Move to make it an independent agency

There was just a passing reference to Hurricane Ian during a congressional hearing last week in which FEMA Administrator Deanne Criswell was called to testify about FEMA’s disaster fund running out of money and the costs of federal flood insurance. Meanwhile, lawmakers are looking to sever FEMA from the Department of Homeland Security in an effort they say to reduce bureaucracy and make FEMA more effective.

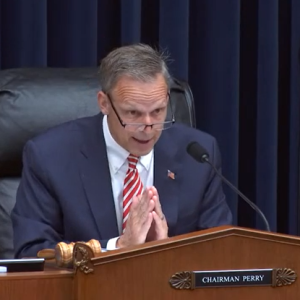

Rep. Scott Perry (R-PA), Chairman of the House House Subcommittee on Economic Development, Public Buildings, and Emergency Management

FEMA Hearing: FEMA’s Disaster Relief Fund in August halted reimbursements for long-term recovery projects after asking Congress to appropriate more money. To stretch the fund, FEMA moved to immediate needs funding (INF) for only immediate life-saving response activities. Criswell told the subcommittee that the move means more than one-thousand rebuilding projects have had their funding paused. Contractors sometimes wait months or even years to be paid by FEMA as it is.

Rep. Scott Perry (R-PA), who chaired the hearing before the House Subcommittee on Economic Development, Public Buildings, and Emergency Management, said FEMA has been spending disaster relief money on the migrant crisis and Ukraine relief. Others complained that FEMA’s disaster mitigation mission has been eroded.

“We see FEMA, under this administration, significantly expanding its mitigation programs in ways that no longer require projects to demonstrate that they will in fact reduce costs and save lives – all in the name of equity and climate change,” said Rep. Sam Graves (R-MO), who chairs the parent House Transportation and Infrastructure Committee.

FEMA Administrator Deanne Criswell testifying before Congress, September 19, 2023

Criswell answered that FEMA’s role is to work with communities to reduce the impact of the risk and that every dollar spent on mitigation saves six-dollars in recovery. She said one method is to have FEMA improve building code standards, and when structures are rebuilt, to build them back better. Rep. Dina Titus (D-NV) asked about the Inflation Reduction Act and its reimbursement programs for this and the use of low carbon materials.

“We’re grateful for that added ability to reimburse jurisdictions that use this type of construction methodology to one, increase their resilience as we’re rebuilding, but also reduce the impact on our environment,” answered Criswell.

Both Republicans and Democrats had questions about FEMA’s National Flood Insurance Program Risk Rating 2.0 program and its rate-making methodology. “Because FEMA refuses to disclose the full algorithms used in Risk Rating 2.0, the county leaders are unable to plan and target projects where they will have the greatest benefits to my constituents,” said Rep. Mike Ezell (R-MS).

FEMA estimated that almost 75% of Louisiana homes would see an increase in their flood insurance rates. Mississippi saw more than 80% of policies increase. Rep. Garret Graves (R-LA) asked why rates in some cases had gone from $560 a year under the old program to $8,000 or more under Risk Rating 2.0.

“I believe one of the most important factors about Risk Rating 2.0 is that it bases our flood insurance rates on a home’s unique risk,” answered Criswell. “While we have seen a significant amount of policies across the nation that have had decreases, we also know that now that we understand the home’s unique risk, many of the policies, many of which are in Louisiana, their rates have gone up,” she said.

Most of the representatives seemed to agree that additional FEMA funding will have to be authorized, but said the above issues need to be resolved before passing a measure. There was no discussion of FEMA’s long-term reauthorization (its short-term authorization expires this Friday night) or the impacts of the pending federal government shutdown next Sunday, October 1.

Freeing FEMA: A new measure before Congress would separate FEMA from the Department of Homeland Security and make it a Cabinet-level stand-alone agency. The bill is sponsored by Florida’s former state emergency management director, Rep. Jared Moskowitz (D-Florida) and Rep. Garret Graves (R-Louisiana). “I have seen firsthand the challenges faced when responding to emergencies, recovering from them, and mitigating their impacts,” Moskowitz said in a written statement. “There is no doubt that in the future FEMA will be busier than ever before, and this move will help cut unnecessary red tape and make FEMA quicker.” Added Graves, “This experiment of putting FEMA under the secretary of Homeland Security has failed.”

Freeing FEMA: A new measure before Congress would separate FEMA from the Department of Homeland Security and make it a Cabinet-level stand-alone agency. The bill is sponsored by Florida’s former state emergency management director, Rep. Jared Moskowitz (D-Florida) and Rep. Garret Graves (R-Louisiana). “I have seen firsthand the challenges faced when responding to emergencies, recovering from them, and mitigating their impacts,” Moskowitz said in a written statement. “There is no doubt that in the future FEMA will be busier than ever before, and this move will help cut unnecessary red tape and make FEMA quicker.” Added Graves, “This experiment of putting FEMA under the secretary of Homeland Security has failed.”

LMA Newsletter of 9-25-23