New study reveals costly consumer consequences

The American Consumer Institute (ACI) has released a new study exposing what it calls “the perverse incentives” driving financial instability in Florida’s homeowner insurance market. It points to the state’s generous fee-shifting policy that has allowed attorneys to collect disproportionate attorney fees in Assignment of Benefit (AOB) lawsuits, encouraging more costly lawsuits. Today, Florida accounts for nearly 80% of the country’s homeowners insurance lawsuits.

The American Consumer Institute (ACI) has released a new study exposing what it calls “the perverse incentives” driving financial instability in Florida’s homeowner insurance market. It points to the state’s generous fee-shifting policy that has allowed attorneys to collect disproportionate attorney fees in Assignment of Benefit (AOB) lawsuits, encouraging more costly lawsuits. Today, Florida accounts for nearly 80% of the country’s homeowners insurance lawsuits.

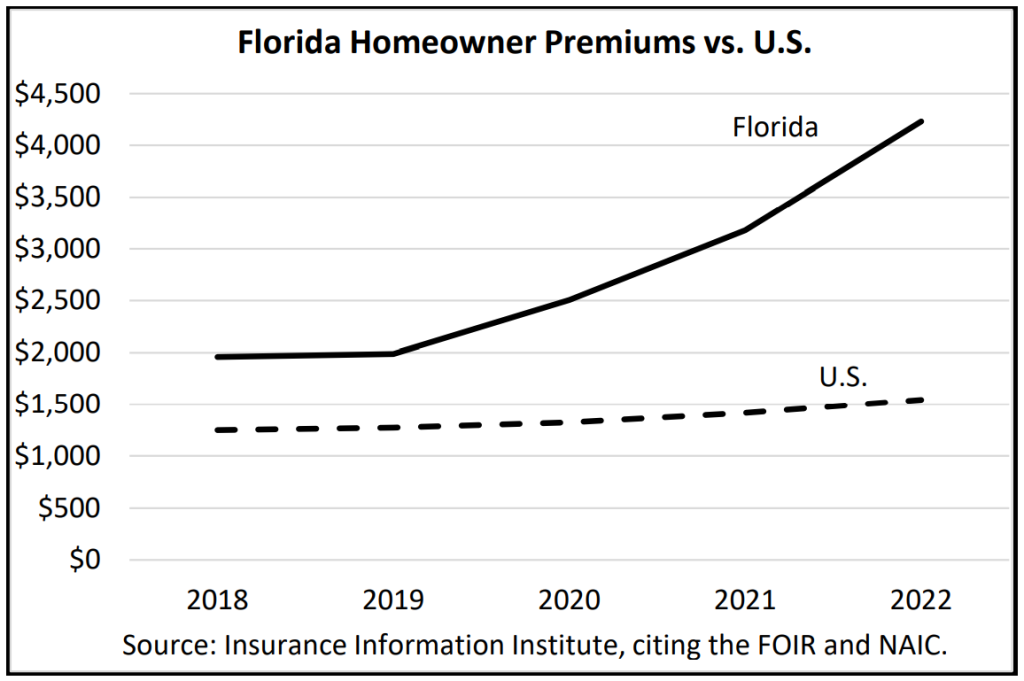

These market conditions harm consumers by forcing them to pay exorbitant premiums to insure their property – doubling in just the last three years and running $2,600 more than the national average. The study says that while the Florida Legislature has attempted to address these concerns, attorneys have already found new ways to circumvent legislative protections, further driving up profits and consumer prices. It’s why Governor DeSantis called for next week’s special session of the legislature. His stated goal: “stabilize the market and introduce more competition and policies that will lower prices for consumers.”

ACI offers key recommendations that would attack litigiousness, close loopholes and protect consumers from rapidly increasing insurance premiums. It urges the Florida legislature to end or significantly restrict the state’s one-way attorney fee statute. ACI also encourages legislators to close off attorneys’ next avenue for fee-shifting by prohibiting AOB vendors in first-party claim matters from filing Civil Remedy Notices against insurers.

In the section titled “The Incentive to Sue” on page 5 of the study, ACI notes:

Florida’s one-way attorney fee system is outdated and in need of repeal. Statute 627.428 and predecessor statutes, originated almost 130 years ago when it was believed that some consumers had difficulty finding competent legal assistance to represent them in insurance disputes and this would encourage fair claims handling. Today, however, this is far from the case with widespread availability of legal assistance throughout the state. Yet, the statute remains in effect and serves as the prime motivation for costly litigation.

The study cites that in some instances, attorneys have recouped fees at an hourly rate of $700 per billable hour, a figure significantly above the $48.28 median hourly rate for attorneys in Florida, according to occupational statistics published by the U.S. Bureau of Labor Statistics. It also says that bad faith cases “are becoming the new means to achieve the same result, which will continue to drive up insurance costs.”

ACI says the needed reforms identified in its study will effectively tackle Florida’s litigious homeowner insurance environment and its increasing premiums for consumers.

LMA Newsletter of 12-5-22