Arguments move to the courthouse

Five months after the Governor signed Assignment of Benefits (AOB) reform into law, enforcement is reported to be a mixed bag in the courts. A key element that drove AOB abuse – one-way attorney fees – is the very thing that is getting uneven enforcement by judges hearing insurance claims disputes.

Five months after the Governor signed Assignment of Benefits (AOB) reform into law, enforcement is reported to be a mixed bag in the courts. A key element that drove AOB abuse – one-way attorney fees – is the very thing that is getting uneven enforcement by judges hearing insurance claims disputes.

The new law, based on passage of HB 7065 by the Florida Legislature, became effective on May 23. Among other things, it revises the previous one-way attorney fee system which incentivized lawsuits. It institutes a new formula, based on the disputed amount; i.e. the difference between the assignee’s presuit settlement demand and the insurer’s pre-suit settlement offer. If the prevailing judgment is:

- Less than 25% of the disputed amount, then the insurer is entitled to reasonable attorney fees;

- At least 25% but less than 50% of the disputed amount, no party is entitled to an award of fees;

- At least 50% of the disputed amount, the assignee vendor is entitled to reasonable attorney fees.

Policyholders still enjoy the protections of the one-way attorney fees under 627.428 F.S.

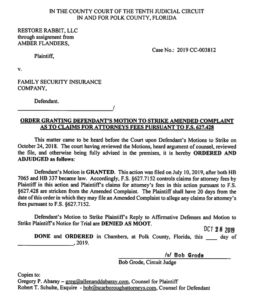

Defense attorney Robert Schulte, a Partner at Scarborough Attorneys At Law, reports success most recently as this past week. His Tampa-based firm secured a ruling in Polk County for client Family Security Insurance Company striking the Plaintiff’s fee claims pursuant to s. 627.428 and ruling that s. 627.7152 (the “new law”) controls claims for attorney fees. Congratulations!

But courts in Miami-Dade County haven’t been so accommodating on a similar motion. An AOB Vendor filed a lawsuit on June 7 and in their Complaint they alleged they are entitled to recover attorney’s fees under the old law 627.428 F.S. Although Heritage Insurance filed a motion to strike that based on passage of the new law and effective date, the court denied that motion.

Mr. Schulte tells us that plaintiff lawyers are fighting hard and will likely continue to fight tooth and nail to avoid being subject to the reforms. Their arguments loosely are that fees under the old law of 627.428 are “vest[ed], substantive rights” that “cannot be adversely affected by the enactment of legislation.”

These, of course, will be the same cottage industry of lawyers who will complain in the not-too-distant-future that insurance rates haven’t been reduced as a result of the AOB reform. We at Lisa Miller & Associates are providing continuing education seminars and presentations on AOB reform and welcome your inquiry.

LMA Newsletter of 11-4-19