Virus and lawsuit protection

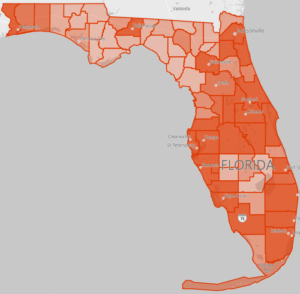

Florida coronavirus incidences as of 4/26/20, 10:33pm ET

While we closely watch the two draft bills in Congress – one that would force insurance companies to pay business interruption (BI) claims regardless of whether the policy covers it and the other providing a federal backstop for claims – there are other developments closer to home on providing lawsuit protection, agent licensing, a return to elective surgery, and an eventual reopening of the courts.

The Business Interruption Insurance Coverage Act of 2020 in the U.S. House would make coverage available for BI losses “due to viral pandemics, forced closures of businesses, mandatory evacuations, and public safety power shut-offs,” per the draft bill. And it voids any exclusion currently in place in an insurance policy. At least eight states have their own bills – Florida is not one of them.

The other approach in the House is the proposed Pandemic Risk Insurance Act (PRIA). It would “create a reinsurance program similar to TRIA for pandemics, by capping the total insurance losses that insurance companies would face,” according to the draft. Most of these BI claims are most likely not covered perils under COVID-19.

Lisa Miller discusses coronavirus insurance claims with reporter Mike Vasilinda of Capitol News Service in Tallahassee, Florida on April 14, 2020.

We’re in a Catch 22. If Congress doesn’t see a groundswell of crisis in BI coverage with policyholders screaming they have no coverage, then it most likely won’t enact PRIA. Yet having the lawyers drive suits isn’t good for policyholders and putting insurance companies out of business isn’t good for Americans. There’s a time when the government needs to step in and just as our country is throwing a lifeline to the airlines and others, the same should occur for insurers. I’ve been trying to put the issue in perspective for policyholders through the news media and here’s a recent television interview that walks through the process.

The virus is reportedly creating a big potential demand for litigation financing in plaintiff insurance lawsuits, specifically BI claims. Florida State Senator Jeff Brandes (R-Pinellas) has responded, tweeting last week “FL can’t get back to work, and businesses won’t reopen with the threat of COVID-19 lawsuits hanging over their head like a sword. I am drafting legislation that would shield businesses from job-killing, frivolous Covid lawsuits by those seeking to turn FL into a legal battlefield.” The concern was voiced by businesses at last week’s Re-Open Florida Task Force working group meetings, with Insurance Commissioner David Altmaier noting that this needs watching. The Florida Legislature failed to pass legislation (HB 7041/SB 1828) this spring to provide needed consumer protection.

So what should you do if you own or manage a business? The CDC has issued Interim Guidance for Businesses and Employers that I’ve had the privilege to help them refine this month. It includes OSHA guidance for employers on preparing workplaces for COVID-19 that several business folks I’ve talked with are using as well for hopeful protection from potential lawsuits. In other news:

Insurance Agents: The Florida Department of Financial Services is issuing temporary insurance agent licenses for applicants who have fulfilled all other requirements, but haven’t been able to take the state exam because of the virus.

Hospitals: Elective surgeries could soon resume after the current executive order expires on May 8. The Governor’s Task Force noted the real hurt on sidelined patients and on facilities losing a needed stream of revenue. The Florida Hospital Association released its plan on how elective surgeries could safely resume. So the lull in insurance billings may soon end – get ready.

Florida Courts: As we’ve mentioned, Florida Courts have been holding most hearings remotely via telephone and video conference, including now the Florida Supreme Court. Chief Justice Charles Canady last week empaneled a 17-member group to come up with a four-phase plan to return to normal court operations in the coming months.

LMA Newsletter of 4-27-20