Cross-state claims jump from Nicole

Damage to a Ft. Myers Beach business from Hurricane Ian. Courtesy, Kevin Miller

This past November 30 marked the official end to the Atlantic Hurricane Season, one that saw 14 named storms and due to Hurricanes Ian and Nichole, made 2022 the third-most expensive hurricane season on record. We remind our readers that December hurricanes are not unheard of, though. Meanwhile, estimated insured losses from Ian and Nichole continue to rise from both wind and flood claims.

Ian: Now 67 days after landfall, the death toll from Ian climbed to 148 this past week, up from 137 in our last update. At latest count going into this past weekend:

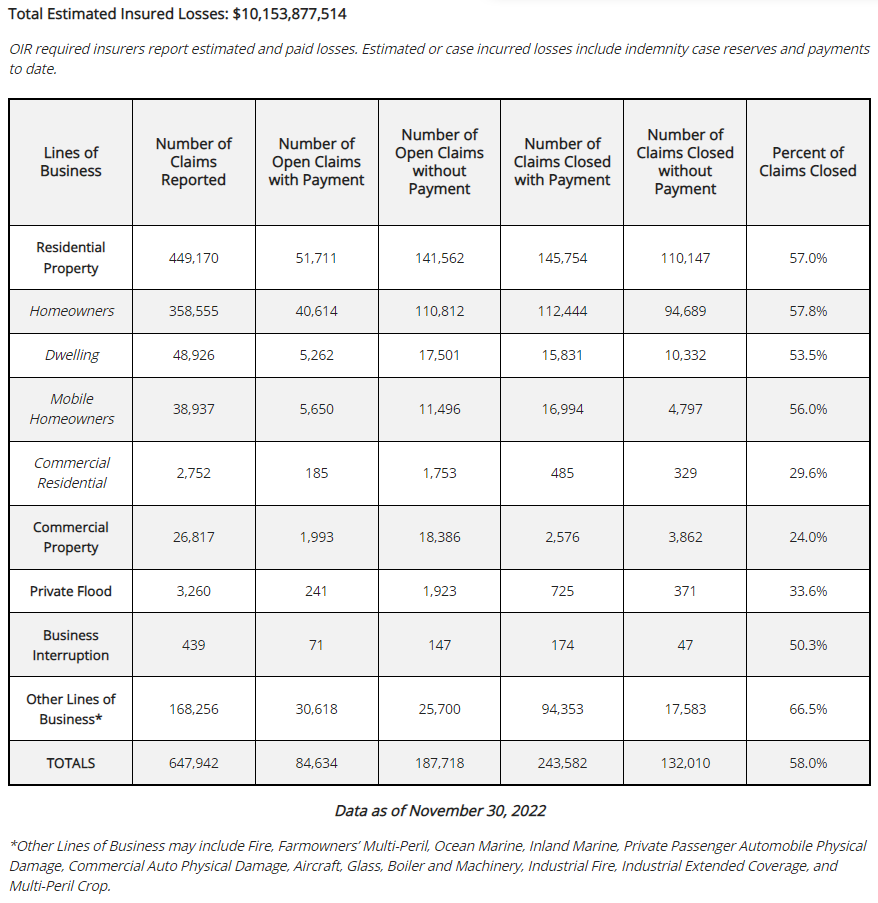

- Florida insurance regulators reported $10.1 billion in estimated insurance losses on nearly 648,000 claims. The percentage of closed claims has grown to 58%, with almost 65% of those closed with payment (see chart below). OIR has moved to bi-weekly data reporting for Ian with the next updates due this Wednesday, December 7 and December 21.

- FEMA’s National Flood Insurance Program (NFIP) this past Thursday reported it had received 44,700 claims and paid more than $882 million to policyholders. It previously announced its initial estimate of NFIP flood insurance losses at between $3.5 billion and $5.3 billion, including loss adjustment expenses. The losses include flood insurance claims received from five states, with the majority coming from Florida.

- FEMA has paid out $779 million in Individual Assistance to 538,000 residents in 26 counties for help with home repair, replacing personal belongings, rental, and temporary lodging. It has extended the application deadline to January 12, 2023. Another $358 million has gone to the state for emergency response, while the U.S. Small Business Administration has provided $1.1 billion in disaster loans, double what we reported in our November 7 update.

- President Biden has amended the time period for 100% federal funding for debris removal and emergency protective measures, including direct federal assistance, for an additional 15 days through December 7.

From Florida Office of Insurance Regulation

Hurricane Ian insured losses are projected to be as much as $65 billion, not including NFIP claims, according to the latest estimate from Munich Re. (We have much more on Hurricane Ian in Early Lessons from Ian’s Damage and Florida’s Floody Mess in this newsletter)

Oceanfront hotel damage in Volusia County from Hurricane Nicole, November 10, 2022. Courtesy, Bridgepoint Global

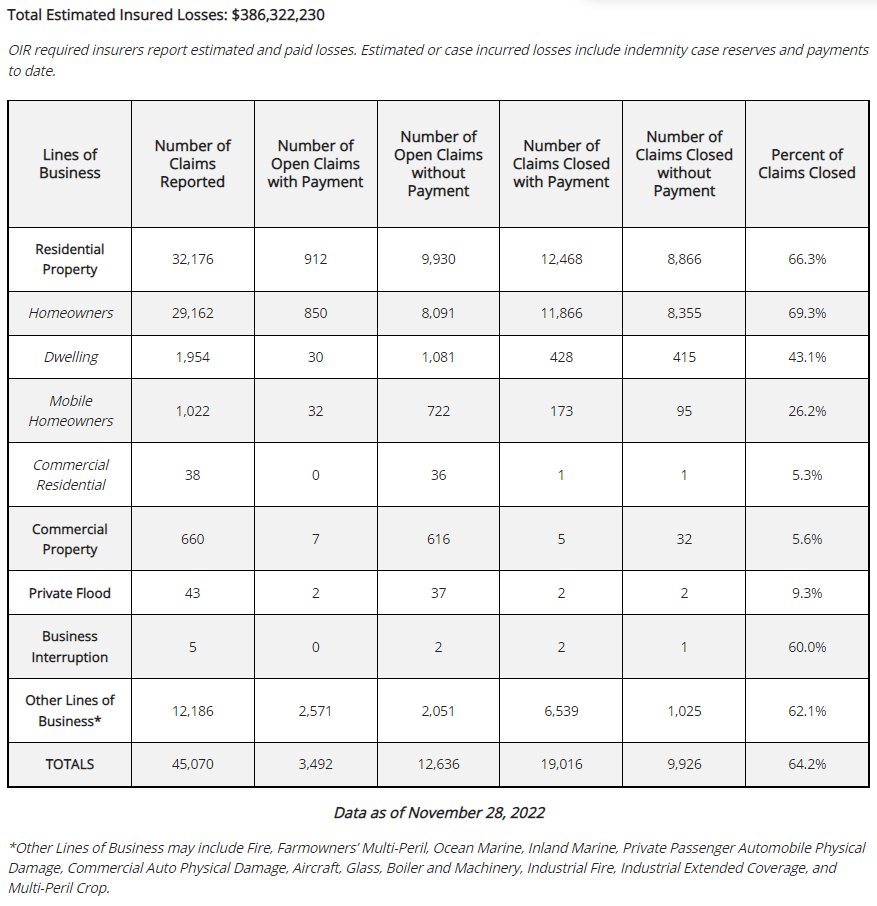

Nicole: Now 26 days after landfall, Hurricane Nicole’s Florida death toll remains at 5 people. As of last Monday, regulators reported $386.3 million in estimated insured losses (up from $72.4 million two weeks earlier) on 45,000 claims (up from 7,200 two weeks earlier). The distribution of those claims has changed dramatically, with Lee County – not in the direct path of the Atlantic storm – now reporting the largest number of claims at 8,247, followed by Orange (4,693), Volusia (3,748), and Brevard (2,734). Charlotte County, just north of Lee County, reported 2,720 claims. The percentage of closed claims was 64%, with almost 66% of those closed with payment (see chart below). OIR has moved to monthly data reporting for Nicole with reports due this Friday, December 9, January 9, and February 9.

From Florida Office of Insurance Regulation

Shoring-up partially collapsed oceanfront buildings remains a major challenge in recovery efforts along Volusia County beaches, along with stemming on-going beach erosion. Officials there have a mystery on their hands now as well. WFTV-TV reports that Nicole has unearthed an as yet unidentified structure on the beach in Daytona Beach Shores, with video showing several pieces of debris in long rows.

LMA Newsletter of 12-5-22