Claims costs, rates rising

The past two weeks have not been good for Florida’s homeowners insurance market – with some calling it “the beginning of the meltdown.” It’s essentially a growing culmination of four factors we’ve outlined in the pages of this newsletter over the past 10 months: claims creep, growing attorney fees, rising reinsurance costs, and the resulting contraction of the private market with taxpayer-backed Citizens left picking up the policies.

The past two weeks have not been good for Florida’s homeowners insurance market – with some calling it “the beginning of the meltdown.” It’s essentially a growing culmination of four factors we’ve outlined in the pages of this newsletter over the past 10 months: claims creep, growing attorney fees, rising reinsurance costs, and the resulting contraction of the private market with taxpayer-backed Citizens left picking up the policies.

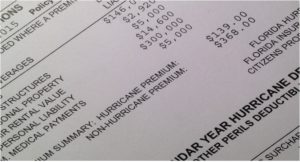

Just in time for hurricane season, Capitol Preferred Insurance becomes the latest company to shed Florida homeowners policies because of unsustainable losses and reinsurance costs. The Office of Insurance Regulation on May 12 issued a Consent Order allowing about 27,500 of the company’s 108,870 policies to be cancelled with a 45-day notice to the policyholders. Florida Peninsula Insurance has a 13.5% statewide average rate increase that kicks in next month, just one of many carriers with double-digit increases approved by regulators since last fall. Others, such as People’s Trust and Typtap are restricting or refusing any new business, while others still are tightening underwriting requirements.

Claims creep from Hurricanes Matthew, Irma, and Michael are part of it. While about 90% of claims are filed in the first 60 days after a storm, Florida law allows consumers three years to file a claim. Experience has proven that’s plenty of time for door-to-door solicitors to convince homeowners to file claims or supplemental claims. Adding a $200 gift card as an incentive for a “free inspection” isn’t helpful. Likewise, rising litigation and attorney fees are growing. This $35,000 settlement in a claims lawsuit came with an initial $360,000 attorney fee award, but Florida’s contingency fee multiplier brought the “Price is Right” amount of fees to $756,495.15. Yet the Florida Legislature failed to pass nearly any reforms this spring, as noted in our Bill Watch.

Also just in time for hurricane season comes the June 1 reinsurance renewals, with reinsurance companies and brokers in Bermuda saying Florida renewals will average between 25%-45% with up to 100% in “extreme cases.” Part of the reason: yep, claims creep and rising litigation costs. When claims costs go up, so do rates! It’s that simple.

Add it all up – then throw in the coronavirus pandemic – and this amounts to what Demotech last week called a “perfect storm” of market challenges for Florida carriers.

Which brings us to Citizens Property Insurance Corporation, Florida’s state-backed insurer of last resort. Since its rates are capped, it is becoming a much cheaper alternative for homeowners either turned away or priced-out by private carriers. Citizens is such a good deal now that its new business is up 48% in the first four months of 2020 over the same period last year. That’s not a good thing for any of us because in the end, all Florida insurance consumers pay for this government insurance company should cumulative losses exceed their reinsurance and reserves.

How to address these challenges?

- Pass contingency fee multiplier reform, such as last session’s SB 914 / HB 7071.

- Right-size Citizens Insurance rates by letting the current 450,000 policyholders keep their subsidized capped rates, but require new policyholders to pay something closer to market rates.

- Require the Florida Hurricane Catastrophe Fund (the state’s own reinsurance entity) offer cheaper reinsurance for the time being until private reinsurers sharpen their pencils.

- Shrink the time limit to file hurricane claims to one year after the storm, just like the National Flood Insurance Program (NFIP) requires. Three years is too long and encourages mischief.

As always, we welcome your reply and viewpoint on Florida’s property insurance marketplace.

LMA Newsletter of 5-26-20