High tides & high expectations

The U.S. and Florida continue to break records for high-tide flooding, the so-called “sunny day flooding,” according to the latest report from the National Oceanic and Atmospheric Administration (NOAA). And there’s new research showing a clear link between residents’ perception that FEMA will pay for flood damage and whether they buy flood insurance. It’s all in this week’s Flood Digest.

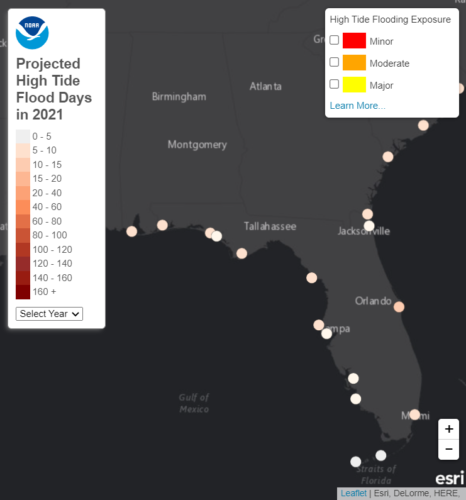

NOAA Report: Coastal communities saw record-setting high-tide flooding last year, forcing their residents to deal with flooded shorelines, streets, and basements — a trend that is expected to continue into 2022 and beyond without improved flood defenses, according to the 2021 State of High Tide Flooding and Annual Outlook. As we know, high waters are affecting coastal economies and crucial infrastructure like waste and stormwater systems and roads, especially in South Florida.

The report documents changes in high-tide flooding (HTF) patterns from May 2020 to April 2021 at 97 NOAA tide gauges along the America’s coastline, including Florida. It provides a flooding outlook for these locations through April 2022, as well as projections for the next several decades:

The report documents changes in high-tide flooding (HTF) patterns from May 2020 to April 2021 at 97 NOAA tide gauges along the America’s coastline, including Florida. It provides a flooding outlook for these locations through April 2022, as well as projections for the next several decades:

- The report shows that between May 2020 and April 2021, coastal communities saw twice as many high tide flooding days than they did 20 years ago — and the trend of near record high tides is expected to continue through April 2022.

- From May 2020 to April 2021, 14 locations tied or broke their records for the number of HTF days along the U.S. Southeast Atlantic and Gulf coastlines, a 400-1100% increase over what was experienced in 2000. The number of high tide flood events is now accelerating at 80% of NOAA water level stations along the East and Gulf Coasts.

- By 2030, high tide flooding is likely to be in the range of 7-15 days and by 2050, between 25-75 days.

“There are some locations (e.g., the Florida Keys; Honolulu, Hawaii) that might experience minor flooding at heights below the local HTF threshold, and conversely, there are some locations that may not experience flooding (e.g., directly behind the seawalls in St. Petersburg, Fla. or Galveston, Tex.) but still experience subsurface impacts like storm-water infiltration or overland flooding impacts further up- or down-coast,” according to the report.

Flooding Coverage Perceptions: We’ve long known, based on anecdotal evidence that if you think the federal government will bail you out (through FEMA) that you’re less likely to bother with buying flood insurance. Now new research from the University of Georgia published in the journal Environmental and Resource Economics has been able to factually verify that to be the case.

The research revealed that several factors influence households’ likelihood to purchase flood insurance, including expectations of disaster assistance. Known as charity hazard, the question of whether expectations of disaster assistance might reduce flood insurance demand was the study’s focus. Using household level survey data from 548 households in 72 counties in Texas, Louisiana, Mississippi, Alabama and Florida, the study found that coastal households with positive expectations of disaster aid eligibility are 25% to 42% less likely to have flood insurance. For more information, visit our LMA Flood Insurance and Resilience webpage.

LMA Newsletter of 7-26-21