New report sheds light and solutions

In order to craft appropriate insurance marketplace reforms, Florida House Commerce Committee Chairman Blaise Ingoglia asked Insurance Commissioner David Altmaier in January to provide additional information on cost drivers in residential and automobile insurance lines. The Commissioner’s report from the Office of Insurance Regulation (OIR) is out and includes both eye-opening data – and suggested solutions. It’s based in part on a survey of about 56% companies doing business here and follows a dramatic increase in double-digit homeowners insurance rate increases in 2020.

In order to craft appropriate insurance marketplace reforms, Florida House Commerce Committee Chairman Blaise Ingoglia asked Insurance Commissioner David Altmaier in January to provide additional information on cost drivers in residential and automobile insurance lines. The Commissioner’s report from the Office of Insurance Regulation (OIR) is out and includes both eye-opening data – and suggested solutions. It’s based in part on a survey of about 56% companies doing business here and follows a dramatic increase in double-digit homeowners insurance rate increases in 2020.

The report identifies four primary cost drivers: Underwriting losses from catastrophe claims, including loss creep ($1 billion alone in 2020); Adverse loss reserve development (cost of claims greater than reserves allotted – by $682 million in 2019); Higher reinsurance costs (up 54% in 2020 and especially impactful on Florida’s reliant domestic market); and an Increase in costly litigation, despite 2019’s Assignment of Benefits (AOB) reform.

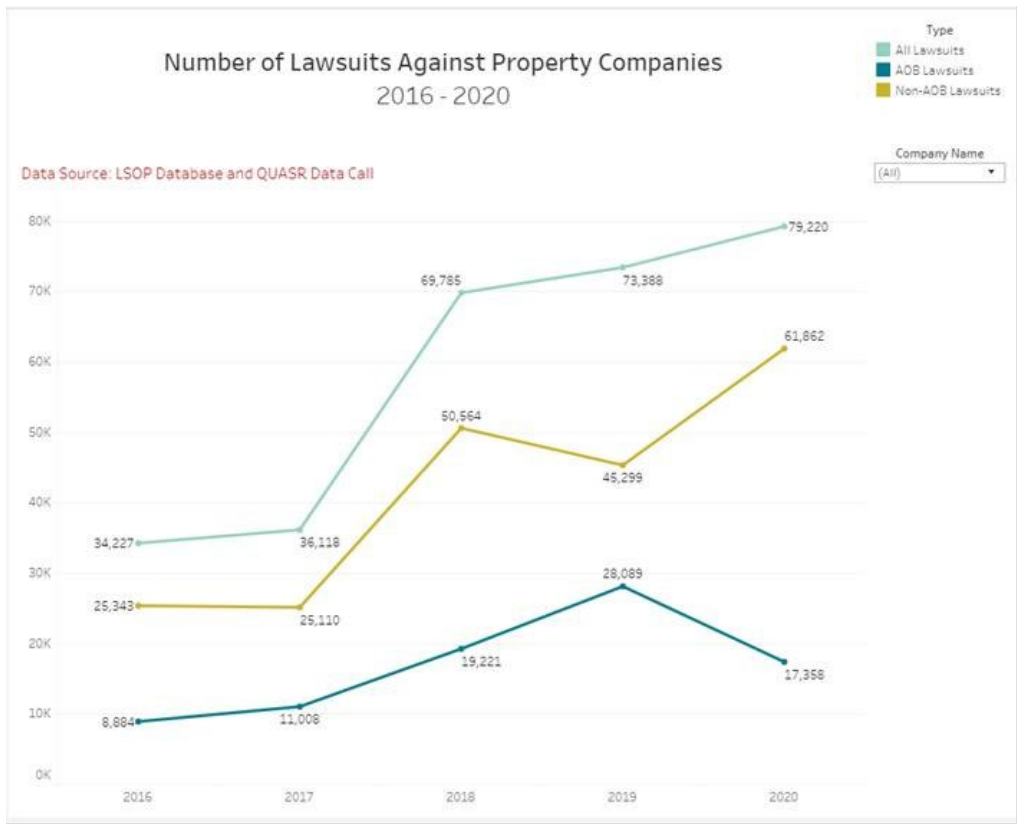

OIR states that one of the primary reasons for the adverse loss reserve development is the increase in the frequency and severity of litigated claims. While AOB lawsuits declined 38% from 2019 to 2020, non-AOB lawsuits rose at a greater rate than prior years (up 36.5%), causing the overall number of lawsuits to increase (see chart below). OIR notes that a litigated claim costs about triple that of a non-litigated claim. There’s lots of good info, including defense costs.

From the Florida Office of Insurance Regulation, February 2021

OIR notes another new trick since the 2019 AOB reform: an increase in roof solicitation “with the promise of a new roof to no cost to the policyholder,” says the report. The numbers show roof-related claims and roof litigation are up – a trend that began back in 2016.

The OIR report includes suggested solutions as well:

Tort Reform, to include a 60-day pre-suit notice requirement to the insurance company prior to filing a lawsuit; a limitation on attorney fees (such as reduced or eliminated fees if a policyholder doesn’t win in trial at least 80% of their pre-suit demand); and a review of the concurrent causation framework established in the Sebo decision. OIR stated “Under the Sebo decision, there could be an incentive to claim that a small portion of shingles that are damaged by a potentially covered peril could lead to the entirety of the roof being replaced. This could cause insurance contracts to function more like maintenance contracts, which is not the intent or purpose of insurance.”

Clear Authority to Review Financial Transactions of MGAs. OIR suggests the legislature could amend Florida Statutes to clarify that OIR has clear authority to examine or review the financial condition of a managing general agent (MGA) to better ensure that transactions between the insurance company and these entities are fair and reasonable in relation to the services provided to the insurer.

Better Data Collection, to include amending Florida Statutes to require insurance companies collect and report litigation trends to OIR on an annual basis. Not all companies collected the right data needed to respond to OIR’s survey. Spotting troubling litigation trends earlier is important.

Smaller Claims Window, specifically to reduce the statutory three-year window for filing a claim in a hurricane or other windstorm. While not recommending a substitute window, OIR stated that a shorter window would help prevent fraudulent claims and help insurance companies more accurately estimate the cost of a claim.

On auto insurance lines, the report said that premiums continue to increase in Florida across all coverages due to cost increases associated with distracted driving, increased repair and medical costs, and other factors. The report contains additional information regarding the potential impact that changes to the PIP law could have on premiums.

LMA Newsletter of 3-1-21