Handling COVID-19 & storm claims

Our Florida property insurance market update this week includes new population projections and trends from state-backed Citizens Property Insurance, new guidance from regulators on hurricane preparedness and response, and fresh insights from Guy Carpenter on insurance and reinsurance losses from various catastrophes and the coronavirus pandemic.

Citizens: Citizens held its quarterly Board of Governors meeting on June 24. In his President’s Report, Barry Gilway, a staunch, steadfast statewide leader of sound insurance consumer protection public policies, noted that while the nature of Citizens’ book had changed to that of a true residual market, it has changed yet again. Its customer count is growing at a rate of about 2,500-3,000 net per week (both renewals/new policies). It is now projected to have about 517,000 by the end of this year, marking the first time since 2015 that it has topped 500,000 policies.

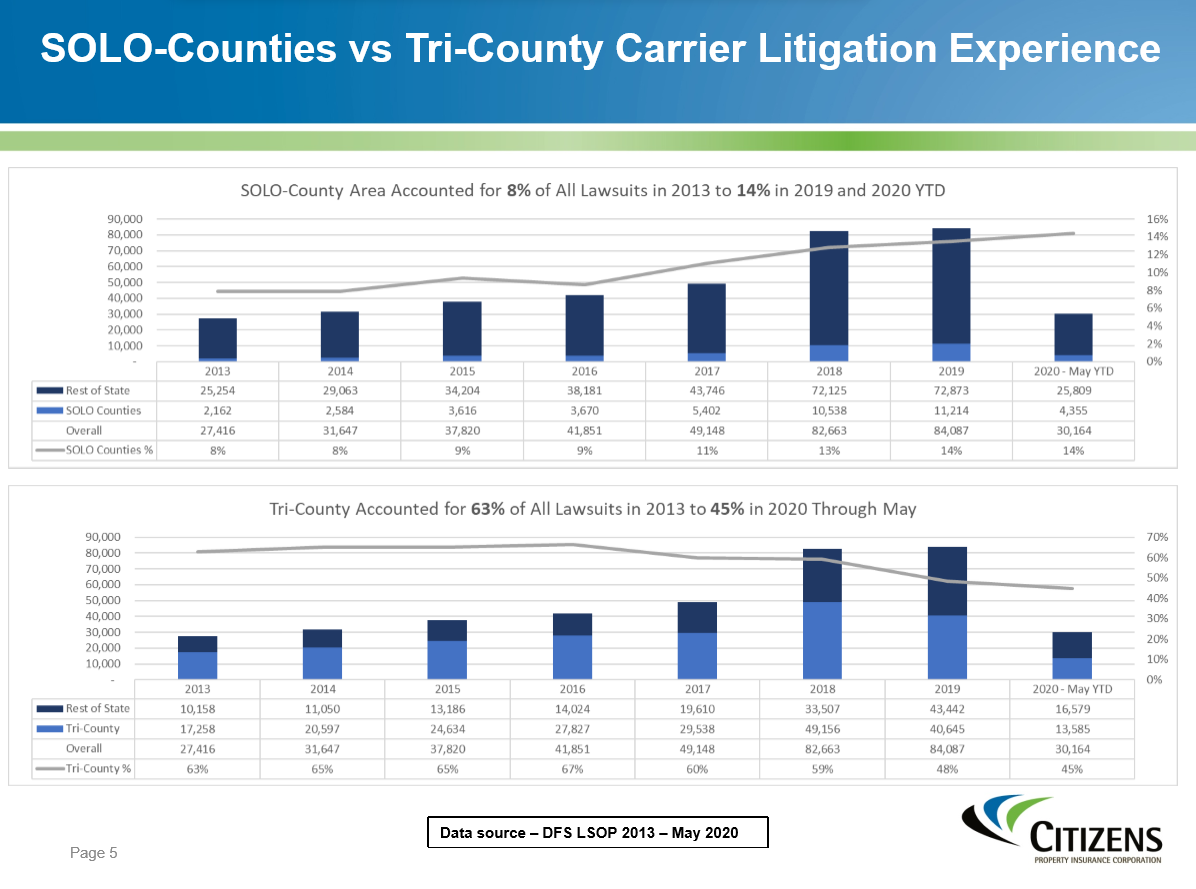

Gilway said that litigated claims costs are four times that of non-litigated claims, with a huge uptick of 518% in number of lawsuits in the past six years in the “SOLO” counties of Seminole, Orange, Lake, and Osceola, as noted in the slide below.

Source: Citizens Property Insurance Corporation

“It is our hope that the FSU Study will provide insight as to why litigation is increasing, why severity is increasing, the role of public adjusters and loss consultants, and so much more,” said Gilway. “There will likely be legislative recommendations along with potential changes in the Citizens Plan of Operations further defining our role in the marketplace.”

Board member Jim Holton discussed a 2012 legal opinion regarding Citizens new business customers potentially receiving quotes for coverage at the market rate. The Citizens team indicated this will be a topic for the September board meeting. We applaud Citizens for adapting to market conditions and Gilway’s leadership in considering “out of the box” solutions to the extraordinary challenges facing our property insurance market.

Florida Office of Insurance Regulation (OIR): To balance the challenges of COVID-19 with potential hurricane claims this season, OIR has issued claims and policyholder communications guidance in Informational Memorandum OIR-20-07M. The guidance advices insurance companies to review all aspects of their claims reporting, customer service, inspection, adjustment, and payment processes to determine what in-person processes can be provided virtually. Where possible, insurers are encouraged to leverage technology to protect and best serve policyholders.

Florida Office of Insurance Regulation (OIR): To balance the challenges of COVID-19 with potential hurricane claims this season, OIR has issued claims and policyholder communications guidance in Informational Memorandum OIR-20-07M. The guidance advices insurance companies to review all aspects of their claims reporting, customer service, inspection, adjustment, and payment processes to determine what in-person processes can be provided virtually. Where possible, insurers are encouraged to leverage technology to protect and best serve policyholders.

Citizens discussed its contingency strategy at the recent Board meeting, including moving entirely to remote adjusters. While there will still be catastrophe adjusters in the field, Citizens has developed a layered virtual vs. hands-on claims workflow process. Working with Verisk’s Xactware ClaimXperience platform, they are developing a Q&A checklist for field adjusters and a Skype-type virtual claim process with the policyholder.

We have the pleasure of working with Xactware and have been following its ClaimXperience product and while we rarely use this space as one for commercials, we have heard some incredible stories from our colleagues on this touchless claims process.

Insurance/Reinsurance Losses: Guy Carpenter in a recent blog said the coronavirus pandemic is likely to be “one of the slowest developing catastrophes that carriers have ever encountered, likely creating a prolonged period of uncertainty.” The brokerage said insurance and reinsurance market losses from various catastrophes plus the virus are set to surpass $100 billion for only the fourth time ever, and could reach upwards of $160 billion. Depending on how the hurricane season plays out and other events, “2020 could go down as the most expensive loss year ever and test further the limits of some carriers’ capital resilience,” according to the blog.

Insurance/Reinsurance Losses: Guy Carpenter in a recent blog said the coronavirus pandemic is likely to be “one of the slowest developing catastrophes that carriers have ever encountered, likely creating a prolonged period of uncertainty.” The brokerage said insurance and reinsurance market losses from various catastrophes plus the virus are set to surpass $100 billion for only the fourth time ever, and could reach upwards of $160 billion. Depending on how the hurricane season plays out and other events, “2020 could go down as the most expensive loss year ever and test further the limits of some carriers’ capital resilience,” according to the blog.

LMA Newsletter of 7-6-20