Hurricane rebuilding in the balance

One of about 200 homes in Gulfport, Florida damaged in the hurricanes awaiting permits to begin repairs. Source: WTVT-TV, Fox 13 Tampa

Months after Hurricanes Helene and Milton, the impact of the storms is still being felt all across Florida. A recent analysis from Munich Re found that Hurricane Milton caused the largest insured losses from any natural disaster in 2024 at $25 billion, while Helene caused the largest amount of overall losses at $56 billion (with only $16 billion insured losses), spelling a disastrous combination for many communities along Florida’s gulf side. Mid-December figures from OIR show 318,000 claims filed from Milton with an estimated insured loss of $3.6 billion; Helene claims total just over 140,000 with a $2.1 billion loss.

The greater Tampa Bay area took the biggest hit in the two storms, in terms of insurance claims and requests for FEMA assistance. At play in the recovery now is FEMA’s enforcement of its so-called “50% Rule” which requires homes in flood zones that suffer damage of at least 50% of their market value (not including the land) be brought up to current building codes – often involving more costly rebuild and elevation, rather than simply being repaired.

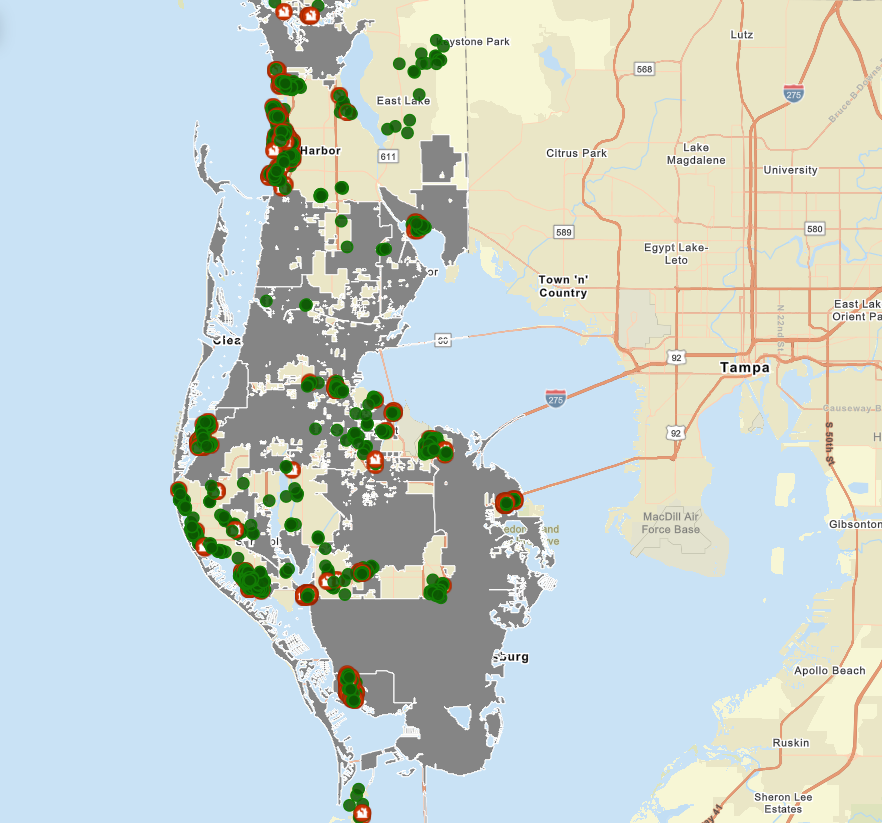

To comply with the 50% rule, Pinellas County has mailed more than 1,600 initial substantial damage assessment letters to unincorporated properties, which can be viewed in the map below and also through this online tool. The green dots represent homes determined not substantially damaged and the red dots those homes substantially damaged over 50%.

Map showing homes in unincorporated Pinellas County that have received Substantial Damage Assessment letters as of January 12, 2023. Source: Pinellas County. (Click here for full scale map and searchable address function & determination)

Florida Attorney General Ashley Moody has sent a letter to the feds, asking for leeway on the 50% rule. “While it is preferable for any home to be built to the most current standards, many of those suffering most from the storms lived in older homes in low-income areas and do not have the resources to fundamentally rebuild their homes…In circumstances like this, many people will simply abandon their home and, possibly, have no choice but to leave the community they love altogether,” wrote Moody.

While FEMA has sent $1B in relief to Florida storm victims to help with temporary expenses, some residents still await aid as a backlog of damage assessments continue. Madeira Beach, an incorporated community within Pinellas County, was especially hard-hit by the hurricanes. According to a Facebook post by one resident, around half of applicants are still waiting for substantial determination letters required before building permits can be issued.

Pinellas County is slated to receive $813.8 million and St. Petersburg over $160 million from the U.S. Department of Housing and Urban Development’s Community Block Grant Disaster Recovery Program – although it could be years before the funding is actually disbursed to the communities. While the money will no doubt be a lifeline for many homeowners, the long wait times have left many residents in a very difficult situation. North Tampa is another such area, where historic flooding outside of flood zones left many residents displaced. Officials have been working closely with FEMA and other third-party entities to get communities back online and last week presented an economic relief plan to the Tampa city council to help its residents.