Consumers suffering consequences

Three more insurance companies went before Florida regulators last week seeking rate increases from 23% to 49%, citing in part the growing frequency and severity of claims litigation which is driving up costs for all Florida property insurance writers. Meanwhile, one of Florida’s largest insurance companies has agreed to voluntarily restructure, shedding 68,000 policies in the process.

Three more insurance companies went before Florida regulators last week seeking rate increases from 23% to 49%, citing in part the growing frequency and severity of claims litigation which is driving up costs for all Florida property insurance writers. Meanwhile, one of Florida’s largest insurance companies has agreed to voluntarily restructure, shedding 68,000 policies in the process.

The Florida Office of Insurance Regulation (OIR) held three virtual public rate hearings last Tuesday for Kin Interinsurance Network, First Floridian Auto and Home Insurance Company, and Florida Farm Bureau General Insurance Company and sister Florida Farm Bureau Casualty Insurance Company. Kin is seeking a 25.1% average statewide increase in its Homeowners Multi-Peril (HO-3) policies, First Floridian a 22.9% increase in HO-3’s, and both Florida Farm Bureau companies a 48.7% increase in HO-3s. Florida Farm Bureau Casualty Insurance is also seeking a 31.7% increase in its Dwelling Fire policies.

As an example, Kin’s request would result in a $452 increase for its 62,000 HO-3 policyholders. Kin has had to adjust rates previously for roof age and roof condition. The company said it is restricting roof age eligibility and adding a roof servicing payment schedule as a customer option to help hold down costs. It’s shed 5,000 policies in the process. First Floridian testified lost costs, including “dubious roof claims,” are responsible for its rate increase. Florida Farm Bureau earlier this year stopped writing new homeowners and rental property policies in Florida, around the time of its ratings downgrade.

As an example, Kin’s request would result in a $452 increase for its 62,000 HO-3 policyholders. Kin has had to adjust rates previously for roof age and roof condition. The company said it is restricting roof age eligibility and adding a roof servicing payment schedule as a customer option to help hold down costs. It’s shed 5,000 policies in the process. First Floridian testified lost costs, including “dubious roof claims,” are responsible for its rate increase. Florida Farm Bureau earlier this year stopped writing new homeowners and rental property policies in Florida, around the time of its ratings downgrade.

These three are but the latest of a series of double-digit rate increases of as high as 111% sought by Florida writers from OIR over the past two years, with the majority granted. Underwriting losses from catastrophe claims ($1 billion each of the past two years) with many late reported, adverse loss reserve development, higher reinsurance costs, and increases in costly litigation all cited as reasons for the greater rate need. Some reinsurers say they simply won’t offer Florida writers coverage unless there’s significant reform in litigation and fraudulent claims in this special session. Reinsurance, like the insurance it backs, is growing more expensive as well. Florida’s CFO Jimmy Patronis took note of that this past week, announcing anti-fraud initiatives he’d like to see the legislature pursue. He also sent a letter urging the Florida Bar to disbar unethical property insurance lawyers.

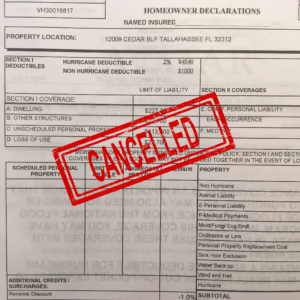

FedNat Insurance, following its ratings downgrade by Demotech on April 15, has entered into a consent order with OIR as part of its rehabilitation plan. FedNat and its sister companies Maison and Monarch National will cancel 68,000 Florida policies by the end of June. FedNat will then transfer its remaining 83,000 policies to Monarch and wind down its operations. The consent order calls it “an extraordinary statutory remedy reserved to address insurers which (without the cancellations) are or may be in hazardous financial condition.” The order stated the cancellations were needed so the three companies can secure adequate reinsurance for the upcoming hurricane season and meet state-required surplus levels. Parent company FedNat Holding reported $103.1 million in losses in 2021 and another $31 million in losses in the first quarter of 2022.

FedNat Insurance, following its ratings downgrade by Demotech on April 15, has entered into a consent order with OIR as part of its rehabilitation plan. FedNat and its sister companies Maison and Monarch National will cancel 68,000 Florida policies by the end of June. FedNat will then transfer its remaining 83,000 policies to Monarch and wind down its operations. The consent order calls it “an extraordinary statutory remedy reserved to address insurers which (without the cancellations) are or may be in hazardous financial condition.” The order stated the cancellations were needed so the three companies can secure adequate reinsurance for the upcoming hurricane season and meet state-required surplus levels. Parent company FedNat Holding reported $103.1 million in losses in 2021 and another $31 million in losses in the first quarter of 2022.

LMA Newsletter of 5-23-22