Insurance litigation increasing

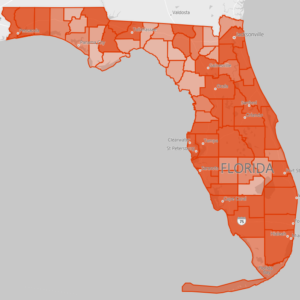

Florida coronavirus incidences as of 5/25/20, 10:28pm ET

As a growing number of Florida businesses reopen from the coronavirus shutdown, the number of insurance lawsuits in our federal courts are on the rise. Members of the Florida Legislature and state officials are working on a bill that would protect businesses from frivolous lawsuits, following similar moves by other states. There’s also news to report on the state courts’ effort to resume civil jury trials and another extension allowing insurance customer service reps to work remotely from a home office.

Federal courts in South Florida are starting to get busy again, at least with insurance cases. According to the Daily Business Review, while new filings (excluding mass tort and noncommercial litigation) are down 17% year to date from last year, insurance filings are up 8%, some of them business interruption (BI) claims cases. “The attorneys are projecting a coming tsunami of coronavirus-related insurance cases,” says the article.

Plaintiff attorneys elsewhere in the country are pursing mass tort insurance claims. The U.S. Judicial Panel on Multidistrict Litigation is now counting more than 100 federal cases filed so far related to a plaintiff petitions in Philadelphia and Chicago to assign a single judge all the COVID-19 BI cases. Congress is still studying a potential federal insurance backstop and other measures, as we’ve reported. Meanwhile, 21 states, including Florida, have requested Congress enact specific liability protections for businesses against such litigation. Several states (Alabama, Louisiana, and Wyoming so far) have acted on their own to do so.

Senator Jeff Brandes (R-Pinellas)

Here in Florida, Senator Jeff Brandes (R-Pinellas) is continuing to work with colleagues and state cabinet members to draft a bill for the next legislative session. The goal is to eliminate incentives for lawyers to engage in predatory practices, while still allowing legitimate lawsuits with clear reckless disregard to proceed. Brandes said the bill would “shield businesses from job-killing, frivolous COVID lawsuits by those seeking to turn Florida into a legal battlefield.” The Florida Legislature failed to pass legislation (HB 7041/SB 1828) pre-virus this spring to provide needed consumer protection.

Some academic legal experts (perhaps unfamiliar with the real-world practice of “sue and settle”) have been quoted in the trades as wondering if the litigation threat is exaggerated. They (rightly) say it would be difficult for someone to prove where they were infected.

Florida Supreme Court Chief Justice Charles Canady

The state court system is looking at ways it can resume civil and criminal jury trials that have been on hold since the pandemic outbreak in March. Florida Supreme Court Chief Justice Charles Canady has launched a pilot program “to establish the framework and identify the logistics of trying a case remotely.” All jury trials have been suspended through July 2 so far, to help prevent the spread of the coronavirus.

Customer Service Representatives with a Florida 4-40 insurance license can continue to work at home for as long as the state’s public health emergency remains active. The Department of Financial Services extended the exemption to the rule that reps conduct business only within their insurance agency office under the supervision of a licensed and appointed agent.

LMA Newsletter of 5-26-20