Regulatory reminders, restrictions

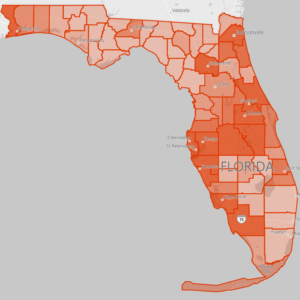

Florida coronavirus incidences as of 4/12/20, 9:45pm ET

The ongoing coronavirus pandemic has prompted additional actions and reactions that affect insurance company operations and their Florida policyholders. Here’s the latest on regulatory and other government actions impacting Florida’s insurance market.

The Florida Office of Insurance Regulation (OIR) has issued two Informational Memoranda. OIR-20-05M says that “First responders, health care workers, and others that contract COVID-19 due to work-related exposure would be eligible for workers’ compensation benefits under Florida law.” We note it says “eligible” and not “entitled”. The state Division of Risk Management is now providing workers’ compensation coverage for front line state employees. We will be watching for further developments. OIR-20-06M “encourages all health insurers, HMOs, and others to broaden access to care for telehealth services…and requests all health insurers and Pharmacy Benefit Managers transition to an electronic audit process to maintain social distancing.” Our preferred telehealth partner is Telehealth Options.

The Department of Business and Professional Regulation (DBPR) has issued Emergency Order 2020-04 for all condo and homeowners associations giving them the same emergency powers as during hurricane declarations. It allows them to take actions as “reasonably necessary to protect the health, safety and welfare of their owners, residents and guests.” While that may be considered to include sharing information when a known COVID-19 case exists within the community, at least one condo association is reserving the right to disclose actual identities.

We will most likely see all types of claims as a result of COVID-19 harm. Whether it’s a workers’ comp claim or a potential liability claim by a condo unit owner because the association may not have done enough, we are anticipating seeing COVID-related claims for a long time.

Governor DeSantis delivers a coronavirus update in Jacksonville, FL, April 10, 2020.

Florida Courts however, are essentially closed. There will be no jury trials until at least the end of May. All other proceedings were ordered rescheduled, postponed or canceled unless they can be conducted by conference call or other technology. No federal jury trials in Florida will take place before July 7.

Most of these actions were the result of Governor DeSantis’ statewide Stay at Home Emergency Order of April 1. While the idea was to reduce the risk of the virus spreading, it’s reduced a lot of other risk as well, including car accidents, since there are fewer cars on the road (and some auto insurers are issuing premium rebates, as a result). The Governor has directed $2.1 billion in already approved highway construction be accelerated during this quiet traffic period. Hopefully, it will provide needed jobs for some of the 624,124 who’ve filed for state unemployment benefits over the past three weeks.

The Governor’s Executive Orders have been coming steadily in action and reaction to the virus and its economic impacts. He has suspended foreclosures and evictions for 45 days through mid-May. Federal HUD has done the same for FHA-insured mortgages. The March drop in Florida consumer confidence as measured in a monthly survey is the worst on record — worse even than the shock delivered by Hurricane Katrina in 2005.

Older shoppers await early morning opening of a Publix Super Market in Tallahassee, FL, April 2, 2020.

The federal CARES Act is providing Florida with a total of $12 billion to help deal with coronavirus impacts. Of that, $8.3 billion will be available for budget stabilization ($4.6B state and $3.7B local governments) along with another $3.7 billion for other state programs. Senate President Galvano released a memo to Senators on April 2 saying a special legislative session may be necessary to determine how to allocate the money.

FEMA has extended the grace period to renew federal flood insurance policies from 30 to 120 days. While flooding hasn’t been a problem so far, given Florida’s moderate to severe drought conditions, FEMA has relaxed its in-person adjuster requirement, allowing for remote inspections of flood claims. (It’s also released its updated Flood Insurance Manual.)

LMA Newsletter of 4-13-20