Plus, proposed tougher rules for public adjusters

A victory for automobile insurance companies from the Florida Supreme Court, a new model law with tougher standards for the nation’s public adjusters, new insurance premium tax breaks for Florida homeowners are signed into law, plus an update on Hurricane Ian claims and damages. It’s all in this week’s Property Insurance News.

A victory for automobile insurance companies from the Florida Supreme Court, a new model law with tougher standards for the nation’s public adjusters, new insurance premium tax breaks for Florida homeowners are signed into law, plus an update on Hurricane Ian claims and damages. It’s all in this week’s Property Insurance News.

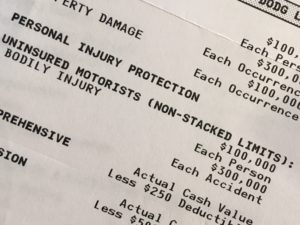

PIP Decision: A long-debated issue of insurance company payments on Florida’s Personal Injury Protection (PIP) law has been resolved. The Florida Supreme Court in late April issued its official opinion, giving automobile insurance companies clarity and flexibility in how much they decide to reimburse a healthcare provider for a PIP claim. The court ruled that it’s not a simple matter of a carrier choosing to either pay the full amount of charges or paying 80% of the maximum reimbursement allowed by Medicare. Instead, the court agreed with Allstate Insurance in its suit with a chiropractor, that insurance companies, if the policy gives notice, can choose instead to pay 80% of the charged amount, even if it’s less than the maximum. “Allstate correctly characterizes this 80% of reasonable expenses requirement as the ‘overarching mandate’ of the PIP statute,” the justices wrote. More on the subtleties of the ruling from William Rabb in the Insurance Journal.

PIP Decision: A long-debated issue of insurance company payments on Florida’s Personal Injury Protection (PIP) law has been resolved. The Florida Supreme Court in late April issued its official opinion, giving automobile insurance companies clarity and flexibility in how much they decide to reimburse a healthcare provider for a PIP claim. The court ruled that it’s not a simple matter of a carrier choosing to either pay the full amount of charges or paying 80% of the maximum reimbursement allowed by Medicare. Instead, the court agreed with Allstate Insurance in its suit with a chiropractor, that insurance companies, if the policy gives notice, can choose instead to pay 80% of the charged amount, even if it’s less than the maximum. “Allstate correctly characterizes this 80% of reasonable expenses requirement as the ‘overarching mandate’ of the PIP statute,” the justices wrote. More on the subtleties of the ruling from William Rabb in the Insurance Journal.

Public Adjuster Standards: The National Council of Insurance Legislators (NCOIL) recently approved the NCOIL Public Adjuster Professional Standards Reform Model Act, which gives states a framework to amend their statutory code regarding licensing and other professional standards for public adjusters. The model law prohibits public adjusters from providing services to a policyholder without an executed written contract first on a form that has been pre-filed with and approved by the insurance commissioner; requires public adjusters to provide a written notice of the policyholder’s rights; sets forth rigorous conflict of interest provisions; and prohibits public adjusters from filing a complaint with the commissioner on behalf of a policyholder alleging an unfair claim settlement practice unless the policyholder has given written consent to file the complaint on their behalf. The Model also requires that all funds received by a public adjuster on behalf of a policyholder toward the settlement of a claim are handled in a fiduciary capacity and sets limits on the fees public adjusters may charge. Public adjusters may charge a reasonable fee that does not exceed, inclusive of all compensation the public adjuster is paid on a claim, 15% of the total insurance recovery for non-catastrophic claims, and 10% for catastrophic claims.

Public Adjuster Standards: The National Council of Insurance Legislators (NCOIL) recently approved the NCOIL Public Adjuster Professional Standards Reform Model Act, which gives states a framework to amend their statutory code regarding licensing and other professional standards for public adjusters. The model law prohibits public adjusters from providing services to a policyholder without an executed written contract first on a form that has been pre-filed with and approved by the insurance commissioner; requires public adjusters to provide a written notice of the policyholder’s rights; sets forth rigorous conflict of interest provisions; and prohibits public adjusters from filing a complaint with the commissioner on behalf of a policyholder alleging an unfair claim settlement practice unless the policyholder has given written consent to file the complaint on their behalf. The Model also requires that all funds received by a public adjuster on behalf of a policyholder toward the settlement of a claim are handled in a fiduciary capacity and sets limits on the fees public adjusters may charge. Public adjusters may charge a reasonable fee that does not exceed, inclusive of all compensation the public adjuster is paid on a claim, 15% of the total insurance recovery for non-catastrophic claims, and 10% for catastrophic claims.

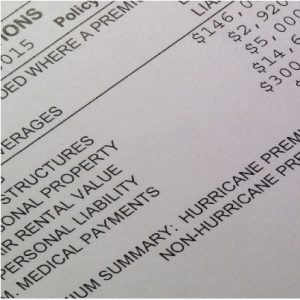

Premium Price Breaks for Florida Consumers: Last week, the Governor signed into law a one-year exemption on the 1.75% homeowners insurance premium tax and the 1.75% state premium tax on personal lines flood insurance policies. Together with a one-year exemption on the 1% State Fire Marshall Regulatory Assessment on homeowners policies and various sales tax holidays, the savings will total $1.07 billion. It follows the Governor signing a bill last month that will add $200 million to the My Safe Florida Home program for the upcoming fiscal year and funding for a new pilot program to provide condominium associations with funds to harden their condo infrastructure. (Editor’s note: the original version of this story noted in error that the 1.75% homeowners insurance premium tax exemption was limited to policies with coverages of $750,000 or less.)

Premium Price Breaks for Florida Consumers: Last week, the Governor signed into law a one-year exemption on the 1.75% homeowners insurance premium tax and the 1.75% state premium tax on personal lines flood insurance policies. Together with a one-year exemption on the 1% State Fire Marshall Regulatory Assessment on homeowners policies and various sales tax holidays, the savings will total $1.07 billion. It follows the Governor signing a bill last month that will add $200 million to the My Safe Florida Home program for the upcoming fiscal year and funding for a new pilot program to provide condominium associations with funds to harden their condo infrastructure. (Editor’s note: the original version of this story noted in error that the 1.75% homeowners insurance premium tax exemption was limited to policies with coverages of $750,000 or less.)

Damage to a Ft. Myers Beach business from Hurricane Ian. Courtesy, Kevin Miller

Hurricane Ian Claims Update: The Florida Office of Insurance Regulation (OIR) is out with the results of the latest data call on insurance claims from the September 2022 Category 4 storm. The total estimated insured losses are nearly $21.4 billion on 776,941 claims (up from $19.4 billion on 758,644 claims in October 2023). OIR reports 93.7% are now closed, with a roughly 5:2 ratio of paid (529,869) to unpaid (198,028) claims. Most counties’ closed claim rate is above 90% with the exception of Miami-Dade (72.7%), Broward (76.2%), and Palm Beach (81.3%) despite having claim totals in the four digits, compared to Lee County with 272,299 claims and Charlotte County with 104,755 claims. Those three South Florida counties are well-known for having the highest percentage of litigated claims and the highest levels of insurance fraud among Florida’s 67 counties..

LMA Newsletter of 5-13-24