Newer, elevated homes fared best

A National Weather Service survey team extrapolates the storm surge high water mark from Hurricane Ian at a Ft. Myers Beach home. Courtesy, NWS

FEMA has just released its Hurricane Ian NFIP Claims Analysis on single-family houses in Southwest Florida and the flood damage was staggering. Ian officially ranks as the fourth most expensive flood disaster by National Flood Insurance Program (NFIP) payouts, right behind Hurricanes Katrina, Harvey, and Sandy. The report also provides a direct comparison of storm/flood damage between older and newer construction homes in 12 Representative Areas of Interest for future policy and design construction. These areas were selected by FEMA’s Mitigation Assessment Team (MAT), the same division that found new roofs make houses safer as we reported last month. Ian’s major flood damage was mostly in the area of landfall in Lee County, with additional damage in adjacent Charlotte and Collier, and inland DeSoto counties. As of September 2023, NFIP has paid out $4.3 billion in claims on more than 48,000 claims. About 37,000 of those were in Florida with 22,000 of those in Lee County.

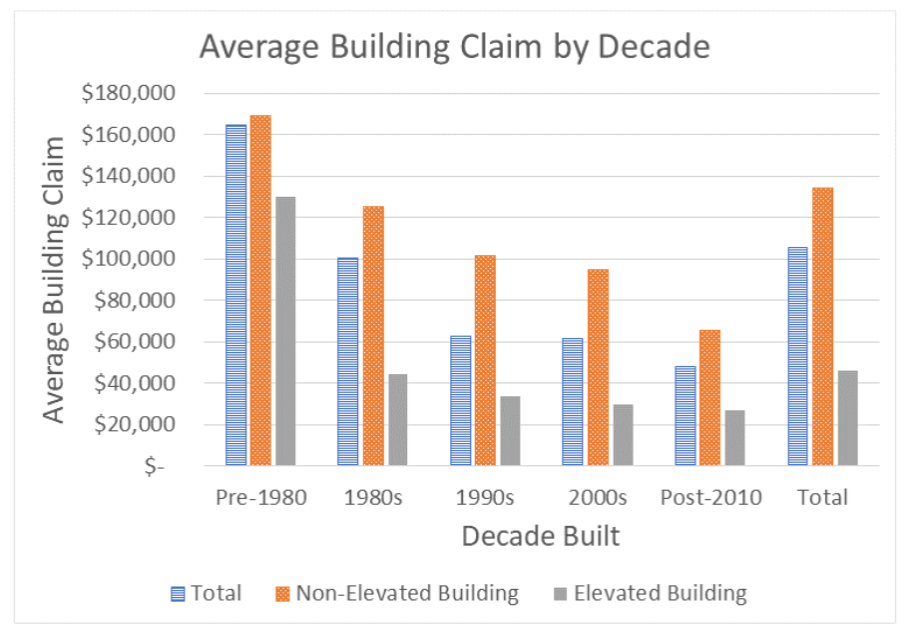

The MAT report found that the elevation of the house, year of construction, and foundation type seemed to be indicative of the claim amounts. Newer-built homes performed much better: the average post-2010 building claim ($48,901) was more than a third less than the average pre-1980 building claim ($164,891), and less than half of the overall average claim of $105,622. This data is consistent with field observations from the team, meaning the updated construction practices generally correlate to less storm and flood damage on the home.

Hurricane Ian average building claim from flooding in elevated versus non-elevated buildings by decade. Source: FEMA

This was also true for elevated homes, which on average saw consistently less damage than non-elevated homes. This seemed to be the biggest indicator of building performance, as only 8 of the 140 maximum claims in the representative areas came from elevated homes (6% of the total). Yet, the report notes that newer buildings are less likely to be elevated buildings. One particularly useful comparison was between two streets in Area of Interest No. 4 (page 27), just north of Estero Island in Lee County. Both streets had similar numbers, construction, and sizes of homes. The marked difference was that one street had 74% elevated buildings and the other 6%. The street with more elevated buildings had average claims, construction, and demolition debris less than half of the other street.

Yet many areas of elevated homes still need improvement. For instance, NFIP mentions that many of the personal belongings and non-structural building components that were exposed to flooding in the elevated homes still caused extensive roadblocks and flood damage during the aftermath of Hurricane Ian and need to be further examined. Interestingly, there was not much to suggest that proximity to the storm track is any indicator of flood likelihood – houses miles away from the direct path experienced much of the same flooding as those in the Areas of Interest. With each passing storm, we gather more evidence and further our understanding of storm-resistant construction and infrastructure and how to coexist with our ever-changing environment.

LMA Newsletter of 2-5-24