Storm surge, rather than wind caught communities off-guard

Hurricane Ian surge in Naples along Vanderbilt Beach Road, September 28, 2022. Photo by Warren Faidley @stormchaser via Twitter

An interim report submitted to the Florida Building Commission on May 10 says that Southwest Florida coastal communities impacted by last September’s Hurricane Ian were “ill-prepared” for the storm surge and flooding, despite lessons on wind mitigation learned from Hurricane Charley 18 years earlier. The interim report by a team of scientists showed Ian’s tropical storm-force wind field was 2.3 times the diameter of 2004’s Hurricane Charley. The greater resulting storm surge of 13 feet impacted high population areas living in both elevated and on-grade homes along hundreds of miles of canals and coastal frontage. Upwards of 20,000 homes were destroyed or severely damaged. Ian was the costliest storm in Florida history, killing 156 people and causing an estimated $109.5 billion in damage in Florida. Only an estimated half of that will be covered by insurance.

I had the pleasure of sitting down with the report’s co-author, Dr. David Prevatt of the University of Florida, and another extreme events scientist, Dr. Karthik Ramanathan of Verisk who produced early catastrophic models on Ian for insurance companies. We recorded our conversation as the latest episode of The Florida Insurance Roundup podcast.

Dr. David O. Prevatt

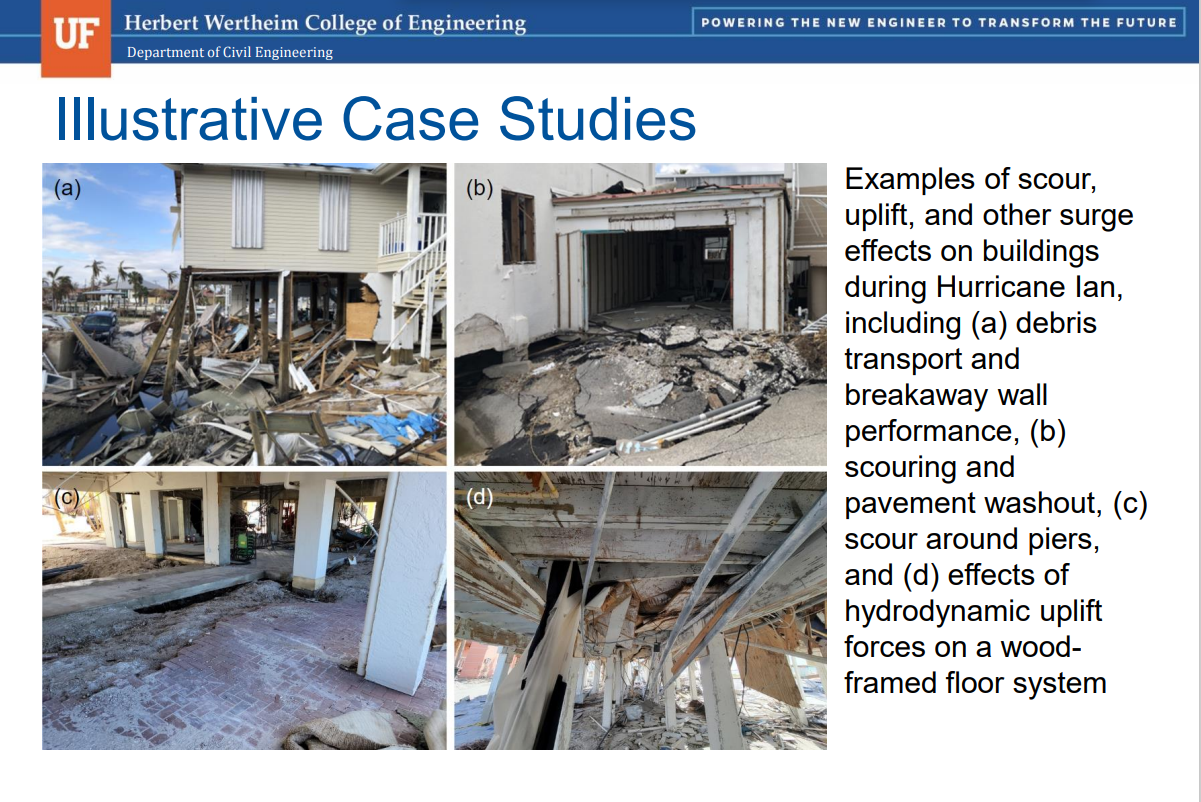

Dr. Prevatt said Ian was not a design level wind-event, meaning its wind speed on land of about 120 mph was below the building code standards of 154-160 mph for Lee County, where it made landfall on September 28, 2022. “The severe damage we saw was really the flooding, in particular the manufactured homes on Fort Myers Beach and mostly older slab-on-grade homes,” said Dr. Prevatt. “The good news, if there is any that we can draw from this, is that recent construction built to the recent Florida Building Code standards performed well, even in areas where they were impacted by the 13-foot high storm surge.”

Dr. Karthik Ramanathan

Dr. Ramanathan led the Verisk catastrophe modeling team that estimated Hurricane Ian’s initial insurance and reinsurance losses at between $42 billion to $57 billion, not including federal flood insurance losses. “As David said, the performance of manufactured homes or mobile homes continues to be a major issue, even 30 years after Hurricane Andrew, although a lot has been done to strengthen them,” said Dr. Ramanathan. “We saw a colossal amount of damage to manufactured homes. Older and middle aged homes also saw significant damage.” He and his team spent a week in South Florida after Hurricane Ian made landfall, surveying damage in both coastal and inland counties. Some inland counties he noted had “pretty staggering” claim losses similar to coastal counties near Ian’s landfall.

“Even on the wind side, some of these inland counties saw a significant amount of claims, primarily coming in from roof damage. And to me, it’s mind boggling, seeing the same state which sort of pioneered wind design, not just in the United States, but across the world, is seeing some of the same issues 30 years on in an event like Ian,” said Dr. Ramanathan.

We discussed a great many things: repeated patterns of destruction seen in prior storms, that Florida hurricanes are not getting stronger or more frequent, how elderly and poor residents are disproportionately hurt, potential changes to the state building code, and why a new approach to mitigation is needed. The interim report will be updated to address questions by the Florida  Building Commission that will lead to a final report, which can inform future code changes. At its May 10 meeting, the Commission agreed to add two ICC standards for the design and construction of storm shelters (ICC 500) and Residential Construction in High Wind Regions (ICC 600) that are already in the Florida Code but missed being included in the 2020 edition.

Building Commission that will lead to a final report, which can inform future code changes. At its May 10 meeting, the Commission agreed to add two ICC standards for the design and construction of storm shelters (ICC 500) and Residential Construction in High Wind Regions (ICC 600) that are already in the Florida Code but missed being included in the 2020 edition.

You can read more – and better yet, listen to the full podcast here. It runs just 38 minutes and will be good company on your way home from work!

LMA Newsletter of 5-22-23