Plus, condominium reform, subpoenas

The Florida Legislature met at the Capitol last week for its organization session with many newly-elected members. The state’s property insurance market was a prominent theme in speeches by the two new leaders of the Florida Senate and House, who said afterward that any further condominium reform will wait until the start of the regular session on March 4, 2025.

Insurance

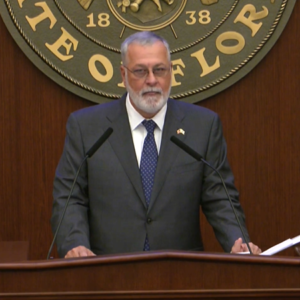

Senate President Ben Albritton addresses the Florida Senate, November 19, 2024. Courtesy, The Florida Channel

“Floridians have been paying faithfully their insurance premiums for years, sometimes decades, and now they expect their insurance company to keep up its end of the bargain,” said Senate President Ben Albritton (R-Bartow). “I want to make sure that impacted Floridians and insurance companies hear me loudly and clearly. We are watching. We’ve made changes that insurance companies said they needed to improve competition and stabilize rates and we’ve enacted pro-consumer transparency to protect homeowners,” he said, referring to the insurance litigation abuse and consumer protection reforms passed in 2022 and 2023. “The proof will be in the results. I’m not going to sit idly by if legitimate claims get denied while rates continue to rise, period,” Albritton said. (You can watch the clip here.)

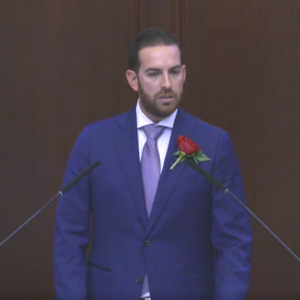

House Speaker Daniel Perez addresses the Florida House of Representatives, November 19, 2024. Courtesy, The Florida Channel

“In my experience, Floridians are realistic,” said House Speaker House Speaker Daniel Perez (R-Miami). “They understand that there are trade-offs. They understand that in a state battered by hurricanes, insurance will be a challenge. But they need to know that our state’s insurance laws are not being written by and for the insurance companies.” Perez also told the chamber, which included Governor DeSantis, that he wants to reduce government bureaucracy and cut the state budget, including legislative member projects, which last session totaled $1.3 billion. (You can watch the clip here.)

Advocates like me will work tirelessly to continue to educate House and Senate leadership. The narrative in the marketplace that insurers “just deny” claims is false, with insurance experts recognizing that the top two reasons for claim denial are claims below the deductible amount or the damage is caused by flood, which is not covered under homeowners policies. We applaud Florida Insurance Commissioner Michael Yaworsky for recently sending subpoenas (see our next story) to those who lead the false narrative relied on by both the Senate and House. The truth will prevail.

Albritton picked Senator Blaise Ingoglia (R-Spring Hill) as chair of the Banking and Insurance Committee. There’s no word yet on Speaker Perez’ pick for chair of the House Insurance & Banking Subcommittee that is part of the Commerce Committee. The legislature has its first of six interim committee meeting weeks beginning December 9.

Condominiums

Members of the Florida House of Representatives, November 19, 2024. Courtesy, The Florida Channel

Both Perez and Albritton told reporters afterward there will be no special session to tweak past condominium reforms that require milestone inspections by the end of this year and structural reserve studies with appropriate budgeting going forward for needed repairs and maintenance. Those deadlines will be dealt with during committee weeks leading into the regular March session. The reforms have created considerable angst in many condo communities, with increasing costs and unit sell-offs.

In other condo news, the Department of Financial Services has formally launched the My Safe Florida Condominium Pilot Project passed by the legislature last spring. The program provides free wind mitigation inspections to condo associations and provides grants of $2 for every $1 spent by an association for hurricane-strengthening measures, up to a maximum of $175,000 per association.