Agent Fraud, statewide policy data revealed

A Florida appeals court has weighed-in on a water damage case concerning an Assignment of Benefits (AOB) claim, a South Florida insurance agent has been arrested for insurance premium fraud, and the Florida Office of Insurance Regulation has resumed reporting statewide policy counts among admitted insurance companies. It’s all in this week’s Property Insurance News.

A Florida appeals court has weighed-in on a water damage case concerning an Assignment of Benefits (AOB) claim, a South Florida insurance agent has been arrested for insurance premium fraud, and the Florida Office of Insurance Regulation has resumed reporting statewide policy counts among admitted insurance companies. It’s all in this week’s Property Insurance News.

AOB Ruling: The First District Court of Appeals found that a policy exclusion for “water damage caused by flood, surface water, waves, tidal water, or overflow of a body of water,” didn’t plainly exclude water damage caused by rain. Its opinion in Air Quality Assessors of Florida vs. Southern-Owners Insurance Company reversed the trial court’s decision that had dismissed the lawsuit brought by Richie Kidwell’s mold inspection and testing company which has a history of suing insurance companies over AOB claims. But the 1st DCA also instructed the Calhoun County Court to decide first whether the insurance policy was still in effect after Florida’s 2019 AOB Reform law was enacted. You can read more in the Insurance Journal.

Insurance Agent Fraud: A Pompano Beach insurance agent has been arrested for stealing more than $41,000 in insurance premiums and for forgery. The Department of Financial Services (DFS) reports Veronica Skopp had the victim wire $41,418 in premium money to her business bank account, which she later indicated that she pocketed for her own personal use. Skopp then provided the victim with a fraudulent Evidence of Commercial Property Insurance Certificate, as well as a fraudulent Certificate of Liability Insurance. When going to refinance the properties, the victim discovered there was no insurance coverage in place on the 31 properties in Naples. After meeting with DFS detectives, Skopp confessed to misappropriating the premiums of the victim and additional consumers, as well as providing the victim with fraudulent documents.

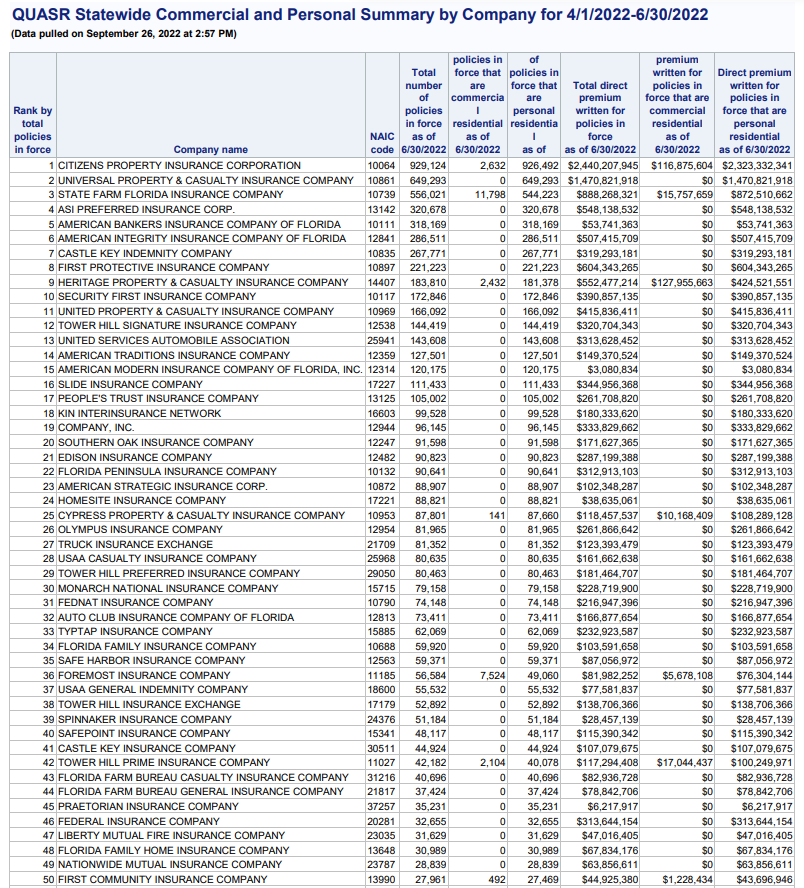

Statewide Policy Data Public Once Again: The Florida Office of Insurance Regulation (OIR) has resumed posting the aggregated statewide data submitted by insurance companies and groups on OIR’s website here through its QUASR (Quarterly and Supplemental Reporting System) system as two downloadable Excel documents. For the first time in 8 years for some companies, you’ll be able to see statewide policyholder counts, policies cancelled/non-renewed, total policy values, total direct premium written, and total exposure in both summary form for the 170 parent companies (and the detail for the 470 total parent & affiliated companies) authorized to write personal and commercial lines property insurance in Florida. OIR’s action was required under Senate Bill 2-D, part of the 2022 Litigation and Consumer Protection Reform passed by the legislature in its May special session. County-level data is still considered trade secret for those companies that have so filed. These reports now include 39 companies, beginning with State Farm in 2014, who cited Trade Secret in requesting OIR no longer publish their policy information in the QUASR system.

Policy counts for the top 50 property insurance companies in Florida ranked by total policy count, as of June 30, 2022. Click image for full list. Source: Florida Office of Insurance Regulation

LMA Newsletter of 11-7-22