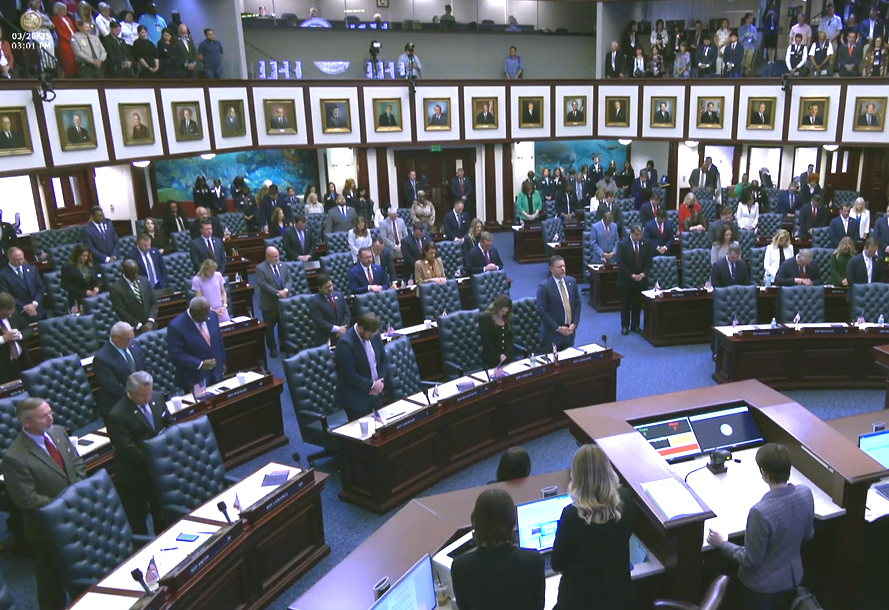

The Florida House of Representatives in session, March 26, 2025. Courtesy, The Florida Channel

Two weeks from today, Florida lawmakers return for two back-to-back weeks of committee meetings, part of the 2026 legislative session that begins on January 13. We know there will be another attempt to roll back the 2022 & 2023 insurance consumer protection and litigation reforms that have proven so critical to Florida’s recovering property insurance market – along with other issues identified in our last newsletter. Here are the 7 common claims we heard made in the last legislative session, amplified by the news media – and our answers to them, with explanation, for lawmakers to hear in this upcoming session.

Claims Payment Delays – Office of Insurance Regulation Examinations Tell a Different Story: The narrative that insurers delay paying claims to increase profits by investing the money that should have been promptly paid to customers with damaged homes is wrong. Nine market conduct exams of Hurricane Ian claims by the Office of Insurance Regulation (OIR) in 2025 show that 93% of claims were paid within the required 90 days. Of the 6.5% that were delayed, half included an additional payment of 9% interest on the past due amount as required by law. Only 3% of claims reviewed were paid late without the interest payment required by law — hardly evidence of systemic abuse.

Legitimate Claims are being denied – Office of Insurance Regulation Examinations Tell a Different Story: The claim that insurers deny legitimate claims is not supported by data. The Office of Insurance Regulation targeted market conduct examinations reported that after reviewing a random sample of the 88,000 Hurricane Ian claims made against six Florida insurance carriers, auditors did not find a single claim that was incorrectly adjusted. Auditors discovered a total of 21 claims at three other carriers which were not adjusted according to the terms of the insurance contract. Those 21 claims that were incorrectly adjusted represented 3% of the 6,887 Hurricane Ian claims reported to those three companies. The headlines focused on fines, but the real story is that 99.1% of claims were handled according to the contract.

Hiding Money and Profits in Affiliates – That’s Impossible without breaking the law: All contracts between an insurance company and its subsidiaries and affiliates must be approved in advance by the Office of Insurance Regulation. All cash distributed from the insurance company to its subsidiaries and affiliates must be reported on Schedule Y of the insurance company’s annual financial statement. The annual statement must be filed under oath and audited by an independent CPA. In addition, all persons owning 10% or more of a Florida insurance company must file a personal financial statement with the OIR annually. Insurance carriers, their managing general agents (MGA’s) and other affiliates are subject to audit by the OIR. To “hide” money and profits, insurance companies would have to keep two sets of books — a criminal act — and conceal it from regulators, auditors, and executives who must sign financial statements under oath. There is no evidence that this is happening, and believing otherwise would require believing in widespread fraud and regulatory failure.

“Thinly Capitalized” Companies and Solvency Concerns – That is addressed by the OIR’s annual reinsurance stress test: Florida-based insurers are often criticized for being thinly capitalized, but they are required by OIR to purchase high levels of reinsurance, protecting policyholders from insolvency even in severe storm seasons. Historical data shows Florida has never experienced a 1-in-135-year hurricane event — an epic hurricane if it were to occur and the standard used for setting first event reinsurance levels. The OIR standard requires companies to purchase second event coverage sufficient to cover a 1– in–50-year event after a 1–in–100-year event. The Lake Okeechobee Hurricane of 1928 was the only time that Florida has experienced a 1–in–50-year event. (Hurricane Andrew, by comparison, is usually considered a 1–in–20-year event). There have only been only six times in 150 years that three hurricanes have made landfall in one year and the OIR stress test requires the purchase of some reinsurance to provide reinsurance protection in that unlikely event. When insolvencies have occurred, they were driven primarily by excessive litigation, not by storms themselves. If an extreme event does occur, the Florida Insurance Guaranty Association (FIGA) provides up to $500,000 in coverage per claim.

The Flood Insurance Gap and poor customer experience after a storm – Federal action is required: Too few Floridians buy flood insurance, and the federal flood insurance program (NFIP) is riddled with problems — poor coverage, delayed claims, lack of standards, and no deadlines for payments. This leaves policyholders frustrated and sometimes waiting years for funds, often blaming their homeowner’s insurer. The average flood claim from Hurricane Irma was $110,000, making it costly to insure. Florida insurers would like to expand private flood offerings, but reinsurers are reluctant to participate. The legislature should advocate for making flood insurance more available and reliable for Floridians..

Annual Homeowners insurance premiums remain high despite legislative reform – what else can be done?: The Office of Insurance Regulation is responsible for annually approving all insurance rates charged by Florida homeowner’s insurance companies. The OIR reviews the cost of claims, reinsurance, operating expenses, taxes and fees. Consumers are protected by rule 690.170.003 which limits profits to 4.2% of premiums. The legislature’s historic litigation reforms in 2022 reduced claim costs. The 2024 legislature further reduced costs temporarily by eliminating the premium tax and providing some additional reinsurance through the Florida Hurricane Catastrophe Fund (FHCF). Consumers have not seen those reductions in costs in their annual insurance bill because of inflation, increased property values, and the expense of required reinsurance. The legislature can’t do much about inflation but can change the FHCF reducing reinsurance cost and reduce taxes & fees. Homeowners insurance rate decreases must be included in insurance company rate filings, filed under oath, that subject insurance executives to penalties for perjury if the filings are false.

Are Florida homeowners companies increasing their rates because they’re paying their executives too much?: No. Analysis of financial statements performed shows that, on average, Florida homeowners’ insurance companies had lower expenses than homeowners insurance companies operating outside of Florida. And, an analysis of executive compensation performed by CompAnalyst of Salary.com showed the median salary of an insurance executive in Florida was 4% less than the median salary for the same position at a company based outside of Florida.

You can access a copy here of the above 7 issues to save & share with your colleagues, clients, and favorite legislators. Or, click the red SHARE THIS button below left to share this newsletter story by email or social media.

Some lawmakers are already at the Capitol here in Tallahassee today and tomorrow for the initial meeting of the House Select Committee on Property Taxes. The 37-member bipartisan committee is examining how to provide additional tax relief through local property taxes that could result in a ballot initiative for voters in November 2026. Its Chair, Rep. Toby Overdorf (R-Palm City) said the committee, however, will not consider a complete elimination of property taxes, as proposed by the Governor. Florida TaxWatch writes that “Florida’s property tax system is at a crossroads,” with total levies surging by 108% over the last decade, far exceeding the combined rate of population growth and inflation. Its analysis is in this research report.

Another financial update: The Legislative Budget Commission met on September 12 and reviewed the state’s Long-Range Financial Outlook. The state expects to have a nearly $3.8 billion budget surplus in the fiscal year 2026-2027 budget, but a $1.5 billion deficit in 2027-2028, and a $6.6 billion deficit in 2028-2029 based on current programs and spending levels. The legislature cut this year’s 2025-2026 budget by about $2 billion from last year’s, but House budget chief Rep. Lawrence McClure said deeper cuts will be necessary this next session.

I’d like to thank everyone who commented on my Educating Florida and the World About Insurance, One Podcast at a Time feature by AM Best TV, produced in mid-August. Always appreciate your comments, questions, and concerns!