Commissioner Yaworsky acknowledges reinsurance dilemma

Florida’s property insurance market posts another year of $1 billion-plus losses, the insurance commissioner weighs-in on the reinsurance scarcity challenge, while consumers look for ways to reduce coverage and price. It’s all in this week’s Property Insurance News.

Florida’s property insurance market posts another year of $1 billion-plus losses, the insurance commissioner weighs-in on the reinsurance scarcity challenge, while consumers look for ways to reduce coverage and price. It’s all in this week’s Property Insurance News.

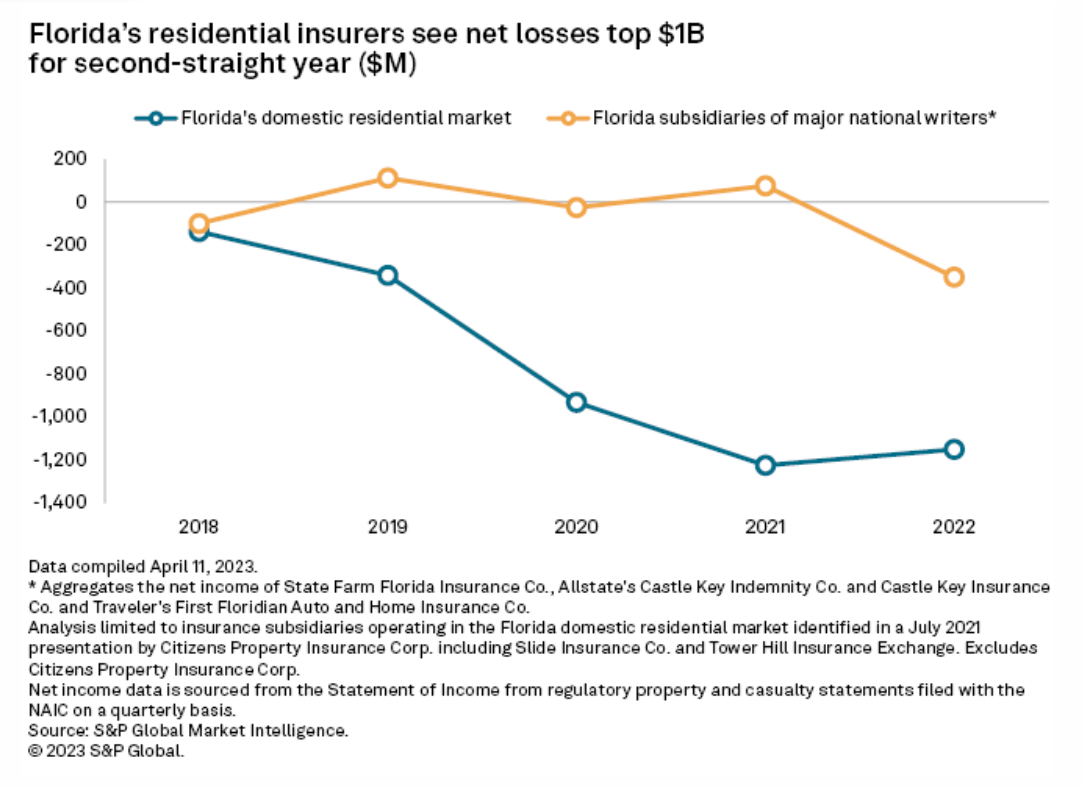

Market Losses: S&P Global reports that Florida’s domestic residential property insurance market had a net loss of $1.5 billion in 2022, following a $1.15 billion loss in 2021. The figures exclude state-backed Citizens Property Insurance but include the eight insurance companies that became insolvent during the previous two years. It marks the fifth-straight year of net market losses in Florida (see chart below). The report also details the growth of Citizens that has resulted.

Source: S&P Global

While eight companies went insolvent, others simply stopped writing new policies. An analysis by the Sun Sentinel’s Ron Hurtibise, one of the best journalists in the business, shows that two-thirds of the property insurance market (70 companies) lost polices and one-third (32 companies) added policies between Q2 & Q3 in 2022. “Of the losers, 16 lost or shed more than 1,000 policies each.” This past week, the state released Q4 figures on statewide policyholder counts, policies cancelled/non-renewed, total policy values, total direct premium written, and total exposure. In the meantime, we’ve seen multiple double-digit rate increases on homeowners insurance policies, some more than 70%.

Florida Insurance Commissioner Michael Yaworsky

Affordable Reinsurance Scarcity: In last week’s newsletter, I shared details of the Florida Insurance Rate Reduction Mechanism (FIRRM) in this briefing paper. The plan would cost the state nothing and would give insurance companies the option to buy less expensive reinsurance which would, in turn, reduce rates for consumers. While the legislature last year offered two state-backed reinsurance programs, the Insurance Journal reports only three insurance companies are participating. It writes that the Reinsurance to Assist Policyholders (RAP) fund didn’t provide enough coverage and the Florida Optional Reinsurance Assistance Program (FORA) “was too expensive and didn’t offer the level of coverage at the bottom of the reinsurance tower, where carriers need it the most.”

Florida’s insurance market has just five weeks left to purchase needed reinsurance to cover losses that may occur during the upcoming hurricane season, which begins June 1. The problem is that the June 1 reinsurance renewal period “by all accounts is set to feature the largest year-over-year price hikes in living memory,” former Citizens chief risk office John Rollins told the Sun Sentinel. Gallagher Re projects increases of 50% to 100% “and companies will pass along the costs in rate filings to consumers,” adds Rollins. Failure by our insurance companies to purchase adequate reinsurance could lead to financial ratings downgrades and potential new insolvencies, with even higher policyholder premiums to follow.

This past week, Florida Insurance Commissioner acknowledged the dilemma. In an address to The Economic Club of Florida, he said “It’s become easier for insurance companies to purchase reinsurance above the Florida Hurricane Catastrophe Fund level, but more difficult to find reinsurance below the Cat Fund level.”

The Insurance Village in Ft. Myers, April 18, 2023. Courtesy DFS

More Hurricane Ian Payouts: The three days of insurance villages that took place last week in Southwest Florida resulted in checks totaling more than $5.7 million issued to policyholders for their insurance claims from Florida’s costliest hurricane. About 20 insurance companies and representatives from the National Flood Insurance Program were on hand to assist nearly 1,000 residents who attended the events in Ft. Myers and Punta Gorda. These Insurance Villages allow policyholders to meet with their property insurance company in-person and work together to file claims or resolve any outstanding claims.

LMA Newsletter of 4-24-23