OIR has answers

OIR Deputy Commissioner Alexis Bakofsky addresses the House Health Care Facilities & Systems Subcommittee on October 14, 2025. Courtesy, The Florida Channel

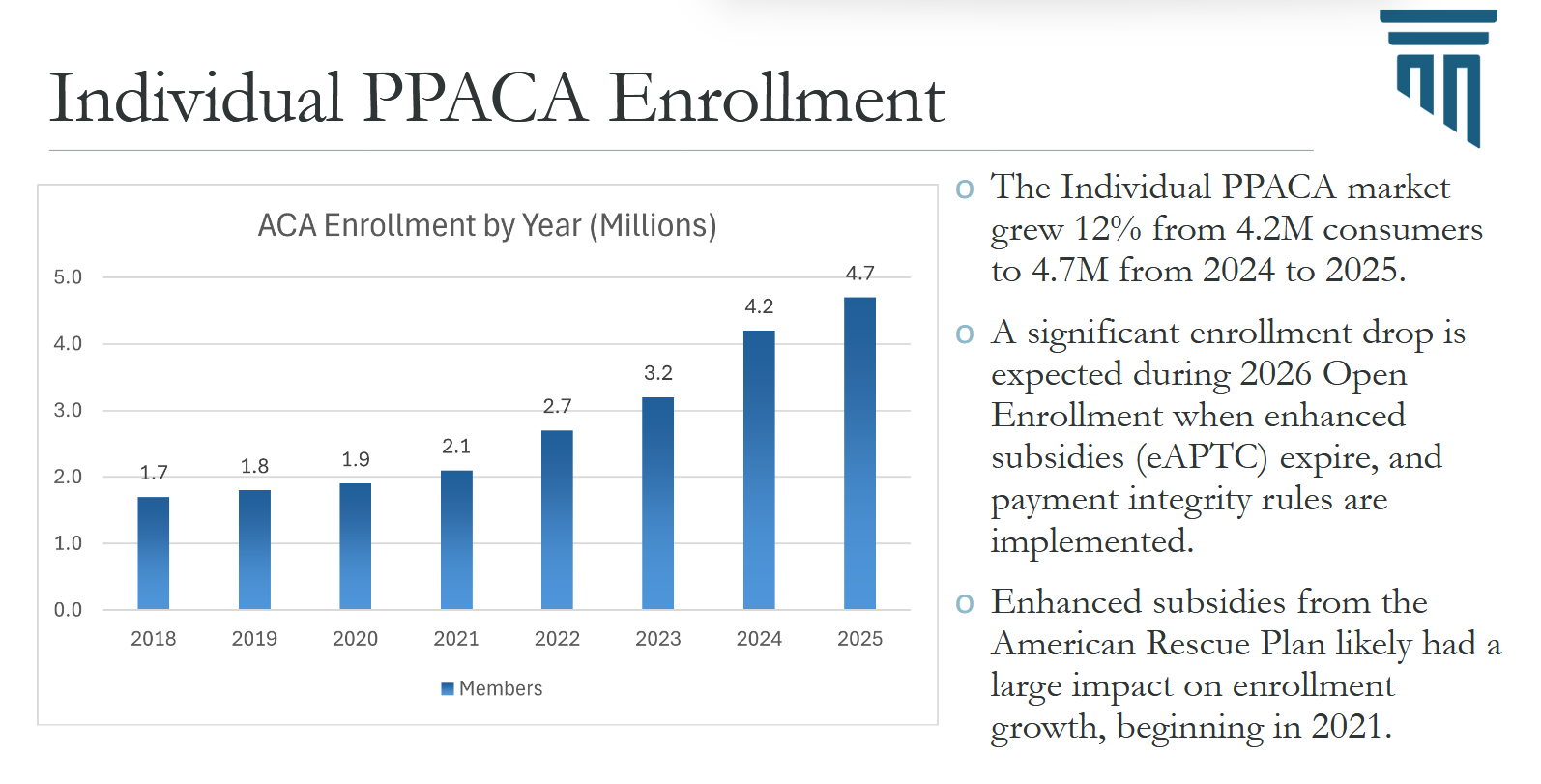

The Affordable Care Act (ACA) has been on the minds of many Floridians recently, with enhanced premium tax credits on federal marketplace plans set to expire at year’s end barring Congressional renewal. At the Florida House’s Health Care Facilities & Systems Subcommittee meeting earlier this month, the Office of Insurance Regulation (OIR) and Deputy Commissioner Alexis Bakofsky brought some much-needed calm to the storm. She first noted that Florida only has the power to review and approve rates in the changing federal exchange landscape. Perhaps most importantly, she explained that while Covid-era enhanced subsidies in the American Rescue Plan will expire, base ACA subsidies will remain in place, and that the 97% of the market that receive subsidies will see much smaller premium changes than their unsubsidized peers.

The 20 private companies writing individual policies in Florida sought an average rate increase of 34% for their 2026 plans, reflecting an anticipated drop in enrollment. The OIR stated very plainly that both the individual and small group markets are still competitive based on the number of carriers. Bakofsky said OIR approved the rates via consent order, with the condition that all dividends taken by insurers in the individual ACA market through the end of 2026 will be subject to OIR review and approval. That includes a detailed explanation by carriers of the planned use of funds. OIR will also conduct enhanced monthly data calls of carriers to track enrollment and claims. After a very informative hour-long presentation, the floor was opened to members’ questions.

Florida Enrollment in federal marketplace health insurance policies. Source: OIR

Rep. RaShon Young (D-Orlando) asked for specifics regarding modeling assumptions and the collection of monthly enrollment and claim data. While Bakofsky could not share the exact data as much of it is considered trade secret, she said she would share with the representatives whatever was possible – OIR is currently planning a data call before session starts to better capture all the existing markets. Rep. Hilary Cassel (R-Dania Beach) also requested data on county market share broken out by related company affiliates, which OIR said it would oblige.

Many questions regarding consumer protections arose, with legislators saying they were ready to be overwhelmed with calls from constituents. Bakofsky had two things to say. First, Florida statutes require a 45-day notice of cancellation for enrollees before the rate increases kick in on the first of the year. She also implored consumers to weigh their options in the marketplace and to consider lower-level plans when the enrollment opens on November 1 if need be, through guidance on OIR’s Federal Health Insurance webpage.