New companies, new rankings

Can Citizens Property Insurance get the rate hike needed to reduce its competition with private market carriers, even as more of them are approved to takeout Citizens policies? Meanwhile, two more property insurance companies join the Florida market, FIGA eyes extending assessments created by past companies’ insolvencies, plus the latest policy counts among carriers. It’s all in this week’s Property Insurance News.

Can Citizens Property Insurance get the rate hike needed to reduce its competition with private market carriers, even as more of them are approved to takeout Citizens policies? Meanwhile, two more property insurance companies join the Florida market, FIGA eyes extending assessments created by past companies’ insolvencies, plus the latest policy counts among carriers. It’s all in this week’s Property Insurance News.

Citizens: Despite its designation as the “insurer of last resort,” the state-backed Citizens Property Insurance Corporation is the largest property writer in the state, with 1.38 million policies and growing each week. Its latest effort to shed policies by asking for a legislative-maximum 12% rate increase for all homeowners policies (part of an overall 13.3% increase) has been denied by the Florida Office of Insurance Regulation (OIR). While admitting its “overall actuarial soundness,” OIR’s order said the rate was not actuarially-justified for certain regions of the state. Citizens has another week to resubmit new rates. OIR did approve Citizens’ commercial rate filings, including an average statewide 9.2% increase in condominium association multi-peril policies.

Citizens: Despite its designation as the “insurer of last resort,” the state-backed Citizens Property Insurance Corporation is the largest property writer in the state, with 1.38 million policies and growing each week. Its latest effort to shed policies by asking for a legislative-maximum 12% rate increase for all homeowners policies (part of an overall 13.3% increase) has been denied by the Florida Office of Insurance Regulation (OIR). While admitting its “overall actuarial soundness,” OIR’s order said the rate was not actuarially-justified for certain regions of the state. Citizens has another week to resubmit new rates. OIR did approve Citizens’ commercial rate filings, including an average statewide 9.2% increase in condominium association multi-peril policies.

Here’s the current rub: unless the rates are high enough, there won’t be the incentive for those policies to move back into the private market – a legislative goal in the recent market reforms. A Citizens policyholder receiving a private carrier’s takeout offer that’s within 20% above the cost of the Citizens policy is no longer eligible to renew with Citizens. Industry stakeholders say Citizens needs that 12% increase to move enough policies within the 20% range to make them viable for takeout. Just before Labor Day, OIR approved another batch of proposals by seven private carriers to takeout as many as 202,000 policies. It follows approvals in July for five carriers to takeout up to 184,000 policies. The greater Citizens’ policy count, the greater likelihood that a hurricane could deplete its surplus and reserves, requiring the multi-level series of assessments that Citizens is legally-allowed to impose, not just on its own policyholders, but those in almost all insurance lines in Florida.

New Companies: OIR has approved two more companies to join the Florida property insurance market. Orion180 Select Insurance Company and Orion180 Insurance Company are Indiana-based property and casualty insurance companies and applied to operate in Florida using an expansion application. An expansion application is for use by companies in good standing in their state of domicile that wish to expand their business into a uniform state. They join Mainsail Insurance and Tailrow Insurance, which were approved earlier this year. In addition, Orange Insurance Exchange was issued a permit, which is the first step toward a Certificate of Authority to write new business.

New Companies: OIR has approved two more companies to join the Florida property insurance market. Orion180 Select Insurance Company and Orion180 Insurance Company are Indiana-based property and casualty insurance companies and applied to operate in Florida using an expansion application. An expansion application is for use by companies in good standing in their state of domicile that wish to expand their business into a uniform state. They join Mainsail Insurance and Tailrow Insurance, which were approved earlier this year. In addition, Orange Insurance Exchange was issued a permit, which is the first step toward a Certificate of Authority to write new business.

FIGA Assessment: The Florida Insurance Guaranty Association, which pays the outstanding claims of insolvent property insurance carriers is considering extending for another year the 0.7% assessment that is set to expire on December 31. FIGA says it’s based on a recent loss development review for insolvencies that occurred before last September’s Hurricane Ian. The assessment on all property insurance companies is directly passed along to policyholders. FIGA says it will make a decision by December.

FIGA Assessment: The Florida Insurance Guaranty Association, which pays the outstanding claims of insolvent property insurance carriers is considering extending for another year the 0.7% assessment that is set to expire on December 31. FIGA says it’s based on a recent loss development review for insolvencies that occurred before last September’s Hurricane Ian. The assessment on all property insurance companies is directly passed along to policyholders. FIGA says it will make a decision by December.

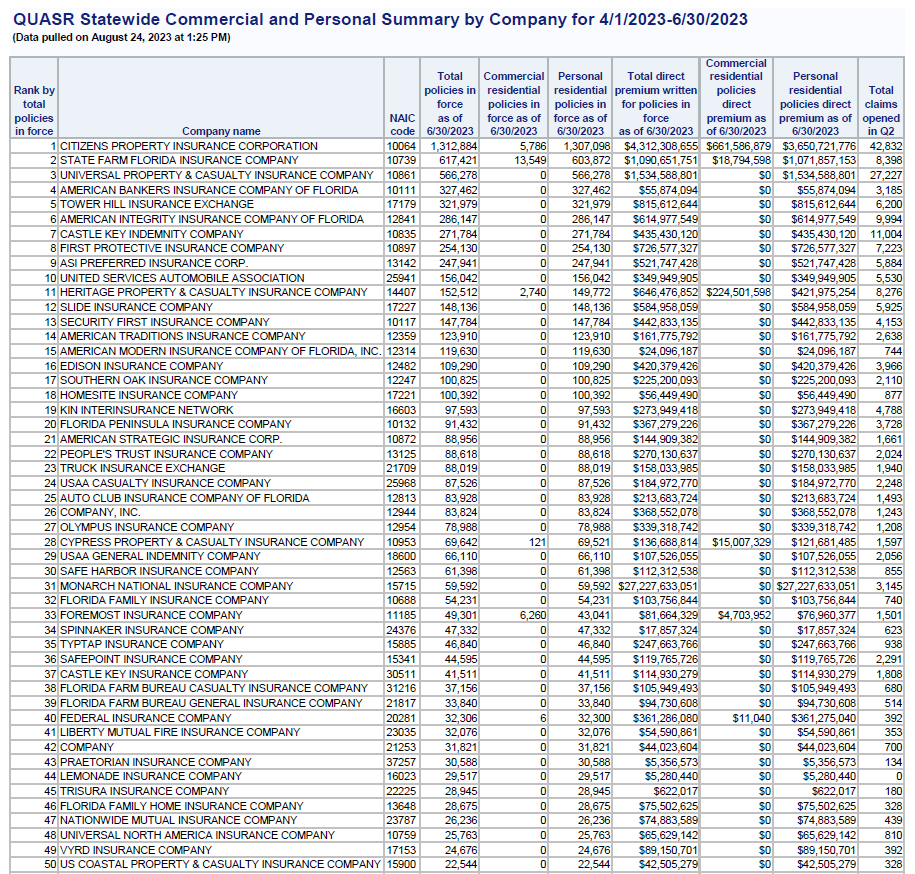

New Rankings: OIR is out with its 2023 Q2 statewide commercial and personal summary, including policy counts. It shows State Farm in second place now behind Citizens, with Universal P&C now third. American Bankers Insurance, Tower Hill, American Integrity, Castle Key Indemnity, and First Protective Insurance are also moving up the chart above ASI Preferred Insurance from the 2022 Q2 report a year ago. The full list has details on numbers of open and closed claims, pending claims, and claims where appraisal, arbitration, mediation, and alternative dispute resolution were invoked.

Policy counts for the top 50 property insurance companies in Florida ranked by total policy count, as of June 30, 2023. Click image for full list. Source: Florida Office of Insurance Regulation

LMA Newsletter of 9-11-23