How Citizens is losing policies

Hurricane Helene and Milton Florida insurance claims now total $7.3 billion with more than 90% of claims closed, Citizens Property Insurance reports continued success in its depopulation and new agent clearinghouse while litigation declines, Uber says it’s uncovered an auto insurance scam racket in South Florida, plus how you can take part in tomorrow night’s insurance town hall meeting. It’s all in this week’s Property Insurance News.

Hurricane Helene and Milton Florida insurance claims now total $7.3 billion with more than 90% of claims closed, Citizens Property Insurance reports continued success in its depopulation and new agent clearinghouse while litigation declines, Uber says it’s uncovered an auto insurance scam racket in South Florida, plus how you can take part in tomorrow night’s insurance town hall meeting. It’s all in this week’s Property Insurance News.

Hurricane Helene damage at Horseshoe Beach, FL

Hurricane Claims: Updated data released last Tuesday from the Florida Office of Insurance Regulation (OIR) shows that total insurance claims from last fall’s Hurricanes Helene and Milton jumped by 103,000 over the past seven months, increasing losses by another $2.6 billion (from $4.7 billion in November to $7.3 billion today). Helene has now generated 155,182 total claims with estimated insured losses of $2.58 billion (up from $1.7 billion), with 41% automobile claims. Milton has now generated 364,507 claims with losses of $4.75 billion (up from $3 billion in November), with 12% automobile claims.

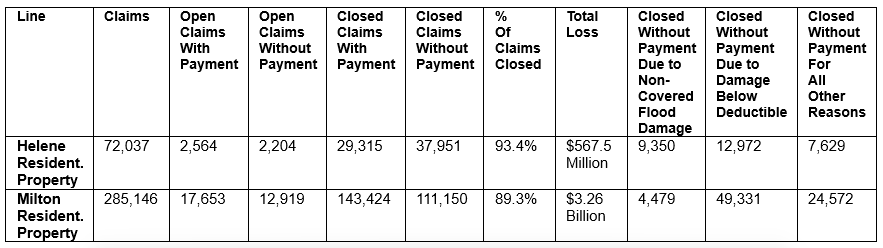

The data table below focuses on just residential property claims from the two storms. The number of Helene claims grew by a little over 12,000 since OIR’s last update on November 8, 2024, five weeks after the hurricane made landfall near Dekle Beach in rural Taylor County. The number of Milton residential claims grew by nearly 60,000 since. In the past seven months, insurance companies have reduced the number of Helene’s open claims without payment from 13,681 to 2,204, and reduced Milton’s similarly open claims from 108,105 to 12,919. About 56% of Helene residential claims have been closed without payment for the reasons noted in the table, and about 43% of Milton residential claims were similarly closed.

Note that the OIR data in this June update goes into much more granular detail beyond the categories listed in our table illustration and shows other reasons claims were closed without payment, including those withdrawn by the policyholder. You can view all the data categories by going to the OIR’s Catastrophe Claims Data and Reporting webpage, then scrolling down and choosing the hurricane you want.

Citizens: Citizens Property Insurance reports it is down to 819,682 policies, with $315 billion in exposure, 10% less than this time last year, and driven by its continued depopulation effort. About 76% of takeout offers from private insurance companies to Citizens’ customers fall within the 20% Citizens’ premium, making those customers ineligible to remain with Citizens. It projects it will end 2025 with 700,000 policies. Also helping: its new “Citizens Reimagined by EZLynx” agent Clearinghouse, where 22% of the risks presented are now being deemed ineligible, compared to 2% in 2024 under the old Clearinghouse. That amounts to $7 billion in averted Coverage A. Citizens is now working to make the Clearinghouse available to wholesalers. You can read more in our full LMA report here.

Citizens: Citizens Property Insurance reports it is down to 819,682 policies, with $315 billion in exposure, 10% less than this time last year, and driven by its continued depopulation effort. About 76% of takeout offers from private insurance companies to Citizens’ customers fall within the 20% Citizens’ premium, making those customers ineligible to remain with Citizens. It projects it will end 2025 with 700,000 policies. Also helping: its new “Citizens Reimagined by EZLynx” agent Clearinghouse, where 22% of the risks presented are now being deemed ineligible, compared to 2% in 2024 under the old Clearinghouse. That amounts to $7 billion in averted Coverage A. Citizens is now working to make the Clearinghouse available to wholesalers. You can read more in our full LMA report here.

Citizens also reports the Florida Legislature’s 2022 and 2023 insurance litigation and other reforms are continuing to work. Its new claims lawsuits averaged 586 per month in the first four months of this year, down 24% over the same period in 2024 (772 lawsuits per month). The number of lawsuits where the plaintiff was represented at First Notice of Loss is down 25% and the Notice of Intent to Litigate statute is working as intended as well. Citizens’ new dispute resolution method through the Florida Division of Administrative Hearings “has proven beneficial to insureds as well as Citizens,” with new data revealed on faster resolution time and reduced costs. Despite positive litigation trends, Citizens has had to spend more money than it anticipated in outside attorneys and needs an extra $200 million, beyond the $500 million budgeted for 2022 through February 2027. You can read more in our full LMA report here.

South Florida Auto Scam: Uber has filed a federal lawsuit under the civil Racketeer Influenced and Corrupt Organizations Act against a South Florida group of attorneys, medical professionals and rideshare drivers that it says is running an insurance fraud scam. Bloomberg reports the lawsuit “outlines claims that the defendants colluded to deliberately stage car accidents, fabricate injuries, and pursue unwarranted medical treatment − all as part of a broader scheme to exploit insurance claims and initiate baseless legal actions.” Uber says the scheme ran from 2023-2024 and has cost the company several million dollars in settlements and legal costs. This is the second such lawsuit Uber filed this year, with the first against a similar network of participants in New York.

South Florida Auto Scam: Uber has filed a federal lawsuit under the civil Racketeer Influenced and Corrupt Organizations Act against a South Florida group of attorneys, medical professionals and rideshare drivers that it says is running an insurance fraud scam. Bloomberg reports the lawsuit “outlines claims that the defendants colluded to deliberately stage car accidents, fabricate injuries, and pursue unwarranted medical treatment − all as part of a broader scheme to exploit insurance claims and initiate baseless legal actions.” Uber says the scheme ran from 2023-2024 and has cost the company several million dollars in settlements and legal costs. This is the second such lawsuit Uber filed this year, with the first against a similar network of participants in New York.

Tune-In: Tampa’s ABC Action News will be hosting a town hall on the state of insurance tomorrow (June 17), featuring leaders from the Florida property insurance industry, including yours truly, along with: Jeff Brandes, former state lawmaker & President of the Florida Policy Project; Coretta Anthony-Smith, an attorney specializing in homeowner’s insurance; Jake Holehouse, President of HH Insurance Group; and Greg Moraski, Chief Claims Officer for Security First Insurance Company. The town hall will be livestreamed tomorrow from 7:30-8:30pm (watch here) and then air as an edited 30-minute program later in the month on WFTS-TV. You can submit questions here that you’d like to have addressed. I’m looking forward to it!

Tune-In: Tampa’s ABC Action News will be hosting a town hall on the state of insurance tomorrow (June 17), featuring leaders from the Florida property insurance industry, including yours truly, along with: Jeff Brandes, former state lawmaker & President of the Florida Policy Project; Coretta Anthony-Smith, an attorney specializing in homeowner’s insurance; Jake Holehouse, President of HH Insurance Group; and Greg Moraski, Chief Claims Officer for Security First Insurance Company. The town hall will be livestreamed tomorrow from 7:30-8:30pm (watch here) and then air as an edited 30-minute program later in the month on WFTS-TV. You can submit questions here that you’d like to have addressed. I’m looking forward to it!