Red ink and high alert

There are more outward signs that Florida insurance regulators are getting more actively involved in trying to resolve current challenges to our property insurance marketplace. Rising reinsurance costs from claims creep and rampant litigation costs have combined to force many companies to increase their rates and some to cut back on their policy count or get out of the market altogether.

There are more outward signs that Florida insurance regulators are getting more actively involved in trying to resolve current challenges to our property insurance marketplace. Rising reinsurance costs from claims creep and rampant litigation costs have combined to force many companies to increase their rates and some to cut back on their policy count or get out of the market altogether.

The Florida Office of Insurance Regulation (OIR) last week approved a plan to allow Homeowners Choice Insurance to provide replacement policies for Anchor Insurance Company policyholders as part the carrier’s buyout of Anchor. It affects about 43,000 policyholders throughout Florida. Regulators appear to be doing their best to provide soft landings for consumers and this is the latest in their facilitation of insurance company mergers.

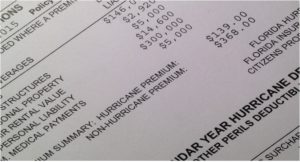

The Sun-Sentinel published a story last weekend, Watch out, homeowners. Your insurance rates are about to jump., that quoted my sentiment that insurance companies aren’t equipped to withstand the volume of lawsuits – many of them from non-weather water claims. “The red ink all over the financials of these insurance companies is dire,” they quoted me. “It’s going to continue to hurt our consumers unless we do something about it.” This story was carried in Florida Trend and several other major publications, which should put regulators on high alert of further market deterioration. It’s why I’ve been testifying at recent OIR rate hearings. Are legislators and regulators taking this problem seriously enough?

Meanwhile another reminder – it now seems weekly – that reinsurance costs will rise steeply at June renewals and beyond. The global insurance and reinsurance group QBE reported last week that its hurricane claims could rise 50% and may make premiums unaffordable. Reinsurance rates rose upwards of 25% in Florida in 2019 and are expected to increase another 20%-30% in 2020.

And another reminder that entire “schools” exist to try to game the claims adjusting system as evidenced by this YouTube video posted by “AdjustingSchool” including how to “set the claim up for a lawsuit “ (at the 1:39 mark). Cynical at best my friends, criminal at worst. Thank you to one of our readers who shared this.

OIR last week issued its previously announced Data Call to property insurance companies writing both residential and commercial policies in Florida. This is essentially a “Pre-Data Call” to help determine the state of the insurance market, both before and in the nine months since the legislature’s Assignment of Benefits (AOB) reform that became law last July 1. The law requires OIR to issue a data call report by January 30, 2022, and each year afterward, with specified data on claims paid in the prior year under AOBs.

Meanwhile, OIR is working on another data call from mid-December and the results are expected in the next few weeks. An industry report noted OIR is reviewing the data as part of confidential, targeted market conduct examinations on 12 insurers related to Hurricane Michael claims handling practices.

LMA Newsletter of 2-24-20