Plus, the Cat Fund’s 2026 reinsurance plan

An updated rule was recently proposed impacting Florida property insurance companies, along with an update on plans by the Florida Hurricane Catastrophe Fund (Cat Fund) to pay for next year’s hurricane season.

An updated rule was recently proposed impacting Florida property insurance companies, along with an update on plans by the Florida Hurricane Catastrophe Fund (Cat Fund) to pay for next year’s hurricane season.

The Cat Fund recently held a workshop on its Insurer Reporting Requirements and Responsibilities rule (19-8.029) that includes proposed changes in all six of its forms. For the most part, the proposed changes are routine or minor, including updating the contract year to 2026-2027 in all the forms. Other changes include:

- The Data Call form eliminates assumption language for Citizens as it’s no longer applicable; there are also some new instructions added to the Construction Mapping Worksheet.

- The Proof of Loss form now requires “Date Claim Reported to Company” and “Deductible Amount Applied to Paid Loss” as part of the records retention requirement.

- The Detailed Claims Listing Instructions form has two new fields added: “Date Claim was Reported to Company” and “Deductible Amount Applied to Paid Loss.” The reporting requirement for this form is now annually at each year-end and quarterly thereafter.

- The Clams Examination Advance Preparation Instructions form added “Date Claim was Reported to Company” and “Deductible Amount Applied to Paid Loss” as requirements for insurance companies to include in their claim file to the Cat Fund.

There was no testimony at the workshop; staff will present the proposed rule and form changes to the Governor and Cabinet at their December 6 meeting.

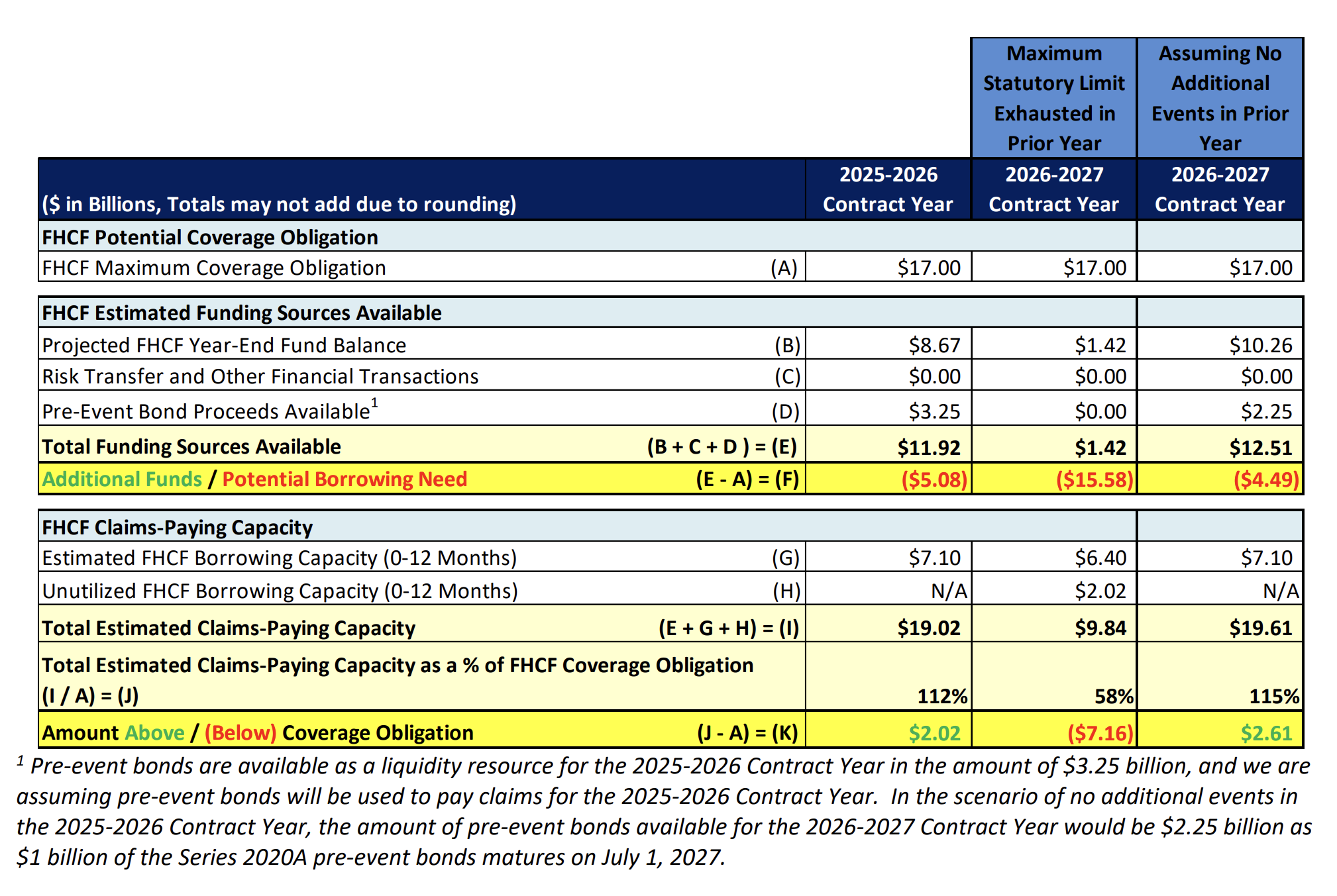

In other news, the Cat Fund’s Advisory Council met on October 23 and approved the Fund’s Claims-Paying Capacity Estimates report that will guide its activities in the 2026 hurricane season. The Cat Fund provides the initial layer of reinsurance for our property insurance companies – the rest they purchase from the more expensive private global reinsurance market. Reinsurance comprises up to 40% of a homeowners policy cost. The Cat Fund reports $8.67 billion in cash, plus $3.25 billion in pre-event bonds, for a total claims-paying ability of $11.92 billion. The Fund is required by law to provide up to $17 billion in claims and is therefore $5.08 billion short, which is typical. Per the chart below, it would make up for that by floating a $7.1 billion bond over 12 months, at a cost of $2.02 billion, which it would pay for with assessments passed on to Florida property insurance policyholders through their carriers.

Source: Florida Hurricane Catastrophe Fund, October 2025

Former state Senator Jeff Brandes, founder of the Florida Policy Project, together with insurance industry executive John Rollins co-authored a thoughtful guest editorial in Florida Politics. In it, they urge the Florida Legislature to lower the Cat Fund’s retention point from $11.3 billion back to its 2010 level of $4.5 billion, which would allow insurance companies to access its less expensive reinsurance more easily, helping further reduce property insurance rates on Floridians.