Plus, the easing FEMA standoff in Southwest Florida

Some new data and insights from a state insurance roundtable that included policyholders, FEMA has extended its deadline and is said to be working closely with five Lee County governments to save their federal flood insurance discount, plus new rankings on the largest property insurance companies in Florida and their litigation burdens. It’s all in this week’s Property Insurance News.

Some new data and insights from a state insurance roundtable that included policyholders, FEMA has extended its deadline and is said to be working closely with five Lee County governments to save their federal flood insurance discount, plus new rankings on the largest property insurance companies in Florida and their litigation burdens. It’s all in this week’s Property Insurance News.

The Florida Insurance Roundtable in Sarasota, April 25, 2024. Courtesy, DFS

Taking it to the People: Florida Insurance Commissioner Michael Yaworsky, CFO Jimmy Patronis, and a handful of state legislators were joined by business leaders and policyholders for a roundtable last week in Sarasota. The message: we understand your pain, but just hold on, as property insurance rates are starting to ease thanks to the last three years of legislative reforms. Patronis called the state’s insurance crisis “manmade” by lawyers who discovered suing insurance companies could be “a very profitable business.” He said those lawsuits declined 20% from the last quarter of 2023 to first quarter of 2024, thanks to litigation reform. Yaworsky said “it makes a tremendous difference,” as an average claim cost of $2,000 rises to $9,000 when a plaintiff lawyer is involved. He said reinsurance costs (about 45% of a homeowners policy) as a result are flattening and may even decrease a bit this year, allowing insurance companies to need less rate. The commissioner said rate-hike requests that averaged 7.7% in March 2023 were down to 1.5% last month. Following personal testimonials from several policyholders, there was acknowledgment that when homeowners insurance rates are high, home ownership becomes unaffordable.

The Sun-Sentinel recently crunched 2023 year-end data and reported that the statewide average premium for a homeowners policy increased by 23.9%, from $2,798 in June 2022 to $3,466 at the end of December 2023. Condominium unit premiums rose 22.9% in the same period, from $1,343 to $1,650. However, the rate of those increases fell sharply quarter to quarter over those 18-months, from a high of 4.8% to 2.6% for homes, and from 5.9% to 2.1% for condos. And now, there’s news that Florida Peninsula Insurance Company is requesting a statewide 2% rate reduction for both its homeowners and condo policies.

FEMA Standoff: In our last newsletter (Ian Repair vs. Rebuild Reaches Crisis Point), we reported on FEMA’s announcement to eliminate flood insurance discounts to Lee County and four of its local governments for failure to follow federal rules on permissible rebuilding after Hurricane Ian under the so-called “50% Rule.” After pressure from Florida’s state and federal lawmakers, FEMA staff is on the ground and working closely with municipal staffs to review building records. “The communication between FEMA and the City of Cape Coral is much, much better now, than it was before,” Mayor John Gunter said at a news conference last week, after previously referring to FEMA as “the villain.” FEMA had extended the deadline to May 9 for proof of proper rebuilding but last week extended it to June 10. At stake is a 25% discount loss worth millions of dollars to the now estimated 699,000 residents with National Flood Insurance Program (NFIP) policies. Meanwhile, Cape Coral has been distributing red tags to about 200 properties, requiring residents to appear before a code compliance magistrate to present their cases.

FEMA Standoff: In our last newsletter (Ian Repair vs. Rebuild Reaches Crisis Point), we reported on FEMA’s announcement to eliminate flood insurance discounts to Lee County and four of its local governments for failure to follow federal rules on permissible rebuilding after Hurricane Ian under the so-called “50% Rule.” After pressure from Florida’s state and federal lawmakers, FEMA staff is on the ground and working closely with municipal staffs to review building records. “The communication between FEMA and the City of Cape Coral is much, much better now, than it was before,” Mayor John Gunter said at a news conference last week, after previously referring to FEMA as “the villain.” FEMA had extended the deadline to May 9 for proof of proper rebuilding but last week extended it to June 10. At stake is a 25% discount loss worth millions of dollars to the now estimated 699,000 residents with National Flood Insurance Program (NFIP) policies. Meanwhile, Cape Coral has been distributing red tags to about 200 properties, requiring residents to appear before a code compliance magistrate to present their cases.

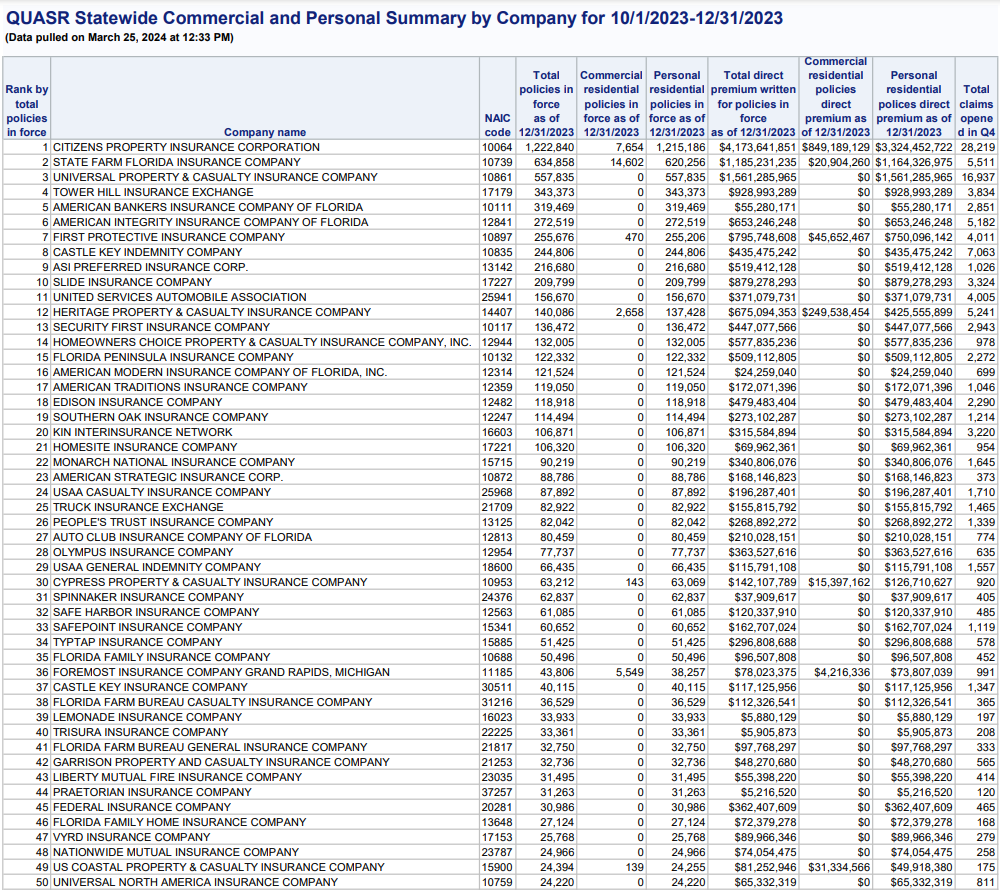

New Rankings, Litigation Burdens: As we mentioned, Commissioner Yaworsky’s office is out with its 2023 year-end statewide commercial and personal lines summary, including policy counts. The full list has details on numbers of open and closed claims, pending claims, and claims where appraisal, arbitration, mediation, and alternative dispute resolution were invoked. Jerry Theodore from R Street Institute wrote in the Insurance Journal that expenditures on legal defense costs, expressed as a percent of premium, fell from 8.4% in 2022 to 3.1% in 2023, still more than double the 1.2% for the overall industry. Also, the direct incurred loss ratio, a measure of insurance underwriting profitability, was 40% in 2023, down from 125% in 2022 and 56% in 2021.

Policy counts for the top 50 property insurance companies in Florida ranked by total policy count, as of December 31, 2023. Click image for full list. Source: Florida Office of Insurance Regulation

LMA Newsletter of 4-29-24