Legislative reforms credited, further rate cuts continuing

The Governor and insurance commissioner announce nearly $1 billion in auto insurance premium credits and rebates to Florida consumers “that would have been going to attorneys’ wallets” as even more auto rate cuts are filed; a new report shows the impact that Florida tort reform has had on national litigation costs ultimately paid by consumers; and property insurance rates in Florida and the U.S are expected to fall further. It’s’ all in this week’s Property Insurance News.

The Governor and insurance commissioner announce nearly $1 billion in auto insurance premium credits and rebates to Florida consumers “that would have been going to attorneys’ wallets” as even more auto rate cuts are filed; a new report shows the impact that Florida tort reform has had on national litigation costs ultimately paid by consumers; and property insurance rates in Florida and the U.S are expected to fall further. It’s’ all in this week’s Property Insurance News.

Florida Insurance Commissioner Michael Yaworsky at the Governor’s news conference, October 22, 2025. Courtesy, The Florida Channel

Auto Credits & Rebates: Governor DeSantis, at an October 22 news conference, announced that Progressive Insurance had agreed to the terms of the $1 billion consumer refund under the state’s excess profit law. That’s an average of $300 per policyholder, depending on their policy history. “I want to commend Progressive particularly for coming to the table first, to work with us to negotiate this, to get dollars back to consumers faster, to avoid those statutory triggers and avoid a fight. Everybody here has just done the right thing,” said Florida Insurance Commissioner Michael Yaworsky, who joined the Governor for the event, adding that he is talking with other auto carriers now to issue similar rebates, “directly attributable to the litigation reforms” of 2022 and 2023, he said. Florida statutes require auto carriers to return excess profits if their underwriting gains exceed anticipated underwriting profit, plus 5% of earned premium, over three years.

Auto Rate Cuts: The above refund is in addition to recent rate decreases filed by Progressive. Just last week, State Farm filed for a 10% rate cut, with the carrier noting it’s cut average Florida rates by more than 20% since October 2024, also crediting reduced litigation. In July, Yaworsky reported that the state’s top five automobile insurance writers – which make up nearly 80% of the market – dropped rates by an average of 6.5% at that point in 2025. That’s down from a 4.3% increase in 2024 and an average 31.7% increase in 2023.

Auto Rate Cuts: The above refund is in addition to recent rate decreases filed by Progressive. Just last week, State Farm filed for a 10% rate cut, with the carrier noting it’s cut average Florida rates by more than 20% since October 2024, also crediting reduced litigation. In July, Yaworsky reported that the state’s top five automobile insurance writers – which make up nearly 80% of the market – dropped rates by an average of 6.5% at that point in 2025. That’s down from a 4.3% increase in 2024 and an average 31.7% increase in 2023.

Insurance Litigation Expenses Dipped Nationwide: A new report by the Federal Insurance Office (FIO) notes that insurance companies’ litigation costs declined between 2023 and 2024 – thanks to Florida. Defense and Cost Containment Expenses (DCC) incurred as a percentage of direct premiums earned declined nationally to 3.9% in 2023 and 2024 after being nearly flat at about 4.5% between 2015 and 2020. “The decline corresponded to reductions in Florida − particularly in multiperil homeowners insurance and private auto lines of business − following Florida legal reforms focused on eliminating one-way attorney’s fees, restricting assignment of benefits, and reducing the time periods for claims and benefits,” states the report. Florida DCC declined to 5.1% in 2024, after having risen from 4.5% in 2015 to 6.6% in 2022, before the reforms were enacted.

Insurance Litigation Expenses Dipped Nationwide: A new report by the Federal Insurance Office (FIO) notes that insurance companies’ litigation costs declined between 2023 and 2024 – thanks to Florida. Defense and Cost Containment Expenses (DCC) incurred as a percentage of direct premiums earned declined nationally to 3.9% in 2023 and 2024 after being nearly flat at about 4.5% between 2015 and 2020. “The decline corresponded to reductions in Florida − particularly in multiperil homeowners insurance and private auto lines of business − following Florida legal reforms focused on eliminating one-way attorney’s fees, restricting assignment of benefits, and reducing the time periods for claims and benefits,” states the report. Florida DCC declined to 5.1% in 2024, after having risen from 4.5% in 2015 to 6.6% in 2022, before the reforms were enacted.

This federal report is further proof of the Governor’s point – and further refute of the Florida trial bar’s continual effort to dismiss the National Association of Insurance Commissioner’s market data showing that Florida had 76% of the homeowners insurance lawsuits in the country in 2021, yet only 7% of the homeowners insurance claims. It is obvious from the FIO report that Florida’s litigation scene was – and continues to be – outsized, given its impact on U.S. statistics overall. As of 2023, Florida had 9.7% of claims and 71.5% of lawsuits, according to OIR. Speaking on the reforms at the news conference, Yaworski said “Florida did not eliminate the option for consumers to litigate against their insurer. It restored rationality to that space in the same manner that exists currently in 49 other states.” He noted that the very same reforms also increased insurer accountability, with more than100 OIR investigations of carriers completed so far this year.

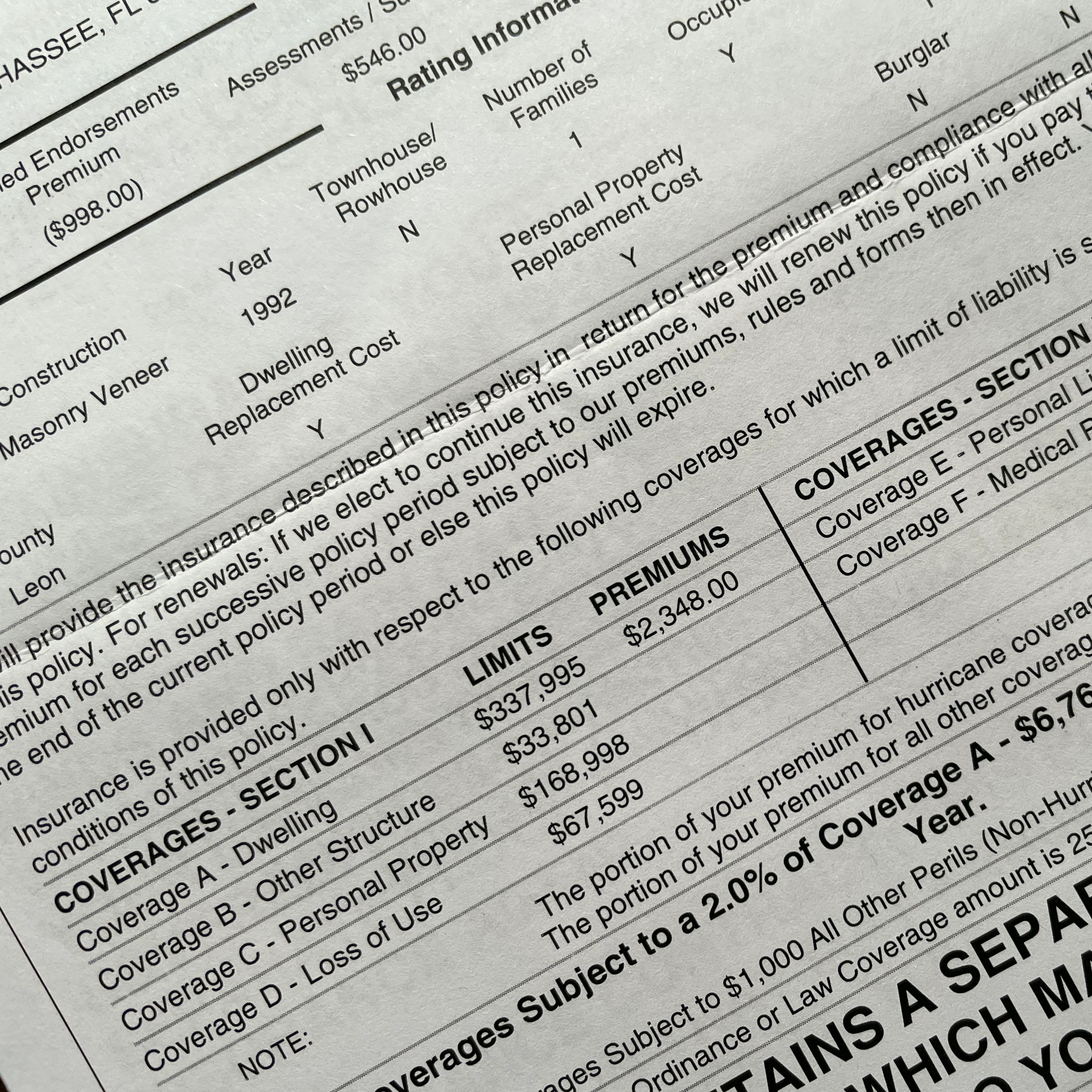

Expect Further Property Insurance Rate Declines: Business Insurance magazine reports that property insurance companies and brokers expect rates to continue their decline into 2026, barring a major hurricane striking the U.S. before the Atlantic hurricane season ends on November 30. That’s backed-up by this past week’s news from the Marsh Global Insurance Market Index, which reports a steep drop in global property insurance premiums from recent years, down 8% in the third quarter of 2025, in part due to fewer catastrophes and increased competition among carriers.

Expect Further Property Insurance Rate Declines: Business Insurance magazine reports that property insurance companies and brokers expect rates to continue their decline into 2026, barring a major hurricane striking the U.S. before the Atlantic hurricane season ends on November 30. That’s backed-up by this past week’s news from the Marsh Global Insurance Market Index, which reports a steep drop in global property insurance premiums from recent years, down 8% in the third quarter of 2025, in part due to fewer catastrophes and increased competition among carriers.

In Florida, Commissioner Yaworsky reports that 150 residential insurance companies have filed for either rate decreases or no rate increases since the end of 2024. The 30-day average for homeowners rates is down 1.3%. As for his hopes in the upcoming Florida legislative session that begins January 13, 2026? “I’m hopeful that we can move the ball forward on things that will meaningfully add value to the consumers in the state and move past this trial bar issue that exists among bad acting attorneys in the space. That billion dollars, much of it that is now going to the pockets of consumers, would have been going to those attorneys’ wallets. That’s the bottom line. And so we’ll continue to see that success.” You can watch the commissioner’s full comments from the news conference here on The Florida Channel, beginning at timecode 22:23.