Recap of Week 1 & Preview of Week 2 of Session

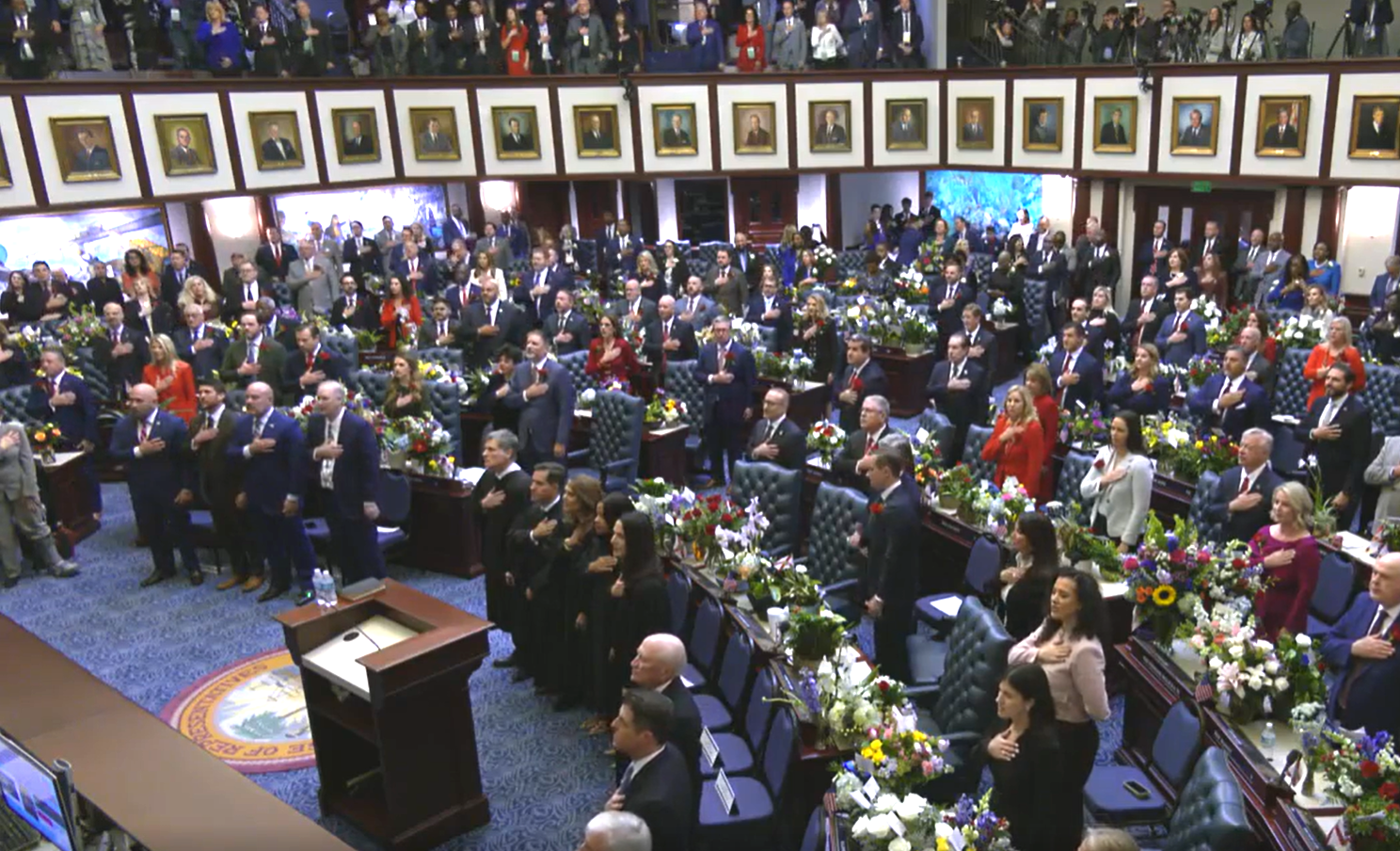

The joint session of the Florida Legislature, January 13, 2026. Courtesy, The Florida Channel

The second week of the Florida legislative session begins this morning, following a busy week last week that saw additional insurance bills filed. The session kicked-off with the two leaders – House Speaker Daniel Perez and Senate President Ben Albritton – addressing their respective chambers, outlining their priorities. For Perez, it is “affordability and insurance. Taxes and the economy. Prescription drug prices and the rising cost of public benefits.” For Albritton, it’s his package to expand programs and funding in rural counties for infrastructure projects, economic development, housing, and healthcare.

Governor Ron DeSantis addresses the joint session of the Florida Legislature

Afterward, Governor DeSantis delivered his last State of the State address to a joint session where he touted past accomplishments and pushed again for this year’s priorities: major property tax cuts for homesteaded residents and new regulations on artificial intelligence (AI). “We can never relieve ourselves of our responsibility to think for ourselves,” DeSantis said. Speaker Perez said he expects the House to put forward a single proposed state constitutional amendment on property taxes among the seven proposed, but it is “somewhat still up in the air” which one that will be, amid ongoing urging by the Governor for a single ballot measure for Floridians to vote on in November. Senate President Albritton has said only that the Senate is “absolutely committed” to putting something on the ballot but has no specific proposals of its own, nor does the Governor.

Senate President Ben Albritton

Both of the presiding officers set the stage for what looks to be a lively session with probably more disagreement than agreement. Last year’s 60-day session took an extra 45 days over disagreements on tax cuts and the budget. There really is no way to accurately describe the major personality differences between these two leaders without watching their style, which you can do in their press availabilities afterward (Perez’s here and Albritton’s here). In his, Albritton was the only one to talk about property insurance affordability (timecode 32:09) noting there are two big drivers to rates: frivolous litigation and storms. “We passed tort reforms that were substantial … and now the number of lawsuits are coming down. The other part of it is up to the good Lord.” He added that he’s “very expectant” of continued rate relief.

House Speaker Daniel Perez

The next day, the Senate passed a bill fixing structural issues with School Choice Scholarships and Albritton’s Rural Renaissance Legislation. Asked afterward by reporters, House Speaker Perez didn’t commit to taking it up in the House. The House, meanwhile, passed a series of bills including expanding E-Verify, firearm purchases, and a family member’s ability to recover damages for medical negligence, delivering them to the Senate for action.

Those of us working in the insurance space are interested in ensuring the legislature’s 2022 and 2023 insurance consumer and litigation reforms remain in place, working with lawmakers on AI, helping expand home mitigation and resiliency efforts against hurricanes, and opposing the perennial effort by the trial bar to repeal Florida’s no-fault auto insurance system. Florida’s property insurance market has seen strong growth and improved affordability under the reforms. Insurance Commissioner Michael Yaworsky has already testified to the legislature that the reforms are working in lowering rates. He and the Governor reiterated that the day before session began last week in a joint news conference that included CFO Blaise Ingoglia.

Here is the updated list of legislative bills we’re following. You can click the bill link in the list below to go directly to the bill and its details further below. “New” and “Updated” bills are so noted. We will continue to monitor each chamber’s position on relevant bills and add further bills showing advancement as warranted. Updates within each bill are noted in blue font:

Property Insurance – Claims & Litigation

Mandatory Human Reviews of Insurance Claim Denials

Resolution of Disputed Property Insurance Claims

Public Adjuster Contracts Updated

Litigation Financing New

Property Insurance – Regulation

Reinsurance Intermediary Managers Updated

Roofing Requirements for Property Insurance Updated

Residential Property Insurance Updated

Unauthorized Aliens New

Department of Financial Services New

Property Insurance – Mitigation & Resilience:

Assessment of Property Used for Residential Purposes

Land Use Regulations for Local Governments Affected by Natural Disasters Updated

Florida Hurricane Catastrophe Fund New

Property Insurance – Citizens Property Insurance Corporation:

Rates for Citizens Property Insurance Corporation Coverage

Citizens Property Insurance Corporation Updated

Coverage by Citizens Property Insurance Corporation Updated

Dispute Resolutions Involving Citizens Property Insurance Corporation New

Other Bills We’re Monitoring:

Rate Filings for Property Insurers

Home Hardening Products

Homeowners’ Insurance Policies

Whistleblower Protections for Employees and Independent Contractors of Property Insurers

Emergency Residential Property Insurance Assistance Trust Fund/Department of Financial Services

Payment Scam Task Force

Transparency in Insurance Matters

Insurance Solutions Advisory Council

Initiating a Property Insurance Interstate Compact

Motor Vehicle Insurance New

Required Reports of the Office of Insurance Regulation

Property Insurer Financial Strength Ratings

Insurance New

Property Insurance Affiliates

Property Insurance – Claims & Litigation

SB 202 Mandatory Human Reviews of Insurance Claim Denials by Sen. Jennifer Bradley (R-Fleming Island) and the comparable HB 527 by Rep. Hillary Cassel require that insurance companies’ decisions to deny a claim or any portion of a claim be made by qualified human professionals; prohibit the use of algorithms, artificial intelligence, or machine learning systems as the sole basis for determining whether to adjust or deny a claim; and authorize the Office of Insurance Regulation to conduct market conduct examinations and investigations under certain circumstances, among other measures.

The Florida House Subcommittee on Insurance & Banking met October 7, 2025, to examine how insurance companies are using artificial intelligence (AI) in their operations. A panel of insurance and technology experts representing CFO Ingoglia’s office, NAMIC, APCIA, FIC and Insurtech told lawmakers that insurers use AI sparingly and primarily for efficiency, accuracy, fraud detection, and faster claims handling—not to make final claims decisions. They emphasized that existing laws already hold insurers accountable for any AI-assisted decisions and that AI cannot replace human oversight. You can read more here.

During the November 19, 2025 meeting of the Senate Banking and Insurance Committee, Insurance Commissioner Yaworsky told lawmakers that “responsible AI governance is crucial. I’m not an opponent of AI, but I do think it needs to be responsibly deployed. There are some companies that I think are doing it in a much more responsible manner than others.” Yaworsky told the committee that his focus in on disclosure when AI is being used, in auditing, and assurances that insurance companies have a “human in the loop that knows what that system is doing, has expertise on that.” As for the Senate bill that had been filed at that point, Yaworsky told Senators “We don’t view it as a necessary benefit to eliminate the use of AI. That’s a legislative decision to make. But we do want to provide a path where, if it is being used, it is being used responsibly, known to the regulator.”

The Florida House devoted the final committee week in December to proposed AI legislation. HB 527 unanimously passed the House Insurance & Banking Subcommittee on December 9 and awaits a final hearing before the Commerce Committee, where if successful, will then go to the House floor. You can read more here. SB 202 is awaiting its first hearing before the Senate Banking and Insurance Committee.

The International Actuarial Association has an Artificial Intelligent Task Force recently released three research papers that discuss the risks of AI in insurance that need to be managed when designing and using AI models and system processes.

On broader AI issues, Sen. Tom Leek (R-Ormond Beach) has filed SB 482, the “Artificial Intelligence Bill of Rights,” that goes beyond simply targeting insurance practices to address a variety of ways that AI may impact our lives. It follows the Governor’s Proposal for Citizen Bill of Rights for Artificial Intelligence that includes data privacy, parental controls, consumer protections, and restrictions on AI use of an individual’s name, image or likeness without consent. It would also prohibit utilities from charging Florida residents more to support hyperscale data center development, including electric, gas, and water utilities. It all comes after President Trump announced plans for an executive order to curb state power over AI regulation in the U.S. (Return to Top of List)

HB 341 Resolution of Disputed Property Insurance Claims by Rep. Leonard Spencer (D-Gotha), and the similar SB 108 by Sen. Polsky (D-Boca Raton) requires parties in a property insurance claim dispute to participate in mediation; provides that mediation is a condition precedent to commencing litigation; provides that parties may mutually agree to conduct mediation by teleconference or other electronic means; requires all insureds, or their representatives, to attend mediation; obligates the policyholder to provide any supporting information and documents within 10 days after invoking mediation; revises and specifies duties relating to bearing certain costs of mediation; broadens the definition of “claim” and updates sinkhole claim procedures to clarify that neutral evaluation supersedes mediation for sinkhole disputes, without invalidating the appraisal clause; revises the policyholder’s right to rescind settlement terms within 3 business days if unrepresented by counsel or a public adjuster; and it includes a $1 million appropriation. A previous bill in our Bill Watch, HB 459, would have mandated mediation for property claim disputes but was withdrawn prior to formal introduction. HB 341 is awaiting its first hearing before the House Insurance & Banking Subcommittee. SB 108 is awaiting its first hearing before the Senate Banking and Insurance Committee. (Return to Top of List)

(UPDATED) HB 427 Public Adjuster Contracts by Rep. Lauren Melo (R-Naples) and the identical SB 266 by Sen. Colleen Burton (R-Lakeland) authorize certain persons to rescind a contract for public adjuster services; and clarify acts that may subject a public adjuster or public adjuster apprentice to discipline. These bills allow a vulnerable adult (defined in Chapter 415, Florida Statutes) to cancel a public adjuster at any time. HB 427 is awaiting its first hearing before the House Insurance & Banking Subcommittee. SB 266 was heard and unanimously passed out of its first committee, Senate Banking and Insurance Committee on Tuesday, January 13, 2026. It is awaiting a hearing at its second committee stop before the Senate Children, Families, and Elder Affairs Committee. (Return to Top of List)

(NEW) HB 1157 Litigation Financing by Rep. Fabián Basabe (R-Miami-Dade) and the similar SB 1396 by Sen. Colleen Burton (R-Lakeland) picks up where past efforts in recent sessions made no progress in regulating third-party funding of lawsuits against businesses, including insurance companies. HB 1157 requires a court’s consideration of potential conflicts of interest which may arise from the existence of a litigation financing agreement in specified circumstances; prohibits specified acts by litigation financiers; requires certain disclosures related to litigation financing agreements and the involvement of foreign persons, foreign principals, or sovereign wealth funds; and requires the indemnification of specified fees, costs, and sanctions by a litigation financier in specified circumstances, among other provisions. The Insurance Journal published an article providing more details on these proposals. HB 1157 is awaiting its first hearing before the House Civil Justice & Claims Subcommittee. SB 1396 is awaiting its first hearing before the Senate Judiciary.

Georgia recently imposed restrictions on such financing, including a disclosure mandate and a requirement for financiers to register with the state. Congress is again considering a transparency measure introduced by Rep. Darrell Issa (R-CA) that would require all parties that have contractual funding arrangements with plaintiffs’ attorneys be visible to the court. “Undisclosed third party litigation funding can inflate costs and shrouds court proceedings in secrecy, eroding confidence in the civil justice system,” stated the American Property Casualty Insurance Association in a news release. (Return to Top of List)

Property Insurance – Regulation

(UPDATED) HB 99 Reinsurance Intermediary Managers by Rep. Richard Gentry (R-Astor) and the identical SB 394 by Sen. Tom Leek (R-Ormond Beach) revise the definition of the term “reinsurance intermediary manager” to exclude certain underwriting managers. HB 99 is awaiting its first hearing before the House Insurance & Banking Subcommittee. SB 394 was heard and unanimously passed out of its first committee, Senate Banking and Insurance Committee on Tuesday, January 13, 2026. Members had no questions, and the sponsor described the bill as a technical measure aligning current DFS practices with statute. It is awaiting a hearing in its second committee stop before Senate Appropriations Committee on Agriculture, Environment, and General Government. (Return to Top of List)

(UPDATED) SB 808 Roofing Requirements for Property Insurance by Sen. Corey Simon (R-Tallahassee) and the identical HB 815 by Rep. Michael Gottlieb (D-Davie) revise the definition of the term “authorized inspector” to include certain roof consultants and roof observers; prohibit an insurance company from refusing to issue or renew a property insurance policy on a residential structure that has a roof less than a specified age solely because of the roof’s age; and prohibit an insurance company from refusing to issue or renew a property insurance policy under certain circumstances, among other measures. SB 808 is awaiting its first hearing before the Senate Banking and Insurance Committee. HB 815 is awaiting its first hearing before the House Insurance and Banking Subcommittee. (Return to Top of List)

(UPDATED) SB 832 Residential Property Insurance by Sen. Bryan Avila (R-Miami Springs) and the similar HB 767 by Rep. Yvette Benarroch (R-Surfside ) requires that certain rate filings with the Office of Insurance Regulation from residential property insurance companies include rate transparency reports; requires OIR to establish and maintain a comprehensive resource center on its website; specifies that certain information is not a trade secret and is not subject to certain public records exemptions; prohibits an insurance company from including the value of certain land when establishing a coverage amount or adjusting certain claims, among other measures. SB 832 was heard and unanimously passed without debate at its first committee, Senate Banking and Insurance Committee and awaits its next hearing before the Senate Appropriations Committee on Agriculture, Environment, and General Government. HB 767 is awaiting its first hearing before the House Insurance and Banking Subcommittee. (Return to Top of List)

(NEW) SB 1380 Unauthorized Aliens by Sen. Jonathan Martin (R-Lee) and the similar bill HB 1307 Unauthorized Aliens by Rep. Berny Jacques (R-Clearwater) is part of Chief Financial Officer, Blaise Ingoglia’s, legislative proposal to fight back against illegal immigration. The legislative proposals remove Illegal aliens as covered employees in the Workers’ Compensation statute; require companies to use E-Verify to submit a Worker’s Compensation claim; forces illegal immigrants’ insurance companies to accept fault if an illegal immigrant is involved in a car accident in Florida. SB 1380 is awaiting its first hearing before the Senate Banking and Insurance. HB 1307 is awaiting its first hearing before the House Commerce Committee. (Return to Top of List)

(NEW) HB 1221 Department of Financial Services by Rep. Chip LaMarca (R-Lighthouse Point) and the identical SB 1452 by Sen. Keith Truenow (R-Tavares) comprise an omnibus bill for the Department that does many things. They revise multiple statutory provisions to enhance the Department of Financial Services’ authority, adjust insurance and reinsurance regulations, refine the My Safe Florida Home program, and update unclaimed property processes. Specifically, the proposals expand rulemaking authority for the Chief Financial Officer and clarifies processes for advance payments; adjust eligibility, inspections, grants, and requirements under the My Safe Florida Home Program, including more flexible reinspection and contractor verification rules; reconfigure the Florida Financial Management Information System coordinating council’s composition and duties, requiring collaborative annual workplans and clarifying oversight structures; authorize the Department of Financial Services to purchase insurance, excess insurance, and reinsurance directly, engage reinsurance brokers, and determine necessary property insurance coverage; modify timeframes and procedures for workers’ compensation disputes and reimbursement schedules; establish permanent and periodic disqualification periods for licensing under funeral, cemetery, and consumer services boards, with pathways for exemptions and restoration of rights; streamline license transfers, reexaminations, and qualifications for general lines, life, and health agents, with enhanced compliance requirements on public adjusters and bail bond applicants; overhaul unclaimed property laws by redefining dormancy periods, clarifying due diligence requirements, expanding notification methods, detailing abandoned property reporting and remittance, and preserving ownership rights until final escheatment. HB 1221 is awaiting its first hearing before the House Insurance and Banking Subcommittee. SB 1452 is awaiting its first hearing before Senate Banking and Insurance. (Return to Top of List)

Property Insurance – Mitigation & Resilience

SB 434 Assessment of Property Used for Residential Purposes by Sen. Leek (R-Ormond Beach) and the identical HB 617 by Rep. Toby Overdorf (R-Stuart) define the term “changes or improvements made to improve the property’s resistance to wind damage;” and prohibits the consideration of the increase in just value of a property which is attributable to changes or improvements made to improve the property’s resistance to wind damage in determinations of the assessed value of certain property, among other measures. SB 434 is awaiting its first hearing before the Senate Finance and Tax Committee. HB 617 is awaiting its first hearing before the House Ways & Means Committee. (Return to Top of List)

(UPDATED) SB 840 Land Use Regulations for Local Governments Affected by Natural Disasters by Sen. Nick DiCeglie (R-Indian Rocks Beach) would throttle-back the scope of SB 180, passed in the 2025 session, that limited post-hurricane land use actions by local governments and has been the subject of subsequent lawsuits. There is a comparable bill in the House, HB 1465 by Rep. Alex Andrade (R-Pensacola). SB 840 clarifies the one-year moratorium on local governments from actions that prevent or delay the repair or reconstruction of hurricane damaged buildings, allowing it only for the purpose of addressing stormwater, flood water management, potable water supply, or necessary repairs or replacement of sanitary sewer systems. The bill keeps the temporary ban that’s in place until June 2026 on “more restrictive and burdensome” planning and land use changes by local governments impacted by the 2024 hurricanes. Among other provisions and clarifications, the bill updates SB 180 to reflect that in the future, local governments may pass tougher building codes for new development but it keeps the one-year block on any new codes that would impact properties being rebuilt after hurricane damage. SB 840 was heard and unanimously passed at its first committee, Senate Community Affairs Committee and is scheduled to be heard at its second committee stop, Senate Judiciary, today (January 20, 2026). There was a question in committee as to why this bill decreased it from the 100 miles to the 50 miles in which Senator DiCeglie (R) answered that the 100-mile radius “ultimately impacted … almost every inch of the state,” and that narrowing it to 50 miles “is going to capture those communities that are directly impacted instead of that wide swath of … area.”

HB 1465 defines “burdensome” and “restrictive” to limit local government actions that reduce development rights or delay approvals; eliminates a study requirement and removes outdated language; allows enforcement of certain plan or regulation changes only if specific conditions are met, including applications aimed at compliance and those that meaningfully expand development options; permits broader civil actions by property owners, business owners, and residents against prohibited local government actions; and requires local governments to process pending applications under the less restrictive regulations in effect when the application was filed. HB 1465 is awaiting its first hearing before the House Intergovernmental Affairs Subcommittee. (Return to Top of List)

(NEW) HB 1349 Florida Hurricane Catastrophe Fund by Rep. Hillary Cassel (R-Broward) and its comparable bill SB 1448 by Sen. Nick DeCeglie (R- Pinellas) do the following: HB 1349 increases the base retention multiple from $4.5 billion to $8.5 billion for the 2026 contract year and adjusts retention calculations accordingly; adds a new 100-percent coverage level, clarifies existing 45-, 75-, and 90-percent coverage levels, and includes applicable loss adjustment expenses in reimbursements; revises the loss adjustment expense reimbursement to the lesser of 25 percent of total subject losses or actual expenses before reimbursement; limits the fund’s contract obligation to $17 billion per contract year; requires hurricane-loss calculations using the averaged results of all state-approved catastrophe models; freezes the cash build-up factor at 25 percent beginning in the 2026-2027 contract year for 12 months, with resulting savings passed directly to consumers; and ensures costs for additional reinsurance or capital market transactions beyond traditional bonding cannot be added to the actuarially determined cost of reimbursement contracts. SB 1448 specifies a retention multiple of $4.5 billion for insurers and removes the former calculation based on estimated reimbursement premium; expands reimbursement contracts to include the lesser of 15% of total subject losses before reimbursement or actual loss adjustment expenses rather than a fixed 5% component; requires the hurricane loss portion of the premium formula to be determined by averaging results from all catastrophe models accepted by the Florida Commission on Hurricane Loss Projection Methodology; and makes the cash build-up factor optional rather than mandatory and sets it to zero for the 2026-2027 contract year. HB 1349 is awaiting its first hearing before the House Insurance and Banking Subcommittee. SB 1448 is awaiting its first hearing before Senate Banking and Insurance Committee. (Return to Top of List)

Property Insurance – Citizens Property Insurance Corporation

SB 634 Rates for Citizens Property Insurance Corporation Coverage by Sen. Nick DiCeglie (R-Indian Rocks Beach) and the identical HB 275 by Rep. Daniel Alvarez (D-Kissimmee) provide that the limitations on the required annual rate increases for Citizens Property Insurance Corporation coverage do not apply to new policies issued by the corporation on or after a specified date and to subsequent renewals of such policies. SB 634 is awaiting its first hearing before the Senate Banking and Insurance Committee. HB 275 is awaiting its first hearing before the House Insurance & Banking Subcommittee. (Return to Top of List)

(UPDATED) HB 943 Citizens Property Insurance Corporation by Rep. Mike Redondo (R-Miami) and the identical SB 1028 by Sen. Joe Gruters (R-Sarasota) furthers the effort to shrink Citizens’ policy count. It requires Citizens to implement a commercial lines clearinghouse to complement its existing personals lines clearinghouse; authorizes approved surplus lines clearinghouse insurers to participate in it; prohibits such insurers from participating in the personal lines clearinghouse; specifies that participation in the program is not mandatory for such insurers; specifies circumstances under which Citizens policyholders are not eligible for commercial lines residential coverage with Citizens; authorizes applicants or insureds to elect to accept coverage with specified insurers or elect to accept or continue coverage with Citizens; requires certain applicants & policyholders to pay specified premium for Citizens’ coverage; revises rights & authorizations for certain independent insurance agents; and removes the prohibition relating to commercial nonresidential policies. HB 943 is awaiting its first hearing before the House Insurance and Banking Subcommittee. SB 1028 was heard and unanimously passed out of its first committee, Senate Banking and Insurance Committee, with a committee substitute adopted. It is now awaiting a hearing at its second committee stop, Senate Appropriations Committee on Agriculture, Environment, and General Government. The bill now requires that approved surplus lines clearinghouse insurers must have both an AM Best financial strength rating of at least A- (excellent) and be in the AM Best financial size category of VII (capital and surplus of at least $50 million) and eligible under the Florida Surplus Lines law; provides that approved surplus lines clearinghouse insurers must be recommended by the commercial clearinghouse administrator and approved by the OIR; and specifies that Citizens will contract with a clearinghouse administrator to establish and maintain the commercial clearinghouse for surplus lines. Citizens must select the clearinghouse administrator within 90 days after the bill becomes law; clarifies the timeframes and procedures for submission of commercial risks to the commercial lines clearinghouse for surplus lines; provides that the commercial lines clearinghouse administrator may charge approved surplus lines clearinghouse insurers and surplus lines agents participating in the program reasonable transaction, technology, administration, and other similar fees; requires the surplus lines agent, managing general agent, or managing general underwriter must pay the producing agent a commission that results in an effective commission percentage at least equal to the Citizens commission percentage in effect on January 1, 2026; provides that if a policyholder or applicant turns down an offer of coverage from the surplus lines insurer with material terms and conditions that are equivalent to or better than the Citizens policy for a rate that is not more than 20 percent more than the Citizens rate, the policyholder will have to pay a policy equalization surcharge on the Citizens policy; and provides that Citizens may, rather than must, establish a commercial lines clearinghouse for authorized insurers.

There was a question as to whether or not there is a plan to hire a clearinghouse administrator in-house or to contract with one and Senator Gruters answered, “On the personal lines, it’s covered by Citizens, in this case; the commercial line, it would be outside of the state.” He also mentioned he would like to provide more competition in response to a question of whether the bill aimed to reduce Citizens’ commercial policy count or exposure by a specific figure. In debate, Senator Gruters cautioned that Citizens has “$65,000,000,000 worth of exposure of commercial properties,” which creates excessive risk for taxpayers; asserted that a new commercial lines clearinghouse would “relieve taxpayers from shouldering Citizens’ risk exposure,” improve market efficiency, and encourage competition; and credited prior insurance reforms with attracting capital, concluding that “competition will drive down rates.” (Return to Top of List)

(UPDATED) HB 909 Coverage by Citizens Property Insurance Corporation by Rep. Jim Mooney, Jr. (R-Islamorada) and the identical SB 1024 by Sen. Ana Maria Rodriguez (R-Doral) would impact Citizens policyholders in areas of Miami-Dade and Monroe Counties, where the Florida Office of Insurance Regulation has determined there’s not a reasonable degree of competition for property insurance – essentially meaning that Citizens Insurance is the only option. With that determination, the bill would limit Citizens’ rate increases to no more than 10% annually in those areas and excuse policyholders from Citizens mandatory flood insurance requirement if the property is in a FEMA X-zone or is elevated at least one foot above base flood elevation. Citizens flood insurance mandate is ongoing. Beginning in 2026, homes with values of $400,000 or greater will be required to have it and then by 2027, all Citizens policies. HB 909 is awaiting its first hearing before the House Insurance and Banking Subcommittee. SB 1024 is awaiting its first hearing before the Senate Banking and Insurance Committee. (Return to Top of List)

(NEW) SB 1716 Dispute Resolutions Involving Citizens Property Insurance Corporation by Sen. Jonathan Martin (R-Lee) and the comparable HB 863 by Rep. Yvette Bennaroch (R-Collier). Both bills remove Citizens’ ability to require policyholders to resolve claim disputes out of court through alternative dispute resolution. The House bill requires policyholder consent, while the Senate bill completely removes the current Division of Administrative Hearings (DOAH) arbitration program from Citizens law. HB 863 was heard and unanimously passed at its first committee stop, House Insurance and Banking Subcommittee and awaits its final hearing before the House Commerce Committee, before it goes to the House Floor for a full vote. SB 1716 is awaiting a hearing at its first committee stop, Senate Finance and Tax. (Return to Top of List)

Other Bills We’re Monitoring

These bills will face challenges in the legislative process and we’ll report relevant updates only as they may occur. With the exception of SB 78, all are awaiting their first committee hearing, a necessary step to progress through the process:

SB 30 Rate Filings for Property Insurers by Sen. Barbara Sharief (D-Miramar) and the comparable bills HB 1493 by Rep. Dotie Joseph (D-Miami-Dade) and SB 1726 by Sen. Carlos Smith (D-Orlando) revises the powers of the insurance consumer advocate; specifies that a failure to obey certain court orders may be punished as contempt; authorizes a circuit court to order a person to pay certain expenses; enhances the state’s consumer advocate powers to challenge property insurance rate filings and restricts repeated steep increases in property insurance rates; limits property insurance rate approvals above a certain threshold and disallows cumulative increases beyond specified percentages within a 12-month period; enhances the powers of the consumer advocate to request hearings, compel testimony, and seek expedited appellate review of property insurance rate filings; requires the Department of Financial Services to adopt a home resiliency grading scale and pilot innovative mitigation solutions for residential property insurers and mortgage lenders; and prohibits the Office of Insurance Regulation from approving certain rate filings, among other measures. (Return to Top of List)

SB 78 Home Hardening Products by Sen. Rosalind Osgood (D-Fort Lauderdale) and the similar HB 185 by Rep. Lisa Dunkley (D- Fort Lauderdale) provide a sales tax exemption for home hardening products used on eligible residential property; specify a limitation on exemptions; require property owners to submit an application to the Department of Revenue in order to be eligible; and provide requirements for the department in issuing refunds. SB 78 unanimously passed the Community Affairs Committee as a committee substitute bill and awaits its next hearing before the Finance and Tax Committee, the second of three scheduled committee stops. (Return to Top of List)

SB 128 Homeowners’ Insurance Policies by Sen. LaVon Davis (D-Ocoee) requires insurance companies to reimburse homeowners for the cost of a specified roof inspection under certain circumstances; and requires companies to make certain notifications to homeowners at a specified time, among other measures. There is no companion bill in the House as of this Bill Watch. (Return to Top of List)

SB 140 Whistleblower Protections for Employees and Independent Contractors of Property Insurers by Sen. Darryl Rouson (D-St. Petersburg) prohibits property insurers, or their agents or affiliates, from taking adverse actions against employees or contractors for specified reasons; and authorizes such employees or contractors to bring a civil action within a specified timeframe, among other measures. There is no companion bill in the House as of this Bill Watch. (Return to Top of List)

SB 160 Emergency Residential Property Insurance Assistance Trust Fund/Department of Financial Services by Sen. Tracie Davis (D-Jacksonville) creates the Emergency Residential Property Insurance Assistance Trust Fund within the Department of Financial Services; provides eligibility for financial assistance from the trust fund; provides for funding and administration of the trust fund; and provides for future review and termination or re-creation of the trust fund. There is no companion bill in the House as of this Bill Watch. (Return to Top of List)

HB 195 Payment Scam Task Force by Rep. Jervonte Edmonds (D-West Palm Beach) and the similar SB 570 by Sen. Tina Polsky (D-Boca Raton) create a Task Force on Payment Scams adjunct to the Department of Financial Services (DFS); requires DFS to provide administrative and staff support relating to the task force; requires Florida’s CFO to establish the task force by a specified date; provides the task force’s purpose; provides memberships & terms; provides that members serve without compensation but are entitled to per diem & travel expenses; provides requirements for meetings; provides duties of the task force; provides reporting requirements; and provides for future repeal and legislative review of the task force. (Return to Top of List)

SB 230 Transparency in Insurance Matters by Sen. Carlos Smith (D-Orlando) defines the term “trade secret;” revises the requirements of a notice of trade secret submitted to the Office of Insurance Regulation or the Department of Financial Services; specifies that certain information is not a trade secret and is subject to public disclosure; requires OIR to review all claims of trade secret protection; requires that fees, commissions, and profit-sharing agreements between insurance companies and their affiliates be filed with OIR and made publicly accessible on the DFS website, among other measures. There is no companion bill in the House as of this Bill Watch. (Return to Top of List)

HB 343 Insurance Solutions Advisory Council by Rep. Leonard Spencer (D-Gotha) and the similar SB 84 by Lori Berman (D-Boynton Beach) create an advisory council within the Florida Office of Insurance Regulation (OIR) to analyze and compile available data and evaluate relevant and applicable information relating to Florida’s property and automobile insurance market; provide for membership of the advisory council; provide for per diem and travel expenses; provide for council meetings; require OIR to provide the advisory council with staffing and administrative assistance; require the advisory council to submit a specified report annually; and provide for future legislative review and expiration of advisory council. (Return to Top of List)

SB 366 Initiating a Property Insurance Interstate Compact by Sen. Mack Bernard (D-Boynton Beach) and the identical HB 319 by Rep. Kelly Skidmore (D-Boca Raton) require the insurance commissioner to initiate a compact with other states to establish a national risk pool for property insurance for natural disasters for a specified purpose; and require the commissioner, as soon as feasible, to enter into the compact with a minimum number of member states. The idea behind it is explained in this Florida Politics article. (Return to Top of List)

(NEW) SB 522 Motor Vehicle Insurance by Sen. Erin Grall (R-Fort Pierce) and the comparable HB 769 by Rep. Meg Weinberger (R-West Palm Beach) are a perennial effort to do away with Personal Injury Protection (PIP) coverage under Florida’s No-Fault insurance law and replace it with bodily injury (BI) liability coverage. The primary difference between PIP and mandatory BI is that under PIP, someone injured in an auto accident seeks coverage first under their own PIP policy, whereas under mandatory BI, someone injured in an auto accident would seek recovery from a responsible third-party’s (other driver’s) BI coverage. And more to the point for the trial bar that supports these measures: After an accident, the victim could sue the offending driver directly rather than their insurance company. The bills are similar to the bill vetoed in 2021 by Governor DeSantis, and filed again in 2022, 2023, and 2024. SB 522 is awaiting its first hearing before the Senate Banking and Insurance. HB 769 is awaiting its first hearing before the House Civil Justice and Claims Subcommittee. (Return to Top of List)

SB 582 Required Reports of the Office of Insurance Regulation by Sen. Don Gaetz (R-Niceville) requires OIR to create specified reports on insurance companies, licensees, registrants, and their related entities, including the compensation of their executive officers; requires OIR to use a reliable and up-to-date methodology and software to create specified reports and review such methodology and software for accuracy; and specifies that certain data are not considered trade secrets and may be used for certain purposes, among other measures. FIGA’s Tim Meenan notes the bill “would require regulators collect annual compensation, including stock options, and publish a report on it and use the information, along with actuarial science, in rate filings to determine a carrier’s rate.” There is no companion bill in the House as of this Bill Watch. (Return to Top of List)

HB 649 Property Insurer Financial Strength Ratings by Rep. Kevin Chambliss (D-Miami) and the identical SB 1664 by Sen. Barbara Sharief (D-Broward) requires certain annual insurance reports prepared by the Office of Insurance Regulation (OIR) for the legislature and Governor to include financial strength ratings of property insurance companies against which delinquency and similar proceedings were instituted; and requires OIR to maintain and make available upon request information relating to financial strength ratings of property insurers. (Return to Top of List)

(NEW) SB 1268 Insurance by Sen. Tracie Davis (D-Duval) and her own comparable SB 1240 (Insurance Regulation) would undo some of the legislature’s 2022 and 2023 insurance consumer and litigation reforms on property insurance, especially regarding attorney fees for plaintiff attorneys. Among other provisions, SB 1268 would:

- Reduces the insurance company’s prompt claim payment requirement from 60 days to 30 days

- Mandates the company provide a clear explanation for any payment or denial, and imposes interest and penalty interest for late payments

- Restricts a liability insurance company’s ability to deny coverage based on a coverage defense unless it provides a series of disclosures and explanations regarding its decision

- Allows attorney fees to prevailing parties and public adjuster fees for underpayment, wrongful denial, or bad-faith

- Requires the company pay for the costs of the appraisal process

- Prohibits insurance companies from including contractual provisions not authorized by statute and declares such provisions void unless approved by the Office of Insurance Regulation

- Adds increased penalties for licensees of the Department of Financial Services who commit crimes, discriminate or lie

There are also provisions regarding automobile insurance, including the required use of OEM parts in repairs. SB 1240 appears to be a subset of SB 1268, with the same or similar language. Both bills are awaiting their first hearing before the Senate Banking and Insurance but neither has a House companion bill. (Return to Top of List)

HB 1399 Property Insurance Affiliates by Rep. Kimberly Berfield (R-Pinellas) and its comparable SB 234 by Sen. Carlos Smith (D-Orange) creates new oversight requirements for property insurers’ transactions with affiliates, requiring fair and reasonable financial arrangements, mandatory registration for affiliates, and consideration of affiliate revenue in rate filings. HB 1399 Creates s. 624.44101, F.S., requiring property insurers to submit documentation showing fees, commissions, and payments to affiliates are fair and reasonable, and authorizing the Office of Insurance Regulation (OIR) to restrict fund transfers during emergencies and impose penalties for violations; creates s. 624.44102, F.S., giving the OIR authority over dividend payments to affiliates and any pledged capital or assets for loans, requiring prior approval, and providing penalties for unauthorized transactions; creates s. 624.44103, F.S., establishing a registration requirement for affiliates, outlining reporting and disclosure obligations, setting grounds for denial or revocation of registration, and imposing potential civil and criminal penalties; and amends s. 627.062, F.S., to require property insurance rate filings to account for an affiliate’s profits and revenues, and deem rates excessive if they fail to include such considerations. SB 234 Mandates that insurers provide annual details on affiliate fees, commissions, and associated cost analyses to the Office of Insurance Regulation; requires insurers working with managing general agents to submit additional disclosures about fee percentages and justifications exceeding 20%; obligates the Office of Insurance Regulation to hire an independent reviewer each year for an analysis of affiliate and managing general agent transactions; instructs insurers to publicly post this financial transaction information on their websites and clarifies that it is not treated as a trade secret; prohibits insurers from entering into affiliate transactions designed to misrepresent or conceal their financial condition; bars the payment of dividends or issuance of executive bonuses if the insurer is in a precarious financial condition or significantly impacted by high affiliate expenses. It is our considered opinion that OIR has tremendous affiliate oversight and more laws are not needed. We will keep you apprised. (Return to Top of List)