Florida in the middle

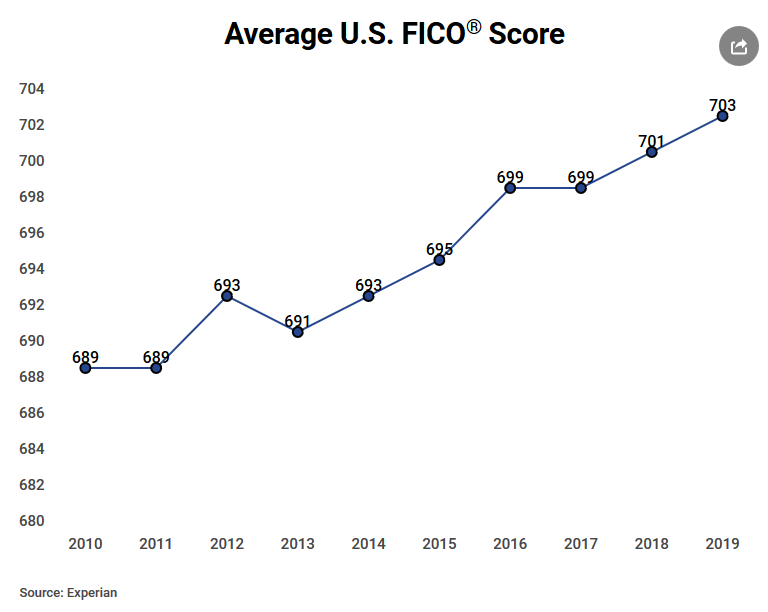

The average FICO® Score in the U.S. has reached an all-time high, driven by millennials, who now outnumber baby boomers. The average credit score rose to 703 on a scale 300 (considered very poor) to 850 (excellent). That’s up from 701 in 2018 and up 14 points since 2010. Florida ranks 37th on the list, with an average FICO score of 694.

The new Experian report also shows 59% of Americans now have FICO® scores above 700, another record. The biggest gain was by millennials, ages 24-39, with a 25-point increase in their average FICO score (668) since 2012.

“We’ve seen the average FICO® Score of the U.S. population steadily increase each year since the Great Recession in the mid-2000s,” says Tom Quinn, vice president of scores at FICO. “The increase is being driven by changes in consumer credit behaviors. For example, the percent of the population with a 30-plus-day past-due [payment] reported in the last year has decreased by 22% between April 2009 and April 2019, and average credit card utilization has decreased by 28% during the same time period.”

In a state comparison, Florida ranks 37th for credit score rankings with its 694 score. A score of 700 is considered the “marker of good credit by many lenders,” said the report. Florida’s highest scored metro area is Naples-Marco Island, where residents have an average FICO® score of 722. The average state credit card balance is $6,460, and the average mortgage balance is $188,223.

And there’s more good news. The average age Americans are reaching a FICO® Score of 700 is the lowest it’s ever been, at 54. Since 2012, eight years have come off the average age, which was 62 nine years ago. That same trend carries over to the age a person reaches their peak FICO® Score age. In 2019, the age was 78, down 11 years from the average age of 89 that stood from 2012 to 2016.

And there’s more good news. The average age Americans are reaching a FICO® Score of 700 is the lowest it’s ever been, at 54. Since 2012, eight years have come off the average age, which was 62 nine years ago. That same trend carries over to the age a person reaches their peak FICO® Score age. In 2019, the age was 78, down 11 years from the average age of 89 that stood from 2012 to 2016.

The report notes that personal loans remain the fastest-growing debt category and that the average student loan debt has increased 6%.

“With FICO® Scores seeing a 14-point increase and loan delinquencies significantly reduced since 2010, Americans seem to be maintaining healthier overall credit habits while also feeling bullish about growing balances across credit cards, retail cards, auto loans and even mortgages,” the report concludes.

LMA Newsletter of 3-9-20