Sore losers resorting to revisionist history & histrionics

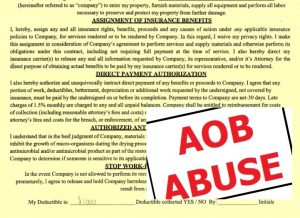

With under two weeks now before Florida’s new Assignment of Benefits (AOB) reform law takes effect, Citizens Insurance Corporation is seeing an ever larger number of pending AOB lawsuits, while the bad actors themselves are acting as if automatic rate cuts were promised in exchange for reform and predicting a slew of dire consequences. Insurance regulators, meanwhile, are out with new guidance on the law’s implementation.

With under two weeks now before Florida’s new Assignment of Benefits (AOB) reform law takes effect, Citizens Insurance Corporation is seeing an ever larger number of pending AOB lawsuits, while the bad actors themselves are acting as if automatic rate cuts were promised in exchange for reform and predicting a slew of dire consequences. Insurance regulators, meanwhile, are out with new guidance on the law’s implementation.

AOB reform couldn’t happen soon enough for Citizens Property Insurance Corporation, the state’s insurer of last resort. Citizens pending lawsuits totaled 14,091 through April, a 14% increase compared to the same time period last year. This is the cumulative effect of the huge increases in AOB suits over the past six years, together with Hurricane Irma claims litigation. The good news: new lawsuit filings continue to be fewer than this same period last year, down 22%, because the explosion of Irma suits has subsided slightly. Yet 833 new lawsuits on average are filed each month.

Citizens is the only insurance company under the new law that’s required to reflect projected savings from AOB reform in its rate filings with the Office of Insurance Regulation (OIR), primarily because it appears to be the largest target for this litigation-for-profit scheme. At this week’s board meeting, Citizens President & CEO Barry Gilway will present an updated rate filing to replace its December filing that was an average 8.2% increase in statewide personal lines. Gilway will also outline actions Citizens is taking “to take full advantage of this bill.” (See our final Bill Watch on what the reform bill – now law – does.)

Meanwhile the bad actors (unscrupulous contractors, their attorneys, and supporters) whose misdeeds led to double-digit rate increases in non-hurricane years and prompted this reform law are now bemoaning that there are no immediate rate decreases on the horizon post-reform. News flash: No one ever said rates were going to go down immediately, especially given the backlog of AOB cases under the old law and the fact it will take at least two years for the existing lawsuits to conclude under the existing law, not HB 7065. There are other dynamic rate factors as well, including the rising cost of reinsurance due to recent hurricane losses.

Meanwhile the bad actors (unscrupulous contractors, their attorneys, and supporters) whose misdeeds led to double-digit rate increases in non-hurricane years and prompted this reform law are now bemoaning that there are no immediate rate decreases on the horizon post-reform. News flash: No one ever said rates were going to go down immediately, especially given the backlog of AOB cases under the old law and the fact it will take at least two years for the existing lawsuits to conclude under the existing law, not HB 7065. There are other dynamic rate factors as well, including the rising cost of reinsurance due to recent hurricane losses.

These pestilent players, appearing in news articles and editorials, are floating an array of dire consequences post-reform. With the one-way attorney fee provision eliminated in AOB contracts, they say contractors might have to charge homeowners less for repair work or accept less money from carriers to avoid going to court and risking paying their own attorney fees. That it “forces contractors to choose between doing quality work and chasing payments to stay afloat,” per the Daily Business Review. And that it “could create collateral damage for lawyers by slashing attorney fees.” Oh please, pass the tissues! No, what it’s going to do is force them to think twice before submitting overinflated or outright bogus claims under an AOB to take advantage of consumers and their insurance companies and suing.

Late Friday afternoon, OIR issued an Informational Memorandum, outlining several key points of the new law and providing guidance on carrier responsibilities. Under the law, companies going forward may choose to issue policies restricting or prohibiting AOBs. While they may choose to notify policyholders of the new law and can do so without filing such notice with OIR, any policy form modifications regarding AOBs must be filed and approved by OIR.

Late Friday afternoon, OIR issued an Informational Memorandum, outlining several key points of the new law and providing guidance on carrier responsibilities. Under the law, companies going forward may choose to issue policies restricting or prohibiting AOBs. While they may choose to notify policyholders of the new law and can do so without filing such notice with OIR, any policy form modifications regarding AOBs must be filed and approved by OIR.

The new law also requires OIR to issue a data call report by January 30, 2022, and each year afterward, with specified data on claims paid in the prior year under AOBs. OIR has decided to do a pre-data call this coming February 2020. “While we appreciate that nine months after the passage of the bill may not be sufficient time to recognize the full impact of the Act on rates and rate indications, collecting preliminary data to evaluate the potential impact of the Act is a valuable exercise,” according to the Memorandum.

LMA Newsletter of 6/17/19