Price transparency, Canadian drugs, and Lyft

As we enter the season of open enrollments in both private and federal marketplace plans, the number of uninsured residents in Florida is growing, as are the number of uninsured children. For those who are insured, we also have a variety of news on efforts to lower healthcare costs through greater price transparency, cheaper prescription drugs, and even free rides to the doctor.

As we enter the season of open enrollments in both private and federal marketplace plans, the number of uninsured residents in Florida is growing, as are the number of uninsured children. For those who are insured, we also have a variety of news on efforts to lower healthcare costs through greater price transparency, cheaper prescription drugs, and even free rides to the doctor.

Uninsured High: This month’s Census Bureau report on health insurance coverage in the U.S. shows 13% of Floridians were uninsured last year, versus 8.5% nationally, the third highest rate behind Georgia and Oklahoma. In 2018, 7.6% of Florida children were uninsured (up 1% from 2016) versus 5.2% nationwide.

Benchmark Plan: Florida began exercising its authority to regulate federal marketplace plans here two years ago and will soon be able to change the menu of essential health benefits in the benchmark plan. A recent OIR report advises against doing so. Reducing benefits will reduce premiums 2.1% in the individual market and 2.3% in the small group market for those who do not receive a subsidy. However, the report says that reduction will only benefit 13% of consumers in the individual market as 87% of consumers in the individual market receive a subsidy and “reducing benefits would have adverse impacts.”

Need a Lyft? Florida Blue is offering its federal marketplace plan customers a free ride to appointments as part of their healthcare coverage. Each customer gets up to $100 in rides through ride-sharing company Lyft, beginning in February.

Cheaper Canadian Drugs: Lowering the cost of prescription drugs to Florida consumers is a priority of the Governor and the legislature, which passed HB 19 last spring. As we reported earlier, it establishes two separate programs to safely import FDA-approved prescription drugs into the state. A legislative committee received an update this month on progress and heard estimated savings of up to $150 million are possible. While the state waits for the federal HHS to issue regulations (something that could take up to two years), our Agency for Healthcare Administration (AHCA) and Department of Business and Professional Regulation are working together to design importation protocols.

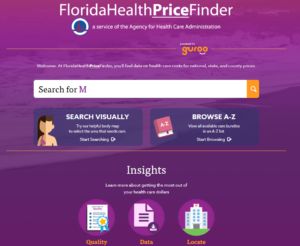

Florida Health Price Finder website

Hospital Transparency Website: Governor DeSantis picked up where Governor Scott left off in pushing regulators to complete work on getting a state website up and running, where consumers can compare the cost of different procedures and services among hospitals. The Florida Health Price Finder is based on claims information that insurance companies are required to report to AHCA. AHCA’s vendor has about 90% of the information imported, so there are still data gaps for now in some areas, such as Tallahassee. The Florida Hospital Association has criticized AHCA for not vetting the cost information through them first, saying the pricing information as a result is “unverified.” The federal CMS has required hospitals to post price lists online since January.

LMA Newsletter of 11-18-19