Plus, the latest Florida market numbers

Citizens Property Insurance denies it’s denying a large number of recent hurricane claims, fresh insight and data debunks charges of a Florida insurance industry in a state of collapse, the latest on actual hurricane claims, plus the 2025 forecast for reinsurance. It’s all in this week’s Property Insurance News.

Citizens Property Insurance denies it’s denying a large number of recent hurricane claims, fresh insight and data debunks charges of a Florida insurance industry in a state of collapse, the latest on actual hurricane claims, plus the 2025 forecast for reinsurance. It’s all in this week’s Property Insurance News.

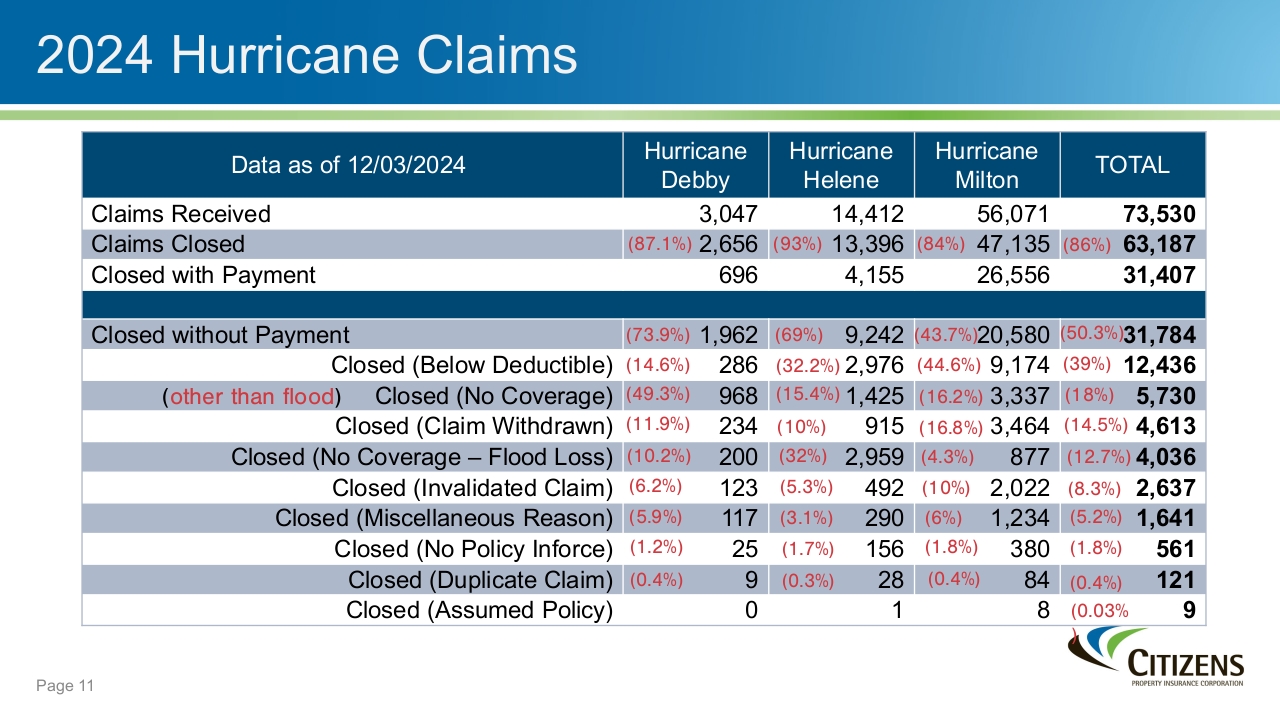

Citizens Claims: Citizens President & CEO Tim Cerio declared “absolutely false” media reports that Citizens has a 77% denial rate of claims from the three hurricanes of 2024. He puts it instead at 31% or 13.2% of total claims filed, as of December 3, per the chart below.

Source: Citizens Property Insurance Corporation (with percentages added by Lisa Miller & Associates)

Cerio provided explanations at the recent Board of Governors meeting for why a claim can be legitimately closed without payment, saying “We have no financial incentive to not play claims. Zero.” The accusation had been made by Martin Weiss of Weiss Ratings. In other Citizens’ news, the state’s insurer of last resort is close to having $600 million in hurricane claims to date, with another $1.5 billion in damages that yet may be filed. Two Governors suggested the Board hold a future conversation on holding the line on rate increases in counties with significant storm damage.

Citizens is expected to end 2024 with 907,286 policies and $387 billion in total insured value, “terrific news,” per Cerio, thanks to depopulation efforts to private market carriers. Citizens is budgeting to spend $650 million for reinsurance in 2025 and another $326 million in ceded premium for required coverage from the Florida Hurricane Catastrophe Fund. Thanks in large part to depopulation, Citizens Probable Maximum Loss for 2025 will go down about $5 billion compared to 2024, from $17.5 billion to about $12.5 billion. That greatly reduces the chances of an assessment on Citizens policyholders and non-policyholders alike next hurricane season. Meanwhile, regulators still haven’t taken action on Citizens overall maximum 14% rate increase request for 2025.

Cars were engulfed in sand on several streets in St. Petersburg Beach from Hurricane Helene’s storm surge. Courtesy, Pinellas County Sheriff’s Office

Overall Florida Market Hurricane Claims: September’s Hurricane Helene claims total 135,500, with an estimated insured loss of $2 billion. A large portion were split evenly between automobile and residential property. 76% of those residential property claims are closed with only 37% having payouts, as many claims were below the deductible or uninsured flood claims. October’s Hurricane Milton has more than double the Helene claims: 313,000 with an estimated insured loss of $3.4 billion, as of December 11. Nearly 76% are closed with just over half closed with payment. Interestingly, especially given the recent controversy in the news media about Citizens: Of the 92,451 Milton claims closed without payment, just under half (44,708) were because the damage was below the deductible (vast majority) or were non-covered flood damage.

The Truth Behind the 50% Claims Denial: Amid accusations that Florida’s property insurance companies, including Citizens Insurance, are deliberately paying only half their claims and “in a state of collapse,” comes new insight and fresh data that debunk the charges. The allegations by Martin Weiss of Weiss Ratings are the subject of an investigation by state insurance regulators. Our latest episode of The Florida Insurance Roundup podcast tackles the issue with guest Locke Burt of Security First Insurance, along with soundbites from Weiss and Citizens’ Tim Cerio. Burt served in the Florida Senate for 12 years, where he helped write the laws that created Citizens and the Florida Hurricane Catastrophe Fund. We discuss Weiss’ questionable methodology, the OIR investigation, and the newest market information from mid-November showing a number of Florida companies making money.

The Truth Behind the 50% Claims Denial: Amid accusations that Florida’s property insurance companies, including Citizens Insurance, are deliberately paying only half their claims and “in a state of collapse,” comes new insight and fresh data that debunk the charges. The allegations by Martin Weiss of Weiss Ratings are the subject of an investigation by state insurance regulators. Our latest episode of The Florida Insurance Roundup podcast tackles the issue with guest Locke Burt of Security First Insurance, along with soundbites from Weiss and Citizens’ Tim Cerio. Burt served in the Florida Senate for 12 years, where he helped write the laws that created Citizens and the Florida Hurricane Catastrophe Fund. We discuss Weiss’ questionable methodology, the OIR investigation, and the newest market information from mid-November showing a number of Florida companies making money.

“The press and the public don’t really have any comprehension of the scrutiny that the private industry faces every single day on its claim handling,” said Burt, whose Security First Insurance has about 135,000 policies in force currently. Listen/read more here.

2025 Reinsurance Outlook: J.P. Morgan analysts predict the price of reinsurance in the new year will revert to roughly 2023 levels, according to Reinsurance News. If not for the 2024 hurricane losses, there might have been a softening in rates. Meanwhile, Citizens Property Insurance CFO Jennifer Montero told her board she expects 2025 reinsurance pricing to be flat to +5%.