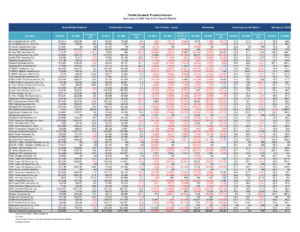

Lots of red ink

One doesn’t have to be an accountant to understand that red means danger and in this Florida Domestic Property Insurers Summary of 2020 Year-End Financial Results it means a financially dangerous trend. Net Underwriting Losses by those companies from S&P Global Market Intelligence totals nearly $1.6 billion. But those figures don’t include four of the 39 companies or groups on the list.

One doesn’t have to be an accountant to understand that red means danger and in this Florida Domestic Property Insurers Summary of 2020 Year-End Financial Results it means a financially dangerous trend. Net Underwriting Losses by those companies from S&P Global Market Intelligence totals nearly $1.6 billion. But those figures don’t include four of the 39 companies or groups on the list.

Florida-based insurance companies aren’t the only ones with losses. According to a recent report from Verisk and the American Property Casualty Insurance Association (APCIA), major losses last year caused the P&C industry’s net income after taxes to drop 27.5% to $35.1 billion in the first nine months of 2020. Net underwriting gains also declined to $0.3 billion from $5.4 billion a year prior. The COVID-19 pandemic is driving a lot of the profit losses nationally.

Meanwhile, Demotech has finished its review of the rest of the 42 Florida domestic carriers it rates, since its initial March 5 report that we shared last week. The financial analysis and actuarial services firm has now affirmed the rest of the carriers on the list, verifying they have the needed fortification to be healthy enough to earn Demotech’s ongoing Financial Stability Rating (FSR) for 2021. But President and Co-Founder Joe Petrelli has this warning in his March 12 update:

“Future profitability may require canceling or non-renewing certain policies whose underwriting characteristics generate a disproportionate cost of reinsurance. Equally important, current management and the investor team have advised us that the companies will secure a premium structure consistent with the anticipated loss and LAE levels in the residential property insurance marketplace. We interpret this to mean if there is no tort reform in 2021, incremental costs associated with fraud and abuse will be passed on to consumers through rate revisions,” wrote Petrelli.

And Mr. Petrelli’s warning about fraud and abuse is reflected in the Florida Office of Insurance Regulation’s necessary and prudent double-digit rate increases, sometimes multiple increases from single carriers throughout 2020, with no end in sight. So the crisis is falling squarely in consumers’ pocketbooks. Many in the financial services sector are looking to the Florida Legislature this session to rebalance the market, stem some of the ongoing necessary rate increases hitting already COVID weary Floridians, and allow the market to expand.

LMA Newsletter of 3-15-21