Plus, initial impacts of Risk Rating 2.0

We can thank weather patterns and the current moon cycle for a moderation of coastal flooding events predicted for this year, but the question of whether our disaster relief system can keep up with the spate of inland flooding events so far remains a serious question. Plus, the answer to how many people have dropped their federal flood insurance policies since the start of FEMA’s new Risk Rating 2.0 pricing program. It’s all in this week’s Flood Digest.

We can thank weather patterns and the current moon cycle for a moderation of coastal flooding events predicted for this year, but the question of whether our disaster relief system can keep up with the spate of inland flooding events so far remains a serious question. Plus, the answer to how many people have dropped their federal flood insurance policies since the start of FEMA’s new Risk Rating 2.0 pricing program. It’s all in this week’s Flood Digest.

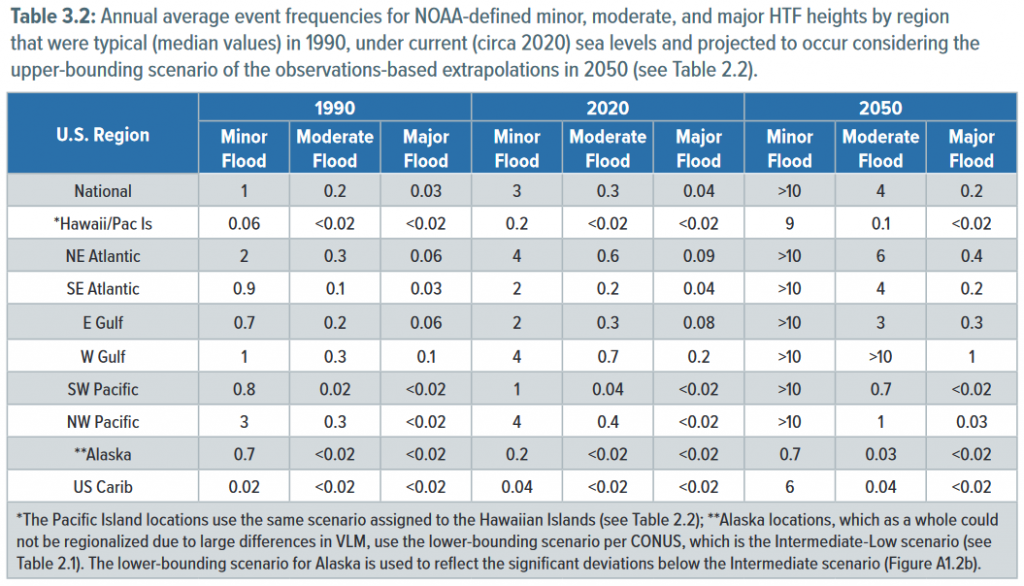

High-tide Flooding: NOAA is out with its 2022 Sea Level Rise Technical Report, with updated projections available through 2150 for all U.S. coastal waters. Often referred to as “nuisance” or “sunny day” flooding, the frequency of this flooding nationally continues to increase. But this year, due to lingering climatological effects from La Niña and Earth’s location in the perigean moon cycle, coastal areas aren’t predicted to experience a record number of flood events compared to last year. As the chart below shows, current projections for the year 2050 for the Southeast Atlantic coastline show moderate flooding events (events with some damage) increasing to 4 events annually (from 2020’s 0.2 events) and for the Eastern Gulf Coast increasing to 3 events annually (from 0.3 events in 2020).

Source: NOAA

Disaster Relief: We’ve certainly seen what seems to be more than our usual share of bad flooding events so far across the country this year, the latest being the flash flooding in Eastern Kentucky last month that claimed 37 lives. The Washington Post’s recent editorial The U.S. disaster relief system was not built for our new climate argues that, insurance aside, our disaster relief efforts can’t keep up with the toll that flooding and other disasters are having. Specifically, it points out the time gap that exists between when FEMA emergency housing assistance ends and when HUD’s disaster recovery grants for rebuilding homes begins, increasingly leaving affected residents in housing limbo.

Risk Rating 2.0 Dropouts: E&E News reports on its analysis of Risk Rating 2.0: Equity in Action, the National Flood Insurance Program’s new model for better pricing rate to risk. The new ratings took effect last October for new policies and this past April for renewals. E&E writes that more than 425,000 people have discontinued their NFIP coverage since October, presumably due to resulting rate hikes. The number of NFIP policies dropped from 4.96 million on Sept. 30, 2021, to 4.54 million as of June 30, 2022, a nearly 9% decrease. FEMA told E&E News that “there are many factors that could influence this drop in policyholders, including the economic impact of the pandemic, inflation, the housing market, affordability or purchasing flood insurance from the private market.” Indeed, the private flood insurance market will certainly have a prominent role to play with their often competitive rates as the new NFIP rates are phased in over the next 10 years. FEMA’s Risk Rating 2.0 Florida Profile shows that 1.4 million Florida policies will see premium increases (most less than $10 per month), while about 342,000 policies will see decreases. We continue to cheer-on the private market in providing a necessary alternative and complement to federal flood policies, with Florida continuing to lead the way!

Risk Rating 2.0 Dropouts: E&E News reports on its analysis of Risk Rating 2.0: Equity in Action, the National Flood Insurance Program’s new model for better pricing rate to risk. The new ratings took effect last October for new policies and this past April for renewals. E&E writes that more than 425,000 people have discontinued their NFIP coverage since October, presumably due to resulting rate hikes. The number of NFIP policies dropped from 4.96 million on Sept. 30, 2021, to 4.54 million as of June 30, 2022, a nearly 9% decrease. FEMA told E&E News that “there are many factors that could influence this drop in policyholders, including the economic impact of the pandemic, inflation, the housing market, affordability or purchasing flood insurance from the private market.” Indeed, the private flood insurance market will certainly have a prominent role to play with their often competitive rates as the new NFIP rates are phased in over the next 10 years. FEMA’s Risk Rating 2.0 Florida Profile shows that 1.4 million Florida policies will see premium increases (most less than $10 per month), while about 342,000 policies will see decreases. We continue to cheer-on the private market in providing a necessary alternative and complement to federal flood policies, with Florida continuing to lead the way!

LMA Newsletter of 8-22-22