Litigation declining, market stability increasing

Lawsuits against property insurance companies writing Florida polices fell 23% in 2024 from the year prior, the lowest since 2018, as some companies have filed for rate decreases in the aftermath of the 2019-2023 insurance reforms. That’s the finding of the Florida Office of Insurance Regulation’s (OIR) latest Property Insurance Stability Report, released last week. This report, mandated by the Legislature, provides insights into litigation practices, market distribution, profitability, premiums, reinsurance availability, and regulatory actions within the state’s property insurance sector.

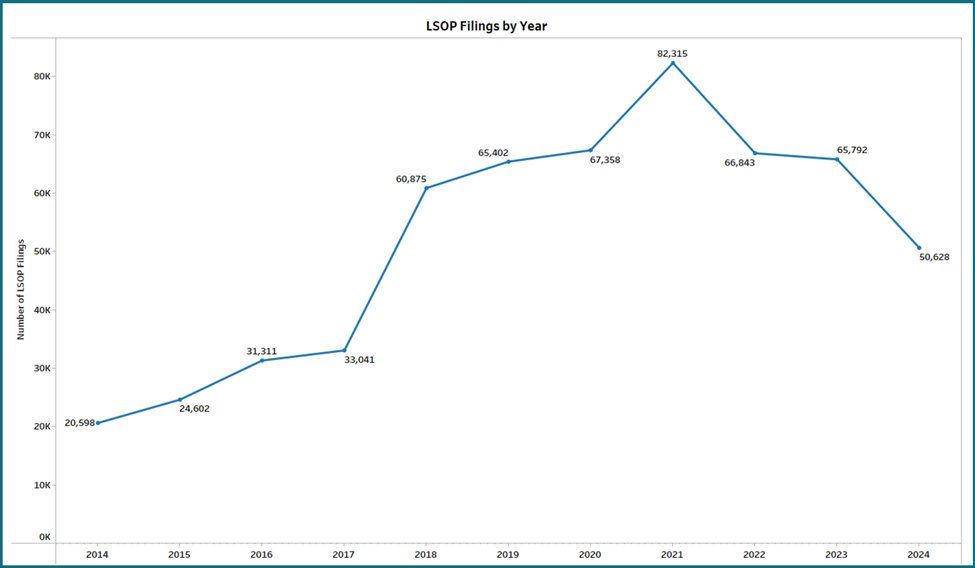

The chart below shows the number of lawsuits, as represented by Legal Service of Process Filings (LSOP) in 2024 declined compared to prior years.

Source: Florida Office of Insurance Regulation, January 2025

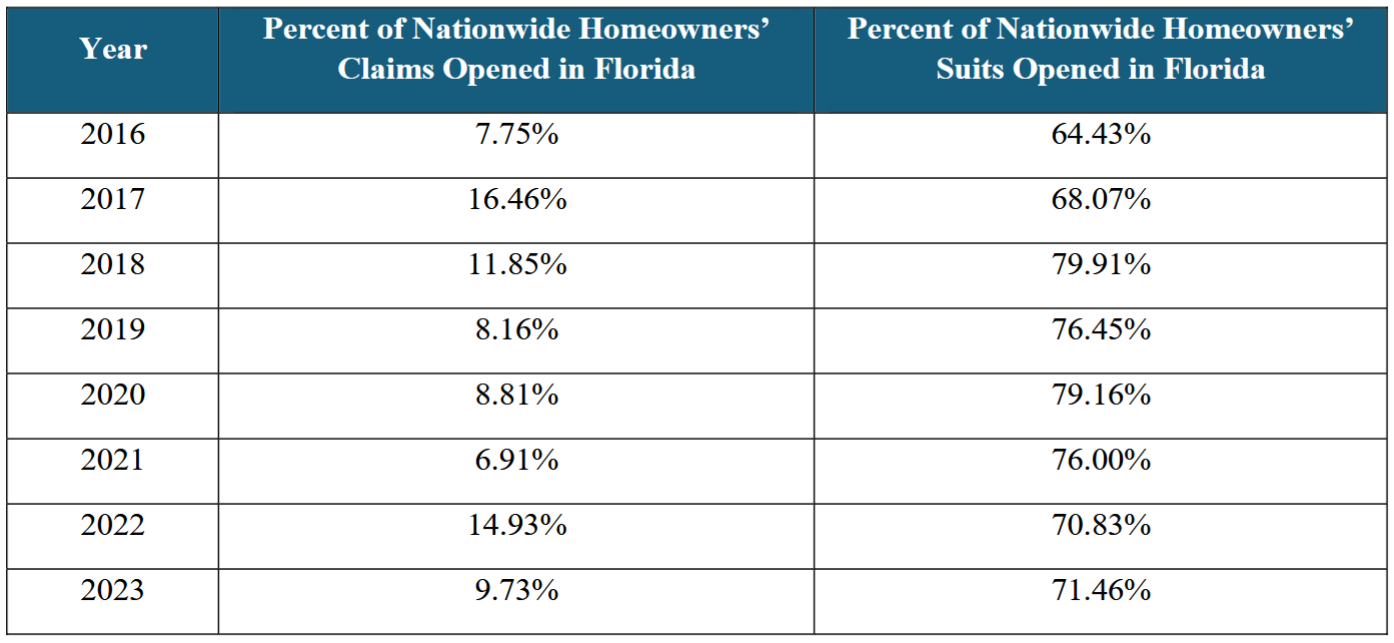

“One of the primary challenges for Florida’s property market has been the frequency and severity of litigated claims,” according to the report. Although the number of LSOP filings have declined for the second year in a row, the percentage of homeowners claims vs. homeowners claims lawsuits in Florida compared to the rest of the U.S. remains out of kilter – and is actually growing worse. The chart below shows that despite a decrease in the percentage of Florida claims in 2023 (9.73%), the percentage of Florida lawsuits actually increased from the prior year (to 71.46%).

Source: Florida Office of Insurance Regulation

Litigation Practices and Outcomes

Legislative measures in 2019 and 2021 aimed to reduce excessive litigation associated with Assignment of Benefits (AOBs) and other practices. Further measures in 2023 modified “bad faith,” essentially adopted the federal standard for contingency fee multipliers, and repealed Florida’s one-way attorney fee statues. The report indicates that these reforms have begun to impact litigation trends. Pages 5 to 8 show litigation trends heading in the right direction, meaning consumers are no longer being duped into believing an attorney is the best route to solve a claims dispute, with the aim of that lawsuit so attorneys could charge fees.

Market Distribution

As of the third quarter of 2024, the distribution of policies is as follows:

- Homeowners Multi-Peril Policies:

- Voluntary Market: 4,123,819 policies (82.6%)

- Citizens Property Insurance Corporation: 868,282 policies (17.4%)

- Condominium Unit Owners Multi-Peril Policies:

- Voluntary Market: 843,402 policies (91.2%)

- Citizens: 81,064 policies (8.8%)

These figures exclude surplus lines policies.

Premiums

Average premiums for homeowners’ and condominium unit owners’ insurance vary across Florida’s 67 counties, with averages are based on data reported as of September 30, 2024. For example:

- Homeowners Insurance:

- Alachua County: $2,451

- Broward County: $6,290

- Leon County: $2,092

- Condominium Unit Owners Insurance:

- Alachua County: $1,053

- Broward County: $2,015

- Leon County: $1,010

The report highlights that recent legislative reforms have positively impacted the property insurance market for consumers, with a slight downward trend in rate filings for 2024. Notably, 32 companies filed for a zero percent increase, and at least 17 companies filed for rate decreases to take effect in 2024.

Regulatory Actions

Between July 1, 2024, and December 11, 2024, 12 insurers were referred to the Insurer Stability Unit for enhanced monitoring due to various concerns, including financial stability and market conduct. However, none of these referrals were deemed appropriate for enhanced monitoring upon further review.

The January 2025 Property Insurance Stability Report indicates that legislative reforms have begun to stabilize Florida’s property insurance market, with positive trends in litigation reduction, market distribution, profitability, and premium rates. Ongoing monitoring and regulatory actions by the OIR aim to maintain and enhance this stability.