Private modeling turning public!

Pensacola, Florida: 1 in 100 annual flood risk or 1% for the year 2020. Source: First Street Foundation

There’s another report that came out this week quantifying the under-classification and reporting of high-risk flood properties here in Florida and in the United States. But this one has an interesting addition – a property-specific look-up data tool that property owners can use to see any past flood events as well as future risk to their properties. The report is the first of its kind in scope and accessibility on the dangers of flood risk.

As we know, some National Flood Insurance Program (NFIP) flood maps haven’t been updated in years – some in more than two decades. The report by First Street Foundation drew on decades of peer-reviewed research and the expertise of more than 70 scientists and other experts to calculate the current and future flood risk for each property in the lower 48 states and D.C.

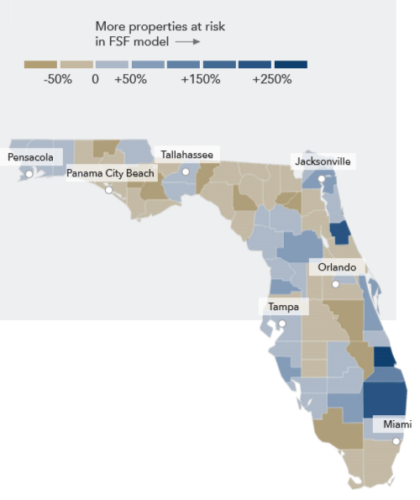

First Street’s model shows 14.6 million properties, representing 10.3% of all properties in the 48 states & D.C. are at risk from a 1-in-100-year flood. That compares with the 8.7 million properties listed on the NFIP’s current flood maps. Florida’s risk is even greater – 20.5% of our properties are at substantial risk today and 24.3% at substantial risk by the year 2050. That gap equates to 113,965 Florida properties that should be categorized today as being in Special Flood Hazard Areas, but are not.

Palm Beach County on the east coast and Lee County on the west coast have the highest discrepancy in the number of properties so categorized. Florida counties with the highest percentage of discrepancies are Duval 67.3%, Volusia 48.7%, Nassau 43%, Sarasota 39.4%, St. Johns 29.7%, and Miami-Dade and Orange, each around 25%.

Palm Beach County on the east coast and Lee County on the west coast have the highest discrepancy in the number of properties so categorized. Florida counties with the highest percentage of discrepancies are Duval 67.3%, Volusia 48.7%, Nassau 43%, Sarasota 39.4%, St. Johns 29.7%, and Miami-Dade and Orange, each around 25%.

First Street, which is a nonprofit organization, is also making available to the public a free property-specific web application called Flood Factor. Property owners can see any history of flooding, the current modeled risk, and projected risk over the next 15 and 30 years. The website has a section labeled “Solutions to Protect Your Property” with helpful tips, but is missing one that we preach regularly: purchase flood insurance!

First Street also has a project called Flood Lab, which is a collaboration with research universities to use the data to further evaluate vulnerabilities and assess resilience and mitigation options with an eye toward doing what we always admire: reduce risk. The Florida schools taking part are Florida Atlantic University, the University of Central Florida, and the University of Miami.

LMA Newsletter of 7-6-20