New policy-writing suspended

Three more property insurance companies announced last week they will no longer write new Florida homeowners insurance policies until further notice. That brings to seven the number of companies in the past few months that are closed to new business and/or renewals. The reason? Overwhelming costs – of claims, increased litigation, and reinsurance.

Three more property insurance companies announced last week they will no longer write new Florida homeowners insurance policies until further notice. That brings to seven the number of companies in the past few months that are closed to new business and/or renewals. The reason? Overwhelming costs – of claims, increased litigation, and reinsurance.

St. Johns Insurance Company, the 8th largest homeowners writer in the state with 160,000 policies worth $400 million in premiums, stopped writing new policies statewide across all lines on February 15. A company bulletin to agents noted the move was part of “an effort to maintain balance within our portfolio” that included non-renewals, new business eligibility rules, managing exposures in riskier territories, and of course, rate increases. The Orlando-based company filed last week with the Florida Office of Insurance Regulation (OIR) for rate increases of 12% on homeowners, 15% on condominiums, and 14.9% on dwelling fire policies. These are on top of a base 8.8% increase filed last September. Demotech pulled its Financial Stability Rating for St. Johns on the news. Insurance agents appointed by St. John’s “own” their respective books of business and will decide what is best for their customers when determining the succeeding insurer to assume the business.

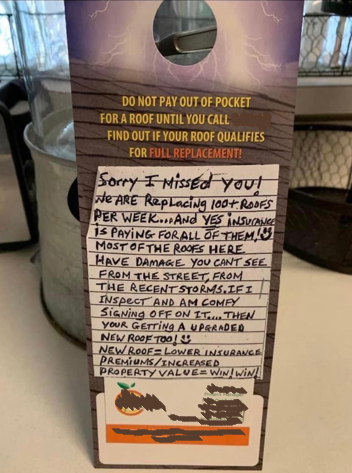

Unscrupulous roofing contractors with their offers of “free roofs” such as this during neighborhood solicitations are driving up the costs of homeowners insurance in Florida

Also last Tuesday, another central Florida insurer announced it was suspending writing new business effective at day’s end. “As we manage our reinsurance placement options, we have made the difficult decision to suspend new business writing for all products in Florida,” its agent bulletin read.

Then on Thursday, Avatar Property & Casualty Insurance of Tampa announced that it, too, would stop writing new business in Florida across all lines, becoming the seventh carrier to do so this year. “After careful consideration, we are taking precautions for the best interests of our policyholders, agents, business partners, and associates,” the company wrote in a bulletin to agents. Avatar had almost 42,000 policies in force as of mid-year 2021. Demotech pulled its Financial Stability Rating for Avatar on the news and currently shows them “Not Rated.”

So now availability and affordability are at risk for Florida consumers. The newspaper headlines this week tell you all you need to know: Florida lawmakers grapple with home insurance ‘catastrophe’ and Floridians running out of options for home insurance. We are seeing coming to fruition all the dire predictions over the past 18 months about the fragility of the Florida homeowners market in the face of growing claims creep, litigation frequency and severity, and reinsurance costs. The Insurance Information Institute says only three out of Florida’s 52 domestic insurance companies actually made a profit last year. Those 52 insurance companies lost more than $1.6 billion.

It’s not just H0-3 homeowners policies impacted by the resulting multiple double-digit rate increases. It’s the HO-6 condominium policies and the commercial residential polices that condo associations have, too. Residents’ condo association dues of $500 per month are now at $600-$700 per month or more. Meanwhile, there’s further news that reinsurance will keep going up in the immediate future. Goldman Sachs reported last week that reinsurance rates may rise faster than primary insurance through this year and next year.

Demotech asked insurance companies provide their 2021 year-end financial results by last week for its annual review of their financial stability. Stay tuned!

LMA Newsletter of 2-21-22