In our recent reporting of the latest Property Insurance Stability Report by the Florida Office of Insurance Regulation (OIR), we noticed that although OIR provided county-by-county average homeowners and condo unit premiums, there was no statewide average shown. So we at LMA crunched the OIR data and found there is more reason for good news here. It’s also an important and relevant figure to provide, at a time when various dot-com publications continue to compile figures of questionable methodology that are then repeated by the Florida news media that are two to three times higher than OIR’s data shows: the true answer – per OIR – is that the average statewide annual homeowners insurance premium, including wind coverage, is $3,330, as of March, a $52 decrease from September 2024.

In our recent reporting of the latest Property Insurance Stability Report by the Florida Office of Insurance Regulation (OIR), we noticed that although OIR provided county-by-county average homeowners and condo unit premiums, there was no statewide average shown. So we at LMA crunched the OIR data and found there is more reason for good news here. It’s also an important and relevant figure to provide, at a time when various dot-com publications continue to compile figures of questionable methodology that are then repeated by the Florida news media that are two to three times higher than OIR’s data shows: the true answer – per OIR – is that the average statewide annual homeowners insurance premium, including wind coverage, is $3,330, as of March, a $52 decrease from September 2024.

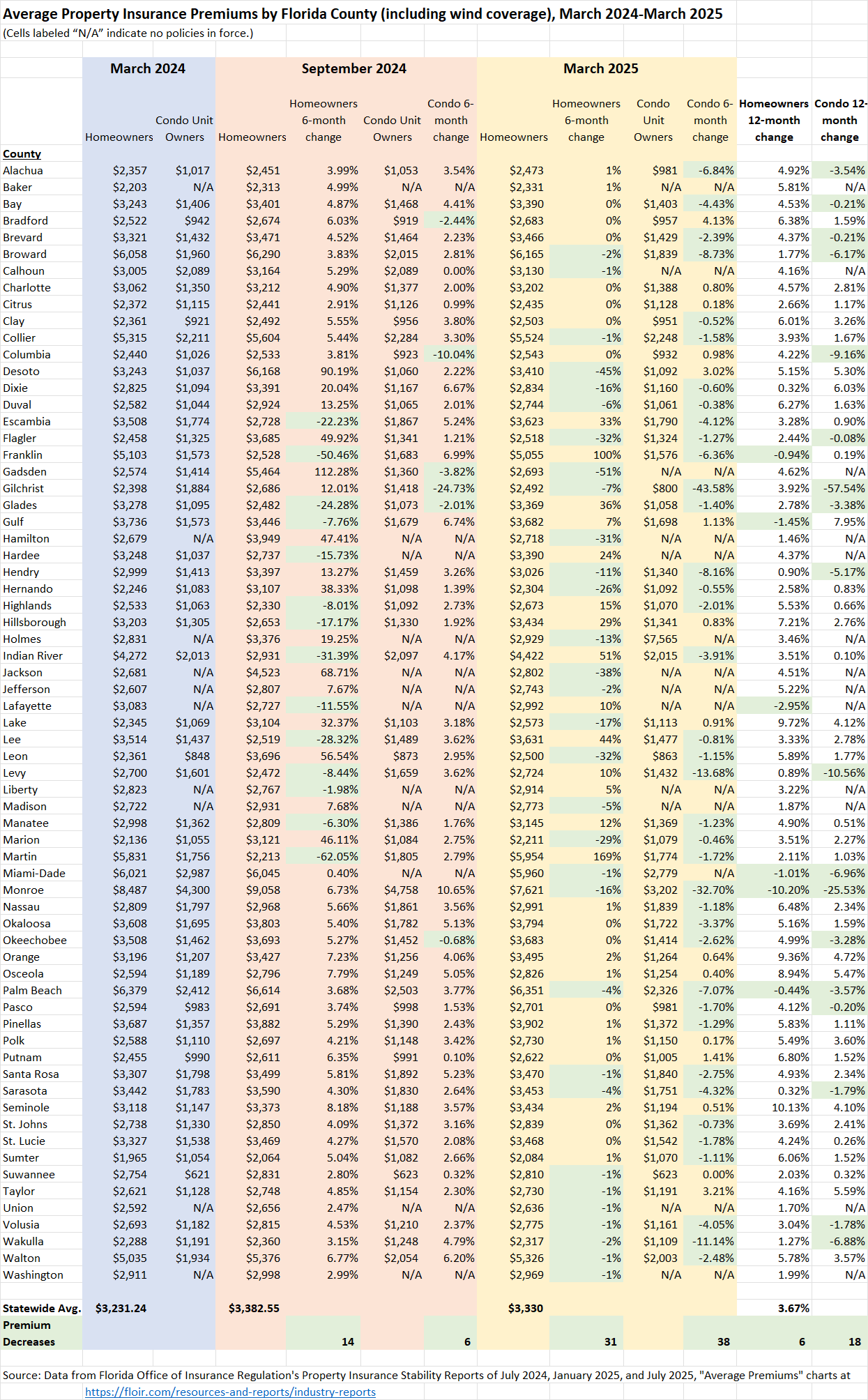

The table below (and here) is a one-year look back at homeowners and condo unit owner policy average premiums, compiled from OIR’s last three Property Insurance Stability Reports. Our observations:

- The number of Florida’s 67 counties enjoying premium decreases has grown over the past year of data (March 2024-March 2025) with 31 counties (nearly half) seeing homeowners decreases and more than half (38) seeing condo unit owner decreases in the most recent six-month period (September 2024-March 2025).

- Another 13 counties saw a 0% change in homeowners premiums and another single county saw a 0% change in condo unit owner premiums.

- While the most recent six-month data is encouraging, the 12-month lookback shows a majority of counties overall have a longer way to go in seeing net average premium decreases. Just 6 counties saw homeowners premium decreases from March 2024 to March 2025, and 18 saw condo unit owner decreases. However, Monroe County, the riskiest in Florida for hurricanes and with resulting higher rates, saw a 10.2% premium decrease.

The statewide average premium for homeowners policies rose from $3,231 in March 2024 to $3,382 in September 2024, but then fell to $3,330 by March 2025. In the 12-month lookback, Florida’s average statewide homeowners premium has increased 3.67%. Compare this to new policies nationally, which increased 9.3% in the first half of 2025, according to Insurance Business. You can also compare this to the annual U.S. inflation rate, which was 2.7% for the 12 months ending in June 2025.

As noted in its recent report, OIR is “confident” about the impact of the 2019-2023 property insurance reforms passed by the Florida legislature and the positive developments in the Florida market. OIR cited a continued decline in insurance litigation and associated costs, declining rates, speedier claims resolution, a respite from rising reinsurance costs, new carriers entering the market, and a return to insurance companies’ profitability and stability. The above table only amplifies that confidence and the “proof in the pudding” of extensive data that OIR collects. We certainly expect those numbers to get even better as new policies take effect and the market recovery continues. Consumers and legislators certainly expect that, too.

On another note: We are closing watching a tropical disturbance that emerged off the coast of Africa this past weekend and that forecasters say could become the season’s first Atlantic hurricane. Please check the latest forecasts from the National Hurricane Center and be ready!

Up next: an updated hurricane season forecast, declining auto insurance rates, Congress’ plan to change FEMA, the latest action in Florida courts, and how insurance industry leaders are planning to give back to Florida communities. Thanks for reading!