Plus, roof fraud & an Ian chop shop

A second South Florida homeowners association is under receivership for alleged financial mismanagement and fraud, a West-Central Florida roofing scheme may involve hundreds of victims, and another victimization of Hurricane Ian survivors, this one involving an alleged stolen car chop shop. It’s all in this week’s look at fraud news around the Sunshine State.

A second South Florida homeowners association is under receivership for alleged financial mismanagement and fraud, a West-Central Florida roofing scheme may involve hundreds of victims, and another victimization of Hurricane Ian survivors, this one involving an alleged stolen car chop shop. It’s all in this week’s look at fraud news around the Sunshine State.

Growing HOA Woes: Just a few miles down the road from the site of the Champlain Towers South condominium collapse that killed 98 people in 2021, is the Mirador Master Association in Miami Beach. It oversees 5 smaller associations serving 1,200 unit owners. Last week a Circuit Court judge ordered Mirador into receivership following a lawsuit by a concrete contractor that was never paid for its work. “That was the tip of the iceberg that made us realize the board was misappropriating funds because we got sued by a contractor and the board really had no explanation for where the money went,” attorney Steve Silverman told the Daily Business Review. Silver, who represents two of the five associations, said the allegations include substantial, unsubstantiated monies paid from the master association to its former board president, current treasurer, and former unlicensed manager for unsubstantiated claimed reimbursements, years of HOA statutory violations including the master association’s failures to perform statutorily required annual audits, as well as failures to pass updated annual budgets and maintain official books, records, and financial records.

Growing HOA Woes: Just a few miles down the road from the site of the Champlain Towers South condominium collapse that killed 98 people in 2021, is the Mirador Master Association in Miami Beach. It oversees 5 smaller associations serving 1,200 unit owners. Last week a Circuit Court judge ordered Mirador into receivership following a lawsuit by a concrete contractor that was never paid for its work. “That was the tip of the iceberg that made us realize the board was misappropriating funds because we got sued by a contractor and the board really had no explanation for where the money went,” attorney Steve Silverman told the Daily Business Review. Silver, who represents two of the five associations, said the allegations include substantial, unsubstantiated monies paid from the master association to its former board president, current treasurer, and former unlicensed manager for unsubstantiated claimed reimbursements, years of HOA statutory violations including the master association’s failures to perform statutorily required annual audits, as well as failures to pass updated annual budgets and maintain official books, records, and financial records.

This is the second such case in the past four months. Last November, State Attorney Katherine Fernandez Rundle announced the arrest of five board members of the Hammocks Homeowners Association in southwest Miami-Dade County. She called it an “organized crime scheme” where the board annually collected $4 million in dues and allegedly stole more than $1 million, while some fees among its 40 subdivisions went up 400%. The Florida Legislature in its May 2022 special session enacted, as part of SB 4-D, new requirements on high-rise condominium building re-inspections and condo/HOA association practices, including reserve accounts and studies to fund milestone inspections and repair. “This added layer of scrutiny is likely to reveal other instances of fraud,” attorney Silverman said.

John Sutton mugshot. Courtesy, Pasco County Jail

Roofing Fraud: The owner of a Pasco County construction company was arrested last week as part of a $41,000 roofing fraud scheme that may have hundreds of more victims yet undiscovered. John Sutton, owner of Kaizen Construction Group in Thonotosassa, is charged with unlicensed contracting, filing a false and fraudulent insurance claim, grand theft, and failure to have workers’ comp insurance. According to the Florida Department of Financial Services (DFS), its insurance fraud investigators found that from August 2021 through February 2022, Kaizen presented itself as a licensed roofing company. Its salesmen went door to door soliciting business for roof replacements, instructing the homeowners on what to say to insurance companies to initiate the claims process. Kaizen’s salesmen would have homeowners sign a “Direct to Pay” after claim numbers were issued to the homeowner. Sutton never pulled any permits to initiate or complete roof replacements.

Further investigation revealed that neither Sutton, nor the Kaizen Construction Group, was properly licensed or insured to conduct roofing business in the State of Florida. According to a release, Sutton allegedly later made a statement saying that he has victimized hundreds of homeowners throughout the state. DFS is now on the lookout for other victims. If you’re heard of this fraud, contact the DFS Insurance Fraud Hotline at 1-800-378-0445.

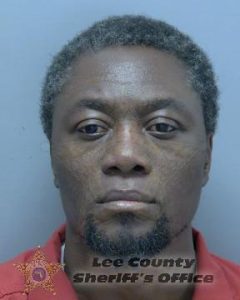

Marcder Guerrier mugshot. Courtesy, Lee County Sheriff’s Office

Hurricane Ian Fraud: The Lee County Sheriff’s Office has arrested three suspects from a towing company, accused of stealing cars, boats, and golf carts from Hurricane Ian victims. Marcder Guerrier, owner of Blessing Towing in Ft. Myers, is accused of twice towing storm-damaged cars and lying to the owners that their insurance company sent them to tow the vehicles. He charged the vehicle owners double-price to get their vehicles back. Guerrier billed a $175 tow fee on top of $75 storage per day, in violation of a county ordinance that caps the daily fee at $35. Investigators recovered nine stolen cars, a trailer, three golf carts and two boats from a North Fort Myers lot. Other stolen vehicles were chopped up. The big break came when a vehicle owner reported their car broke down, and moved the vehicle off the roadway. The vehicle then vanished. Detectives traced it back to Blessing Towing. Guerrier told WFTX-TV Fox 4, “I haven’t done anything wrong. That didn’t happen. There are no stolen cars.”

LMA Newsletter of 3-27-23