Recap of Week 8 & Preview of Week 9 of Session

It is not uncommon for the big tough issues to be left to the end of a Florida legislative session. And that’s certainly the case this year as we enter the last scheduled week of session with some major issues still being resolved. So it is uncertain whether the session will end on time this Friday the 13th. Almost all of the tort reform bills we’ve been following are no longer in play.

It is not uncommon for the big tough issues to be left to the end of a Florida legislative session. And that’s certainly the case this year as we enter the last scheduled week of session with some major issues still being resolved. So it is uncertain whether the session will end on time this Friday the 13th. Almost all of the tort reform bills we’ve been following are no longer in play.

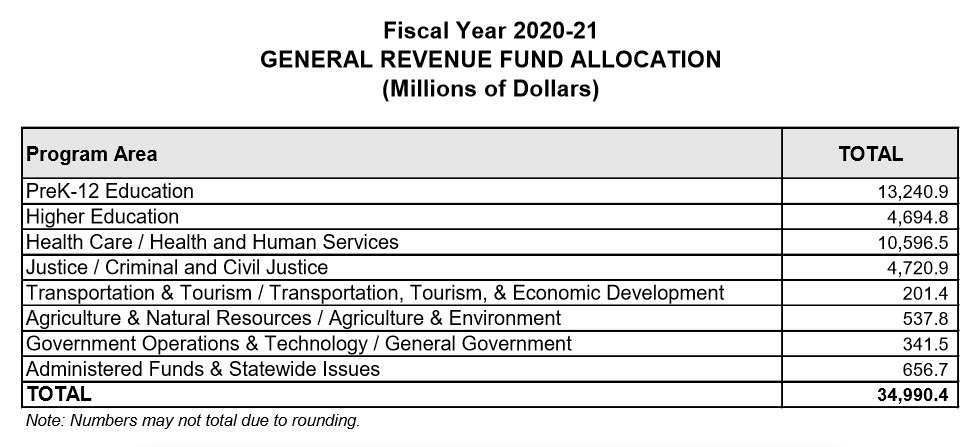

The only bill the legislature is required to pass each year is the General Appropriations Act, funding the next fiscal year’s state budget, which begins on July 1. The two chambers have been about $1.4 billion dollars apart (the House at $91.4 billion to the Senate’s $92.8 billion) in their proposals. Leadership agreed on budget allocations of general revenue late Friday, as noted in the chart below. The two chambers held budget conference meetings over this past weekend and announced they’d reached agreement on some key differences, including 3% pay raises for state employees, funding Visit Florida for another year, and leaving the Sadowski Trust Fund intact and dedicated to funding affordable housing. Unresolved issues by 1pm today (Monday) will move to the Appropriations Chairmen (Senator Bradley and Rep. Cummings) to try to resolve. Whatever they fail to settle, then goes to Senate President Galvano and Speaker Oliva to work out.

State law requires a 72-hour “cooling off” period from the time the proposed final budget is printed to the time it’s voted on (to allow legislators to actually review what they will vote on). That means for the session to end as scheduled this Friday the 13th, the budget would have to be agreed upon by leadership and printed sometime tomorrow (Tuesday). While both sides said last week that an extended session was inevitable because of budget differences, there’s still a chance for a timely Friday finish.

The nearly $35 billion above in General Revenue is about 38% of the state budget, with trust funds making up the remaining 62%. As for tax cuts, the House on Friday approved a package that trims state and local taxes by $133 million on a recurring basis with an additional $61.6 million in one-time cuts. The two largest tax cuts are a reduction in the communication services tax of 0.5% and the business rent tax from 5.5% to 5.4%. The Senate tax plan comes out early this week. Other tax measures include the usual back to school and disaster preparedness sales tax holidays, an aviation fuel tax cut for commercial carriers, and tax administration changes.

Here is a list of the legislative bills we’re following in this 60-day session (you can click the link to go directly to the bill). Our list is organized by those bills “In Play” and “Not In Play”. “Updated” bills are so noted. Updates within each bill are noted in red font:

Assignment of Benefits (Windshield AOB) NOT IN PLAY

Bad Faith Updated

Contingency Fee Multiplier/1st Party Insurance Lawsuits Updated

Contingency Fee Limitations Local Government NOT IN PLAY

Omnibus Insurance Bill Updated

Litigation Financing Consumer Protection Updated

Damages Updated

Legal Advertising NOT IN PLAY

Public Records/Records of Insurers/Department of Financial Services Updated

Property Insurance (surplus lines) NOT IN PLAY

Consumer Protection Updated

Insurance Claims Data Updated

Insurance Guaranty Associations Updated

Construction Defects NOT IN PLAY

Disposition of Insurance Proceeds Updated

Financial Services Updated

Residential Property Disclosures (Flood) NOT IN PLAY

Sanitary Sewer Levels NOT IN PLAY

Florida Building Code NOT IN PLAY

Motor Vehicle Insurance (PIP) Updated

Motor Vehicle Rentals NOT IN PLAY

Motorist Fines and Fees Updated

Credit for Reinsurance Updated

Genetic Information for Insurance Purposes Updated

Pharmacy Benefit Managers (PBMs) Updated

Criminal Justice Reform NOT IN PLAY

Tobacco and Nicotine Products Updated

Cruelty to Dogs NOT IN PLAY

Bad Faith – While this particular bill is dead, the idea of bad faith reform remains alive in a catch-all insurance House bill by Rep. David Santiago (HB 895 – see the “Disposition of Insurance Proceeds” section of this report below.) At least, that is, bad faith as it relates to an ongoing effort to repeal Florida’s No-Fault Auto Insurance law and with it, Personal Injury Protection (PIP) insurance. As a result, the 2020 session may very well be a repeat of the 2019 session – a stalemate – with no PIP repeal and no bad faith reform.

Bad Faith – While this particular bill is dead, the idea of bad faith reform remains alive in a catch-all insurance House bill by Rep. David Santiago (HB 895 – see the “Disposition of Insurance Proceeds” section of this report below.) At least, that is, bad faith as it relates to an ongoing effort to repeal Florida’s No-Fault Auto Insurance law and with it, Personal Injury Protection (PIP) insurance. As a result, the 2020 session may very well be a repeat of the 2019 session – a stalemate – with no PIP repeal and no bad faith reform.

Senator Jeff Brandes (R-Pinellas) drew the line in the sand on the Senate side, saying any PIP repeal needs to address bad faith, otherwise, litigation will run rampant. His SB 924 never received the support necessary to be heard by the Senate Banking and Insurance Committee, nor was there a House companion bill. Its amendment addressing bad faith in auto claims also spelled the demise of the Senate’s PIP repeal bill this session before the same committee. While bad faith and PIP bills are dead in the Senate, they have counterparts in the House, both of which are ready for floor votes. (see the “Motor Vehicle Insurance –PIP” bill section of this report.)

Senator Brandes’ barely four-page bill requires that policyholders and claimants in third-party bad faith actions against insurance companies must prove that the company acted with reckless disregard. The bill also limits an insurance company’s liability to third-party claimants under certain circumstances, if it files an interpleader action within a certain time period.

House leaders this session had been waiting on the Senate to make the first “move” on Bad Faith, especially as it pertained to the PIP auto repeal bill. That move happened on February 11, when Senator Brandes filed an amendment to his bill, laying out precise provisions on third-party bad faith against automobile insurers. It’s the same amendment that Senator Lee had filed, apparently under protest, onto his own PIP bill that same day. And essentially the same amendment that Senator Brandes filed onto his own Omnibus bill (see the “Omnibus” section of this report).

At the February 11 Senate Banking and Insurance Committee meeting, Senator Lee made it clear he didn’t support the amendment – on either of Brandes’ two bills or on his own PIP bill – and was later reported as saying the amendment was the product of “people above my pay grade.” As a result, all of the bills were either temporarily postponed or otherwise not considered. (Return to Top of Page)

Contingency Fee Multiplier/1st Party Insurance Lawsuits – SB 914 by Senator Jeff Brandes (R-Pinellas) is designed to do away with enhanced attorney fees that came into being under a 2017 Florida Supreme Court decision. Courts have used the traditional Lodestar method for calculating attorney fees, where the court multiplies a reasonable hourly rate by a reasonable number of hours expended. But the Supreme Court decision noted that insurance claims are especially complex cases and allowed the use of a contingency risk multiplier to double and sometimes triple plaintiff attorney fee awards. The bill has languished, as it failed to be scheduled last week before the Senate Rules Committee, its final committee. It will take a miracle for the Senate to move on this bill.

However, the House version of the bill, HB 7071 filed by the Judiciary Committee and Rep. Mike Beltran (R-Lithia) and Rep. Anthony Sabatini (R-Howey-in-the-Hills) mirrors the Senate bill and passed the House last week on a 72-46 vote. It is now in Senate messages but whether it is taken up by the Senate remains uncertain.

During House floor debate, there was concern raised whether the bill would actually lead to more litigation about attorney fees and whether risk multipliers actually help “level the playing field” for plaintiffs who need attorneys to represent them in pursing insurance claims. Rep. Beltran countered that he didn’t think plaintiffs would be at a disadvantage with passage of the bill. Rep. Sabatini called it a “modest step” to fix the problem and said there will be plenty of lawyers to take cases without the contingency risk multiplier. A shout-out Rep. Beltran who stood on the House floor for two days and vigorously defended the bill and its common sense approach.

The issue was the subject of an extraordinary collaboration last week by five groups (Florida Insurance Council, Florida Association of Insurance Agents, Florida Chamber of Commerce, Associated Industries of Florida, and the Florida Justice Reform Institute) to urge Governor DeSantis to support both the House and Senate reform bills.

It is our hope this House bill becomes a part of larger House/Senate negotiations in these final days of the session. (Return to Top of Page)

Omnibus Insurance Bill – HB 359 by Rep. David Santiago (R-Deltona) covers several topics. A majority of the bill has a new regulatory framework for travel insurance and some other minor tweaks to the insurance code, but nothing in this bill will stem the litigation explosion in our state or do one thing to stop the tremendous rate increases that will be implemented in the next 18-24 months. The bill was amended at the House Commerce Committee meeting on February 20, to include the travel insurance framework. It still awaits scheduling for a vote by the full House but appears dead. The first page of the latest bill analysis has a good summary of its current provisions.

Senator Jeff Brandes (R-Pinellas) filed a comparable bill, SB 1334 in the Senate, which leans more toward litigation reform, but the bill is dead. He filed an amendment with precise provisions on third-party bad faith against automobile insurers. It’s very similar to an amendment he filed onto his Bad Faith bill (see above) and that Senator Lee had filed onto his own Motor Vehicle Insurance (PIP) bill (below). (Return to Top of Page)

Litigation Financing Consumer Protection – The House Civil Justice Committee explored creating a regulatory framework for litigation financiers who provide capital to firms who take cases on contingency, similar to a “factoring” company that buys receivables and pays an upfront, discounted fee for the right to assume the receivable at full value. A workshop led to the release of HB 7041 by Rep. Tom Leek (R-Ormond Beach) which passed the last of its three committee hearings last week, with a 20-3 vote in the House Commerce Committee. It still awaits scheduling for a vote by the full House but appears dead. The first page of the latest bill analysis has a good summary of its current provisions after last week’s action.

A similar companion bill, SB 1828 by Senate Banking and Insurance Chairman Doug Broxson, failed to pass its first committee. (Return to Top of Page)

Damages – SB 1668/HB 9 requires that in personal injury and wrongful death actions to recover medical damages, the jury must only hear evidence of medical expenses based on the usual and customary amounts actually received by medical providers. This ensures the jury does not incorrectly rely on the amount billed by the medical provider to calculate damages. The American Tort Reform Foundation’s annual report places Florida on its “Watch List,” indicating that it considers Florida to have a history of “abusive litigation or troubling developments.” The report’s summary acknowledges, however, that “Florida took great strides toward improving its legal climate in 2019.” These bills appear to continue Florida’s effort in litigation reform.

HB 9 is sponsored by the House Civil Justice Subcommittee and Reps. Leek, Sabatini, and Stone, and still awaits scheduling for a vote by the full House but appears dead.

In past meetings, William Large of the Florida Justice Reform Institute, delivered powerful presentations about this bill, discussing in intimate detail before the Commerce Committee about how lawyers and their favorite physicians game the system. You can find his testimony here and forwarding to the 39-minute mark in the video. The Senate bill died. (Return to Top of Page)

Public Records/Records of Insurers/Department of Financial Services – Consumers’ personal financial and health information, certain underwriting files, insurer personnel and payroll records, and consumer claim files that are made or received by the Department of Financial Services would be exempt from public records law under SB 1188, by Senator Ben Albritton (R-Bartow). The bill is a necessary consumer protection and would keep consumers’ confidential information away from over-zealous attorneys seeking prospective clients.

The bill would also exempt from public records law certain reports and documents held by the department relating to insurer own-risk and solvency assessments, corporate governance annual disclosures, and certain information received from the National Association of Insurance Commissioners or governments. The bill was retained on the Senate’s Special Order calendar Friday for a potential vote this week by the full Senate. An identical House bill, HB 1409 by Rep. Michael Grant (R-Port Charlotte) passed second reading Friday in the full House and rolls to third reading for a potential final vote this week. (Return to Top of Page)

Consumer Protection – HB 1137 / SB 1492 prohibits certain charges for removal of security freeze; prohibits unlicensed activity by adjusting firms & bail bond agents; provides administrative & criminal penalties; revises actions against certain license, appointment, & application of insurance representatives; revises status, notice, & payment requirements for claims; revises classes of insurance subject to disclosure requirement before eligible for export under Surplus Lines Law; prohibits certain writing of industrial life insurance policies; revises Homeowner Claims Bill of Rights; removes certain deductible obligation of the Florida Insurance Guaranty Association; and revises unclaimed property recovery agreements & purchase agreements. These bills are among the very few insurance bills still alive. As such, they are attractive for those wanting to keep their issues alive by attaching amendments to the bills.

HB 1137 is sponsored by Rep. Chuck Clemons (R-Newberry) is still sitting on second reading before the full House and hasn’t been placed on its Special Order calendar for consideration.

SB 1492, by Senator Tom Wright (R-Port Orange), was brought up by the full Senate on Friday’s Special Order calendar but Senator Wright asked the bill be temporarily postponed and it was. There were 14 amendments filed onto the bill last week on a variety of topics, including automobile windshields, MGAs, and public adjusters. As negotiations continue on what, if any of those amendments will be agreeable, the bill remains on the Special Order calendar.

At its last committee stop, an amendment by Senator Wright was adopted that he said was an agreement between the CFO and the public adjusters association. It:

- Gives consumers more time to get out of public adjuster contracts (7 calendar days after initial contract execution and 14 days during a state of emergency or during the one-year period after date of loss)

- Gives consumers right to cancel public adjuster contracts if there’s no written itemized per-unit estimate of repairs provided within 45 days of contract execution.

- Ensures that Floridians have information about their insurance coverage before hurricane season starts.

- Requires all insurance companies to settle claims in 90 days.

- Cracks down on unlicensed transactions of insurance and stops companies from misleading practices like using the term Medicare in their name.

- Requires insurance companies to communicate with consumers more effectively when they send a partial payment or initial estimate.

- Eliminates fees on Floridians who are trying to take charge of their credit or when their insurance company goes under.

There was a second amendment approved that limits insurance companies from providing a list of recommended or preferred vendors unless requested by the insured. It was opposed by Senator Wright and Senator Brandes. Its author, Senator Flores, said she would work with the two to address their concerns that this would change the existing managed repair programs. The House version of this bill, HB 1137, does not contain this amendment.

There were lively exchanges during the committee meeting on this and concern about unregulated surplus lines and the trend of admitted carriers setting up surplus lines companies to avoid regulation. (You can watch it beginning at the 1 hour 42 minute mark in the video recording of the meeting.)

There are decided differences between the Senate and House. We will report the reconciliation of these two bills as we watch the negotiations proceed. We are happy to talk with you about the specifics of each bill. (Return to Top of Page)

Insurance Claims Data – SB 292 by Senator Doug Broxson (R-Pensacola), who chairs the Banking and Insurance Committee, addresses disclosure of, and defines a “loss run statement” as a report relating to risks maintained by an insurer which contains the history of claims occurring during a policy term. The bill requires surplus and admitted carriers to provide a statement to a policyholder at no charge upon request. The bill was taken up Friday by the full Senate and rolled to third reading for a potential final vote this week. A similar bill in the House, HB 269 by Rep. Daniel Perez (R-Miami) passed its committees and is still awaiting scheduling before the full House. “The overall effect of the bill is to establish a statutory framework for an insurance practice that routinely occurs,” states the bill analysis. As such, we find it odd that a routine practice needs to put into law. (Return to Top of Page)

Insurance Guaranty Associations – Essentially a “Condo Parity Bill”, HB 529 by Rep. Jennifer Webb (D-St. Petersburg) would provide an increase from $100,000 to $200,000 per unit as the payout to condominium and homeowners associations. The bill was taken up Friday by the full House and rolled to third reading for a potential final vote this week. An identical bill, SB 898 by Senator Joe Gruters (R-Sarasota), was temporarily postponed on second reading before the full Senate on Friday and retained on the Special Order calendar.

The Guaranty Association protects a traditional single-family dwelling for an up to $300,000 loss for the dwelling should the insurance company go bankrupt. The associations in favor of this year’s legislation argue that a total loss where a condo building is leveled would cost substantially more than $100,000 “per door” to rebuild and that the payout hasn’t been increased in over 30 years. This has been a point of conversation for many years and we look forward to the debate.

The bill also increases the funding available to FIGA through emergency assessments levied against insurance companies. The bill authorizes assessments up to 4% of a carrier’s net written premiums in this state in any single calendar year, an increase from the current 2% cap.

Another bill making its way through the process is HB 329 (also titled “Insurance Guaranty Associations) by Rep. David Smith (R-Winter Springs). This bill tweaks the major FIGA reform of several years ago, changing assessment calculations for both homeowners and workers compensation guaranty funds.

The bill had been on a fast-track, passing all of its committees in mid-January, yet is still awaiting scheduling before the full House. Rep. Smith said the bill had the support of CFO Patronis and Insurance Commissioner Altmaier. He said the bill clarifies the method that FIGA assessments are collected and remitted. Remittance would be quarterly, instead of the monthly remittance passed in the 2016 changes to the law. The bill also allows out of state adjusters operating under a licensed FIGA adjuster to adjust claims. An identical bill in the Senate, SB 540 unanimously passed the full Senate last week.

For a bill to make its way to the Governor’s desk, the House and Senate version must be identical before final passage. We will await to see which version of these bills ultimately is agreed upon and will know more as we see further movement in either the House or Senate. (Return to Top of Page)

Disposition of Insurance Proceeds – Going into this last scheduled week of session, SB 1606 by Senator Keith Perry (R-Gainesville) and HB 895 by Rep. David Santiago (R-Deltona) are among the very few insurance bills still alive. They’ve evolved over the past few weeks into “minibus” bills, a play on words for omnibus, but still address a variety of insurance issues.

SB 1606 passed unanimously last Tuesday in the Senate Appropriations Committee, was heard on the Senate floor on Friday, and moved to third reading for a final vote one day this week. As we went to press, we were unsure of when as the floor calendars had not been released. Because it’s progressing, it has been attractive for those wanting to keep their issues alive by attaching amendments to the bill. It appears resistant to those efforts. We have reduced this bill to one sentence: it simply forces mortgagees (those financial institutions that lend money and hold mortgages) to comply with Fannie Mae and Freddie Mac guidelines with respect to insurance claim deposits.

Thanks to a successful surprise strike all amendment on February 27, HB 895 was essentially re-written and now contains a bad faith provision that was previously missing from all other House legislation. It now includes the following:

- Requires carriers to act in good faith.

- Curbs abuses and levels the playing field with respect to the civil remedy process regarding lawsuit notice and when the current 60-day clock starts before a bad faith suit may be filed. Rep. Santiago said, “The 60 day notice is a pre-suit heads up to allow litigants to attempt to resolve the case.”

- Prohibits a third-party lawsuit for insurer bad faith in a liability claim, if there is a single claimant and the insurer paid the lesser of the claimant’s demand or policy limits.

- If the insurer pays policy limits for a third-party(ies), that does not constitute bad faith and allows for a judicial interpleader action when there are multiple payments to have the court help in settling who receives what portion of the policy limit and doesn’t expose carriers to illegitimate bad faith claims.

- Makes changes in the PIP (Personal Injury Protection) insurance demand letter (that is sent to a carrier for payment) and requires certain items in the demand letter:

- the name of the insured

- copy of assignment of rights

- claim or policy number

- medical provider, type of treatment, and date of treatment

Rep. Santiago, speaking before the House Commerce Committee that passed this on a party-line vote, was quick to point out that this does not stop a bad faith suit but rather levels the playing field. He said, “What is happening in Florida is a gotcha tactic…(where certain lawyers work on) how do we trip up a carrier…(just) to penetrate the policy limits.”

Two additional amendments were added. The first one establishes a fee schedule on emergency medical treatments in hospitals – 200% of Medicare reimbursement amounts for emergency room services versus the current law of “usual and customary” pricing. Rep. Santiago referenced the $10,000 limit on PIP coverage and said he is trying to make sure that emergency care doesn’t eat up all of a patient’s benefits. The second amendment adopted was mostly technical in nature and removes the word “substantial” from the demand letter description in law to let the courts decide what is/is not substantial and allows for attorney fees to be recoverable from the prevailing side.

HB 895 still awaits scheduling for a full House vote. We remain uncertain of this bill’s fate in the Senate as there isn’t a “companion” or anything similar to it in that chamber that has survived.

The Florida Chamber of Commerce notes that Florida is one of the few states in the country that allows for third-party bad faith, which costs Florida policyholders an additional $106 per insured vehicle in Florida. (Return to Top of Page)

Financial Services – A previously innocuous bill that covers rather routine fraud oversight and licensure rules, SB 1404 took on new attraction and importance this week, as it is another of the very few insurance bills still alive. So it is attractive for those wanting to keep their issues alive by attaching amendments to the bill.

That’s exactly what happened at last Tuesday’s Senate Appropriations Committee meeting, when its sponsor, Senator Keith Perry (R-Gainesville), introduced an amendment that changes the statute of limitations for filing initial catastrophe claims from 3 years to 2 years. Rather than our team trying to explain the intense and contentious back and forth, we highly recommend that you watch the debate beginning at the 3:20:00 mark in the video recording of the meeting. There was concern among several members about sending the bill with that provision to the House and whether it will be palatable. Nevertheless, SB 1404 passed the committee on a 12-8 vote. However, it was temporarily postponed Friday on the Senate floor and sits on the special order calendar queue but is as yet, unscheduled. (Return to Top of Page)

Motor Vehicle Insurance (PIP) – This is a perennial effort to do away with Personal Injury Protection (PIP) coverage under Florida’s No-Fault insurance law and replace it with bodily injury (BI) liability coverage. Similar bills failed last session. Senator Tom Lee (R-Brandon) returned this session with SB 378 which previously passed out of the Senate Infrastructure and Security Committee, which he chairs, but without Bad Faith provisions, which concern many. The prevailing opinion is that should PIP go away and be replaced with mandatory Bodily Injury Liability coverage, every auto accident will have a resulting lawsuit which would increase bad faith suits, often with little justification. There is a great staff analysis of this bill that is worth the read should our audience want to learn more. You can read it here.

While the Senate version of PIP repeal is dead because of the Bad Faith amendment that was attached to it (see the Bad Faith section above), the House version of PIP, HB 771 by Rep. Erin Grall (R-Vero Beach) is alive but as yet still unscheduled for a vote on the House floor. It does not contain a bad faith provision. However, bad faith is now in play in the House, thanks to HB 895 (see “Disposition of Insurance Proceeds” section above). So the showdown/stalemate continues.

Rep. Grall – who is an attorney by occupation – has said that any bad faith changes would make the proposal “more complicated than it needs to be.” She’s been quoted in news reports as saying she remains open to adding bad faith language but questioned if there is a “landing spot” for such a provision. At the House Commerce Committee meeting in late February, she was quoted as saying the bill represented tort reform, saying it would eliminate at least 25% of litigated cases in the state.

There was discussion that although auto insurance rates could initially go down, because of reduced PIP fraud, that rates would eventually go up. This was confirmed by the Office of Insurance Regulation staff person, who told committee members that “if you were to repeal PIP, rates eventually would go up.”

Rep. Grall’s bill would replace PIP with mandatory Bodily Injury coverage. It would also require insurance companies offer MedPay (medical payments coverage) that would help motorists pay medical bills from accident injuries. It got its initial hearing in early February before the Insurance and Banking Subcommittee. There, Rep. Grall called the current PIP system “broken” and an added expense on consumers’ auto insurance bills. She said eliminating PIP would result in 8%-9% savings. Rep. Byron Donalds (R-Naples) noted a problem with the current auto insurance system in Florida, where some motorists just carry PIP as bare bones coverage, but that it doesn’t pay for actual accident damages.

(See LMA Backgrounder: Personal Injury Protection for more details on the history of PIP reform and the failed 2018 bills, data, and past committee and stakeholder discussions.) (Return to Top of Page)

Motorist Fines and Fees – Noting that there are almost 2 million people in the state of Florida driving daily on suspended licenses “because they don’t have the ability to pay the fines and fees in one lump sum,” Senator Tom Wright, (R-Volusia) is sponsoring SB 1328. The bill would require a uniform payment system in all 67 counties and allow those motorists to pay fines and fees by making partial payments or by through community service. The bill is dead, having not be heard by its final committee of reference.

A comparable House bill, HB 903 by Rep. Byron Donalds (R-Naples) and Rep. Rene Plasencia (R-Orlando) still awaits a hearing before the full House. (Another comparable House bill, HB 6083 by Rep. Anthony Rodriguez (R-Miami) and Rep. Blaise Ingoglia (R-Spring Hill) didn’t make it beyond its first committee.) (Return to Top of Page)

Credit for Reinsurance – The Florida Legislature has begun the process to remove or reduce existing collateral restrictions on European Union and United Kingdom based reinsurers, to comply with the 2017 U.S. Covered Agreements.

HB 1211 / SB 1376 would amend section 624.610 Florida Statutes, to comply with the changes required by the Covered Agreements and provide the Financial Services Commission sufficient time to amend Rule 69O-144, Credit for Reinsurance.

The House bill, sponsored by Rep. Shevrin Jones (D-West Park), the House Deputy Democratic Leader, still awaits scheduling for a vote on the House floor. The similar Senate bill, sponsored by Senator Doug Broxson (R-Pensacola), unanimously passed the Rules Committee last week and has been placed on the Special Order calendar for today (Monday) before the full Senate. (Return to Top of Page)

Genetic Information for Insurance Purposes – Did anyone get a “23andMe” or “Acestory.com” gift certificate for Christmas? When we listened to testimony last year about the issue of life insurers using genetic information in underwriting, many of us in The Capitol pondered the future of life insurance. We recalled that in 2008, a federal law called the Genetic Information Nondiscrimination Act (GINA) made it illegal for health insurance providers in the United States to use genetic information in decisions about a person’s health insurance eligibility or coverage, with certain exceptions. The movement is now in the life insurance arena. Legislators’ attempts last year to stop life insurers from using genetic information failed.

This year’s effort, HB 1189 / SB 1564, prohibits life insurers & long-term care insurers from canceling, limiting, or denying coverage, or establishing differentials in premium rates based on genetic information. It also prohibits such insurers from taking certain actions relating to genetic information for any insurance purpose. Florida would become the first state to enact such a law.

HB 1189 passed the full House in late January and SB 1564 has now been placed on the Senate’s Special Order calendar for tomorrow (Tuesday) for a vote before the full Senate. There has been discussion and one objection by Senator Jeff Brandes, who has been the solitary “no” vote in committee meetings, that consumers should have the choice to allow insurers to use their DNA, especially consumers who have the good fortune of a healthy family history.

The House bill is co-sponsored by incoming House Speaker Rep. Chris Sprowls (R-Clearwater) and Rep. Jayer Williamson (R-Pace). Senator Kelli Stargel (R-Lakeland) is sponsoring the Senate’s identical version. (Return to Top of Page)

Pharmacy Benefit Managers (PBMs) – While the federal government pursues tougher restrictions on PBMs in an ongoing effort to lower the cost of prescription drugs for consumers, there’s an effort underway in the Florida legislature to do the same. HB 7045, sponsored by two committees and Rep. Alex Andrade (R-Pensacola) would increase regulation of PBMs utilized in state employee pharmacy plans and is otherwise mostly oriented toward data collection by insurance regulators and state agencies for building future recommendations.

The full House took up the bill on second reading last week, adding an amendment by Rep. Andrade that requires an annual audit of any PBM vendor of the state employees’ prescription drug program and requiring price increase pre-notification. The bill passed and was rolled to third reading for a potential final vote before the House this week. A comparable bill in the Senate, SB 1338 by Senator Tom Wright (R-Port Orange), was never scheduled for its last committee stop and is dead.

The two bills are a more conservative approach to a set of other bills which have languished in the legislature. Rep. Jackie Toledo (R-Tampa) filed HB 961 that would regulate PBMs, targeting “predatory practices”. It’s inspired in part by a University of Southern California study that found that 23% of pharmacy prescriptions involved a patient copayment that exceeded the average reimbursement paid by the insurer by more than $2.00. The average overpayment was $7.69. Small pharmacies claim the system also creates an unfair competitive disadvantage with larger pharmacy chains.

The bill never had its first hearing, nor did a similar bill, SB 1444 by Senator Gayle Harrell (R-Stuart) and a comparable bill, SB 1682 by Senator Javier Rodriguez (D-Miami

There are mixed feelings about PBMs with some insurance companies seeking to manage their prescription drug costs owning a PBM vs. other insurers who believe PBMs are part of the drug pricing problem. This is another marketplace issue, where PBMs utilize sometimes monopolistic methods in their pricing and lawmakers and regulators have now decided they want more oversight.

There does not appear to be any appetite to provide stronger regulatory oversight of PBM’s. Independent pharmacists say that PBM’s are price fixing and raising prices and others say they function as the economy of scale/price aggregation solution to high drug prices. If any of our readers want to learn more about this fascinating debate between one of the last bastions of “the middle man” and main street America independent pharmacies, let us know! (Return to Top of Page)

Criminal Justice Reform – Led by Senator Jeff Brandes as chair of the Senate Criminal Justice Appropriations Committee, his bill SB 1308 authorizes resentencing and release of certain persons who are eligible for sentence review under specific conditions, including subsequent sentencing guidelines. The bill was scheduled but not considered last week before the Senate Appropriations Committee and is essentially dead. It could make more than 4,200 incarcerated juveniles eligible for sentence reviews and possible release from prison.

Senator Brandes’ guiding principal is that offenders should come out (of prison/incarceration) better than they went in. His passionate advocacy includes a more formal education system in correctional facilities, ready to work programs, updating the cleanliness and conditions of facilities and sentencing reform. Reform will come down to a matter of resources. The Tallahassee Democrat newspaper ran this op-ed: My son was sentenced to life in prison at age 19 for a crime in which no one was physically harmed that references his bill, which is awaiting its first hearing. A comparable bill, HB 1131 by Rep. Michael Gottlieb (D-Plantation) and Rep. Fentrice Driskell (D-Tampa) never received a hearing.

Meanwhile, the Senate has approved changes in mandatory minimum sentence laws, passing SB 346 by Senator Rob Bradley (R-Fleming Island) on a 39-1 vote in late February. It would give judges discretion in sentencing certain drug offenses if the defendant meets certain criteria. The bill was amended in recent weeks to strike language in the bill that would have required that all police interrogations be recorded. Another change reduced the amount of controlled-substances allowed in order to receive a shorter sentence. The measure is expected to reduce the state’s 96,000 prison population by 4,800 for a potential savings of $50 million. Its companion, HB 339 by Rep. Alex Andrade (R-Pensacola) and Rep. Mike Grieco (D-Miami Beach) never received its first committee meeting. It appears that there will be no meaningful criminal justice reform in the 2020 session, despite herculean attempts by Senator Brandes year after year.

The Senate under Jeff Brandes leadership has been “leaning in” with passage of SB 346 and its recognition that times change and locking ’em up and throwing away the keys may not necessarily be the best way to rehabilitate an offender. The Florida Sheriff’s Association doesn’t agree in many instances holding a press conference in January and releasing Truth in Sentencing report stating many of the criminal justice reforms Senator Brandes and others are calling for are based on “myths.” Our firm watches this debate closely for a lot of reasons, not the least of which is we need talent in many professions and perhaps there are individuals who can contribute to many of our employment openings. (Return to Top of Page)

Tobacco and Nicotine Products – SB 810 / HB 151 would raise the age to 21 for all tobacco products – smoking, chewing, and electronic/vaping. The bill reflects changes on the federal level and the penalty for states that don’t comply is withholding of FEMA disaster and non-disaster grants. Congress last year passed and the President signed legislation raising the national age for tobacco products to 21, which takes effect this summer.

The Senate bill sponsor, Senator David Simmons (R-Altamonte Springs) told the Senate Health Policy in January that evidence points to the harm created by tobacco and that “we know that if we don’t solve this problem, we are going to be in a health crisis and a financial crisis in the future.”

The Senate passed SB 810 on a 34-4 vote on Friday and sent it to the House for consideration. The bill:

- Increases the minimum age to lawfully purchase and possess tobacco products from 18 years of age to 21 years of age.

- Repeals exceptions allowing persons in the military and emancipated minors to possess or purchase tobacco products under current law.

- Prohibits smoking and vaping by any person under 21 years old, on or near school property, regardless of hours of the day.

- Bans cigarette vending machines from anywhere people under the age of 21 could access.

- Requires age verification before a sale or delivery to a person under 30 years of age, to comply with federal law.

The House bill, sponsored by Reps. Jackie Toledo (R-Tampa) and Nicholas Duran (D-Miami), never received its first hearing and is dead. It will be up to the House now to decide whether to approve the Senate version. (Return to Top of Page)

Assignment of Benefits (Windshield AOB) – Unfortunately, the House version of the AOB windshield reform bill (HB 169) was withdrawn from further consideration. And as you read in our previous editions, the Senate Banking and Insurance Committee showed no appetite to pass its proposed bill (SB 312), although the Senate sponsor vowed to keep an eye out on ways to get something passed.

Assignment of Benefits (Windshield AOB) – Unfortunately, the House version of the AOB windshield reform bill (HB 169) was withdrawn from further consideration. And as you read in our previous editions, the Senate Banking and Insurance Committee showed no appetite to pass its proposed bill (SB 312), although the Senate sponsor vowed to keep an eye out on ways to get something passed.

While we never quit, it remains apparent that any reform of this insane practice of the flood of lawsuits against auto insurance companies will not occur this session. We will work with our colleagues who are working every day to bring some sense to this litigation insanity and will keep you posted. On my desk is a case where a lawsuit was filed for a $4 difference in what was paid by the insurer and what the glass shop charged. You decide if that makes sense or not!

You will recall that these bills are part of the ongoing effort to reform growing AOB abuse in automobile windshield repair and replacements. It was initially part of the 2019 session’s broader AOB reform, but was dropped during negotiations on final passage of HB 7065 which became law last year.

The House and Senate versions were drafted to put consumers back in charge…not windshield replacement companies and their favorite trial lawyers who are gaming the system, laughing all the way to the bank at our expense.

The Florida Justice Reform Institute released its latest Auto Glass AOB Data Update in November. Using Department of Financial Services’ data, it shows growth from about 400 auto glass AOB lawsuits in 2006 to 24,000 in 2017, with a leveling off last year to about 17,000 suits and holding steady for 2019. Orange (Orlando) and Hillsborough (Tampa) Counties are the most popular spots for such litigation, with 15 firms accounting for 90% of the litigation. One firm (Malik Law) is responsible for filing nearly 30% of all lawsuits. (Return to Top of Page)

Contingency Fee Limitations Local Government – There’s an effort underway as well to make sure that local governments aren’t contributing to exorbitant attorney fees or adding unnecessarily to state court caseloads, especially cases of statewide interest better pursued through the Attorney General’s Office. HB 7043 / SB 1574 would prohibit local or regional governments from a contingency fee arrangement in excess of $20 million with a private firm. The bills originate, in part, out of concern of the myriad local city and county lawsuits against Big Pharma for our statewide opioid addiction crisis. The House bill was supposed to have its first of only two committee hearings on February 4 before the House Oversight, Transparency and Public Management Subcommittee but was temporarily postponed and has not been rescheduled. This, too may be part of the greater negotiations on litigation reform. The Senate bill still awaits its first of three committee hearings. (Return to Top of Page)

Legal Advertising – HB 7083 ups the definitions of deceptive and unfair practices, which are second degree felonies. Among other things, the bill requires that when recovery money is mentioned in an advertisement, it must clearly disclose the amount the client received after paying legal fees and costs. It also seeks to clear up confusion some ads create on whether a product has truly been recalled by the government. And not ironically, the bill includes the right to recover court costs and attorney fees from violations of it! We’ll be watching and will likely add it to the list below. The effort appears dead for this session. Details below.

On February 4, the House Civil Justice subcommittee, which is sponsoring the bill with Rep. Tom Leek (R-Ormond Beach), heard public testimony on needed consumer protections. Lively debate discussed deceptive legal ads relating to what an actual consumer is awarded versus what the law firms receive from litigation. The speakers also addressed drug advertisements and whether consumers benefit from warnings of a drug’s negative side effects. Those that supported free speech and legal advertisements, opposing this bill, referenced first amendment issues relating to the idea of placing governmental limitations on legal advertising in the state. The bill ultimately passed on a 10-4 vote and failed to get a hearing before the House Health and Human Services Committee, one of two final stops. The committee is not meeting anymore this session.

A comparable bill in the Senate, SB 1288 by Senator Tom Wright (R-Port Orange), failed to get its first hearing before the Criminal Justice Committee, which is not meeting anymore this session. (Return to Top of Page)

Property Insurance (surplus lines) – SB 1760 by Senator George Gainer (R-Panama City) addresses Surplus Lines regulation. This bill is directed at ensuring consumers have access to Florida based courts and dispute resolution processes based in Florida versus what many surplus lines policies include which requires disputes to be heard in states or countries outside Florida. But the bill affects the admitted market, raising concerns about overreaching regulation. An identical House bill, HB 1357 by Rep. Jay Trumbull (R-Panama City) passed unanimously in early February without debate in the House Insurance and Banking Subcommittee but failed to get scheduled before the Civil Justice Subcommittee, which is no longer meeting. The Senate bill failed to get its first hearing before the Senate Banking and Insurance Committee. None of these bills contents are contained in any other bills. (Return to Top of Page)

Construction Defects – SB 1488 / HB 295 specify that certain disclosures and documents must be provided before a claimant may file an action; revising the timeframes within which certain persons are required to serve a written response to a notice of claim; providing requirements for the repair of alleged construction defects; prohibiting certain persons from requiring advance payments for certain repairs; and requiring parties to a construction defect claim to participate in certain mandatory nonbinding arbitration within a specified time.

The Senate bill is sponsored by Senator Joe Gruters (R-Sarasota) and is awaiting its first hearing. A similar House version by Rep. David Santiago (R-Deltona) had its committees of reference changed in early February and had its hearing postponed last week in the House Commerce Committee, its second stop. There’s also a comparable Senate version, SB 948, by Senator Dennis Baxley (R-Lady Lake) that still awaits its first hearing. (Return to Top of Page)

Residential Property Disclosures (Flood) – Sellers of residential property would have to specifically disclose any past flooding, present flood insurance coverage, and a host of other prescriptive conditions under SB 1842 by Senator Bobby Powell (D-West Palm Beach). The disclosure summary, whether separate or included in the contract for sale, would also require disclosure of any past insurance claim filings for flood damage, past FEMA or other federal assistance, and any flooding due to reservoir release. The disclosure also requires notice that the buyer should not rely on the seller’s current property taxes, as a change in ownership triggers reassessments. There is still no hearing scheduled nor House companion bill filed yet.

The Miami Herald and others have reported that although current Florida law requires sellers and their real estate agents disclose known defects or anything that “materially affects” a property’s value, there are cases where someone bought not knowing they were in a flood plain or had suffered previous flooding. The idea has the support of the Federal Association for Insurance Reform (FAIR) and others in recent editorials.

While Realtors® are being targeted, can’t we get insurance agents to step-up? The piece that’s missing is the fact that insurance agents are not required to talk about flood insurance with their customers. Regardless of a home’s past experience or future flood propensity, insurance agents have a responsibility to TALK about flood insurance with customers at the time of initial property insurance policy issuance and on every renewal. A handful of agents do, but for those that don’t? The results are disastrous yet Florida’s law is silent when it comes to mandatory insurance agent documentation of a conversation with its customers. We hope the Federal Association for Insurance Reform can get behind this as well. (Return to Top of Page)

Sanitary Sewer Levels – SB 150 by Senator Jeff Brandes (R-Pinellas) would require a seller of real property to disclose any known defects in the property’s sanitary sewer lateral. The bill has unanimously passed two committees and awaits a hearing in the Rules Committee, its last stop before heading to the full Senate for consideration. That committee meets this Wednesday (26th) but this bill is not on the agenda. Without a House companion, this effort appears dead. (Return to Top of Page)

Florida Building Code – SB 710 is in reaction to the destructive damage created by last year’s Hurricane Michael and other recent hurricanes. Sponsored by Senator Ben Albritton (R-Bartow), the bill mandates the Florida Building Code require that the entire envelope of certain buildings being constructed or rebuilt be impact resistant and constructed with high wind-resistant construction materials; requiring that all parts or systems of a building or structure envelope meet impact test criteria or be protected with an external protection device that meets such criteria; and provides certain exceptions. The bill is still awaiting its first hearing and as yet, has no House companion.

(See Is Florida’s Building Code Protecting All of Us? and Why the Panhandle Wasn’t Hurricane Strong for Michael episodes for more details, from The Florida Insurance Roundup podcast.)(Return to Top of Page)

Motor Vehicle Rentals – Just as you can rent out your home when you go away on vacation, likewise your car, with online services such as Turo (https://turo.com/). HB 377 by Rep. Chris Latvala (R-Clearwater) would insert government intervention to regulate another sharing economy company advance.

In a nutshell, if a car owner parks their car at an airport for any length of time, a Turo user could “rent” that car and drive it until the owner returns from their trip. The bill provides financial responsibility & insurance requirements and a host of other regulations on this emerging idea/market. Of course, the traditional rental car companies are in favor of the legislation and Turo opposes, calling the regulations unnecessary. This effort is dead in the Senate and now appears dead in the House.

The bill was re-referenced and is awaiting a hearing before the Commerce Committee, its final stop before the full House. But that committee is not scheduled to meet anymore this session and so this bill appears dead. A recent report by the state’s Revenue Estimating Committee examined the bill’s financial impact. It adopted a positive indeterminate impact for new cash and recurring revenue, noting “It is unclear the extent to which the provisions of this bill are enforceable given the out-of-state nature of the current marketplace providers.”

Its Senate companion, SB 478 by Rep. Keith Perry (R-Gainesville) was never heard before the Senate Banking and Insurance Committee and is dead for this session.

Another comparable “peer-to-peer car sharing” bill in the House, HB 723, by Rep. Jason Fischer (R-Duval) also awaited scheduling before the House Commerce Committee but since that committee is not scheduled to meet anymore, this, too, appears dead.

Discussion has centered around how the peer-to-peer car sharing companies have partnered with used car lots so that those cars are part of peer-to-peer platforms. The car rental corporations are calling foul since there is no oversight, taxes or other government intervention that the car rental corporations must comply with. It does not appear however that the rental car corporations will be successful in moving the bills they support that put in place regulations over these peer-to-peer car sharing platforms.

The National Council of Insurance Legislators (NCOIL) in December adopted the Peer-to-Peer Car Sharing Program Model Act for states to consider adopting as law. (Return to Top of Page)

Cruelty to Dogs – People who leave their dogs outside and unattended on a restraint during a natural disaster would face a misdemeanor charge of animal cruelty under SB 522 by Senator Joe Gruters (R-Sarasota). The punishment would carry a potential $5,000 fine and be triggered any time there’s a hurricane, tropical storm, or tornado warning, or in the case of mandatory or voluntary evacuation orders. It passed the Criminal Justice committee unanimously in December and still awaits a hearing in the Judiciary committee. It has no House companion.

Meanwhile SB 1044 by Senator Jason Pizzo (D-Miami), referenced as “Allie’s Law” would require veterinarians to report suspected animal cruelty in certain circumstances and provide immunity from criminal and civil liability for certain persons and entities. It unanimously passed the Senate Judiciary Committee in early February and has one more stop before the Rules Committee but is not scheduled on today’s (3/2) committee agenda. The committee is not scheduled to meet again this session after today so this bill appears dead. A similar House bill, HB 621 by Reps. Dan Daley (D-Coral Springs) and Scott Plakon (R-Longwood) never received a hearing. (Return to Top of Page)

LMA Newsletter of 3-9-20