Insurance, resilience bills emerging

With five weeks to go before the start of the regular 60-day Florida legislative session, some insurance bills are now being filed. One would further restrict bad-faith claims and public adjuster conduct, another would increase policyholder notification on rate changes and cancellations, while other bills focus on increasing hazard mitigation measures and building resilience.

With five weeks to go before the start of the regular 60-day Florida legislative session, some insurance bills are now being filed. One would further restrict bad-faith claims and public adjuster conduct, another would increase policyholder notification on rate changes and cancellations, while other bills focus on increasing hazard mitigation measures and building resilience.

During these committee weeks leading to the regular session, lawmakers have been receiving briefings on Florida’s improving property insurance marketplace. Insurance Commissioner Michael Yaworsky over the past two weeks has made presentations to both the Senate Banking and Insurance Committee and the House Insurance & Banking Subcommittee. He’s also been answering lawmakers’ questions, especially about the slowly improving rate environment in the aftermath of the legislature’s 2022-2023 consumer insurance reforms.

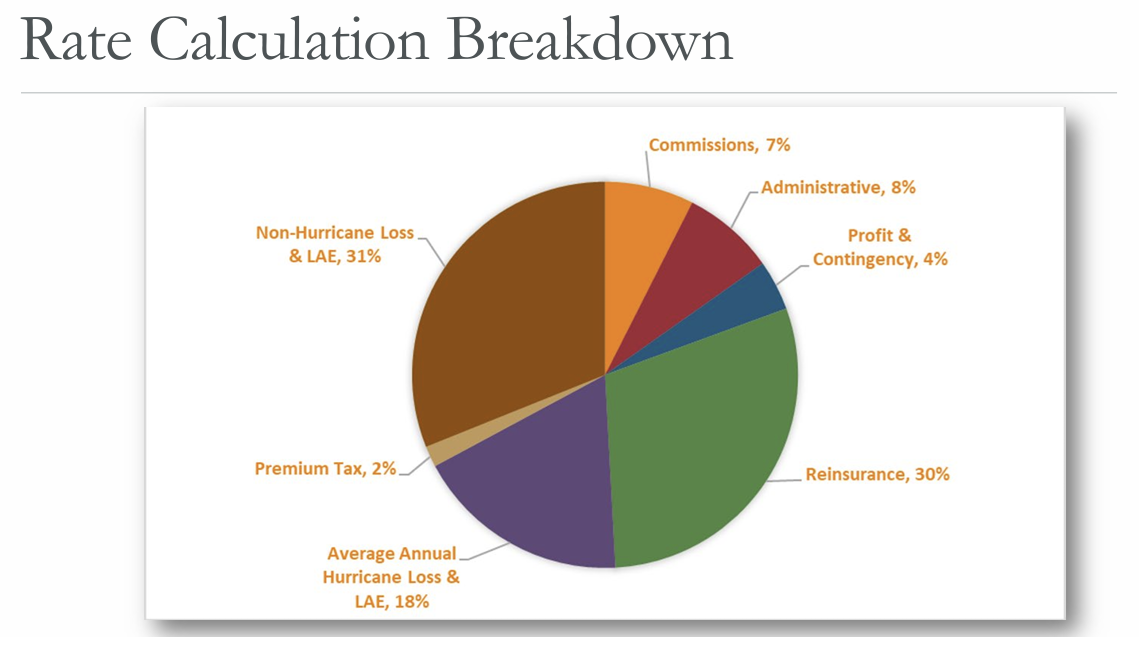

Although the reforms have stabilized the market, with a slight downward trend in rates, premiums have generally increased because inflation has increased the value of homes, as represented by a greater Total Insured Value of about 40% in Florida since 2021, Yaworsky explained. “It means that the consumer at the end of the day is having to pay more because the cost to replace their home and put themselves where they were before they had the accident is a much more costly endeavor than it was a couple years ago,” Yaworsky said. “This is not my first exposure to consumers that are experiencing a difficult time. The thing about insurance is we’re all in this together at the end of the day. Prices go up for all of us or they go down for all of us, ultimately over time, and it’s really just in the margins where they change.” The commissioner pointed out that in addition to inflation, reinsurance is the other big driver in property insurance rates, showing the chart below.

Source: Florida Office of Insurance Regulation, January 2025

The legislative committee weeks are also the time that state departments and agencies present their budget requests for the next fiscal year that begins July 1, 2025. Commissioner Yaworsky shared that his Office of Insurance Regulation (OIR) is asking for about $400,000 to open a field office in Tampa. He told the State Administration Budget Subcommittee that doing so would help OIR improve its ability to recruit and retain employees. Tampa is an insurance employee-rich environment, as the home of several property insurance companies.

The Florida Legislature last year passed a record $117.46 billion budget. This year, with the end of federal COVID pandemic funding, legislative leaders are warning state spending will be less, including for local lawmakers’ projects.

Here is an initial list of the legislative bills we’re following so far. We will continue to monitor each chamber’s position on relevant bills with likely movement and will add to this list as appropriate. Updates within each bill will be noted in blue font:

Property Insurance:

Insurance ̶ SB 230 by Senator Keith Truenow (R-Tavares) is the most meaty of all bills filed so far. It would put new restrictions on bad faith claims by first requiring a court ruling and final judgment that an insurance company breached the policy contract before a bad faith claim could be filed. It would also:

- Prohibit a bad faith claim simply because the insurance company paid a claim following a Notice of Intent to Litigate or a demand for judgment;

- Require the plaintiff to cite specific bad faith laws that were allegedly violated;

- Require the plaintiff to note the amount of damages required to cure the violation;

- Require any damages sought to be available under the terms of the insurance policy; and

- Prohibit attorney fees or costs from any damages sought.

The bill is meant to close loopholes identified since the initial bad faith law reforms that were part of the 2022 insurance consumer protections and market reforms. The bill contains other tweaks to current insurance law. It would prohibit public adjusters from engaging in certain adversarial conduct, revise the circumstances under which a carrier or agent may cancel certain policies, and revise the required disclaimer statement on policies that do not provide flood insurance. The bill would also reduce the current coursework requirement from 200 hours to 60 hours to become a general lines insurance agent.

Residential Property Insurers ̶ SB 128 by Senator Danny Burgess (R-Zephyrhills) is meant to give insurance consumers better notification of a policy cancellation, nonrenewal, and rate change by mandating notices be sent by email. Current state law allows emailing such documents only if the policyholder affirmatively elects email delivery, reflecting federal law. We as an industry cannot automatically email someone something, without their prior approval. The bill would also change the timetable for such notifications. Current law requires a 45-day notice for change in premium and 120-day notice for cancelation and nonrenewal. The bill as filed appears to shorten the 120-day notice of cancelation or nonrenewal to 45 days. Look for potential changes to this bill as a result.

Resilience:

Resilient Buildings ̶ HB 143 by Rep. Webster Barnaby (R-Deltona) and the similar SB 62 by Senator Ana Maria Rodriguez (R-Doral) would authorize owners of resilient buildings to receive a specified tax credit for those improvements and outlines specific LEED (Leadership in Energy and Environmental Design) requirements of a building. The bill also creates the Florida Resilient Building Advisory Council which would work with the Department of Environmental Protection.

Nature-based Methods for Improving Coastal Resilience ̶ SB 50 by Senator Ileana Garcia (R-Miami) would require the Florida Flood Hub for Applied Research and Innovation to develop guidelines and standards for “green and gray infrastructure” to improve coastal resilience to storms. It would also require the Department of Environmental Protection to adopt rules for nature-based methods for coastal resilience and require a statewide feasibility study with the Department of Financial Services Division of Insurance Agent and Agency Services on the value of applying those methods.