Legislature and regulators react

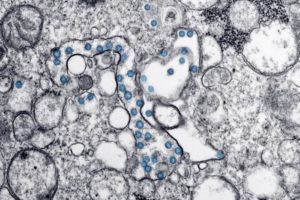

Image of an isolate from the first U.S. case of COVID-19, formerly known as 2019-nCoV. The spherical viral particles, colorized blue, contain cross-sections through the viral genome, seen as black dots. Courtesy, Hannah A Bullock; Azaibi Tamin/CDC

The Florida Legislature’s budget negotiations over this past weekend included an additional $25 million in state health department funding to fight the spread of both the coronavirus and hepatitis A, for which a public health emergency was also declared last August. Meanwhile, the Office of Insurance Regulation (OIR) has directed health insurers and HMOs to “consider all practicable options to reduce the barriers of cost-sharing” for testing and treatment of COVID-19 during the emergency.

The OIR Informational Memorandum also urges insurance companies and HMOs to share health information with their policyholders regarding prevention and treatment and otherwise up their communications game. “Insurers are directed to devote resources to inform consumers of available benefits, quickly respond to consumer inquiries, avoid and dispel misinformation, and review their processes to streamline consumer services,” according to the memorandum. It also reminds companies that under Florida law, emergency services must be covered at the in-network level and that any out-of-pocket consumer expenses should be no greater than those by a participating provider.

Just like in any other emergency situation, the state anticipates some of the extra spending involved in prevention and treatment will be reimbursed by the federal government. The President last week signed an $8.3 billion package to address the spread of the coronavirus across the nation. Also of concern is the economic impact, especially to tourism, the state’s number one industry. Nowhere are the stakes in Florida higher than in Orlando, the country’s top tourism destination.

Governor DeSantis has ordered the state Division of Emergency Management to Level 2 activation to coordinate the statewide response (a pending hurricane prompts a Level 1 full activation, for perspective). The Florida Department of Health has established a dedicated COVID-19 webpage, available at: http://www.floridahealth.gov/diseases-and-conditions/COVID-19/index.html.

In testament to the power of modeling in providing insights on the virus to public health officials and private companies, AIR Worldwide is out with a pandemic model that identifies countries at highest risk for the coronavirus. The model is based on hypothetical scenarios.

Guy Carpenter affiliate Mercer has conducted a global spot survey on this topic with input from more than 300 companies across 37 countries. Topics include: COVID-19 planning; expatriate and business-traveler concerns; post-travel quarantine; and self-imposed isolation procedures in a nifty live-updated survey.

As for property & casualty insurance carriers, Fitch reports the coronavirus outbreak isn’t expected to have a significant adverse impact on financials or ratings.

LMA Newsletter of 3-9-20