voluntary buyout programs. The communities are defined as those with 50 or more RLPs with three or more claims greater than $1,000; or those with 5 or more RLPs where mitigation hasn’t happened; for that have received Stafford Act assistance in the past decade.

There’s a companion bill in the U.S. Senate (S. 2088) that also requires those communities to submit action plans to FEMA to reduce their flood risks. Communities that fail to comply or implement the plans would be subject to sanctions, including reductions in financial assistance.

“This legislation takes a carrot-and-stick approach to the problem of repeat flood losses, facilitating access to mitigation funding for communities that take the initiative, with potentially significant financial consequences for those that do not,” the R Street Institute noted in a statement.

FEMA has identified about 160,000 RLPs in the nation. Louisiana, Texas, New York, New Jersey, and Florida have the most. A 2017 report found Florida has 15,000 RLPs. Those properties collectively filed more than 40,000 claims against FEMA’s National Flood Insurance Program between 1978 and 2011 – more than 1,200 claims per year, on average. In fact, 12 counties account for a third of flood insurance claims; Broward and Miami-Dade Counties here in Florida are among them.

FEMA is almost $21 billion in debt, in part due to catastrophic flooding associated with large hurricanes and Midwest rains over recent years. That figure is on top of the $16 billion of debt Congress forgave back in 2017. For more information, including the growth of private flood insurance alternatives, visit our Flood and Resilience webpage.

LMA Newsletter of 2-17-20