Plus, clearing an obstacle to private flood insurance coverage

The federal flood insurance program faces yet another shutdown at month’s end, a new bill in Congress would end the penalty for switching to private flood insurance, and Hurricane Melissa data details the devastation in the Caribbean. It’s all in this week’s Flood Digest.

The federal flood insurance program faces yet another shutdown at month’s end, a new bill in Congress would end the penalty for switching to private flood insurance, and Hurricane Melissa data details the devastation in the Caribbean. It’s all in this week’s Flood Digest.

NFIP Reauthorization: The National Flood Insurance Program (NFIP) authorization will expire on January 30 along with funding for most federal government functions (except agriculture, military construction, veteran affairs, and Congress) unless Congress approves a full year funding bill, or another continuing resolution; otherwise, another partial government shutdown will occur. The NFIP Extension Act of 2026 (H.R. 5577) would extend the federal flood insurance program through the end of 2026. It had a hearing in the U.S. House Financial Services Committee last month, with concerns expressed about the impacts of another lapse like the October-November 43-day shutdown.

NFIP Reauthorization: The National Flood Insurance Program (NFIP) authorization will expire on January 30 along with funding for most federal government functions (except agriculture, military construction, veteran affairs, and Congress) unless Congress approves a full year funding bill, or another continuing resolution; otherwise, another partial government shutdown will occur. The NFIP Extension Act of 2026 (H.R. 5577) would extend the federal flood insurance program through the end of 2026. It had a hearing in the U.S. House Financial Services Committee last month, with concerns expressed about the impacts of another lapse like the October-November 43-day shutdown.

“Another lapse of the NFIP would leave millions of Americans at risk and disrupt the purchase of flood insurance in more than 22,000 communities across the United States,” wrote the American Property Casualty Insurance Association (APCIA). “Without an authorization extension, Americans’ ability to purchase or renew their NFIP policies will encounter significant difficulties leading to an eventual lapse for policyholders.” The committee approved the measure on a 53-0 vote. Representatives on both sides of the aisle pushed for further reauthorizations, with Rep. Nydia Velazquez (D-NY) calling for a decade long NFIP extension and proposed legislation to improve transparency and oversight for flood insurance, including a tax credit for flood insurance expenses. Rep. Monica De La Cruz (R-TX) and Rep. Mike Flood (R-NE) both spoke on the gravity of the renewal, ensuring market stability and a peace of mind for coastal and inland communities alike, in protecting for many Americans their most valuable asset.

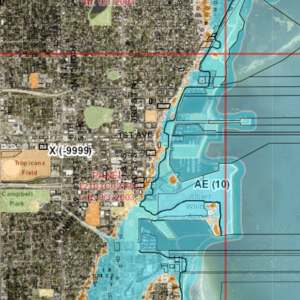

Private Flood Insurance Penalty: Many private flood insurers have re-entered the market in recent years after federal rules were relaxed allowing homeowners required to purchase flood insurance for mortgage qualification to purchase private flood policies. Under the current system though, any homeowner opting for private coverage loses their lower grandfathered premiums if they return to NFIP coverage. That’s seen as a disincentive to purchasing private flood insurance. U.S. Rep. Kathy Castor (D-Tampa) and Rep. Maria Salazar (R-Miami) noticed the ongoing problem and have proposed H.R. 6620, making continuous coverage requirements more lenient to help lower premiums for homeowners across the nation. The bill comes after much scrutiny regarding NFIP’s outdated flood maps, where researchers have suggested that over 17.7 million homeowners have high flood risk properties, far higher than the official figure of 8 million. “Our bipartisan legislation empowers consumers with more options by allowing access to private flood insurance, without penalty,” Castor said. “For coastal communities like Tampa Bay, healthy competition can lower costs, expand the insurance pool and help bring down flood insurance rates.”

Private Flood Insurance Penalty: Many private flood insurers have re-entered the market in recent years after federal rules were relaxed allowing homeowners required to purchase flood insurance for mortgage qualification to purchase private flood policies. Under the current system though, any homeowner opting for private coverage loses their lower grandfathered premiums if they return to NFIP coverage. That’s seen as a disincentive to purchasing private flood insurance. U.S. Rep. Kathy Castor (D-Tampa) and Rep. Maria Salazar (R-Miami) noticed the ongoing problem and have proposed H.R. 6620, making continuous coverage requirements more lenient to help lower premiums for homeowners across the nation. The bill comes after much scrutiny regarding NFIP’s outdated flood maps, where researchers have suggested that over 17.7 million homeowners have high flood risk properties, far higher than the official figure of 8 million. “Our bipartisan legislation empowers consumers with more options by allowing access to private flood insurance, without penalty,” Castor said. “For coastal communities like Tampa Bay, healthy competition can lower costs, expand the insurance pool and help bring down flood insurance rates.”

Thunderous torrents of muddy water flow down Santa Cruz Street in Saint Elizabeth, Jamaica during the heart of Hurricane Melissa, October 28, 2025. Courtesy, Eian Thomas via Facebook

Hurricane Melissa Impacts: Hurricane Melissa rapidly intensified into a Category 5 storm in late October last year, making landfall in Jamaica with record-breaking windspeeds, clocking in as the third-most intense Atlantic hurricane on record. A post-storm evaluation by the StEER Network of researchers details the widespread wind damage, storm surge, and flooding that resulted in 45 deaths across Jamaica, and a similar figure in Haiti, bringing the 2025 worldwide tropical cyclone totals to almost 2,000 confirmed fatalities and almost $20 billion in losses. While Florida and the rest of the U.S. mainland dodged the bullets in 2025, the threat of disaster and the costs of long-standing exposure are recurring, unavoidable, and growing in scope. While human activity has certainly exacerbated extreme weather events in recent years, human insight and advances can help us strengthen our communities and their preparedness for these storms – because as we know, it’s not if the next storm will hit, it’s simply a matter of when.

See you on the trail,

Lisa