Recap of Week 9 & Interim Adjournment of Session

This edition’s Bill Watch will close out the 2025 legislative session reports on bills that would change public policy. On Friday, May 2, legislators in both chambers had finally agreed on a “framework” for a budget deal that would include $2.8 billion in tax cuts, with the legislature extending the session until June 6 and reconvening May 12 to hammer out the budget details. The decision was made that no other bills will be considered except for those dealing with the budget. That means a wide range of other bills died Friday night after not passing during the 60 days of the scheduled session. The House adjourned at 10:23 p.m., with the Senate following nine minutes later.

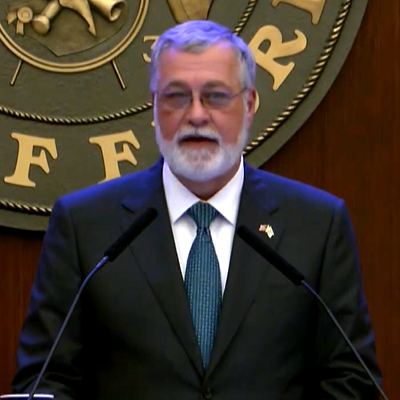

House Speaker Daniel Perez, May 2, 2025. Courtesy, The Florida Channel

Speaker Danny Perez said, “I know the extension of session presents difficulties and challenges for you and your families. I apologize for this delay. But I believe it is better to do it right than to do it fast.”

Perez’s priority is to reduce Florida’s 6% sales tax and he doesn’t agree with the Governor’s $115.6 billion proposed budget for the 2025-2026 July 1 fiscal year,

“We have a responsibility to safeguard taxpayer dollars and improve accountability, transparency, and oversight of government spending,” Senate President Albritton said in his closing remarks to tired senators who were anxiously awaiting adjournment. A reminder to our readers that legislators must, as mandated by the Florida constitution, pass a budget before the start of the fiscal year on July 1, but Governor DeSantis has line-item veto power before the budget takes effect. You will recall the House and Senate budget proposals began with a $4.5 billion gap between them. The House’s proposal totaled $112.95 billion, while the Senate’s weighed in at $117.36 billion.

Senate President Ben Albritton, May 2, 2025. Courtesy, The Florida Channel

The House proposed a tax package (HB 7033) totaling about $5 billion, with cuts largely stemming from a plan to permanently reduce the state’s sales-tax rate from 6% to 5.25%. The Senate proposed a $1.83 billion tax-cut package (SB 7034) that included eliminating sales taxes on clothing and shoes that cost $75 or less. The $2.8 billion tax cut they have now agreed on is expected to bring the state sales tax rate down to 5.75%.

Senator Don Gaetz, a Niceville Republican who was Senate president during the 2013 and 2014 sessions, is one of the two most senior senators. He said this isn’t the first time lawmakers have disagreed on the budget. “Our obligation is to agree on a budget before the end of the fiscal year. My hope is that, in the intervening time between now and the time we come back, that there would be folks from the Senate and folks from the House who would lock themselves in a windowless room with warm beer and cold pizza and come up with a solution.” Another senior senator said about the session, “This one is probably the most tense in the last week that I’ve seen.”

Republicans weren’t the only ones complaining, with one Democratic House member saying she was “startled” by the surprise amendment introduced on the House floor during a charter school debate. For the last three days, legislators would applaud when, as an example, the Senate refused to concur with the House on a measure and as the vote was taken when refusing, the Senate would erupt in applause. Lawmakers have had a combative year, which started with Governor DeSantis squaring off with the House and Senate leaders over carrying out President Donald Trump’s efforts to crack down on illegal immigration.

When watching floor debate you could see on legislators faces utter frustration…for a variety of reasons. Senate President Albritton in recent weeks pointed to “philosophical differences” with the House, as he expressed concerns about approving recurring tax cuts amid the nation’s uncertain economy. Albritton is known as a pragmatist and he raised the possibility that deep budget cuts could cause deep financial shortfalls if the budget isn’t carefully planned.

Perez accused the Senate of supporting “pathological overspending!”

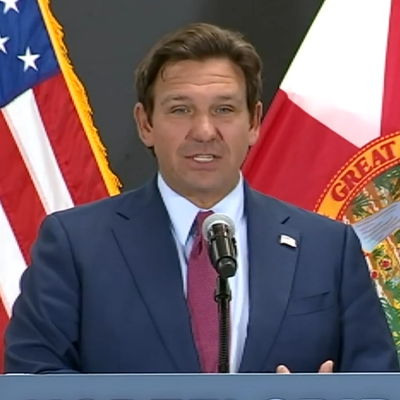

Governor Ron DeSantis speaking in Fruitland Park, FL, April 30, 2025. Courtesy, The Florida Channel

While making an appearance Wednesday at a Fruitland Park school, Governor DeSantis said “this will go down as the least productive Florida House of Representatives in decades.” DeSantis also described the House as being focused “on the personal agendas of the leadership,” and “dysfunctional.” USA Today Network of Florida reporter John Kennedy did the math and reports of the 1,823 bills filed this year, only 227 had passed the House and Senate, heading into May 2’s closing day – a 12% success rate. This compares to an 18% success rate last year under different legislative leadership.

It’s been wild this year. Thanks for being there for us – and with us! With the end of the policy part of this legislative session comes the end of our weekly newsletters. We’ll return on our regular bi-monthly schedule on May 19.

This Bill Watch clearly labels bills that DID NOT PASS and those that PASSED. PASSED bills require the Governor’s signature to become law, unless otherwise noted.

Here is the list of legislative bills we followed in this past 60-day session. You can click the bill link in the list below to go directly to the bill and its details further below. Updates within each bill are noted in blue font:

PASSED:

Roof Contracting

Condominium Associations

Emergency Preparedness and Response

Pet Insurance and Wellness Programs

DID NOT PASS:

Insurance Research

Attorney Fee Awards in Insurance Actions

Evidence of Damages to Prove Medical Expenses in Personal Injury or Wrongful Death Suits

Residual Market Insurers

Nature-based Methods for Improving Coastal Resilience

Mandatory Human Reviews of Insurance Claim Denials

Property Insurance Claims

Court Judgment Interest Rates and Insurance Reports and Practices

Insurance (Truenow)

Insurance (Berfield)

Litigation Financing

Insurer Accountability to Insureds

Office of Insurance Regulation

Insurance and Hurricane Mitigation Grants

Uniform Mitigation Verification Inspection Form

Property Insurer Financial Strength Ratings

Coverage by Citizens Property Insurance Corporation

Motor Vehicle Insurance

Attorney Fees and Costs for Motor Vehicle Personal Injury Protection Benefits

Resilient Buildings

Roof Contracting ̶ PASSED & AWAITING GOVERNOR’S SIGNATURE ̶ SB 1076 by Senator Stan McClain (R-Ocala) and the identical HB 715 by Rep. Juan Porras (R-Miami) expand the definition of a “roofing contractor” to include the evaluation and enhancement of roof-to-wall connections for structures with wood roof decking. SB 1076 is now on its way to the Governor for his expected signature. The bill would allow roofing contractors to install hurricane straps and clips, something that is currently considered structural work to be performed only by building contractors. The measure reflects proposed changes by the Florida Roofing & Sheetmetal Contractors Association and the International Association of Certified Home Inspectors. You can read more in the Insurance Journal. The bill also limits the current right for residential property owners to cancel a roof replacement or repair contract within 10 days of signing the contract or the official start date by limiting it to contracts signed within 30 days after a declared state emergency. (Return to Top of List)

Condominium Associations ̶ PASSED & AWAITING GOVERNOR’S SIGNATURE ̶ HB 913 by Rep. Vicki Lopez (R-Miami) is an almost 200-page bill yet again refining Florida’s condominium laws. It follows complaints from condominium associations and their residents that condo safety laws passed in 2022 and 2023 were too inflexible and causing financial hardship. The passed bill provides three key reliefs:

- Extends the December 31, 2025 deadline for any needed structural integrity studies by one year. (These studies are required if the milestone inspections under previous law revealed potential structural problems.)

- Clarifies that milestone inspections and structural integrity studies apply to buildings with three or more habitable stories (and not just three or more stories under previous laws).

- Pauses the requirement on condo associations to create reserve funds for building repairs for two years after completing the structural integrity study.

The bill also allows associations to take on loans or levy special assessments with the approval of a majority of the unit owners to pay for the repairs, along with other provisions. It allows insurance companies to price coverage as determined by the value of the property by “an independent insurance appraisal or update of a previous appraisal…and must be determined every 3 years, at a minimum.”

Instead of mandating full replacement cost coverage, the bill states condo associations “may” buy it, taking into consideration the 1-in-250 return period model indications as the law references, and an appraisal updated every three years.

In the past, LMA has advocated to allow condo associations to buy roof coverage covering the actual cash value of roofs but ultimately Fannie Mae and Freddie Mac, as backers of many condo mortgages, would not support the concept. With the passage of HB 913 now on its way to the Governor, condo associations “may” now buy full replacement cost on a policy form known as “loss limit” coverage with HB 913’s statutory language change. While it is early and many are studying the law changes made as a result of HB 913, some insurance practitioners have concerns about the use of the word “may” that is now in HB 913. While providing condo association coverage options may save premium costs for condo associations, the unknown is will there be enough coverage at the time of a claim? Ultimately, it will be an association’s responsibility to ensure there is. See our story Legislature Passes Condo Reform in this newsletter for more on this bill and its necessity.

More than half of the 18,468 condominium buildings insured by Citizens are located in Miami-Dade, Broward and Palm Beach counties. Per published news articles from February 2025, approximately 12,000 (3 stories or higher) were required to have milestone inspections by the end of 2024 but only 4,096 have done so as of February, according to state officials who said compliance is self-reported and therefore difficult to verify. (For more, read Plea for Condominium Relief Reflected in Bills from our March 3 newsletter.)

Other condominium bills PASSED & AWAITING GOVERNOR’S SIGNATURE include:

- HB 393 by Representative Vicki Lopez (R-Miami) would restrict the use of grant funds in the My Safe Florida Condo Pilot Project to those buildings three stories or higher, to help pay for structural fortification against storms. The program, approved by the legislature in 2024, provides free inspections to identify recommended improvements to protect against hurricane winds, and grant funding to help pay for those improvements. The bill also revises rules for roof repair projects and revises reimbursement language, while clarifying that detached units are excluded. When it returns on May 12, the legislature must still consider enhanced funding of the My Safe Florida Home program for single-family homes, for which the Governor has asked the legislature for $600 million in funding.

- SB 948 (Real Property and Condominium Flood Disclosures) by Sen. Bradley requires landlords to disclose flood propensity of real property. It also broadens out 2024’s law (HB 1049) and would require all sellers to disclose past flooding to buyers. The Miami Herald in late April published an interesting article How secret flood histories cost Florida home buyers and mask state’s risk that reveals the difficulty in disclosure of previously flooded properties by city, state, and federal governments. (Return to Top of List)

Emergency Preparedness and Response ̶ PASSED & AWAITING GOVERNOR’S SIGNATURE ̶ SB 180 by Senator Nick DiCeglie (R-Pinellas County) addresses needed changes to emergency preparedness, response, and recovery identified after 2024’s Hurricanes Debby, Helene, and Milton.

Among its many provisions, the bill would:

- Require local governments each year to designate at least one debris management site and develop post-storm staffing plans.

- Require local governments to develop post-storm permitting processes for homeowners and businesses.

- Prohibit local governments from increasing fees for building permits and inspections for 180 days after emergencies are declared for hurricanes or tropical storms.

- Allow rebuilding to have up to a 130% larger footprint than the pre-hurricane homesteads, allowing for home elevation that often requires it, be it a new external staircase or more space for utilities.

- Require local governments establish mutual-aid agreements to bring in help outside their area if needed.

For more details, you can read this summary of the passed bill. (Return to Top of List)

Pet Insurance and Wellness Programs ̶ PASSED & SIGNED INTO LAW ̶ HB 655 by Rep. Kaylee Tuck (R-Lake Placid) has been signed into law by Governor DeSantis, putting new requirements on property insurance companies to make certain disclosures to applicant pet-owners and existing policyholders. The new law clarifies that homeowners insurance policies may include coverage for pet medical care and that the coverage isn’t subject to statutes governing health or life insurance. The law also bars agents from marketing wellness programs as pet insurance, nor may they make a wellness program a prerequisite to purchasing insurance. There’s also tightened rules on coverage exclusions and claims payments, along with a 30-day refund policy. You can read more in the bill analysis. The law takes effect on January 1, 2026. (Return to Top of List)

Insurance Research ̶ DID NOT PASS ̶ SB 114 by Senator Jay Trumbull (R-Panama City) and the similar HB 1097 by Rep. Hillary Cassel (R-Dania Beach) would rename the Florida Catastrophic Storm Risk Management Center to the Florida Center for Excellence in Insurance and Risk Management and move it from Florida International University to Florida State University. Further, the bills would:

- Transfer the public hurricane loss projection model from FIU to FSU as well.

- Require the center to use the public hurricane loss projection model when necessary.

- Require the Office of Insurance Regulation (OIR) to contract with the center to manage the public hurricane loss projection model.

- Require the center to collaborate with OIR to produce an annual report analyzing the property insurance market in this state.

The bills had passed their respective chambers and each was awaiting action by the House when they were unexpectedly pulled on the last day of session and marked “Indefinitely postponed and withdrawn from consideration.” (Editor’s Note: This bill had originally been reported as passed in our original May 5, 2025 newsletter. We regret the error.) (Return to Top of List)

Attorney Fee Awards in Insurance Actions ̶ DID NOT PASS ̶ HB 1551 by Rep. Hillary Cassel (R-Dania Beach), an attorney, and the similar SB 426 by Senator Jonathan Martin (R-Fort Myers), another attorney, would essentially undo the 2023 session’s elimination of one-way attorney fees signed into law 2 years ago.. Even the bill analysis states it would increase insurance premiums. On April 25, HB 1551’s provisions were folded into SB 832 on the House floor by amendment. SB 832 was a totally unrelated phosphate mine liability bill that was a Senate President priority. But last week, the bill was never brought up in the Senate before adjournment and died. So LMA is pleased to report the attempt to reverse the good litigation reforms have not materialized.

Governor DeSantis reiterated his pledge to veto any bill that would have rolled back the legal reforms of 2022 & 2023 that he signed into law. “If you didn’t know anything else about the House and you just saw what they were pushing, you would think that they are all sponsored by Morgan & Morgan,” DeSantis said in an interview with a Jacksonville television. “You might as well as put the billboard on the top of the Florida House of Representatives.”

Citizens Property Insurance did its own analysis of the impact of HB 1551, finding it “effectively reinstates the one-way attorney’s fee provision… because HB 1551 incorrectly measured a ‘win’ at trial.” Citizens cited an analysis by former Florida Supreme Court Justice Ricky Polston that explored exactly how HB 1551 would work as written. The Citizens analysis concluded: “Complete trial victories happen, but often the winner is the party who gets a verdict closest to its pre-trial expectation. Under HB 1551, the winner, or ‘prevailing party,’ at trial would be measured against the insurance company’s offer only; the policyholder’s pre-trial demand is completely disregarded. Further, HB 1551 added the policyholder’s attorney’s fees and costs to the judgment, all but guaranteeing the policyholder would recover fees in most cases.” Read More Bill History

Florida Insurance Commissioner Yaworsky issued the following about the attempt the House was making to reverse tort reform and he referenced HB 947 when it had the same harmful language added to it as HB 1551, writing that it would:

- Return to a legal framework that incentivizes aggressive litigation tactics;

- Remove the practical application of offer of judgment statutes, eliminating tools that currently encourage early and fair settlements;

- Expand the admissibility of inflated medical expenses, which will likely inflate damage awards and claims costs;

- And signal to capital markets and reinsurers that Florida is backtracking—undermining investor confidence in our risk environment.

Since the 2022–2023 reforms, Florida has seen measurable and unprecedented improvements:

- Reinsurance rates have declined. In 2024, risk-adjusted costs dropped by 1.70%—a stark reversal from the 27.03% increase in 2022.

- Twelve new insurers have entered the Florida market since the reforms—an unmistakable vote of confidence in our stabilized landscape.

- Lawsuit filings are down 23% year-over-year, reducing systemic legal pressure on carriers.

- Homeowners are seeing relief:

- 19 insurers have approved rate reductions;

- 37 insurers filed no increase at all;

- And per S&P Global, Florida had the lowest average homeowners insurance rate increase in the nation for 2024.

Based on market history and regulatory experience:

- Insurance rates would again increase at a pace that Florida consumers cannot bear.

- Such premium impacts would lead to a marketplace where insurers would be less likely to remain and grow. This ultimately leaves consumers, once again, facing fewer and fewer options at higher and higher costs.

- Citizens Property Insurance, the state-backed insurer of last resort, will again swell in market share—placing billions in contingent liability on Florida taxpayers.

In conclusion, Yaworsky wrote that HB 947 does not “balance the scales.” It resurrects the very legal incentives that made Florida an outlier in litigation and a cautionary tale where the whims of powerful interests outweigh the insurability of the public.

A vote for HB 947 Yaworsky wrote is a vote to:

- Raise rates on Florida families,

- Clog the courts with profit-driven lawsuits,

- Chill private investment in our state, and

- Shift financial risk back onto the public.

Yaworsky concluded, writing “Florida cannot afford to go back. The very reforms that have restored market stability risk being dismantled. This is not risk management ̶ it’s policy-induced crisis creation.” (Return to Top of List)

Evidence of Damages to Prove Medical Expenses in Personal Injury or Wrongful Death Suits ̶ DID NOT PASS ̶ HB 947 by Rep. Omar Blanco (R-Miami) and SB 1520 by Senator Erin Grall (R-Fort Pierce) are pro-litigation measures. HB 947 as originally filed at the beginning of session provoked business community and other leaders to vehemently oppose its provisions which would reverse the impactful 2023 tort reform legislation by repealing parts of the accuracy in damages law while changing other parts. In essence, the 2023 tort reform requires juries to see all the relevant medical costs versus the often inflated “sticker price” of medical care which could lead to higher damage awards, increasing medical malpractice insurance premiums. Former House Speaker Paul Renner, who presided over the 2022-2023 litigation reforms, urged lawmakers to vote “no” on HB 947 in an explosive tweet on April 3, warning “Billboard lawyers want those savings back in their pockets.”

Like HB 1551, this bill’s provisions in late April were also placed into SB 832, the totally unrelated phosphate mine liability bill. And like HB 1551 last week, this bill was never brought up in the Senate before adjournment and died. (Return to Top of List)

Residual Market Insurers ̶ DID NOT PASS ̶ An attempt to pass HB 643 by Rep. John Snyder (R-Stuart), resurrected on April 22, with new language from HB 881 regarding affiliate relationships of insurance companies, never materialized last week. The bill also had a repeal of the diligent effort required for insurance agents to place business in the surplus lines market.

However, late last week, another bill, HB 1549 was amended to add the repeal of diligent effort process and passed both chambers. This process was the best hope in keeping a firewall between admitted and surplus lines. Although the current Diligent Effort requirement is not a perfect way to stop surplus lines carriers from encroachment on the admitted (regulated) market, its repeal is now headed to the Governor unfortunately for signature and will blur the lines between admitted and surplus lines. The bottom line is that it will result in an unlevel playing field between admitted and surplus lines carriers in my opinion. We can only hope our surplus lines players will be respectful of the admitted lines, recognizing that the admitted market should be the first line of risk coverage. I’ve been a longtime supporter of keeping the firewall between surplus and admitted lines.

Please see the bill analysis for HB 643 from the April 22, 2025 Commerce Committee. There was no corresponding identical bill in the Senate. Former Florida Insurance Commissioner Kevin McCarty, in a late April column titled Let Insurance Reforms Work, is critical of both HB 643 and HB 947 in the prior section. Read More Bill History (Return to Top of List)

Nature-based Methods for Improving Coastal Resilience ̶ DID NOT PASS ̶ SB 50 by Senator Ileana Garcia (R-Miami) and HB 371 by Rep. Jim Mooney, Jr. (R-Islamorada) would require the Florida Flood Hub for Applied Research and Innovation to develop guidelines and standards for “green and gray infrastructure” to improve coastal resilience to storms. It would also require the Department of Environmental Protection to adopt rules for nature-based methods for coastal resilience and require a statewide feasibility study with the Department of Financial Services Division of Insurance Agent and Agency Services on the value of applying those methods. Although both bills made it through their committees and to the full House, neither was taken up for further consideration or vote. (Return to Top of List)

Mandatory Human Reviews of Insurance Claim Denials ̶ DID NOT PASS ̶ SB 794 by Senator Jennifer Bradley (R-Fleming Island) defines “qualified human professional” and requires an insurance company’s decision to deny claims to be reviewed, approved, and signed off on by the professional. The bill passed unanimously in its first hearing but never progressed to its two remaining committee hearings.

It prohibits artificial intelligence, machine learning algorithms, and automated systems from serving as the basis for denying claims. Of note: Section (4) In all denial communications to a claimant, and insurer shall: (a) Clearly identify the qualified human professional who reviewed the denial decision. A comparable House bill (HB 1555) by Rep. Cassel never received a hearing. (Return to Top of List)

Property Insurance Claims ̶ DID NOT PASS ̶ SB 1508 by Senator Tom Leek (R-Ormond Beach) and the similar HB 1087 by Rep. Randy Maggard (R-Dade City) remove the existing alternative procedure for resolving disputed residential property insurance claims (mediation) and replaces it with a mandatory one. These bills never received an initial hearing. Read More (Return to Top of List)

Court Judgment Interest Rates and Insurance Reports and Practices ̶ DID NOT PASS ̶ HB 451 by Rep. Alex Andrade (R-Pensacola) and the similar SB 554 by Senator Don Gaetz (R-Pensacola) would essentially undo the 2023 tort reform under HB 837 that eliminated one-way attorney fees for plaintiff attorneys and reverts to something similar to previous attorney fee calculations under SB 76 that were part of the 2021 reforms. These bills never received an initial hearing. Read More (Return to Top of List)

Insurance ̶ DID NOT PASS ̶ SB 230 by Senator Keith Truenow (R-Tavares) would put new restrictions on bad faith claims by first requiring a court ruling and final judgment that an insurance company breached the policy contract before a bad faith claim could be filed. This bill never received an initial hearing. Read More (Return to Top of List)

Insurance ̶ DID NOT PASS ̶ HB 1047 by Rep. Kim Berfield (R-Clearwater) is a wide-ranging bill that touches on various aspects of Florida’s insurance laws. HB 1047 is comparable to SB 230 by Senator Truenow above and SB 790 by Senator Bradley, which was never in play. A new version of HB 1047 added a provision making it easier for liability lawsuits to be filed. The new language shrinks the notice requirement and timeline for insurers to react to a lawsuit. The bill did not make it to the second of its two committee hearings. Read More (Return to Top of List)

Litigation Financing ̶ DID NOT PASS ̶ SB 1534 by Senator Jay Collins (R-Tampa) picks up where past efforts in recent sessions made no progress in regulating third-party funding of lawsuits against businesses, including insurance companies. This bill never received an initial hearing and had no House companion bill. Read More (Return to Top of List)

Insurer Accountability to Insureds ̶ DID NOT PASS ̶ HB 881 by Rep. Griff Griffiths (R-Bay County) was supported by the CFO’s office and contained many consumer protection provisions. The version released April 1 has anything but and in fact, has provisions that would inhibit a vibrant competitive market, not reduce rates, and thwart the market momentum currently in place. It adds language that would require insurance companies to provide more details on their affiliate relationships (including Managing General Agents) and allow regulators much greater powers, including even determining the amount of payments and dividends allowed. When weighing whether a fee or commission is fair and reasonable, OIR must look at the actual cost of the service the affiliate provided to the insurer, the financial condition of both companies, the level of debt, the amount and purpose of payments and dividends, whether the contract benefits the insurer, and other information the office needs to make the determination. We recommend that you peruse the proposed committee substitute that became the new bill version. It contains some very charged language as well, including “The Legislature finds that criminal activity of insurers poses a particular danger to the residents of this state.” Many are shaking their heads in disbelief at this defaming characterization within formal bill drafting. This bill died prior to session end, with its affiliate relationship requirements put into HB 643. (Return to Top of List)

Office of Insurance Regulation ̶ DID NOT PASS ̶ SB 1656 by Senator Jay Collins (R-Tampa) nor its similar House companion HB 1429 by Rep. Tom Fabricio (R-Miami Lakes) ever received a hearing. The original version of HB 1429 proposed regulatory measures intended to improve transparency and target fraudulent practices without overburdening insurance companies. You can read more in the HB 1429 bill analysis produced on April 2. (Return to Top of List)

Insurance and Hurricane Mitigation Grants ̶ DID NOT PASS ̶ SB 1740 by Senator Blaise Ingoglia (R-Spring Hill) and the identical HB 1433 by Rep. Yvette Benarroch (R-Marco Island) covers both insurance regulation and wind mitigation efforts. These bills received just one committee hearing.

It specifies that hurricane mitigation grants funded through the My Safe Florida Home Program may be awarded only to projects that will result in rate credits or discounts. On the regulation side, it increases the Certificate of Authority minimum surplus requirements from $15 million to $35 million for not wholly owned subsidiaries of foreign insurers; from $7.5 million to $10 million for carriers offering only sinkhole coverage; and from $10 million to $12.5 million for carriers offering only renter’s insurance. It also increases the lookback period from 2 years to 5 years for Directors and Officers of insolvent companies and adds attorneys in fact to the lookback period; it prohibits future service as a director of a reciprocal, carrier, MGA, or affiliated entity; but does not change the director’s burden for proving ‘not at fault’ past service. (Return to Top of List)

Uniform Mitigation Verification Inspection Form ̶ DID NOT PASS ̶ SB 1596 by Senator Nick DiCeglie (R-St. Petersburg) authorizes the Governor and Cabinet sitting as the Financial Services Commission to incorporate flood mitigation criteria into the uniform mitigation verification inspection form. The current form includes only wind mitigation criteria. This bill never received an initial hearing and had no House companion bill. (Return to Top of List)

Property Insurer Financial Strength Ratings ̶ DID NOT PASS ̶ SB 792 by Senator Jennifer Bradley (R-Fleming Island) would require annual insurance reports prepared by the Office of Insurance Regulation for the Legislature and the Governor to include financial strength ratings of property insurance companies issued by third-parties whose fees are not paid for by insurance companies. This bill never received an initial hearing and had no House companion bill. (Return to Top of List)

Coverage by Citizens Property Insurance Corporation ̶ DID NOT PASS ̶ SB 1020 by Senator Ana Maria Rodriguez (R-Doral) and the identical HB 1073 by Rep. Jim Mooney, Jr. (R-Islamorada) would allow higher-priced homes in Miami-Dade and Monroe counties to get coverage from state-backed Citizens Insurance. Current law restricts Citizens from selling policies for homes with replacement dwelling costs of $700,000 or more except in those two counties, where the limit is $1 million. The bills would raise the limit in those two counties to $1.5 million. The bills would also require Citizens to annually raise rates by up to 10% in counties without a reasonable degree of competition, such as Miami-Dade and Monroe, as designated by the Florida Office of Insurance Regulation (OIR). It would also exclude properties in X flood zones from the Citizens flood insurance requirement for wind policies. These bills never received an initial hearing. (Return to Top of List)

Motor Vehicle Insurance ̶ DID NOT PASS ̶ SB 1256 by Senator Erin Grall (R-Fort Pierce) and the identical HB 1181 by Rep. Danny Alvarez (R-Brandon) are a perennial effort to do away with Personal Injury Protection (PIP) coverage under Florida’s No-Fault insurance law and replace it with bodily injury (BI) liability coverage. The primary difference between PIP and mandatory BI is that under PIP, someone injured in an auto accident seeks coverage first under their own PIP policy, whereas under mandatory BI, someone injured in an auto accident would seek recovery from a responsible third-party’s (other driver’s) BI coverage. And more to the point for the trial bar that supports these measures: After an accident, the victim could sue the offending driver directly rather than their insurance company. The bills are similar to the bill vetoed in 2021 by Governor DeSantis, and filed again in 2022, 2023, and 2024. Last year’s bills never received a hearing. Governor DeSantis remains opposed to the idea, telling reporters in early March “I don’t want to do anything that’s going to raise the rates.” HB 1181 failed to make it to its last of three committee hearings while SB 1256 never received a hearing. This is yet another bill in a growing list that would allow more insurance lawsuits. “This feels good for the trial attorneys, and maybe we should call this the ‘Insurance and Trial Attorneys Subcommittee’,” said Rep. Mike Caruso (R-Delray Beach) before voting against the bill. (Return to Top of List)

Attorney Fees and Costs for Motor Vehicle Personal Injury Protection Benefits ̶ DID NOT PASS ̶ HB 1437 by Rep. John Snyder (R-Stuart) and the identical SB 1840 by Senator Jonathan Martin (R-Fort Myers), an attorney, provides that prevailing parties in lawsuits by health care providers for overdue medical benefits under motor vehicle personal injury protection policies (PIP) are entitled to reasonable attorney fees & costs.

HB 1437 made it through only one of its three committee hearings and its Senate counterpart never had a hearing. In testimony, one expert pointed to a 2021 study that indicated auto rates would increase over 40% should a bill of this nature pass.

It is abundantly clear that a major theme in the House of Representatives is to provide additional avenues for plaintiff attorneys to increase their income. From reversing the 2022-23 property insurance litigation tort reform in HB 1551 this session, to creating a path for plaintiff lawyers to be a “prevailing party” in PIP claims in HB 1437.

The bill addresses overdue medical benefit disputes between medical providers and auto insurers under PIP. Interestingly, there are no provisions determining prevailing party. The bill would leave the decision of who prevails to the courts. The two sides warring over this bill: the insurance and business communities oppose the bill and the Florida Medical Association and the Florida Chiropractic Association support the bill. The common case pattern is where trial attorneys diligently dig into physician files looking for an innocuous insurer payment mistake so they can file a case with this small dollar amount yet leading to large attorney fee awards. It is a familiar pattern. (Return to Top of List)

Resilient Buildings ̶ DID NOT PASS ̶ HB 143 by Rep. Webster Barnaby (R-Deltona) and the similar SB 62 by Senator Ana Maria Rodriguez (R-Doral) would authorize owners of resilient buildings to receive a specified tax credit for those improvements and outlines specific LEED (Leadership in Energy and Environmental Design) requirements of a building. The bill also creates the Florida Resilient Building Advisory Council which would work with the Department of Environmental Protection. Neither HB 143 nor SB 62 were heard beyond their first committee meeting hearings. (Return to Top of List)