Nearly 1.4 million Floridians will pay more

FEMA last week rolled-out specifics on its new Risk Rating 2.0 flood insurance rates in the wake of renewed criticism by some congressional leaders that it lacks authority to do so and that rate hikes will hurt consumers. Calling it “transformational and equitable” FEMA and its many supporters who “get it”, said the new pricing for National Flood Insurance Program (NFIP) policies is overdue. One of the strongest advocates for the new rating platform said, “Those that oppose these reasonable and necessary rate increases remind me of a reverse Robin Hood, stealing from the poor to provide for the rich.”

FEMA last week rolled-out specifics on its new Risk Rating 2.0 flood insurance rates in the wake of renewed criticism by some congressional leaders that it lacks authority to do so and that rate hikes will hurt consumers. Calling it “transformational and equitable” FEMA and its many supporters who “get it”, said the new pricing for National Flood Insurance Program (NFIP) policies is overdue. One of the strongest advocates for the new rating platform said, “Those that oppose these reasonable and necessary rate increases remind me of a reverse Robin Hood, stealing from the poor to provide for the rich.”

“The new pricing methodology is the right thing to do. It mitigates risk, delivers equitable rates and advances the Agency’s goal to reduce suffering after flooding disasters,” said David Maurstad, senior executive of FEMA’s NFIP at a news conference last Thursday and in this news release. “Equity in Action is the generational change we need to spur action now in the face of changing climate conditions, build individual and community resilience, and deliver on the Biden Administration’s priority of providing equitable programs for all.”

FEMA last month agreed to delay the effective date of the new rates from April 1 to October 1 and phase-in the rates. They’ll take effect for new policies on October 1 and for renewing policies on or after April 1, 2022. Those current policyholders eligible for renewal on October 1 whose rates will decrease can go ahead and renew on October 1.

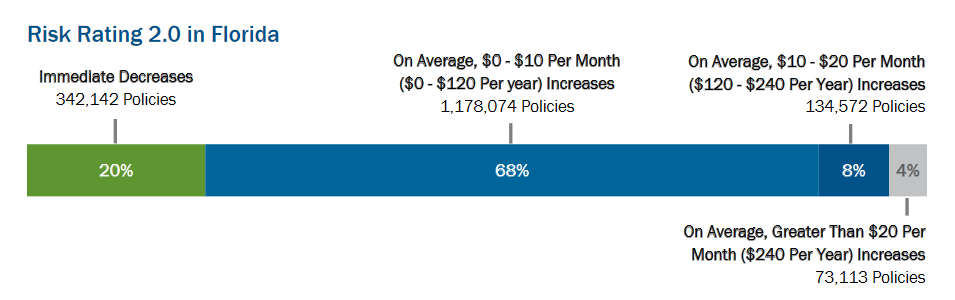

Florida has the largest number of the NFIP’s 5.1 million policies, coming in at 1,727,900 policies in force. FEMA’s Risk Rating 2.0 Florida Profile shows that 1.4 million of these policies will see premium increases, while about 342,000 will see decreases, per the chart below. Overall, it says that 96% of current policyholders’ premiums will either decrease or increase by $20 or less per month. Roughly two-thirds of policyholders with older pre-FIRM homes (pre-1970’s) will see a premium decrease.

Source: FEMA

FEMA notes that premium increases will also be subject to the 18% per year cap set by Congress for most policies but that those increases will eventually stop under Risk Rating 2.0.

Instead of charging premiums based on what flood zone a property is in on an old Flood Insurance Rate Map, Risk Rating 2.0 is property-specific – using a broader range of flood frequencies and sources as well as geographical variables such as the distance to water, the type and size of nearest bodies of water, and the elevation of the property relative to the flooding source. Premiums are then calculated based on the features of an individual property’s structure, including the foundation type, the height of the lowest floor relative to base flood elevation, and the replacement cost value of the structure.

Congress has considered but delayed for years a major revamp of the NFIP, which currently has $22 billion in debt because of its essentially taxpayer-subsidized flood coverage. This recent article, Flood Risks Are Rising Amid Climate Change, But Congress Is Delaying Action provides interesting perspective.

LMA Newsletter of 4-5-21